The negative impact of the coronavirus on the global economy is titanic and unsurprisingly a raft of businesses and industries are being trounced as a result of lockdowns. However, amongst the horror stories there are many sectors and niches that are bucking the trend. Here’s a look at a few.

Food and drink

Staying in is the new going out so any services or products, which make our indoor life more pleasant and enjoyable are winners. For many, food is not just sustenance it’s an experience and key pleasure. As a nation we love having our food prepared by someone else as a treat. According to research body Kantar, the UK spent £49 billion on food and drink purchased and consumed outside the home in 2017 (not including alcohol).

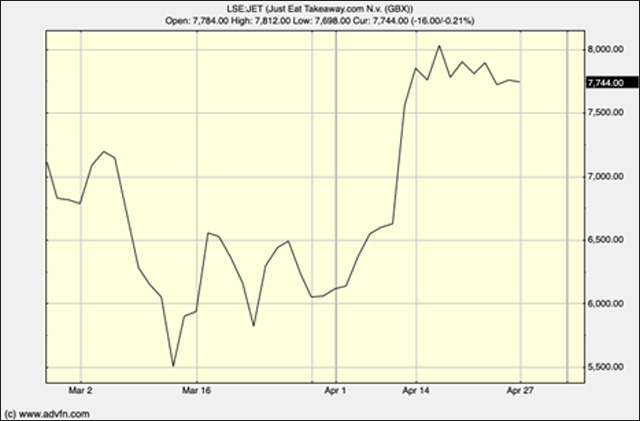

Whilst many restaurants are adapting and keeping afloat by offering new takeaway services, it’s the businesses that have delivery/takeaway as their core proposition, which are prospering in the current conditions. In the UK, Domino’s Pizza is a prime example. The stock (LSE:DOM) has been performing very well of late and on April 20th even hit an upwards quarterly price break out. Just Eat, in solely operating a food delivery service and being an intermediary between independent food outlets and customers, has been in a plum position. It’s able to cater for food tastes across the spectrum from meatless Monday and taco Tuesday through to Friday fish and chips and Saturday night curry. Since lockdown began on March 23rd, its share price (LSE:JET) has seen a 35% rise.

Anecdotal evidence certainly points to an increase of alcohol consumption amongst Brits in lockdown (Majestic even had to temporarily suspend new customers while it processed existing orders) and figures from the Office for National Statistics (ONS) have confirmed. Alcohol sales volume jumped by 31.4% – 32.6% in value terms – in March. A separate survey by Nielsen found that spirit sales were up 75 per cent in the week ending March 21st compared with the same period last year with beer up 66% and wine up 42%. Diageo (LSE:DGE) and Naked Wines (LSE:WINE) stock charts tell the same story with the latter hitting an upwards yearly price breakout today.

Working under lockdown

With an unprecedented number of people now working from home, companies helping to facilitate the transition from the office are capitalising. Broadband is one particular commodity in demand. Aim-listed Bigblu Broadband (LSE:BBB) saw its share price lift almost as soon as lockdown was announced. March 23rd was also a pivotal moment for Nasdaq-listed Liberty Global (NASDAQ:LBTYA) – the parent company of Virgin Media. TalkTalk (LSE:TALK) has also been buoyed.

Zoom (NASDAQ:ZM) was certainly on the radar for video conferencing in the business space prior to coronavirus. However, the pandemic has catapulted it into the mainstream for remote working. Not only that, it is the de rigueur platform for quizzes and children keeping in touch with their friends.

Learning resources

Speaking of children, there’s a huge paradigm shift in education right now. A lot of frazzled parents are juggling their day job with their not very lucrative teaching career and are eager to find resources to aid them. EdTech and gamification companies are poised to become an even more attractive investment proposition in the current climate. Not just for school children, they have individual, institutional and corporate applications. Here are a few companies in this space that are currently on the ascent:

RM – LSE:RM.

2U Inc – NASDAQ:TWOU

K12 – NYSE:LRN

Chegg – NYSE:CHGG

Learning Technologies – LTG

Financial and investing

The financial sector might seem one of the unlikelier areas to receive an uplift. However, there is a renewed enthusiasm for stocks, shares, commodities, crypto and forex information. During these unprecedented times an increased number of people simply want to know what’s happening in the markets.

ADVFN (LSE:AFN) has seen a surge in people seeking stocks, shares and crypto information. There has been a 20% increase in site visitors since financial markets started plummeting due to coronavirus (March 9th) and through subsequent lockdown.

General uncertainty and volatile financial markets always result in increased traffic for ADVFN, but this has been a more extreme case for the site. More traffic is resulting in increased advertising revenue and subscriptions. As well as greater general interest in stocks and shares, it appears that more people are actually actively investing and trading.

Danny Scott, CEO and Co-Founder of UK bitcoin buying and selling site CoinCorner, reports that March sign ups have increased by 17.6% against February’s, making it the company’s strongest March since it began operating in 2014 (and its strongest month in the last two years) – “For now, the market remains bullish, with 95% of our trades being buys.” With bitcoin halvening fast approaching, it’s worth keeping an eye on the king of crypto.

There has also been a surge of account openings on investment platforms in the UK. ADVFN Award winner The Share Centre reported a 269% increase in brokerage account openings from March 9th to March 30th (compared with the same period in 2019).

Entertainment

Netflix was obviously going to be a big lockdown winner. It added 15.8 million paying subscribers in the first quarter of 2020 to take its tally to 182.86 million, and this month it saw its share price hit an all-time high (NASDAQ:NFLX). Whether it will retain all of these customers post lockdown remains to be seen. However, its existing stable of strong content will certainly help as will its flow of new originals and the knock-on additional revenue streams from this content. There is also potential for further subscription plans to be added to its product mix.

Unsurprisingly business for online gaming and gambling websites has increased since the introduction of lockdown. Canadian-based The Stars Group (TSX:TSGI) reported record revenue for the first quarter of 2020 as a result of rises in online poker and casino play. The company saw 27% year-over-year growth to US$ 735m (£592m). After a market-correlated sharp drop in the first part of March, it then saw its share price double in the space of a month.

London-listed 888’s (LSE:888) chart follows a similar course as does Flutter Entertainment plc’s (the bookmaking holding company created by the merger of Paddy Power and Betfair) – LSE:FLTR.

The video gaming sector is also particularly buoyant in the current environment. Video games developer Codemasters Group Holdings PLC (LSE:CDM) has seen a significant acceleration in its digital sales which is reflected in its recent share price performance. Meanwhile across the pond, game developing giants Electronic Arts (EA) – NASDAQ:EA and Activision Blizzard (NASDAQ:ATVI) were up 34% and 31% respectively between March 20th and April 20th.

Whilst it didn’t see immediate uplift from lockdown, Online Blockchain plc (LSE:OBC), which has gaming site FreeLoadr.com in its portfolio, is now starting its ascent.

Keep up to date with all the markets moves at: www.advfn.com

Hot Features

Hot Features