Despite the shortness, last week was quite full of events. Big US banks reported their first-quarter results, with JPMorgan delivering slightly lower revenue than expected, and Goldman Sachs, Citigroup, and Bank of America presenting mixed results. It was more than expected, considering the fact that central banks in the US and UK cut interest rated to record lows. A recent change in US financial accounting rules forced banks to squirrel away their loan loss provisions upfront, something that obviously affected their profits.

JPMorgan Chase & Co. said first-quarter profit decreased 69% as credit costs surged. The bank set aside $4.5 billion of extra reserves for losses in its consumer bank, mainly on credit cards, and marked down its bridge loan positions by $896 million. Even though, the bank generated $7.23 billion from trading stocks and bonds, thanks to high volatility on markets. SoftBank, in turn, expects nearly $17 Billion loss on tech-focused vision fund. According to the bank, the deteriorating market environment helped push the Japanese company into an expected operating loss of $12bn and a net loss of $7bn for the year ended 31 March.

European car sales, in turn, fell by 50% last month, with the hardest hit on Fiat-Chrysler, PSA Group, and Volkswagen. It is still expected that things will start getting better in the second half of the year, but no one considers the possibility of the second wave of infections that once again will hit businesses and consumers.

Some of the companies and even banks can temporarily cut their dividends, but some believe that it will create a panic that will make it harder for them to raise money, making customers and lenders nervous. The question is why it doesn’t happen when a company decides to stop its buyback program?

Finally, it is important to mention that pandemic fuels rapid increase in missed mortgage payments: approximately 3.74% of home loans are in forbearance as of April 5, according to Mortgage Bankers Association data, up from about 2.73% the prior week.

From the macroeconomic perspective, China delivered its first economic contraction in Q1, registering an unprecedented fall of -6,8% YoY and -9,8% QoQ, when forecasts suggested the contraction of -9.9% QoQ and -6.5% YoY figures. The country also reported a set of other key economic data, which has been equally disappointing. In this context, it would not be a surprise if the central bank decided to cut Loan Prime Rate (LPR) by another 20 bps this year to lower the borrowing cost for companies. And, it’s still very likely for the PBOC to cut the benchmark deposit rate by around 25 bps to ease the pressure for banks.

Key macroeconomic data from China:

- Chinese exports went down by 20,2% YoY, falling from USD 71,342 million to USD 281.4 billion in January-February 2020 according to the IHS Markit Global Trade Atlas database. The worst affected trade partners were the US (USD -16,235 million), Hong Kong (USD -7,477 million), Japan (USD- 5,500 million), South Korea (USD -3,096 million) and Germany (USD -3,031 million).

- March industrial output decreased -1,1% YoY (forecasted -7.3%, Jan-Feb -13.5%)

- March retail sales downgraded -15.8% YoY (forecasted -10%, Jan-Feb -20.5%)

- Jan-March fixed-asset investment fell -16.1% YoY (forecasted -15.1%, Jan-Feb -24.5%)

- Jan-March property investment went to -7.7% YoY (Jan-Feb -16.3%)

COVID-19 Updates: Monetary policy

The European Central Bank (ECB) announced a temporary reduction in capital requirements for market risk, by allowing banks to adjust the supervisory component of these requirements.

The ECB is temporarily reducing a supervisory measure for banks – the qualitative market risk multiplier – which is set by supervisors and is used to compensate for the possible underestimation by banks of their capital requirements for market risk. This decision will be reviewed after six months on the basis of observed volatility.

RBI extends market hours amendments to 30 April 2020

In view of the Government of India’s order that the lockdown will continue to be in force till May 3, 2020 (Sunday), it was decided the amended trading hours for various RBI regulated markets will continue to be effective till the close of business on Thursday, April 30, 2020.

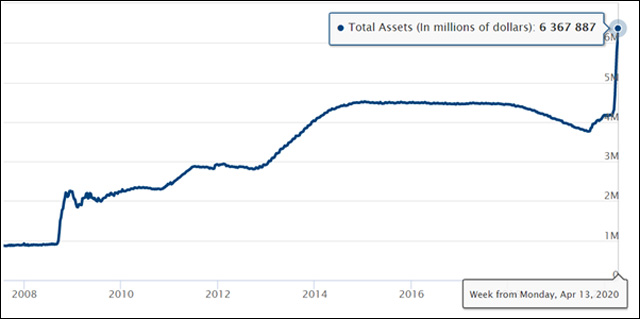

Historical movement from the Fed: Buying High Yield ETFs

The Fed has announced measures that will provide up to USD 2.3 trillion in loans to support the US economy during the COVID-19 crisis, which includes purchases of High Yield ETFs.

Total Assets of the Federal Reserve

Economic data and events: Week of 20 April 2020

The week ahead around 500 US companies will report earnings, providing initial insight into how the Coronavirus and quarantine affected their revenues and profits. Special attention will be given to guidance on full-year expectations from technological, consumer products, airlines, telecoms, and pharmaceuticals.

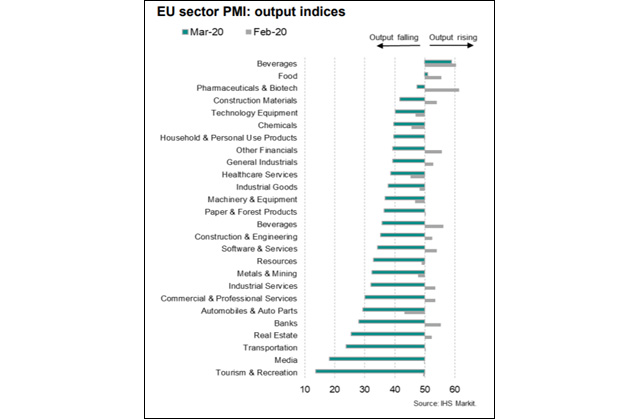

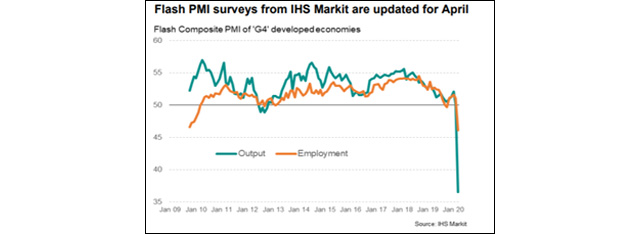

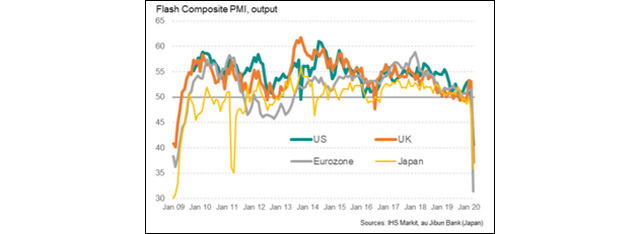

Besides that, we will get a lot of key macroeconomic data that will provide some information on how global economies are dealing with the COVID-19. It is expected that the PMIs will have deteriorated further. It is worth reminding that March PMI data showed record rates of collapse in the UK and Eurozone with Japan contracting at the fastest rate in a decade.

In the US, the release of ‘flash’ manufacturing and services PMI data will give an early signal of output and client demand going into the second quarter of 2020.

According to the IMF, growth in advanced economies is projected at -6.1 percent for 2020. Emerging market and developing economies with normal growth levels well above advanced economies are also projected to have negative growth rates of -1.0 percent in 2020, and -2.2 percent if you exclude China. The income per capita is projected to shrink for over 170 countries. Both advanced economies and emerging market and developing economies are expected to partially recover in 2021.

Monday 20: China loan prime rate (Apr), Taiwan export orders (Mar), Hong Kong SAR unemployment rate (Mar), UK Household Finance Index (Apr), Euro area trade balance (Feb), US Chicago Fed national activity index (Mar).

Tuesday 21: RBA meeting minutes (7 Apr), UK jobless rate, earnings (Feb), claimant count (Mar), Spain trade balance (Feb), Euro area and Germany ZEW economic sentiment index (Apr), the US existing home sales (Mar).

Wednesday 22: Thailand trade (Mar), UK and Malaysia inflation (Mar), France business confidence (Apr), Euro area government budget to GDP (2019), Euro area consumer confidence (Flash, Apr), US house price index (Feb), Commonwealth Bank Australia PMI (Flash, Apr), South Korea GDP (Adv, Q1).

Thursday 23: PMI for US, Eurozone, Germany, France, UK, Japan (Apr), Singapore inflation (Mar), Germany consumer confidence (May), UK retail sales (Mar), UK public sector net borrowing (Mar), Taiwan industrial output, retail sales (Mar), US weekly initial jobless claims (18 Apr), US new home sales (Mar), Kansas Fed manufacturing index (Apr), Japan inflation (Mar).

Friday 24: Australia trimmed-mean CPI (Q1), Singapore jobless rate (Q1), industrial output (Mar), Germany Ifo survey (Apr), Hong Kong SAR business confidence (Q2), US durable goods orders (Mar), Brazil business confidence (Apr), US Michigan consumer surveys (Final, Apr).

Hot Features

Hot Features