Drinks giant Diageo (LSE:DGE), producer of alcohol brands such as Johnnie Walker whiskey and Smirnoff vodka, has said that if U.S. tariffs go ahead it could damage any recovery to its sales and results in a $200m hit to its profits. Its tequila and Canadian whiskey brands would be most affected.

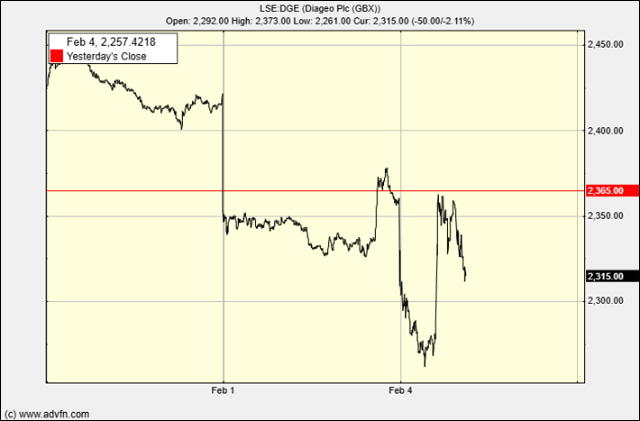

The company’s shares fell again on this morning’s opening, hitting a low of 2,262, although they recovered some of that value before falling again. This followed the fall yesterday morning after U.S. President Trump announced his tariffs on Canada and Mexico at the weekend.

The company’s chief executive, Debra Crew, said the tariff situation was “very fluid,” but the company estimated it could result in a reduction of $200m in operating profit over the last four months of its financial year. 85% of that loss would be related to tequila, which has to be made in Mexico.

Diageo is considering raising its prices and running fewer promotions in order to offset the reduction in profits.

The company’s new financial office, Nik Jhangiani, said the company “could cover 40% [of the hit] before any pricing action”. Diageo intends to ship more products into the US before the tariffs kick in.

The investment bank Jefferies has calculated that 46% of Diageo’s US revenues are from goods imported from Mexico and Canada, including brands such as Crown Royal, Don Julio and Casamigos. The company could also be hurt if Trump imposes tariffs on EU products.

Hot Features

Hot Features