false000102156100010215612023-08-012023-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| |

August 1, 2023

|

|

| |

Date of Report (Date of earliest event reported)

|

|

| |

NU SKIN ENTERPRISES, INC.

|

|

| |

(Exact name of registrant as specified in its charter)

|

|

|

Delaware

|

|

001-12421

|

|

87-0565309

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification Number)

|

| |

75 West Center Street

Provo, Utah 84601

|

|

| |

(Address of principal executive offices and zip code)

|

|

| |

(801) 345-1000

|

|

| |

(Registrant’s telephone number, including area code)

|

|

| |

N/A

|

|

| |

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock, $.001 par value

|

NUS

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition.

|

On August 1, 2023, Nu Skin Enterprises, Inc. (the “Company”) issued a press release announcing its financial results for the three- and six-month periods ended June 30,

2023, and certain other information. A copy of the press release is attached as Exhibit 99.1 to this report.

The information furnished pursuant to this Item 2.02 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits.

|

(d) Exhibits.

| 99.1 |

Nu Skin Enterprises’ press release dated August 1, 2023, regarding financial results for the three- and six-month periods ended June 30, 2023.

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

NU SKIN ENTERPRISES, INC.

|

| |

(Registrant)

|

| |

|

| |

/s/ James D. Thomas

|

|

| |

James D. Thomas

|

| |

Chief Financial Officer

|

| |

|

|

Date: August 1, 2023

|

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

Nu Skin Enterprises Reports Second Quarter 2023 Financial Results

PROVO, Utah — Aug. 1, 2023 — Nu Skin Enterprises, Inc.

(NYSE: NUS) today announced second quarter 2023 results in line with expectations.

Executive Summary

Q2 2023 vs. Prior-year Quarter

|

Revenue:

|

|

$500.3 million; (11)%

• (3)% FX impact or

$(16.4) million

|

|

Earnings Per Share (EPS):

|

|

$0.54 compared to $0.67 or $0.77 excluding charges associated with our exit from Grow Tech

|

|

Customers:

|

|

1,041,118; (25)%

|

|

Paid Affiliates:

|

|

187,652; (23)%

• An adjustment to

eligibility requirements accounted for approximately (13)% of the decline

|

|

Sales Leaders:

|

|

45,807; (9)%

|

“Our second quarter results improved sequentially and landed within our guidance range, driven in large part by year-over-year gains in Mainland China and our Rhyz segments,”

said Ryan Napierski, Nu Skin president and CEO. “We are seeing early signs of momentum building in Mainland China; however, we continue to be negatively impacted in several key markets by macro-economic factors and associated price increases that have

had a dampening effect on consumer spending and customer acquisition.

“Despite the lingering macro challenges, we continue to make steady progress toward our Nu Vision 2025 strategy. In Q3 we will be rolling out ageLOC® TRMe®, our personalized

weight management system, in China. Most other markets will begin introducing ageLOC WellSpa iO™, a smart device system focused on holistic wellness and beauty, with consumer launches in Q4 to help us drive year-over-year growth in the quarter. To

complement these introductions, we will be introducing a new channel growth incentive in the second half to attract new affiliates and develop sales leaders. In addition, our Vera® and Stela apps continue to gain healthy traction as downloads and

monthly active users exceed expectations.

“We continue to be pleased with the performance of Rhyz improving 33% year over year. As part of building our long-term enterprise strategy, we announced today the Rhyz

acquisition of BeautyBio, an omnichannel, clean and clinically proven skincare and beauty device brand. BeautyBio’s unique device IP in hydration facial and micro-needling technology will further strengthen Nu Skin’s position as the world’s

best-selling beauty device systems brand.* Our expertise in devices, manufacturing and technology will help BeautyBio reach its potential as we explore synergies within the Rhyz ecosystem.”

Q2 2023 Year-over-year Operating Results

|

Revenue:

|

|

$500.3 million compared to $560.6 million

• (3)% FX impact or

$(16.4) million

|

|

Gross Margin:

|

|

72.9% compared to 73.6%

• Nu Skin business was

77.2% compared to 77.0%

• Impacted by revenue

growth in Rhyz Manufacturing

|

|

Selling Expenses:

|

|

37.0% compared to 39.1%

• Nu Skin business was

40.2% compared to 42.0%

|

|

G&A Expenses:

|

|

27.4% compared to 25.3%

|

|

Operating Margin:

|

|

8.5% compared to 9.2%

|

|

Other Income / (Expense):

|

|

$(5.4) million compared to $(8.6) million

|

|

Income Tax Rate:

|

|

27.5% compared to 20.2%

|

|

EPS:

|

|

$0.54 compared to $0.67 or $0.77 excluding charges associated with our exit from Grow Tech

|

Stockholder Value

|

Dividend Payments:

|

|

$19.5 million

|

|

Stock Repurchases:

|

|

$0.0 million

• $175.4 million

remaining in authorization

|

Q3 and Full-year 2023 Outlook

|

Q3 2023 Revenue:

|

|

$500 to $540 million; (7)% to 0.5%

• Approximately (2) to

(1)% FX impact

|

|

Q3 2023 EPS:

|

|

$0.54 to $0.69

|

|

2023 Revenue:

|

|

$2.00 to $2.08 billion; (10)% to (6)%

• Approximately (3) to

(2)% FX impact

|

|

2023 EPS:

|

|

$2.15 to $2.45 or $2.30 to $2.60 non-GAAP

|

“Taking into account first half results, a stronger-than-expected U.S. dollar and recent acquisitions, we are adjusting our 2023 guidance, which

continues to show sequential improvements in the back half of the year with a return to year-over-year growth in the fourth quarter,” said James D. Thomas, chief financial officer. “We now anticipate our annual revenue to be $2.00 to $2.08 billion,

with an approximate 2 to 3 percent foreign currency headwind. We are also adjusting reported EPS of $2.15 to $2.45, or $2.30 to $2.60 excluding first quarter restructuring charges. For the third quarter, we project revenue of $500 to $540 million,

assuming a negative foreign currency impact of approximately 1 to 2 percent, with reported earnings per share of $0.54 to $0.69. In summary, while the persistence of macro headwinds has made the journey more challenging than expected, we continue to

invest in key growth initiatives that support our long-term enterprise strategy and remain confident in our direction and future.”

Conference Call

The Nu Skin Enterprises management team will host a conference call with the investment community today at 5 p.m. (ET). Those wishing to access the

webcast, as well as the financial information presented during the call, can visit the Investor Relations page on the company's website at ir.nuskin.com. A replay of the webcast will be available on the same page through Aug. 15, 2023.

About Nu Skin Enterprises Inc.

The Nu Skin Enterprises Inc. (NYSE: NUS) family of companies includes Nu Skin and Rhyz Inc. Nu Skin is an integrated beauty and wellness company, powered

by a dynamic affiliate opportunity platform, which operates in nearly 50 markets worldwide. Backed by nearly 40 years of scientific research, the company’s products help people look, feel and live their best with brands including Nu Skin® personal

care, Pharmanex® nutrition and ageLOC® anti-aging, which includes an award-winning line of beauty device systems. Rhyz is the strategic investment arm of Nu Skin Enterprises. Formed in 2018, Rhyz is a synergistic ecosystem of consumer, technology and

manufacturing companies focused on innovation within the beauty, wellness and lifestyle categories.

*Source Euromonitor International Limited; Retail Value RSP terms; all channels; 2017 to 2022. Beauty Systems are at-home Skin Care Beauty Devices that

are exclusively paired or recommended to be used with a topical consumable of the same brand. Claim verification based on Euromonitor custom research and methodology conducted April - June of 2023. Sales of at-home skin care beauty devices includes

sales of electric facial cleansers as defined in Passport database. This category does not include hair care/removal appliances, body shavers, and oral care appliances.

Important Information Regarding Forward-Looking Statements: This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that represent the

company’s current expectations and beliefs. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws and include, but are not limited to, statements of management’s

expectations regarding the macro-environment and the company’s performance, growth, shareholder value, strategies, transformation, initiatives, product pipeline and product introductions/launches, digital and social-commerce tools and initiatives,

benefits of the BeautyBio acquisition, customers, sales leaders, and affiliates; projections regarding revenue, expenses, operating income, earnings per share, foreign currency fluctuations, uses of cash and other financial items; statements of

belief; and statements of assumptions underlying any of the foregoing. In some cases, you can identify these statements by forward-looking words such as “believe,” “expect,” “anticipate,” “project,” “continue,” “outlook,” “guidance,” “remain,”

“will,” “would,” “could,” “may,” “might,” the negative of these words and other similar words.

The forward-looking statements and related assumptions involve risks and uncertainties that could cause actual results and outcomes to differ materially

from any forward-looking statements or views expressed herein. These risks and uncertainties include, but are not limited to, the following:

|

• |

risk that epidemics, including COVID-19 and related disruptions, and other crises could negatively impact our business;

|

|

• |

adverse publicity related to the company’s business, products, industry or any legal actions or complaints by the company’s sales force or others;

|

|

• |

risk that direct selling laws and regulations in any of the company’s markets, including the United States and Mainland China, may be modified, interpreted or enforced in a manner

that results in negative changes to the company’s business model or negatively impacts its revenue, sales force or business, including through the interruption of sales activities, loss of licenses, increased scrutiny of sales force actions,

imposition of fines, or any other adverse actions or events;

|

|

• |

any failure of current or planned initiatives or products to generate interest among the company’s sales force and customers and generate sponsoring and selling activities on a

sustained basis;

|

|

• |

political, legal, tax and regulatory uncertainties, including trade policies, associated with operating in Mainland China and other international markets;

|

|

• |

uncertainty regarding meeting restrictions and other government scrutiny in Mainland China, as well as negative media and consumer sentiment in Mainland China on our business

operations and results;

|

|

• |

risk of foreign-currency fluctuations and the currency translation impact on the company’s business associated with these fluctuations;

|

|

• |

uncertainties regarding the future financial performance of the businesses the company has acquired;

|

|

• |

risks related to accurately predicting, delivering or maintaining sufficient quantities of products to support planned initiatives or launch strategies, and increased risk of

inventory write-offs if the company over-forecasts demand for a product or changes its planned initiatives or launch strategies;

|

|

• |

regulatory risks associated with the company’s products, which could require the company to modify its claims or inhibit its ability to import or continue selling a product in a

market if the product is determined to be a medical device or if the company is unable to register the product in a timely manner under applicable regulatory requirements;

|

|

• |

unpredictable economic conditions and events globally;

|

|

• |

the company’s future tax-planning initiatives; any prospective or retrospective increases in duties or tariffs on the company’s products imported into the company’s markets outside

of the United States; and any adverse results of tax audits or unfavorable changes to tax laws in the company’s various markets; and

|

|

• |

continued competitive pressures in the company’s markets.

|

The company’s financial performance and the forward-looking statements contained herein are further qualified by a detailed discussion of associated

risks set forth in the documents filed by the company with the Securities and Exchange Commission. The forward-looking statements set forth the company’s beliefs as of the date that such information was first provided, and the company assumes no duty

to update the forward-looking statements contained in this release to reflect any change except as required by law.

Non-GAAP Financial Measures:

Constant-currency revenue change is a non-GAAP financial measure that removes the impact of fluctuations in foreign-currency exchange rates, thereby facilitating period-to-period comparisons of the company’s performance. It is calculated by

translating the current period’s revenue at the same average exchange rates in effect during the applicable prior-year period and then comparing that amount to the prior-year period’s revenue. The company believes that constant-currency revenue

change is useful to investors, lenders and analysts because such information enables them to gauge the impact of foreign-currency fluctuations on the company’s revenue from period to period.

Earnings per share, excluding charges associated with our exit from Grow Tech or restructuring and impairment charges, is also a non-GAAP financial

measure. Charges associated with our exit from Grow Tech and restructuring and impairment charges are not part of the ongoing operations of our underlying business. The company believes that these non-GAAP financial measures are useful to investors,

lenders and analysts because removing the impact of charges associated with our exit from Grow Tech and restructuring and impairment charges facilitates period-to-period comparisons of the company’s performance. Please see the reconciliations of these

items to our earnings per share and operating margin calculated under GAAP, below.

The following table sets forth revenue for the three-month periods ended June 30, 2023 and 2022 for each of our reportable segments (U.S. dollars in thousands):

| |

|

Three Months Ended

June 30,

|

|

|

|

|

|

Constant-

Currency

|

|

| |

|

2023

|

|

|

2022

|

|

|

Change

|

|

|

Change

|

|

|

Nu Skin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas

|

|

$

|

107,641

|

|

|

$

|

124,445

|

|

|

|

(14

|

)%

|

|

|

(10

|

)%

|

|

Mainland China

|

|

|

88,362

|

|

|

|

86,808

|

|

|

|

2

|

%

|

|

|

8

|

%

|

|

Southeast Asia/Pacific

|

|

|

63,764

|

|

|

|

94,067

|

|

|

|

(32

|

)%

|

|

|

(30

|

)%

|

|

South Korea

|

|

|

53,686

|

|

|

|

69,308

|

|

|

|

(23

|

)%

|

|

|

(19

|

)%

|

|

Japan

|

|

|

50,862

|

|

|

|

55,952

|

|

|

|

(9

|

)%

|

|

|

(4

|

)%

|

|

Europe & Africa

|

|

|

46,968

|

|

|

|

50,871

|

|

|

|

(8

|

)%

|

|

|

(9

|

)%

|

|

Hong Kong/Taiwan

|

|

|

37,108

|

|

|

|

39,327

|

|

|

|

(6

|

)%

|

|

|

(3

|

)%

|

|

Nu Skin other

|

|

|

597

|

|

|

|

1,318

|

|

|

|

(55

|

)%

|

|

|

(55

|

)%

|

|

Total Nu Skin

|

|

|

448,988

|

|

|

|

522,096

|

|

|

|

(14

|

)%

|

|

|

(11

|

)%

|

|

Rhyz Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing

|

|

|

45,551

|

|

|

|

38,229

|

|

|

|

19

|

%

|

|

|

19

|

%

|

|

Rhyz other

|

|

|

5,718

|

|

|

|

290

|

|

|

|

1872

|

%

|

|

|

1872

|

%

|

|

Total Rhyz Investments

|

|

|

51,269

|

|

|

|

38,519

|

|

|

|

33

|

%

|

|

|

33

|

%

|

|

Total

|

|

$

|

500,257

|

|

|

$

|

560,615

|

|

|

|

(11

|

)%

|

|

|

(8

|

)%

|

The following table sets forth revenue for the six-month periods ended June 30, 2023 and 2022 for each of our reportable segments (U.S. dollars in thousands):

| |

|

Six Months Ended

June 30,

|

|

|

|

|

|

Constant-

Currency

|

|

| |

|

2023

|

|

|

2022

|

|

|

Change

|

|

|

Change

|

|

|

Nu Skin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas

|

|

$

|

208,798

|

|

|

$

|

248,025

|

|

|

|

(16

|

)%

|

|

|

(12

|

)%

|

|

Mainland China

|

|

|

156,338

|

|

|

|

211,303

|

|

|

|

(26

|

)%

|

|

|

(21

|

)%

|

|

Southeast Asia/Pacific

|

|

|

131,574

|

|

|

|

184,303

|

|

|

|

(29

|

)%

|

|

|

(26

|

)%

|

|

South Korea

|

|

|

124,010

|

|

|

|

141,441

|

|

|

|

(12

|

)%

|

|

|

(8

|

)%

|

|

Japan

|

|

|

103,468

|

|

|

|

117,743

|

|

|

|

(12

|

)%

|

|

|

(3

|

)%

|

|

Europe & Africa

|

|

|

94,412

|

|

|

|

103,839

|

|

|

|

(9

|

)%

|

|

|

(8

|

)%

|

|

Hong Kong/Taiwan

|

|

|

71,656

|

|

|

|

77,821

|

|

|

|

(8

|

)%

|

|

|

(4

|

)%

|

|

Nu Skin other

|

|

|

482

|

|

|

|

1,938

|

|

|

|

(75

|

)%

|

|

|

(75

|

)%

|

|

Total Nu Skin

|

|

|

890,738

|

|

|

|

1,086,413

|

|

|

|

(18

|

)%

|

|

|

(14

|

)%

|

|

Rhyz Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing

|

|

|

81,318

|

|

|

|

78,570

|

|

|

|

3

|

%

|

|

|

3

|

%

|

|

Rhyz other

|

|

|

9,663

|

|

|

|

531

|

|

|

|

1720

|

%

|

|

|

1720

|

%

|

|

Total Rhyz Investments

|

|

|

90,981

|

|

|

|

79,101

|

|

|

|

15

|

%

|

|

|

15

|

%

|

|

Total

|

|

$

|

981,719

|

|

|

$

|

1,165,514

|

|

|

|

(16

|

)%

|

|

|

(12

|

)%

|

The following table provides information concerning the number of Customers, Paid Affiliates and Sales Leaders in our core Nu Skin business for the three-month periods

ended June 30, 2023 and 2022:

| |

|

Three Months Ended

June 30,

|

|

|

|

|

| |

|

2023

|

|

|

2022

|

|

|

Change

|

|

|

Customers

|

|

|

|

|

|

|

|

|

|

|

Americas

|

|

|

263,138

|

|

|

|

302,849

|

|

|

|

(13

|

)%

|

|

Mainland China

|

|

|

214,907

|

|

|

|

392,268

|

|

|

|

(45

|

)%

|

|

Southeast Asia/Pacific

|

|

|

106,283

|

|

|

|

152,775

|

|

|

|

(30

|

)%

|

|

South Korea

|

|

|

112,019

|

|

|

|

135,290

|

|

|

|

(17

|

)%

|

|

Japan

|

|

|

112,484

|

|

|

|

122,643

|

|

|

|

(8

|

)%

|

|

Europe & Africa

|

|

|

177,472

|

|

|

|

205,379

|

|

|

|

(14

|

)%

|

|

Hong Kong/Taiwan

|

|

|

54,815

|

|

|

|

69,411

|

|

|

|

(21

|

)%

|

|

Total Customers

|

|

|

1,041,118

|

|

|

|

1,380,615

|

|

|

|

(25

|

)%

|

|

Paid Affiliates

|

|

|

|

|

|

|

|

|

|

|

Americas

|

|

|

36,048

|

|

|

|

44,523

|

|

|

|

(19

|

)%

|

|

Mainland China

|

|

|

28,825

|

|

|

|

19,257

|

|

|

|

50

|

%

|

|

Southeast Asia/Pacific

|

|

|

32,769

|

|

|

|

41,512

|

|

|

|

(21

|

)%

|

|

South Korea(1)

|

|

|

23,012

|

|

|

|

48,605

|

|

|

|

(53

|

)%

|

|

Japan

|

|

|

36,765

|

|

|

|

38,269

|

|

|

|

(4

|

)%

|

|

Europe & Africa(1)

|

|

|

19,906

|

|

|

|

32,323

|

|

|

|

(38

|

)%

|

|

Hong Kong/Taiwan(1)

|

|

|

10,327

|

|

|

|

17,644

|

|

|

|

(41

|

)%

|

|

Total Paid Affiliates

|

|

|

187,652

|

|

|

|

242,133

|

|

|

|

(23

|

)%

|

|

Sales Leaders

|

|

|

|

|

|

|

|

|

|

|

Americas

|

|

|

7,872

|

|

|

|

9,320

|

|

|

|

(16

|

)%

|

|

Mainland China(2)

|

|

|

13,777

|

|

|

|

11,458

|

|

|

|

20

|

%

|

|

Southeast Asia/Pacific

|

|

|

5,814

|

|

|

|

8,407

|

|

|

|

(31

|

)%

|

|

South Korea

|

|

|

5,784

|

|

|

|

6,557

|

|

|

|

(12

|

)%

|

|

Japan

|

|

|

5,853

|

|

|

|

6,097

|

|

|

|

(4

|

)%

|

|

Europe & Africa

|

|

|

4,105

|

|

|

|

5,192

|

|

|

|

(21

|

)%

|

|

Hong Kong/Taiwan

|

|

|

2,602

|

|

|

|

3,054

|

|

|

|

(15

|

)%

|

|

Total Sales Leaders

|

|

|

45,807

|

|

|

|

50,085

|

|

|

|

(9

|

)%

|

(1) The June 30, 2023 number is affected by a change in eligibility requirements for receiving certain rewards within our compensation structure. We plan to implement

these changes in additional segments over the next several quarters.

(2) The June 30, 2023 number reflects a modified Sales Leader definition, as described in our quarterly report on Form 10-Q.

|

● |

“Customers” are persons who have purchased directly from the Company during the three months ended as of the date indicated. Our Customer numbers include members of our sales force who made such a

purchase, including Paid Affiliates and those who qualify as Sales Leaders, but they do not include consumers who purchase directly from members of our sales force.

|

|

● |

“Paid Affiliates” are any Brand Affiliates, as well as members of our sales force in Mainland China, who earned sales compensation during the three-month period. In all of our markets besides Mainland

China, we refer to members of our independent sales force as “Brand Affiliates” because their primary role is to promote our brand and products through their personal social networks.

|

|

● |

“Sales Leaders” are the three-month average of our monthly Brand Affiliates, as well as sales employees and independent marketers in Mainland China, who achieved certain qualification requirements as

of the end of each month of the quarter.

|

NU SKIN ENTERPRISES, INC.

Consolidated Statements of Income (Unaudited)

(U.S. dollars in thousands, except per share amounts)

| |

|

Three Months Ended

June 30,

|

|

|

Six Months Ended

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenue

|

|

$

|

500,257

|

|

|

$

|

560,615

|

|

|

$

|

981,719

|

|

|

$

|

1,165,514

|

|

|

Cost of sales

|

|

|

135,542

|

|

|

|

148,100

|

|

|

|

269,130

|

|

|

|

309,599

|

|

|

Gross profit

|

|

|

364,715

|

|

|

|

412,515

|

|

|

|

712,589

|

|

|

|

855,915

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

185,165

|

|

|

|

219,426

|

|

|

|

373,289

|

|

|

|

462,125

|

|

|

General and administrative expenses

|

|

|

137,044

|

|

|

|

141,562

|

|

|

|

270,943

|

|

|

|

290,118

|

|

|

Restructuring and impairment expenses

|

|

|

—

|

|

|

|

—

|

|

|

|

9,787

|

|

|

|

—

|

|

|

Total operating expenses

|

|

|

322,209

|

|

|

|

360,988

|

|

|

|

654,019

|

|

|

|

752,243

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

42,506

|

|

|

|

51,527

|

|

|

|

58,570

|

|

|

|

103,672

|

|

|

Other expense, net

|

|

|

(5,393

|

)

|

|

|

(8,640

|

)

|

|

|

(6,869

|

)

|

|

|

(10,093

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before provision for income taxes

|

|

|

37,113

|

|

|

|

42,887

|

|

|

|

51,701

|

|

|

|

93,579

|

|

|

Provision for income taxes

|

|

|

10,221

|

|

|

|

8,650

|

|

|

|

13,433

|

|

|

|

20,626

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

26,892

|

|

|

$

|

34,237

|

|

|

$

|

38,268

|

|

|

$

|

72,953

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.54

|

|

|

$

|

0.68

|

|

|

$

|

0.77

|

|

|

$

|

1.45

|

|

|

Diluted

|

|

$

|

0.54

|

|

|

$

|

0.67

|

|

|

$

|

0.76

|

|

|

$

|

1.43

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding (000s):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

49,931

|

|

|

|

50,368

|

|

|

|

49,789

|

|

|

|

50,181

|

|

|

Diluted

|

|

|

50,161

|

|

|

|

50,960

|

|

|

|

50,098

|

|

|

|

50,959

|

|

NU SKIN ENTERPRISES, INC.

Consolidated Balance Sheets (Unaudited)

(U.S. dollars in thousands)

| |

|

June 30,

2023

|

|

|

December 31,

2022

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

235,554

|

|

|

$

|

264,725

|

|

|

Current investments

|

|

|

16,772

|

|

|

|

13,784

|

|

|

Accounts receivable, net

|

|

|

67,166

|

|

|

|

47,360

|

|

|

Inventories, net

|

|

|

372,250

|

|

|

|

346,183

|

|

|

Prepaid expenses and other

|

|

|

100,833

|

|

|

|

87,816

|

|

|

Total current assets

|

|

|

792,575

|

|

|

|

759,868

|

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

430,328

|

|

|

|

444,806

|

|

|

Operating lease right-of-use assets

|

|

|

94,707

|

|

|

|

98,734

|

|

|

Goodwill

|

|

|

229,469

|

|

|

|

206,432

|

|

|

Other intangible assets, net

|

|

|

112,619

|

|

|

|

66,701

|

|

|

Other assets

|

|

|

234,078

|

|

|

|

244,429

|

|

|

Total assets

|

|

$

|

1,893,776

|

|

|

$

|

1,820,970

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

49,529

|

|

|

$

|

53,963

|

|

|

Accrued expenses

|

|

|

255,510

|

|

|

|

280,280

|

|

|

Current portion of long-term debt

|

|

|

140,000

|

|

|

|

25,000

|

|

|

Total current liabilities

|

|

|

445,039

|

|

|

|

359,243

|

|

| |

|

|

|

|

|

|

|

|

|

Operating lease liabilities

|

|

|

74,487

|

|

|

|

76,540

|

|

|

Long-term debt

|

|

|

367,753

|

|

|

|

377,466

|

|

|

Other liabilities

|

|

|

111,152

|

|

|

|

110,425

|

|

|

Total liabilities

|

|

|

998,431

|

|

|

|

923,674

|

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Class A common stock – 500 million shares authorized, $0.001 par value, 90.6 million shares issued

|

|

|

91

|

|

|

|

91

|

|

|

Additional paid-in capital

|

|

|

615,579

|

|

|

|

613,278

|

|

|

Treasury stock, at cost – 40.6 million and 41.1 million shares

|

|

|

(1,557,777

|

)

|

|

|

(1,569,061

|

)

|

|

Accumulated other comprehensive loss

|

|

|

(101,446

|

)

|

|

|

(86,509

|

)

|

|

Retained earnings

|

|

|

1,938,898

|

|

|

|

1,939,497

|

|

|

Total stockholders' equity

|

|

|

895,345

|

|

|

|

897,296

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

1,893,776

|

|

|

$

|

$1,820,970

|

|

NU SKIN ENTERPRISES, INC.

Reconciliation of Earnings Per Share Excluding Impact of Restructuring to GAAP

Earnings Per Share

(in thousands, except for per share amounts)

| |

|

Three Months Ended

June 30,

|

|

|

Six Months Ended

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net income

|

|

$

|

26,892

|

|

|

$

|

34,237

|

|

|

$

|

38,268

|

|

|

$

|

72,953

|

|

|

Impact of restructuring and impairment expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring and impairment

|

|

|

-

|

|

|

|

-

|

|

|

|

9,787

|

|

|

|

-

|

|

|

Tax impact

|

|

|

-

|

|

|

|

-

|

|

|

|

(2,593

|

)

|

|

|

-

|

|

|

Impact of charges associated with our Q4 exit from Grow Tech:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on investment

|

|

|

-

|

|

|

|

5,711

|

|

|

|

|

|

|

|

5,711

|

|

|

Tax impact

|

|

|

-

|

|

|

|

(459

|

)

|

|

|

|

|

|

|

(459

|

)

|

|

Adjusted net income

|

|

$

|

26,892

|

|

|

$

|

39,489

|

|

|

$

|

45,462

|

|

|

$

|

78,205

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share

|

|

$

|

0.54

|

|

|

$

|

0.67

|

|

|

$

|

0.76

|

|

|

$

|

1.43

|

|

|

Diluted earnings per share, excluding restructuring impact

|

|

$

|

0.54

|

|

|

$

|

0.77

|

|

|

$

|

0.91

|

|

|

$

|

1.53

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding (000)

|

|

|

50,161

|

|

|

|

50,960

|

|

|

|

50,098

|

|

|

|

50,959

|

|

NU SKIN ENTERPRISES, INC.

Reconciliation of Earnings Per Share Excluding Impact of Restructuring to GAAP

Earnings Per Share

| |

|

Year ended December 31,

|

|

| |

|

2023 - Low-end

|

|

|

2023 High-end

|

|

|

Earnings Per Share

|

|

$

|

2.15

|

|

|

$

|

2.45

|

|

|

Impact of Q1 restructuring and impairment expense:

|

|

|

|

|

|

|

|

|

|

Restructuring and impairment

|

|

|

0.20

|

|

|

|

0.20

|

|

| |

|

|

|

|

|

|

|

|

|

Tax impact

|

|

|

(0.05

|

)

|

|

|

(0.05

|

)

|

| |

|

|

|

|

|

|

|

|

|

Adjusted EPS

|

|

$

|

2.30

|

|

|

$

|

2.60

|

|

# # #

CONTACTS:

Media: media@nuskin.com, (801) 345-6397

Investors: investorrelations@nuskin.com, (801) 345-3577

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

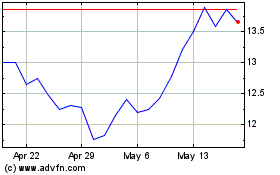

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Apr 2024 to May 2024

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From May 2023 to May 2024