Currently, Uniswap enjoys the position of being the world’s leading decentralized exchange platform. Unlike some other DEXs and CEXs, it relies on a smart algorithm instead of a centralized order book to set prices on hundreds of ERC-20 token pairings that are available for purchase and sale on the platform. Centralized exchange platforms like Coinbase and Binance also needed to depend on order books, which are lists of all buyers and sellers for a certain security. Uniswap’s low trading fee and growing customer base have kept it the leading decentralized exchange platform in the world. However, there are so many decentralized exchange platforms that want to unseat Uniswap from its leading position. Let us zoom into the issue for today and consider how this might be possible.

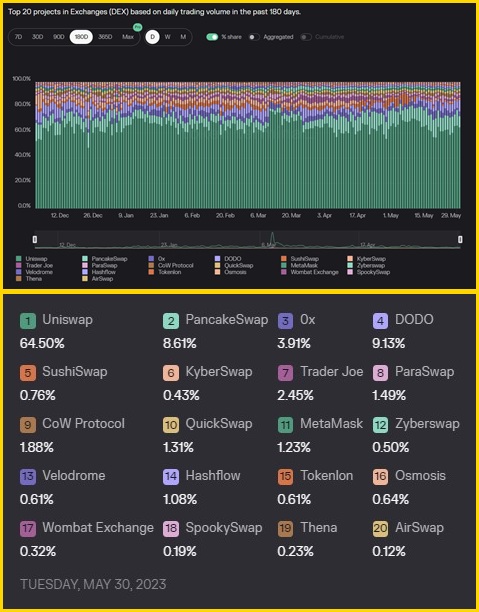

Below is a quick look at some of the formidable DEXs by their trade volume in the past 180 days, and as we can see, Uniswap has the lion’s share among them all.

The development of Uniswap was a major one in the history of crypto.

When there was sufficient supply and demand, Uniswap could immediately support any Ethereum-compatible coin, but centralized exchange platforms are slow to add new tokens (they had to thoroughly vet each one). The software-based strategy allowed the business to expand swiftly.

In November 2018, the Ethereum mainnet saw the debut of the first iteration of the Uniswap protocol. Since then, there have been a number of little upgrades:

The first version makes it possible for users to exchange ETH for any ERC-20 token. The second version was released in May 2020 and included new features and capabilities like greater decentralization, flash swaps, and ERC-20 pools, enabling direct trading between various Ethereum-based tokens. The third version offers enhanced security and efficiency, as well as features including concentrated liquidity, range orders, NFTs, and adjustable fees. Version 4 is currently under development. It is anticipated to be a step-by-step upgrade that focuses on QoL upgrades such as a better user interface, an integrated wallet, NFT aggregation, and perhaps a batched auction system to counteract MEVs.

Uniswap’s Fee and Revenue

The platform has its own native token, also known as Uniswap (UNI). Although the token’s declared function is to act as the protocol’s governance token, our hypothesis is that purchasing UNI is equivalent to purchasing Uniswap “stock.”

The revenue and fee structure on Uniswap, being a decentralized exchange (DEX), are different when compared to centralized exchange platforms like Binance and Coinbase. Uniswap doesn’t levy additional fees, unlike the majority of other CEXs. Uniswap levies a fixed cost of 0.30% for each token swap instead. The liquidity pools (i.e., the users that provide the token pairs for swapping) receive full payment of the revenue generated by this charge. The “company” doesn’t directly benefit from the Uniswap fees, nor do the owners of its governance token (UNI).

The second version of Uniswap introduced the possibility of a “fee switch.” If enabled, this option would permit the protocol (i.e., the Uniswap corporation) to retain a portion of the fees from trades. Theoretically, this might be paid out of retained earnings.

The move-in fees have not yet been put into effect as of this writing. Only an open vote among the protocol governing forums will be able to decide whether to activate the free swap (UNI token holders must approve it).

The fee switch option was still available when Uniswap released the third version. The establishment of multiple price categories, ranging from 0.01% to 1%, was the primary change. The choice of charge structure is up to the liquidity providers if they choose to turn on fee sharing.

All of the revenues so far have been sent to liquidity providers because the fee switch hasn’t been put into place. This indicates that at this time, the Uniswap “company” is not holding any “revenue.” That might, however, change if the fee switch is turned on.

Uniswap vs. Other Decentralized Exchange Platforms

A number of competitors have emerged in the past three to four years, creating fierce competition in the decentralized exchange sector. There are now more widely used DEXs on the market besides Uniswap. Let’s quickly review a few of the DEX rivals:

Both SushiSwap and PancakeSwap: These two DEXs are both Uniswap’s clones that were created utilizing its open-source technology and share many of the same features and costs as competitive advantages.

Compound: It is a specialized DEX that was introduced in 2017 and produces tokens for assets that are locked on the platform. The ability to transfer and use the assets on other platforms is preserved, while users can earn interest thanks to the tokens.

dYdX: Another DEX introduced in 2017 is dYdX, which offers customers extra possibilities through derivative trading. In September 2021, it briefly replaced Uniswap as the leading DEX in terms of trading volume.

Why Is Uniswap Important to investors?

The most prosperous DEX, according to the AMM model, is Uniswap. Additionally, it serves as proof of concept that a cryptocurrency exchange can function without a centralized order book or market maker if it can sustain high revenues and stability.

With the latest announcement of the SEC’s investigation into Binance, this has gained additional significance. (As a decentralized alternative, Uniswap is difficult to shut down.)

However, the future prospects for Uniswap are unclear. Even though it still has a sizable user base, competitor DEXs that lack the AMM concept are taking market share away from it. Many LPs struggle mightily to hold onto earnings in AMMs because of “impermanent loss.”

The “fee switch” concept has also encountered significant controversy since it raises the possibility of heightened scrutiny from US regulators (Uniswap is based there) due to changes in income generation.

Nevertheless, Uniswap has a reputation for innovation and for providing important protocol updates (Uniswap ships). Additionally, it is far simpler to comprehend and utilize than tech-heavy websites like dYdX for the typical user.

With imitations and non-AMM substitutes on the rise, Uniswap has its work cut out for it. It has to keep innovating, adding new features, and enhancing user experiences—all tasks it has historically excelled at.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features