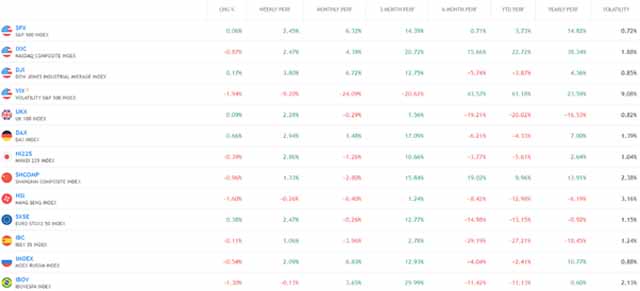

Despite the fact that the new stimulus package hasn’t been approved yet, S&P 500 continues to grow further to the moon, meanwhile the Nasdaq has already surpassed its last week record. Probably, it can be contributed to a drop in the US dollar and strong earnings results (especially by the companies from the Health Care and Communication Services sectors).

According to Factset, 89% of the companies in the S&P 500 have reported results for Q2 2020. The percentage of companies reporting actual EPS above estimates (83%) is above the five-year average. In terms of sales, the percentage of companies reporting actual sales above estimates (64%) is above the five-year average. In aggregate, companies are reporting sales that are 1.6% above estimates, which is also above the five-year average.

RBC found that the companies issuing guidance, several warned that virus-related uncertainties clouded their forecasts. Others noted that their continued recovery – and recovery across the US economy – relied on new stimulus from Congress.

In terms of macroeconomic data, the US labor market is slowly recovering with hiring registering growth in July. Total nonfarm payroll employment rose by 1.8 million in July, and the unemployment rate fell to 10.2 percent. Despite declines over the past 3 months, these measures are up by 6.7 percentage points and 10.6 million.

People have serious concerns regarding the future of the global economy, US dollar volatility, and the coronavirus pandemic, appealing to an alternative investment for hedging against stock market volatility. As a result, gold prices grew above $2000, whilst bitcoin rose above $11500. Some believe that with real interest rates near zero in many countries, and in a deflationary environment, with unprecedented worldwide central bank stimulus, gold could touch $3,400 an ounce.

On the geopolitical front, we can see that year 2020 can still bring some surprises to the world. When everyone thought that virus was the worst thing that could possibly happen, comes Beirut explosion followed by anti-government protests. Donald Trump meanwhile signed a presidential decree blocking TikTok and WeChat, effective in 45 days’ time.

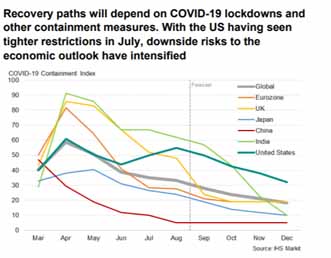

Chart of the week

Macroeconomic Data & Events

This past week, Republicans and Democrats were unable to agree on the conditions of a new stimulus program. Democrats suggested to cut the program by $ 1 trillion dollars, but the White House refused. US Treasury Secretary Mnuchin said he would advise the president to resort to executive orders that do not require congressional approval.

Thus, the topic will continue dominating the news. Besides that, we will get a bunch of macroeconomic data that will shed further light on the extent of the global economic collapse caused by the coronavirus lockdown. The industrial production and retail sales data, on the other hand, will help assess recovery paths. Finally, we shouldn’t forget that the earning season continues and over 600 companies will report their quarterly results.

August 10: Inflation data from China, Denmark, and Norway.

August 11: ZEW Economic Sentiment survey results from Germany and unemployment data in Sweden and the UK.

August 12: US non-manufacturing ISM, together with service PMIs for China, the UK, and Europe. Besides that, we will know the UK Q2 GDP (Preliminary)/Manufacturing output and New Zealand monetary policy decision.

August 13: Initial jobless claims release in the US

August 14: GDP estimates from the Euro area, Denmark, and Finland. Finally, we will get retail sales and industrial figures from both the US and China.

Hot Features

Hot Features