South32 Limited 2017 Interim Dividend Currency Exchange Rates (5154Z)

March 15 2017 - 3:02AM

UK Regulatory

TIDMS32

RNS Number : 5154Z

South32 Limited

15 March 2017

15 March 2017

2017 INTERIM DIVIDEND CURRENCY EXCHANGE RATES

South32 Limited (ASX, LSE, JSE: S32; ADR: SOUHY) (South32)

announced on

16 February 2017 that the Board resolved to pay an interim

dividend of US 3.6 cents per share for the half year ended 31

December 2016. The dividend payment date is 6 April 2017.

The US cent currency exchange rate applicable to the dividend

payable in Australian cents, British pence and New Zealand cents is

determined as the volume weighted average price achieved on foreign

exchange trades executed over the period 3 March 2017 to 15 March

2017, and is detailed below:

Currency Exchange rate Dividend per ordinary

share in local currency

------------------- -------------- -------------------------

Australian cents 0.755535 4.764833

------------------- -------------- -------------------------

British pence 1.217565 2.956721

------------------- -------------- -------------------------

New Zealand cents 0.692930 5.195330

------------------- -------------- -------------------------

On 3 March 2017, South32 announced to the Johannesburg Stock

Exchange that the US cent currency exchange rate applicable to the

dividend payable in South African cents to shareholders on the

South African branch register on the Record Date is the volume

weighted average price achieved on foreign exchange trades executed

over the period 28 February 2017 to 3 March 2017:

Currency Exchange rate Dividend per ordinary

share in local currency

--------------- -------------- -------------------------

South African

cents 13.06550 47.03580

--------------- -------------- -------------------------

About South32

South32 is a globally diversified mining and metals company with

high quality operations in Australia, Southern Africa and South

America. Our purpose is to make a difference by developing natural

resources, improving people's lives now and for generations to

come. We are trusted by our owners and partners to realise the

potential of their resources. We have a simple strategy to maximise

the potential of our assets and shareholder returns by optimising

our existing operations, unlocking their potential and identifying

new opportunities to compete for capital.

FURTHER INFORMATION

INVESTOR RELATIONS

--------------------------------------------------------------

Alex Volante Rob Ward

T +61 8 9324 T +61 8 9324

9029 9340

M +61 403 328 M +61 431 596

408 831

E Alex.Volante@south32.net E Robert.Ward@south32.net

---------------------------- ------------------------------

MEDIA RELATIONS

--------------------------------------------------------------

Diana Wearing James Clothier

Smith T +61 8 9324

T +61 8 9324 9697

9198 M +61 413 319

M +61 436 482 031

290 E James.Clothier@south32.net

E Diana.Smith@south32.net

---------------------------- ------------------------------

Further information on South32 can be found at

www.south32.net.

JSE Sponsor: UBS South Africa (Pty) Ltd

15 March 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCJAMRTMBABMLR

(END) Dow Jones Newswires

March 15, 2017 04:02 ET (08:02 GMT)

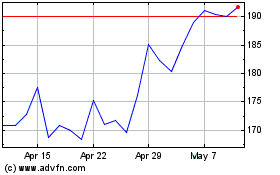

South32 (LSE:S32)

Historical Stock Chart

From Apr 2024 to May 2024

South32 (LSE:S32)

Historical Stock Chart

From May 2023 to May 2024