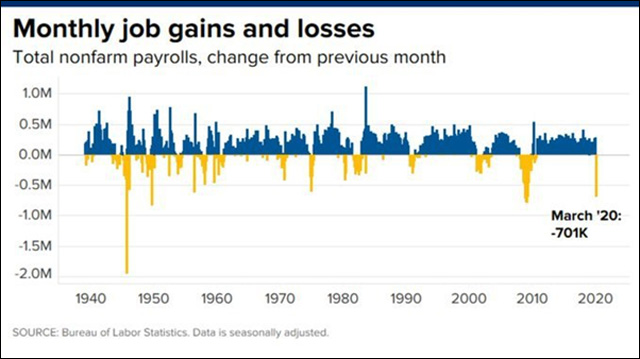

Macroeconomic data has only started to reflect the negative impact of COVID-19, but stock markets do not sit there waiting and respond accordingly. Despite the US Senate’s recently approved stimulus package, stock markets continue to fall, thus reacting to disappointing economic data, such as the reports on the March employment situation.

The sudden stop in the activity due to mandatory quarantine has pushed global economies into an actual recession. FMI, Central Banks and rating agencies, all of them predict global GDP to decline. Nevertheless, there is still an expectation that recovery may potentially begin in H2 2020. So far, the negative effect will depend on the duration of quarantine, as it is triggering declines in consumption, manufacturing, building investment, and, of course, the labor market.

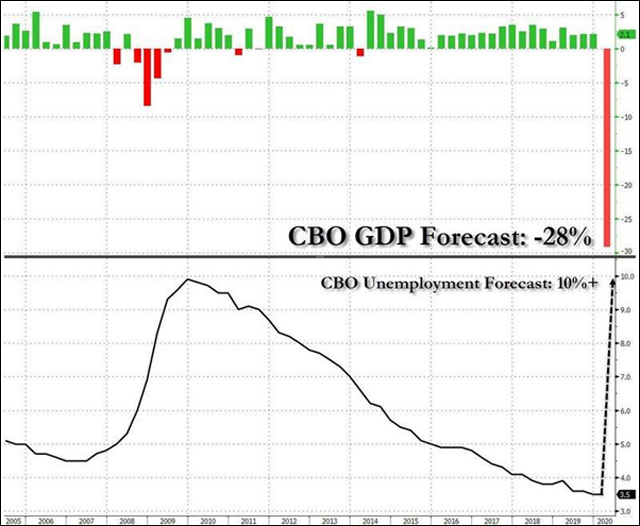

CBO (congressional budget office) expects the unemployment rate to exceed 10 percent during the second quarter, in part reflecting the 3.3 million new unemployment insurance claims reported on March 26 and the 6.6 million new claims reported this morning. (The number of new claims was about 10 times larger this morning than it had been in any single week during the recession from 2007 to 2009.)

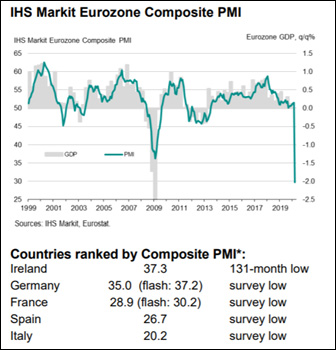

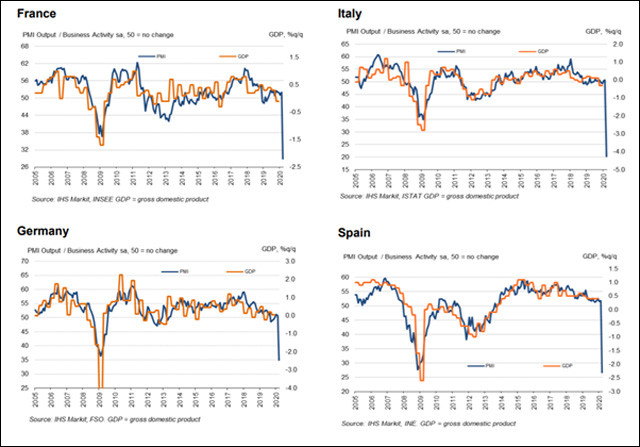

The PMIs published during the week already indicate a severe contraction, except in China, which gradually returns to activity.

- Final Eurozone Composite Output Index: 29.7 (Flash: 31.4, February Final: 51.6)

- Final Eurozone Services Business Activity Index: 26.4 (Flash: 28.4, February Final: 52.6)

According to the U.S. Bureau of labor statistics, total nonfarm payroll employment fell by 701,000 in March, and the unemployment rate rose to 4.4 percent. Employment in leisure and hospitality fell by 459,000, mainly in food services and drinking places. Notable declines also occurred in health care and social assistance, professional and business services, retail trade, and construction. This is the largest over-the-month increase in the rate since January 1975, when the increase was also 0.9 percentage point. The number of unemployed persons rose by 1.4 million to 7.1 million in March.

So far, central banks have cut policy rates and/or increased QE programs with unlimited commitment in the US, and at least €750bn in the Euro area and £200bn in the UK. The main purpose is to keep financial systems liquid and help troubled banks and companies. The Japanese government is preparing a plan that could exceed 10% of its GDP and many other governments and central banks have announced new measures. But the market reactions to the news are unpredictable. Even so, volatility has slightly decreased.

Last week, S&P 500 fell 2,08%, Nasdaq Composite lost 1,72%, Industrial Dow Jones decreased 2,70%, UX 100 Index went down by 1,72%, DAX registered a 1,11% downgraded, whereas Euro Stoxx 50 Index fell -2,41%. Nikkei 225 rested 8,09%, while the Hang Seng Index decreased by 1,06%. Finally, the Russian Moex Index grew 7,13%, whilst Spanish Ibex 35 lowered 2,90%.

The top asset of the week has been crude oil. It started falling to $20 but finished the week growing back to $25. It happened after US President Trump tweeted that he spoke with Saudi Crown Prince Mohammed bin Salman about a potentially ‘huge’ output cut. According to him, the production cut from Saudi Arabia and Russia could be as high as 15 million bpd. Is it actually going to happen?

Macro data of the week

- Pending Home Sales for Feb: +2.4% vs. +1.0% est

- Consumer Confidence for Mar: 120.0 vs. 110.0 est

- Chicago PMI for Mar: 47.8 vs. 40.0 est

- ADP Employment Change for Mar: -27k vs. -150k est

- ISM Manufacturing Index for Mar: 49.1 vs. 44.5 est

- Trade Deficit for Feb: -$39.9B vs. -$40.0B est

- Average Hourly Earnings for Mar: +0.4% vs. +0.2% est

- Average Workweek for Mar: 34.2 vs. 34.1 est

- ISM Services Index for Mar: 52.5 vs. 43.0 est

- Case-Shiller Home Price Index for Jan: +3.1% vs. +3.2% est

- Construction Spending for Feb: -1.3% vs. +0.6% est

- Initial (weekly) Jobless Claims: 6.648M vs. 3.763M est

- Factory Orders for Feb: 0.0% vs. +0.2% est

- Nonfarm Payrolls for Mar: -701k vs. -100k est

- Unemployment Rate for Mar: 4.4% vs. 3.8% est

- Underemployment Rate (U-6) for Mar: 8.7% vs. 7.0% last month

- Labor Force Participation Rate for Mar: 62.7% vs. 63.3% est

Hot Features

Hot Features