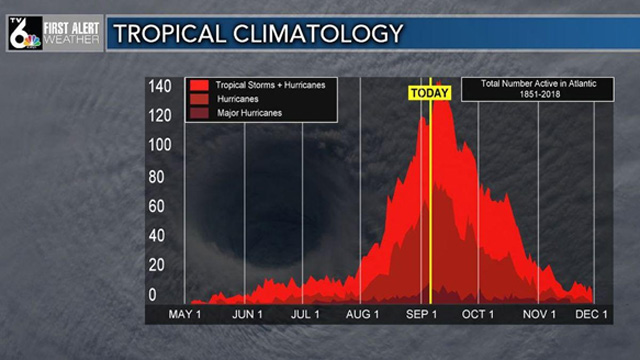

As is customary, the summer will end with the US Gulf Coast facing two potential hurricanes – Marco and Laura.

The double threat has already caused evacuations on off-shore energy platforms, and about 13% of oil and 4% of natural gas production have been shut-in. More than 45% of America’s fuel refining capacity is located along the Gulf Coast, as well over half its natural-gas processing.

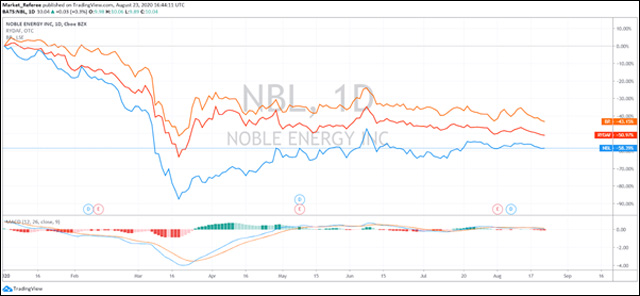

See how this will affect oil prices (if refining shuts down, it is logical to have a surplus of crude oil for a couple of weeks). Still, it is important to understand that even without hurricanes, Noble Corp., BP Plc and Royal Dutch suffered serious setbacks during the lockdown.

Tens of thousands of people in California meanwhile are suffering from wildfires that already destroyed almost 700 structures. Large wildfires may have extensive, interrelated local, including suppression spending in the short term. Power woes already pressure bonds of big utilities.

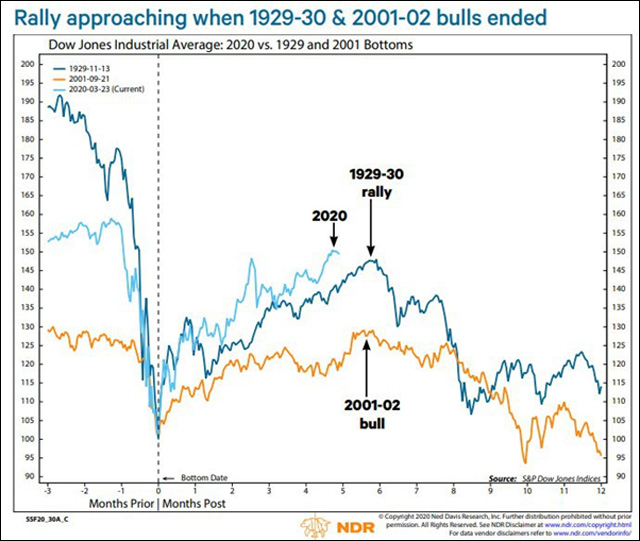

Apparently, even hurricane and wildfires can’t stop the S&P500 and the NASDAQ from reaching new highs. Despite the fact that the global economy is in worse condition, US equities have returned to pre-crisis levels. Apple’s market capitalization even touched $2 trillion. All together (Google, Apple, Facebook, Amazon, and Microsoft) now represent close to $7 trillion in market cap.

European markets, on the other hand, are still far getting into positive territory due to the stronger euro, low tech stock index weightings, and fears over a second wave of Covid-19. In this context, it shouldn’t be a surprise that European PMIs for August dropped, with Euro Area’s composite falling to 51.6 from 55.7.

Talking about market movers, there was no progress in talks between Democrats and Republicans over a new stimulus plan. The latest FOMC minutes, in turn, showed concerns over the economic recovery scenario. Fed Chair Jerome Powell said the path forward for the economy was “extraordinarily uncertain” and would depend on containing the virus.

Claims for unemployment benefits rose in the latest week. Around 1.11 million Americans filed for first-time unemployment insurance in the week ending Aug. 15, up from the prior week’s revised reading of 971,000. Finally, US-China tensions continued with Washington unveiling further restrictions on Huawei.

Chart of the week

Weekly market performance

Macroeconomic Data & Events

In the upcoming week, the world will keep an eye on the Jackson Hole conference, German IFO, US consumer confidence and GDP estimate updates for the US, Germany, and France. Traders hope policymakers will provide signals on future monetary stimulus. The market will be also looking at the outcome of trade talks between the US and China.

August 24: US Chicago Fed national activity index and South Korea consumer confidence.

August 25: Germany Q2 GDP and IFO surveys, Richmond Fed manufacturing index, and US Case-Shiller home price.

August 26: France consumer confidence, together with unemployment benefit claims.

August 27: US Central Bank Symposium, US Q2 GDP, US Weekly jobless claims

August 28: US Personal Spending, Germany consumer confidence, UK nationwide housing prices, France GDP, Euro area economic sentiment, consumer confidence and Speech by BoE governor Bailey

Hot Features

Hot Features