0000827876falseCLEANSPARK, INC.00008278762023-12-082023-12-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 08, 2023 |

CleanSpark, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Nevada |

001-39187 |

87-0449945 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2370 Corporate Circle, Suite 160 |

|

Henderson, Nevada |

|

89074 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (702) 989-7692 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

CLSK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On December 8, 2023, CleanSpark, Inc. (the “Company”) posted to its website an investor presentation, which is furnished as Exhibit 99.1 herewith. The investor presentation is also available on the Company’s website at www.cleanspark.com.

The information in this Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CLEANSPARK, INC. |

|

|

|

|

Date: |

December 8, 2023 |

By: |

/s/ Gary Vecchiarelli |

|

|

|

Gary Vecchiarelli

Chief Financial Officer |

Investor Presentation December 2023 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark

NASDAQ: CLSK All Rights Reserved. CleanSpark cautions you that statements in this presentation that are not a description of historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on CleanSpark’s current beliefs and expectations. The inclusion of forward-looking statements should not be regarded as a representation by CleanSpark that any of our plans will be achieved. Actual results may differ from those set forth in this presentation due to the risk and uncertainties inherent in our business, including, without limitation: known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: the success of its bitcoin mining activities; the volatility of bitcoin value and energy prices; disruptions in the crypto asset markets; market perception of the Company’s business and the crypto asset markets generally; the timely completion of mining facilities or expansions thereof; recognizing the full benefits of immersion cooling; increasing difficulty rates for bitcoin mining; future hashrate growth; bitcoin halving; new or additional governmental regulation; the anticipated delivery dates of new miners; the ability to successfully deploy new miners; the dependency on utility rate structures and government incentive programs; dependency on third-party power providers for expansion efforts and power rates; the risk that future revenue growth may not be realized; and other risks described in the Company's prior press releases and in its filings with the Securities and Exchange Commission (SEC), including under the heading "Risk Factors" in the Company's most recent Annual Report on Form 10-K and any subsequent filings with the SEC. The forward-looking statements in this presentation are based upon information available to us as of the date it is given, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and we undertake no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This presentation also contains aspirational statements regarding our efforts to source renewable and clean energy. Our sustainable energy strategy includes the use of renewable energy certificates as well as other strategies and efforts we may employ from time to time to mitigate or change our energy mix. Our sustainable energy strategy is at least in part dependent on the ability of certain third parties with which we contract to supply renewable and clean energy, and we do not control or independently review or audit their efforts or data. Copyright 2023 CleanSpark | Disclaimer 2

$168M Revenue FYTD Industry-leading operational track record ~$71M Cash balance1 Exceptionally strong balance sheet 155,000 88,825 Miners at full deployment Miners deployed Transformational infrastructure NASDAQ: CLSK 3 Copyright 2023 CleanSpark | 20.4 EH/s 10 EH/s After full deployment2 Deployed hashrate 5 Owned & operated data centers 44% FY2023 gross profit margin 6,903 FYTD Bitcoin Mined 1. Unaudited, as of November 30, 2023. 2,575 BTC / ~$97M Bitcoin Held1 $14.8M Total debt1 CleanSpark is America's Bitcoin Miner™ 2. Includes recent purchase of 4.4 EH/s of S21s.

NASDAQ: CLSK All Rights Reserved. With a Proven Track Record of Strategic Growth 4 Copyright 2023 CleanSpark | From September 30, 2022, to September 30, 2023 From September 30, 2022, to September 30, 2023 FY2023 wholesale low. FY2023 all-in power rate at wholly-owned and operated facilities is 4.8 cents. Purchased direct from Bitmain Fall 2023. Proven Track Record of Growth Market-driven Strategies 28% YoY Revenue Growth1 135% YoY Hashrate Growth2 Power rates as low as3 1.5¢ Purchased S21s at historic lows4 $14/TH

5 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | 8 EH/s JULY 2023 A Track Record of Never Letting a Bear Market Go to Waste *EH/s = Exahash per second 6 EH/S December 2022 5 EH/S & ACQUIRED NEW SANDERSVILLE, GA, FACILITY FROM MAWSON, INC October 2022 3 EH/S August 2022 ACQUIRED FACILITY IN WASHINGTON, GA, FROM WAHA TECHNOLOGIES August 2022 ACQUIRED NEW 20 MW IMMERSION-COOLED FACILITY December 2021 1 EH/S September 2021 1,000TH BITCOIN MINED October 2021 2 EH/S January 2022 PURCHASED 20,000 S19J PRO+ MINERS February 2023 RELEASED ESG AND CORPORATE RESPONSIBILITY REPORT March 2023 PURCHASED 45,000 ANTMINER S19 XP MINERS April 2023 2020 2023 2021 2022 FIRST BITCOIN MINED December 2020 ACQUIRED FIRST BTC MINING FACILITY IN COLLEGE PARK, GEORGIA December 2020 10 EH/S October 2023 4 EH/S September 2022 PURCHASED 10,000 S19J PRO MINERS September 2022 ACQUIRED NEW DALTON, GA, FACILITY FROM MAKERSTAR June 2023 PURCHASED 12,500 ANTMINER S19 XP MINERS June 2023 8 EH/S July 2023 Price per Bitcoin ACQUIRED 4.4 EH/S OF NEW ANTMINER S21 MINERS October 2023

Price Per Bitcoin A Track Record of Pragmatically Growing our Bitcoin Balance Bitcoin is a strategic part of our capital strategy. We are bullish on bitcoin and believe it plays an important role in our growth plans. 6 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Bitcoins in Treasury

BEGINNING OF FISCAL YEAR 2023 42,000+ Operational Miners 4.2 EH/s ~88,825 Operational Miners 10+ EH/s NOVEMBER 30, 2023 7 NASDAQ: CLSK All Rights Reserved. Hashrate (EH/s) Quarterly Bitcoin Mined 660₿ 889₿ 964₿ 1,227₿ 1,530₿ 1,872₿ Forecasted Hashrate 1,624₿ Copyright 2023 CleanSpark | A Track Record of Being a Top Bitcoin Producer 1,877₿ Now over 10 EH/s!

8 Copyright 2023 CleanSpark | NASDAQ: CLSK All Rights Reserved. Source: Bitcoin First, Fidelity Digital Assets, 2022 Durable Divisible Fungible Portable Verifiable Scarce Track Record Gold Bitcoin Fiat Currency While all are physically durable, fiat currency over history has not maintained purchasing power durability. Physical gold is only divisible into small pieces; Bitcoin is divisible to eight decimals. Gold and bitcoin are fungible, but fiat currency is not fungible with other fiat (US Dollar is not fungible with the Canadian Dollar). Gold has a high value-to-weight ratio, but it is still heavy and cumbersome to transport compared to the others. Both gold and fiat currency have been counterfeited; Gold can be verified but only through cumbersome assay. Gold is scarce, bitcoin is scarce and finite; The only constraint on fiat currency is willingness of government or central bank. Gold has the longest track record of money and maintaining purchasing power; Bitcoin's history is the shortest; Fiat currency has a poor track record. Bitcoin is a Superior Form of Money

9 Copyright 2023 CleanSpark | NASDAQ: CLSK All Rights Reserved. Best Operators in the Industry Leading efficiency Proprietary infrastructure Extraordinary people Energy expertise Massive scale

Efficiency of Fleet: We mine more bitcoin with less power Current fleet efficiency: 26.4 J/TH1 Expected fleet efficiency at 20.4 EH/s: 24.1 J/TH2 Efficiency of Operations: We run our own facilities Highest hashrate realization in the industry at scale3 Maximum flexibility and industry-leading margins Efficiency of Capital: Faster ROI for shareholders Build, buy rigs, and deploy as quickly as possible Identify market trends to acquire latest-gen ASICs at industry-setting prices 10 NASDAQ: CLSK All Rights Reserved. We are one of the most efficient operators in the industry Copyright 2023 CleanSpark | Leaders in Efficiency November 30, 2023. Based on expected upgrades and optimization. TheMinerMag, August 2023

11 NASDAQ: CLSK All Rights Reserved. As of November 30, 2023 of real estate and infrastructure adjacent to energy resources, putting us in control of our destiny. 3.2 million sq. ft. We own “Owning our infrastructure makes us more efficient, predictable, and reliable. This strategy has made us one of the top operators in the industry.” Copyright 2023 CleanSpark | Zach Bradford, CEO 78% 22% Predictability Efficiency Reliability Building Proprietary Infrastructure

Best Mining Technicians: We have a team of experts who deeply understand Bitcoin technology with extensive knowledge of mining equipment, safety protocols, and the latest technological advancements in the field. Best Repair Teams: They are the heartbeat of our mining operations. Our team is dedicated to optimizing, refurbishing, and maximizing the efficiency of our rigs. We've saved hundreds of thousands of dollars with in-house repairs. Best Site Leaders: Our site leaders have an unwavering commitment to staying ahead of the curve. They leverage cutting-edge technologies and adapt strategies to ensure we're always at the forefront of the mining landscape. Best Corporate Support: It's not just about technology – it's about people. Our leaders foster a culture of collaboration, empowerment, and continuous learning. They inspire and motivate our teams to reach new heights, turning challenges into opportunities and obstacles into stepping stones. Best Management Teams: Our management team isn’t just experts – they're visionaries. With years of hands-on experience and a deep understanding of the intricacies of Bitcoin mining, they're the driving force behind our operation's efficiency, innovation, and profitability. 12 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Best-in-Class Teams

13 NASDAQ: CLSK All Rights Reserved. “By running at max operating power when electricity costs are lowest, and optimizing when electricity costs are higher, we have been able to achieve some of the best margins in the industry, all while maintaining one of the highest realized hashrates in North America.” Copyright 2023 CleanSpark | Gary Vecchiarelli, CFO Our Energy Expertise Drives Sophisticated Power Management $0.036 $0.006 $0.003 $0.003 $0.048 Total Cost of Power

$20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 300 EH/s $44m $65m $86m $107m $128m $149m $171m 5.3% 325 EH/s $37m $57m $76m $96m $115m $135m $154m 4.9% 350 EH/s $31m $50m $68m $86m $104m $122m $140m 4.6% 375 EH/s $27m $44m $60m $77m $94m $111m $128m 4.3% 400 EH/s $22m $38m $54m $70m $86m $102m $118m 4.0% 425 EH/s $19m $34m $49m $63m $78m $93m $108m 3.8% 450 EH/s $15m $29m $44m $58m $72m $86m $100m 3.6% Footnote: Key assumptions: Miner up-time 98%; Average realized power cost: $.048; Pre-halving NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Positioned to Accumulate Rapid Gains as We Scale Bitcoin Price Global Hashrate (EH/s) Quarterly Gross Margin at 16 EH/s (in Millions) CLSK Share of Global Hashrate 14

15 NASDAQ: CLSK All Rights Reserved. Dalton, Georgia .8 EH/s Massena, New York 1.6 EH/s Copyright 2023 CleanSpark | Bitcoin Mining Data Centers *Hashrate as of November 30, 2023. College Park, Georgia 1.5 EH/s Sandersville, Georgia 2.4 EH/s Washington, Georgia 3.2 EH/s Norcross, Georgia .5 EH/s

Why We Love Georgia: 16 NASDAQ: CLSK All Rights Reserved. Best State for Business 9 years in a row – Area Development, 2022 Competitive Fiscal and Tax Structure Ranked 8 for corporate tax climate – Tax Foundation, 2023 Educated and Growing Workforce McKinsey Global Institute Analysis, 2022 Temperate Climate National Weather Service, 2023 Abundant, Affordable Energy North American Electric Reliability Council, 2023 Legend CleanSpark Bitcoin Mining Facility Nuclear Power Plant University of Georgia Georgia Institute of Technology Emory University Dalton State College Spelman College Morehouse College Morris Brown College Copyright 2023 CleanSpark | Georgia: (Actually) the Best State to Mine Bitcoin

$145+ million in capital commitments over five years in Gwinnett county $2.5+ million in local sales tax across Georgia (FYTD) Supporting renewable generation with Georgia's Flex REC program Chamber Memberships: Georgia, Washington-Wilkes, Washington, Las Vegas, Henderson, Chamber of Digital Commerce Community Days at our facilities Support through volunteering, and tens of thousands of dollars in donations and sponsorships for community events and initiatives Full scholarships for five Gwinnett Tech computer science students Walking trail and benches for College Park nature area NASDAQ: CLSK All Rights Reserved. Community Impact 17 Copyright 2023 CleanSpark |

*As of November 30, 2023 Hashrate No. of Machines MW Uptime Square Footage Utility Provider 1.5 EH/s 12,022 38 99.82% 261,360 MEAG/Georgia Power .5 EH/s 4,289 17.7 99.94% 317,988 Georgia Power 3.2 EH/s 25,840 82 98.83% 1,176,120 MEAG 2.4 EH/s 23,600 72 98.53% 1,437,480 MEAG .8 EH/s 6,114 20 99.70% 87,120 Dalton Utilities 1.6 EH/s 16,368 50 97.53% N/A NYISO 10 88,825 279.7 98.80% 3,280,068 Sandersville Co-locations Dalton Washington Norcross College Park Facility 18 NASDAQ: CLSK All Rights Reserved. Total Copyright 2023 CleanSpark | Our Facilities*

NASDAQ: CLSK All Rights Reserved. Efficiency Operational Leader Infrastructure First Profitable Operations Regional Expertise (Georgia) Clean Balance Sheet, Low Leverage As of November 30, 2023 26.4 J/Th September 30, 2023 $14.8m $761.6m Total Debt Total Assets 78% 22% Investment Highlights September 30, 2023 Adjusted EBITDA $25M As of October 31, 2023 Source: The Miner Mag 19 Copyright 2023 CleanSpark |

Appendix 20 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark |

21 NASDAQ: CLSK All Rights Reserved. Word Definition CY Abbreviation for calendar year; refers to the timeframe of January 1, 2023, through December 31, 2023. EBITDA Abbreviation for earnings before interest, taxes, depreciation, and amortization; is a widely-used, non-GAAP measure of a company’s financial health. EH/s Abbreviation for exahashes per second; a measurement of hashrate. An exahash is equivalent to 1 quintillion hashes per second. FY Abbreviation for fiscal year; refers to the budget year used for accounting purposes (October 1, 2022, through September 30, 2023). Hashrate Realization Expressed as a percentage of a company’s stated hashrate and calculated based on how much bitcoin a company is expected to produce. HODL Hold on for dear life; slang description for the strategy of not selling Bitcoin despite market volatility. J/TH Abbreviation for Joules per Terahash; used to describe a bitcoin mining fleet's efficiency using its energy-to-hashrate ratio. KWh Abbreviation for kilowatt-hour; a measurement based on the amount of energy it takes to run a 1,000-watt appliance for 1 hour. MW Abbreviation for megawatt; an energy measurement equivalent to 1 million watts. MRQ Abbreviation for most recent quarter; refers to the fiscal quarter that most recently ended. Uptime Percentage of time a miner is operational is often used interchangeably with hashrate realization. Copyright 2023 CleanSpark | Glossary

Natasha Betancourt Chief of Staff Taylor Monnig SVP, Mining Isaac Holyoak Chief Communications Officer Gary A. Vecchiarelli Chief Financial Officer Zach Bradford CEO & President S. Matthew Schultz Executive Chairman Bradley Audiss VP, Operations Scott Garrison SVP, Growth Joni McMillan VP, Organizational Development 22 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Leaders of Teams and Industries

What is Bitcoin? ESG & Corporate Responsibility Report 2023 Facility Locations 23 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Other Resources

24 NASDAQ: CLSK All Rights Reserved. Bitcoin Gold NASDAQ 100 S&P 500 2014 -58% -2% 19% 14% 2015 35% -11% 10% 1% 2016 125% 8% 7% 12% 2017 1331% 13% 33% 22% 2018 -73% -2% 0% -4% 2019 95% 18% 39% 3% 2020 301% 25% 49% 18% 2021 66% -4% 27% 29% 2022 -66% -1% -33% -18% 2023 YTD 127% 11% 36% 18% 2014-23 Annualized 48% 5% 16% 9% Copyright 2023 CleanSpark | Bitcoin & Traditional Assets ROI Source: Creative Planning

Q1-23 December 31, 2022 Q2-23 March 31, 2023 Q3-23 June 30, 2023 Q4-23 September 30, 2023 FYE-23 September 30, 2023 Revenue, net Bitcoin mining revenue, net $ 27,746 42,488 45,427 52,460 $ 168,121 Other services revenue 73 58 96 60 287 Total revenue, net $ 27,819 42,546 45,523 52,520 $ 168,408 Costs and expenses Cost of revenues (exclusive of depreciation and amortization shown below) 20,416 22,082 20,681 30,401 93,580 Professional fees 2,831 3,750 2,225 2,063 10,869 Payroll expenses 9,802 9,750 10,405 15,757 45,714 General and administrative expenses 3,724 4,329 5,064 7,706 20,823 Loss on disposal of assets - 3 - 1,928 1,931 Other impairment expense (related to bitcoin) 83 194 740 6,146 7,163 Realized (gain) loss on sale of bitcoin 517 (1,422) 143 (595) (1,357) Depreciation and amortization 19,329 21,346 21,850 58,203 120,728 Total costs and expenses $ 56,702 60,032 61,108 121,609 $ 299,451 Loss from operations (28,883) (17,486) (15,585) (69,089) (131,043) Other income - 11 - - 11 Change in fair value of contingent consideration 485 - 2,000 (1) 2,484 Unrealized gain (loss) on derivative security (1,271) 56 105 851 (259) Interest income 70 52 52 307 481 Interest expense (889) (799) (689) (600) (2,977) Total other (expense) income (1,605) (680) 1,468 557 (260) 25 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Income Statement FYE-23 ($ in thousands, except per value and share amounts)

Q1-23 December 31, 2022 Q2-23 March 31, 2023 Q3-23 June 30, 2023 Q4-23 September 30, 2023 FYE-23 September 30, 2023 Loss before income tax expense (30,488) (18,166) (14,117) (68,532) (131,303) Income tax expense - - - 857 857 Loss from continuing operations $ (30,488) (18,166) (14,117) (69,389) $ (132,160) Discontinued operations Gain (Loss) from discontinued operations $ 1,457 (294) (102) (5,490) $ (4,429) Net loss $ (29,031) (18,460) (14,219) (74,879) $ (136,589) Other comprehensive income 29 29 28 30 116 Total comprehensive loss attributable to common shareholders $ (29,002) (18,431) (14,191) (74,849) $ (136,473) Loss from continuing operations per common share - basic $ (0.46) (0.23) (0.12) (0.47) $ (1.29) Weighted average common shares outstanding - basic 66,395,174 80,469,471 114,844,402 148,1579,790 102,707,509 Loss from continuing operations per common share - diluted (0.46) (0.23) (0.12) (0.47) (1.29) Weighted average common shares outstanding - diluted 66,395,174 80,469,471 114,844,402 148,1579,790 102,707,509 Adjusted EBITDA calculation: Net loss $ (29,031) (18,460) (14,219) (74,879) $ (136,589) (Gain) loss on discontinued operations (1,457) 294 102 5,490 4,429 Depreciation and amortization 19,329 21,346 21,850 58,203 120,728 Share-based compensation expense 5,878 5,743 5,947 6,574 24,142 Other income - - - (11) (11) Change in fair value of contingent consideration (485) - (2,000) 1 (2,484) Unrealized (gain) loss of derivative security 1,271 (56) (105) (851) 259 Interest income (70) (52) (52) (307) (481) Interest expense 889 799 689 600 2,977 Loss on disposal of assets - 3 - 1,928 1,931 Income tax expense - - - 857 857 Litigation related expenses 1,163 3,056 1,036 2,617 7,872 Professional fees related to financing & business development transactions 542 48 85 22 697 Severance expenses - - - 701 701 Adjusted EBITDA $ (1,971) 12,721 13,333 945 $ 25,028 26 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Income Statement FYE-23 (cont’d) ($ in thousands, except per value and share amounts)

Q1-22 December 31, 2021 Q2-22 March 31, 2022 Q3-22 June 30, 2022 Q4-22 September 30, 2022 FYE-22 September 30, 2022 Revenue, net Bitcoin mining revenue, net $ 36,975 $ 36,965 $ 30,942 $ 26,118 $ 131,000 Other services revenue 150 233 87 55 525 Total revenue, net $ 37,125 $ 37,198 $ 31,029 $ 26,173 $ 131,525 Costs and expenses Cost of revenues (exclusive of depreciation and amortization shown below) 5,636 8,684 10,288 16,626 41,234 Professional fees 3,102 1,059 1,428 880 6,469 Payroll expenses 7,328 8,806 8,076 16,710 40,920 General and administrative expenses 1,816 2,773 2,119 3,716 10,424 (Gain) loss on disposal of assets 278 (921) - - (643) Other impairment expense (related to bitcoin) 6,222 812 4,418 758 12,210 Impairment expense - other - - - 250 250 Impairment expense - goodwill - - - 12,048 12,048 Realized (gain) loss on sale of bitcoin (9,995) 2,734 5,235 (541) (2,567) Depreciation and amortization 7,427 10,452 14,781 16,385 49,045 Total costs and expenses $ 21,814 $ 34,399 $ 46,345 $ 66,832 $ 169,390 Income (loss) from operations 15,311 2,799 (15,316) (40,659) (37,865) Other income - 308 - - 308 Change in fair value of contingent consideration 55 291 - (40) 306 Realized gain on sale of equity security 1 - - - 1 Unrealized loss on equity security (2) - - - (2) Unrealized gain (loss) on derivative security 299 (1,410) (1,033) 194 (1,950) Interest income 33 52 52 54 191 Interest expense (53) (8) (314) (703) (1,078) Total other income (expense) $ 333 $ (767) $ (1,295) $ (495) $ (2,224) 27 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Income Statement FYE-22 ($ in thousands, except per value and share amounts)

Q1-22 December 31, 2021 Q2-22 March 31, 2022 Q3-22 June 30, 2022 Q4-22 September 30, 2022 FYE-22 September 30, 2022 Income (loss) before income tax expense $ 15,644 $ 2,032 $ (16,611) $ (41,154) $ (40,089) Income tax expense - - - - - Income (loss) from continuing operations 15,644 2,032 (16,611) (41,153) (40,089) Loss from discontinued operations (1,158) (2,203) (12,729) (1,147) (17,237) Net income (loss) 14,486 (171) (29,340) (42,301) (57,326) Other comprehensive income 18 28 29 41 116 Preferred stock dividends (315) (20) - - (335) Total comprehensive income (loss) attributable to common� shareholders $ 14,189 $ (163) $ (29,311) $ (42,261) $ (57,546) Income (loss) per common share - basic $ 0.38 $ (0.05) $ (0.40) $ (0.97) $ (0.95) Weighted average common shares outstanding - basic 40,279,938 41,336,342 41,277,090 42,614,197 42,614,197 Income (loss) per common share - diluted 0.38 (0.05) (0.40) (0.97) (0.95) Weighted average common shares outstanding - diluted 40,485,761 41,395,075 41,277,090 42,614,197 42,614,197 Adjusted EBITDA calculation: Net income gain (loss) $ 14,486 $ (171) $ (29,340) $ (42,301) $ (57,326) Loss on discontinued operations 1,158 2,203 12,729 1,147 17,237 Impairment expense – other - - - 250 250 Impairment expense – goodwill - - - 12,048 12,048 Depreciation and amortization 7,427 10,452 14,781 16,385 49,045 Share-based compensation expense 5,749 6,554 5,213 13,949 31,465 Other income - - - - - Change in fair value of contingent consideration (55) (291) - 41 (305) Realized gain on sale of equity security (1) - - - (1) Unrealized loss of equity security 2 - - - 2 Unrealized (gain)/loss of derivative security (299) 1,410 1,033 (194) 1,950 Interest income (33) (52) (52) (54) (191) Interest expense 53 8 314 703 1,078 (Gain) loss on disposal of assets 278 (921) - - (643) Legal fees related to litigation 136 116 143 126 521 Professional fees related to financing & business development transactions - 41 189 597 827 Severance expenses - 289 102 14 405 Adjusted EBITDA $ 28,901 $ 19,638 $ 5,112 $ 2,711 $ 56,362 28 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Income Statement FYE-22 (cont’d) ($ in thousands, except per value and share amounts)

September 30, 2023 September 30, 2022 Assets Current assets Cash and cash equivalents $ 29,215 $ 20,463 Accounts receivable, net 5 27 Inventory 809 216 Prepaid expense and other current assets 12,034 7,931 Bitcoin 56,241 11,147 Derivative investment asset 2,697 2,956 Investment in debt security, AFS, at fair value 726 610 Current assets held for sale 445 7,426 Total current assets $ 102,172 $ 50,776 Property and equipment, net $ 564,395 $ 376,781 Operating lease right of use asset 688 551 Intangible assets, net 4,603 6,485 Deposits on miners and mining equipment 75,959 12,497 Other long-term asset 5,718 3,990 Goodwill 8,043 - Long-term assets held for sale - 1,545 Total assets $ 761,578 $ 452,625 29 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Balance Sheet ($ in thousands, except per value and share amounts)

September 30, 2023 September 30, 2022 Liabilities and stockholders' equity Current liabilities Accounts payable and accrued liabilities $ 65,577 $ 24,662 Current portion of operating lease liability 181 113 Current portion of finance lease liability 130 260 Current portion of long-term loans payable 6,992 7,786 Dividends payable - 21 Current liabilities held for sale 1,175 1,199 Total current liabilities $ 74,055 $ 34,041 Long-term liabilities Operating lease liability, net of current portion 519 447 Finance lease liability, net of current portion 9 180 Loans payable, net of current portion 8,911 13,433 Deferred income taxes 857 - Long-term liabilities held for sale - 512 Total liabilities $ 84,351 $ 48,613 Stockholders' equity Common stock 160 56 Preferred stock 2 2 Additional paid-in capital 1,009,482 599,898 Accumulated other comprehensive income 226 110 Accumulated deficit (332,643) (196,054) Total stockholders' equity 677,227 404,012 Total liabilities and stockholders’ equity $ 761,578 $ 452,625 30 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Balance Sheet (cont’d) ($ in thousands, except per value and share amounts)

31 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Facility: College Park CleanSpark's first ever bitcoin mining facility is in College Park, Georgia. It sits on six acres near the Hartsfield-Jackson Atlanta International Airport and features at its heart 48 new generation air-cooled pods enclosed by a Department of Transportation sound wall. Machines are also housed in 20 Ant boxes, an annex building and within the original data center. CleanSpark founder and CEO Zach Bradford originally visited the operation to consult on an energy project but quickly recognized the opportunity to lead one of the most important energy projects of our generation: bitcoin mining. ESTABLISHED DECEMBER 2020 OWNED & OPERATED AIR-COOLED SYSTEM 1.5 Hashrate (EH/s) 99.82% Uptime 12,022 No. of Machines 261,360 Square Footage 38 Megawatts MEAG / Georgia Power Utility Provider

32 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Facility: Norcross An 87,000-square-foot data center in Norcross was purchased and transformed into CleanSpark's second Bitcoin mining facility. Situated on over seven acres, the immersion-cooled site participates in Georgia’s Flex REC program and is 100% net carbon-neutral. There are two large rooms that house 20 MW of single-phase immersion — about 4,300 machines. Liquid immersion cooling, where the bitcoin mining machines are fully immersed in a specialized oil, has proven to significantly improve efficiency by reducing power consumption and extending the life of the machines — thereby maximizing financial gains. ESTABLISHED AUGUST 2021 OWNED & OPERATED IMMERSION- COOLED SYSTEM .5 Hashrate (EH/s) 99.94% Uptime 4,289 No. of Machines 317,988 Square Footage 17.7 Megawatts Georgia Power Utility Provider

33 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Facility: Washington Nestled between Augusta and Athens, the historic town of Washington is home to CleanSpark’s third bitcoin mining facility. It was purchased during the summer 2022 bear market from another bitcoin miner as an already-operational site. Bitcoin mining machines operate in multiple air-cooled buildings. A completed 50MW expansion created four more buildings filled with an additional 14,000 latest-gen miners. It draws power predominantly from low-carbon sources, such as nuclear energy. Since its acquisition, CleanSpark has contributed hundreds of thousands in taxes to the city and supported numerous local businesses through sponsorships and charities. It is a perfect place to mine bitcoin, and we are thrilled to partner with the community. ESTABLISHED AUGUST 2022 OWNED & OPERATED AIR-COOLED SYSTEM 3.2 Hashrate (EH/s) 98.83% Uptime 25,840 No. of Machines 1,176,120 Square Footage 82 Megawatts MEAG Utility Provider

34 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Facility: Sandersville CleanSpark’s fourth bitcoin mining site (and second to be purchased during the summer 2022 bear market) is the largest facility in our portfolio. The turnkey operation in Sandersville was acquired from another bitcoin miner with room to almost triple its capacity. The site is undergoing a massive 150 MW expansion with expected completion later this year. It will feature cathedral-style buildings, some the length of over three football fields. Each building will house thousands of high-performance bitcoin mining machines and, once completed, will add about 7 EH/s to CleanSpark’s hashrate. ESTABLISHED OCTOBER 2022 OWNED & OPERATED AIR-COOLED SYSTEM 2.4 Hashrate (EH/s) 98.53% Uptime 23,600 No. of Machines 1,437,480 Square Footage 72 Megawatts MEAG Utility Provider

35 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Facility: Dalton Dalton marks CleanSpark's fifth campus in Georgia. We collaborate closely with the local utility, which is owned and operated by the City of Dalton. This campus is unique, being made of two separate sites a few miles from each other. ESTABLISHED JUNE 2023 OWNED & OPERATED AIR-COOLED SYSTEM .8 Hashrate (EH/s) 99.70% Uptime 6,114 No. of Machines 87,120 Square Footage 20 Megawatts Dalton Utilities Utility Provider

36 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Facility: Co-locations Most of CleanSpark’s hashrate comes from the bitcoin mining locations that we own and operate. However, we also co-locate some of our machines at Coinmint in Massena, New York. The facility runs on hydroelectric power—a prime example of bitcoin mining with clean energy. 1.6 Hashrate (EH/s) 97.53% Uptime 16,368 No. of Machines 50 Megawatts PARTNERED JULY 2021 CO-LOCATED AIR-COOLED SYSTEM

Adjusted EBITDA is not a measurement of financial performance under generally accepted accounting principles in the United States (“GAAP”). Because of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact a company's non-cash operating expenses, CleanSpark management believes that providing a non-GAAP financial measure that excludes non-cash and non-recurring expenses allows for meaningful comparisons between the Company's core business operating results and those of other companies, as well as providing the Company with an important tool for financial and operational decision making and for evaluating its own core business operating results over different periods of time. The Company's Adjusted EBITDA measure may not provide information that is directly comparable to that provided by other companies in its industry, as other companies in its industry may calculate non-GAAP financial results differently, particularly related to non-recurring, unusual items. The Company's Adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to operating income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. Our management does not consider Adjusted EBITDA to be a substitute for, or superior to, the information provided by GAAP financial results. We are providing supplemental financial measures for non-GAAP adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) that excludes the impact of interest, taxes, depreciation, amortization, our share-based compensation expense, and impairment of assets, unrealized gains/losses on securities, certain financing costs, other non-cash items, certain non-recurring expenses, and impacts related to discontinued operations. These supplemental financial measures are not measurements of financial performance under GAAP and, as a result, these supplemental financial measures may not be comparable to similarly titled measures of other companies. Management uses these non-GAAP financial measures internally to help understand, manage, and evaluate our business performance and to help make operating decisions. We believe that these non-GAAP financial measures are also useful to investors and analysts in comparing our performance across reporting periods on a consistent basis. Adjusted EBITDA excludes (i) impacts of interest, taxes, and depreciation; (ii) significant non-cash expenses such as our share-based compensation expense, unrealized gains/losses on securities, certain financing costs, other non-cash items that we believe are not reflective of our general business performance, and for which the accounting requires management judgment, and the resulting expenses could vary significantly in comparison to other companies; (iii) significant impairment losses related to long-lived and digital assets, which include our bitcoin for which the accounting requires significant estimates and judgment, and the resulting expenses could vary significantly in comparison to other companies; and (iv) and impacts related to discontinued operations that would not be applicable to our future business activities. Non-GAAP financial measures are subject to material limitations as they are not in accordance with, or a substitute for, measurements prepared in accordance with GAAP. For example, we expect that share-based compensation expense, which is excluded from Adjusted EBITDA, will continue to be a significant recurring expense over the coming years and is an important part of the compensation provided to certain employees, officers, and directors. We have also excluded impairment losses on assets, including impairments of our digital currency our non-GAAP financial measures, which may continue to occur in future periods as a result of our continued holdings of significant amounts of bitcoin. Our non-GAAP financial measures are not meant to be considered in isolation and should be read only in conjunction with our Consolidated Financial Statements, which have been prepared in accordance with GAAP. We rely primarily on such Consolidated Financial Statements to understand, manage, and evaluate our business performance and use the non-GAAP financial measures only supplementally. 37 NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark | Non-GAAP Measures

NASDAQ: CLSK All Rights Reserved. Copyright 2023 CleanSpark

v3.23.3

Document And Entity Information

|

Dec. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 08, 2023

|

| Entity Registrant Name |

CLEANSPARK, INC.

|

| Entity Central Index Key |

0000827876

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39187

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Tax Identification Number |

87-0449945

|

| Entity Address, Address Line One |

2370 Corporate Circle, Suite 160

|

| Entity Address, City or Town |

Henderson

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89074

|

| City Area Code |

(702)

|

| Local Phone Number |

989-7692

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CLSK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

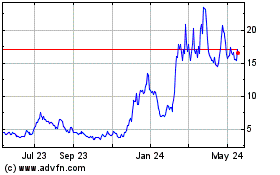

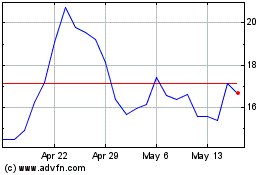

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Apr 2024 to May 2024

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From May 2023 to May 2024