There is no doubt that the UK fintech sector is booming. Investment in fintech has doubled at the start of 2019 compared to the start of 2018.

Rather than seeing FinTech as a threat to their existence, traditional banks are realising the competitive gains that can be harnessed by turning to FinTech for support in digitizing to meet customer needs. Investment in fintech has therefore boomed, as disruptors in the market teamed up with large financial service providers.

Recent Accenture data showed fintech investment almost doubled to £2.15bn at the start of 2019. New digital banks like Monzo and Starling are raising huge amounts of cash investment, and the money transfer market is also enjoying significant growth. Transferwise raised £241m investment, while Monzo received £119m and Starling Bank £174m. This type of investment is helping the challenger and disruptor brands to scale up.

However, Julian Skan, Senior MD at Accenture, predicts fundraising is likely to plateau and drop off in the future. The UK is currently bucking the global trend towards a decline in fintech investment. The total value of deals in fintech dropped by 29% to $22bn, driven by a decline in China in 2018. China and US trade wars may not help either, potentially posing a threat to the fintech bubble.

With Brexit looming, some believe it has the potential to push European markets into chaos, and the likelihood of recession is high. Brexit could be about to test the willingness of investors to put money into fintech. CB Insights Data also suggested there may be cause for worry. Its findings showed fintech deals backed by venture capitalists dropped to the lowest level since Q4 2016 – the period following the EU Referendum.

However, London has now beaten New York in the race to become the central hub for fintech investment. Record levels of investment in 2019, with more than 26bn invested in London businesses, shows fintech is attracting more deals than ever before – 114 in London, putting it top of the chart for number of investment deals.

Investment in fintech startups looks buoyant, up 45% on 2018 figures. Although the number of deals has recently dropped slightly, the size of investments has increased. The majority went to private equity and venture capital rounds – over 85% of the total investment.

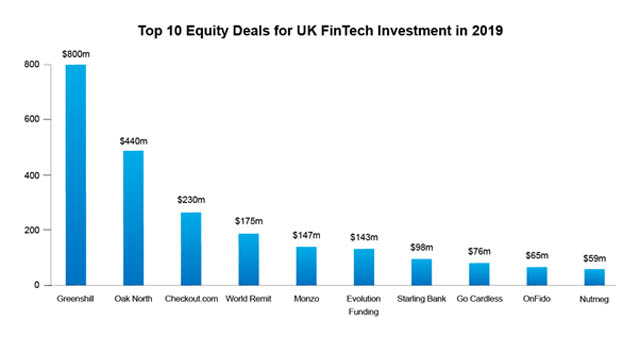

The payments sector in attracting a great deal of investment, with Checkout.com raising $230m, World Remit $175m and Go Cardless gaining $76m of investment. London-based fintechs dominated the market, accounting for 90% of the total investment, with the other 10% going to Derby, Newcastle and Greater Manchester.

The UK fintech market has attracted more investment deals than anywhere else, with 1,277 deals in the past five years, which is more than the nine other European countries that are active in the market put together. Funding raised in the UK and Germany accounted for over half the total funding rounds in Europe since 2014.

Companies such as eToro are also helping the fintech sector to grow, thanks to fintech investment trading opportunities and a complete guide to FinTech. Indeed, these types of platforms enable to increase investments through guidance and trading. It is the chance for young investors wanting to explore and invest to do so, therefore ensuring an increase in growth for FinTech companies in 2020.

With Brexit on the horizon, speculation is growing around whether the UK can hold on to the crown as the top location for fintech investment. Could it be overtaken by cities remaining in the EU such as Paris or Berlin? Other countries are following the UK’s lead in relaxing the regulatory constraints with the intention of increasing innovation in fintech. Lithuania is establishing a new regulatory framework to make life easier for fintech startups. It is also working with the FCA to ensure fintech companies that have already received the UK seal of approval are fast-tracked for approval from the authorities of Lithuania.

It is hoped that London’s natural advantage in the fintech sector will not be impacted significantly by Brexit. The close proximity of fintechs to banks in the city won’t change after Brexit. The UK Government encourages innovation in the sector, and it has gone from strength to strength since the Brexit vote in 2016.

The UK has good relations with other non-EU countries such as China, Singapore, Australia and India, and Japan’s Softbank is planning to locate its headquarters for tech investment in London, giving a further indication that positive growth is set to continue in the sector post-Brexit.

Regulators continue to support growth in fintech despite the turbulence of Brexit, with all the uncertainties it brings. Potential loss of investment from Europe post-Brexit is shored up by plenty of support from other areas such as Asia. Although growth may slow down, it still looks set to continue.

Fintech is now the most rapidly growing sector of London’s economy, and job growth in fintech saw a 61% increase last year. Brexit does however appear to be limiting how fintech startups operate with other European companies though, as employment and trade become real concerns. Risk factors include loss of investment and recruitment from the EU. Some of this could be counteracted by attracting more Asian job seekers to the UK.

Fintech companies can reduce the potential for damage by Brexit through building international investor relationships outside the EU. Creating new services, and improving existing services gives real value to clients, and experts predict fintech companies may need to adapt their services to meet the needs of other markets outside the Eurozone.

The UK’s regulatory framework means it is likely to remain an attractive option as a base for fintechs post-Brexit. However, a 5th of UK fintech skills come from the EU, so we may need to train some more home-grown talent if EU workers leave the UK. Experts warn FinTech will still need to remain adaptable and nimble to ride out any negative impact of Brexit. London offers some great options for investment incentives for FinTech, including 50% tax relief on start-up investments of up to £100k.

The state of European fintech 2019 report examined the past 5 years and demonstrated that fintech was the largest sector for investment, with 20% of global investment in fintech. The way in which fintech is helping financial services tackle the inefficiencies for customers means there is plenty of scope for the sector to continue growing. Some industry experts have predicted that investment opportunities are set to shift from banking and payments to other enabling technology such as Artificial Intelligence.

It would appear then that Brexit, while posing some concerns to the fintech sector, is unlikely to halt its huge potential for growth.

Hot Features

Hot Features