Last week major indexes registered double-digit growth with the S&P 500 recording its biggest weekly gain in 45 years. Small-cap stocks, on the other hand, outpaced large-cap indexes and slower-growing value shares over-performed higher-valuation growth stocks.

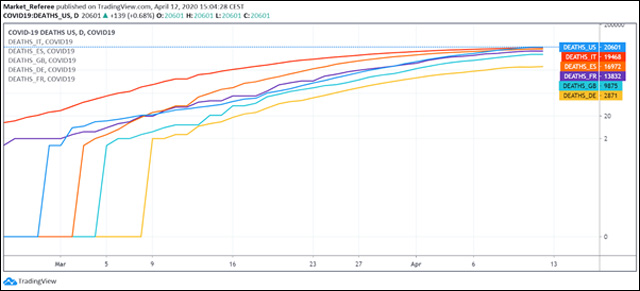

The turn in the sentiment can be mainly contributed to an easing toll of new coronavirus infections and fatalities in Italy, France, Germany, Spain, and New York City.

In addition, the Fed announced a massive new loan program, while an additional fiscal stimulus is under discussion. To be more precise, the US Federal Reserve extended $2.3 trillion in financing to small and midsize businesses as well as state and municipal governments. The Fed also announced it would allow investment in lower-quality debt as part of its Term Asset-Backed Securities Lending Facility and other emergency lending programs.

The Bank of England and the Treasury agreed on Thursday to expand the government’s overdraft ‘Ways and Means’ facility, looking to allow the government to smooth its cash flow.

Lastly, oil prices declined, partly discounting prior gains, as investors saw OPEC’s proposal to cut back on production as insufficient to offset the impact from lower demand.

COVID-19 and financial markets

Whether we like it or not, we have to accept that coronavirus has brought radical changes in our consumption habits and soon companies will begin proving it to investors, by publishing their first-quarter earnings. Keep in mind that not every business reacts differently to the ongoing crisis. In other words, whilst some were announcing profit warnings, others were registering even higher growth rates, together with a rapid increase in new users. Samsung and Tesla, for example, both released a positive update.

Most industries weren’t severely affected by coronavirus up until March. Even though, earnings are expected to fall around 10% YoY. Of course, the major part has already been discounted in the stock price given their extraordinary selloff last month. What will actually matter is companies’ future expectations. Also, there is the question of dividends: JPMorgan, for example, is considering suspending its own.

It is expected that companies like Amazon and Procter&Gamble will continue showing demand for their products no matter how long the pandemic will last. On the other hand, there are businesses that theoretically should recover quickly once the quarantine is lifted and the economy begins stabilizing (the question is long it will take), for example, Uber. Finally, some companies may take advantage of the ongoing situation: Blackstone raised an $11 billion fund targeting European real estate.

Overall, consumer staples tech and healthcare stocks did better than oil and financial services. Asian (Chinese and Japanese) and American share indexes lost less than Europe and the UK. Thus, the diversification approach would have still worked.

Weekly market performance

Macroeconomic Data & Events

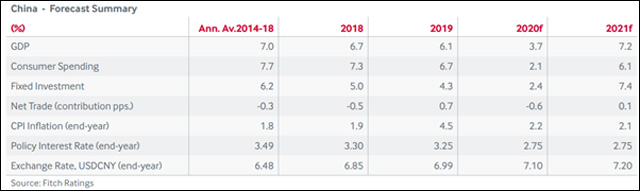

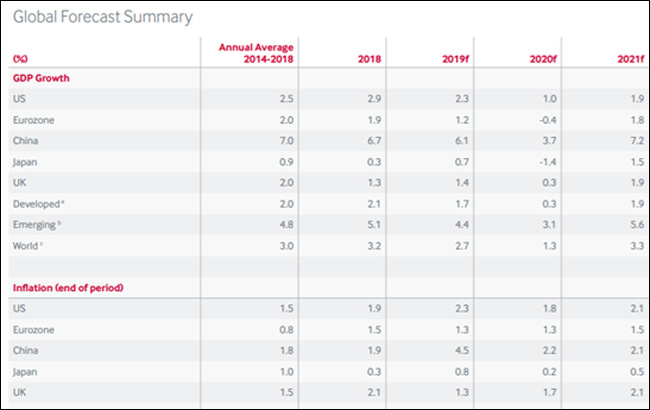

While most of the world remains in quarantine, China slowly but steadily starts to return to normal life. A question that many people are interested in, is how the virus outbreak affected its economy. This week, China will shed some light on that, reporting GDP growth estimates. For now, markets are forecasting China’s first-quarter GDP to show a drop of nearly 10% compared with the previous three months, and 6% down on a year earlier. Even though Fitch ratings expects a recovery in China from 2Q20, growth is expected to fall to 3.7% for the year as a whole. Howbeit, the data will either give hope or spread negative sentiments to those countries still struggling with the coronavirus.

It is worth reminding that in 1Q20, Industrial production was down by 13.5% y/y in January and February, fixed-asset investment was down 25%, while retail sales fell 20%. PMI balances fell to the low 30s and below in February, car sales were down 80% y/y and exports fell by 17%.

In the US, we will receive a March number for retail sales and industrial production. On Wednesday and Thursday, Manufacturing surveys from the New York and Philly Feds will be released. Another key data to follow will be building permits and housing starts, along with the latest initial jobless claims.

In the case of Canada, the BoC has cut rates three times in March and announced its first-ever quantitative easing program, so it shouldn’t be a surprise that many expect BoC to hold interest rate at 0.25% on April 15. Keep in mind that as interest rates approach zero, further rate cuts have a less stimulative impact.

Finally, investors will keep an eye on the Spring Meetings of the International Monetary Fund (IMF) and the World Bank at the end of the week. Many expect a plan to help heavily indebted countries get through the current crisis. According to Kristalina Georgieva, IMF Managing Director, the organization has $1 trillion in lending capacity and is already placing it at the service of its membership. Its Executive Board has just agreed to double access to its emergency facilities, allowing to meet the expected demand of about $100 billion in financing.

Overall, the most important events and macroeconomic data for the week of April 13 – 17, 2020 that will move the markets.

April 13: no major events as the vast majority of markets will be closed due to Easter Monday.

April 14: Inflation data from Denmark and Finland. Besides that, Fed’s Evans will give a speech in Pittsburgh.

April 15: Interest rate announcement and Monetary Policy Report in Canada. In addition, we will get inflation and SPES unemployment data for Sweden. Later, the NY Fed manufacturing index, retail sales and industrial production in the US will be published.

April 16: Initial Jobless Claims, together with the Philly fed business index will be released in the US. In Europe, we will get inflation expectations from Sweden and industrial production figures in the Euro Zone.

April 17: GDP YoY in China

Hot Features

Hot Features