Japan’s Prime Minister Shinzo Abe resigns for health reasons, DJI is now +0,40% on YTD basis, the S&P 500 and the Nasdaq reached new highs, meanwhile the Fed confirmed its plans to keep interest rates low for the near future.

Only in coronavirus cases, Europe is over performing the US. The old continent is experimenting a surge in new cases; thankfully, the death rate does not follow the path. On Friday, 7379 new cases of Covid were detected in France. This is only 200 cases less than was recorded in the spring at the very peak of the first wave of infections. The epidemiological situation in France is rapidly deteriorating. Here it is important to remind that in a few days school will start to reopen soon. If things continue to deteriorate, the second largest economy in the Eurozone could see another lockdown. Bye-bye French economy?

The latest macroeconomic data suggests the US economy is recovering sharply thanks to manufacturing and property industries. On the other hand, Americans slowed spending in July as relief aid ended; unemployment benefits were cut and Congress’s failure to agree on a stimulus package. As Josh Shapiro said, a lot depends on how fast some 28 million who remain unemployed get rehired, versus when their savings and unemployment insurance—particularly as the extra $600 a week in pandemic assistance expired at the end of July—is depleted.

Moving to the most important event of the week (virtual Jackson Hole Symposium),US Federal Reserve Chair Powell announced a monetary policy realignment, which basically means ultra-low interest rates for a long time to come. Besides that, there were no updates on yield curve control or quantitative easing and the central bank has started to distance itself from the idea that the U.S. economy has a peak sustainable level of employment above which inflation will become damaging.

On the geopolitical level, EU warned PM of the UK Boris Johnson that he has less than two weeks to save post-Brexit trade talks. For now, there has not been “any tangible progress” in talks. Can the economic consequences of a no-deal agreement be worse than from the lockdown?

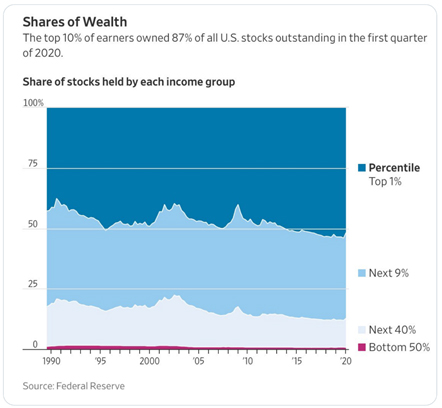

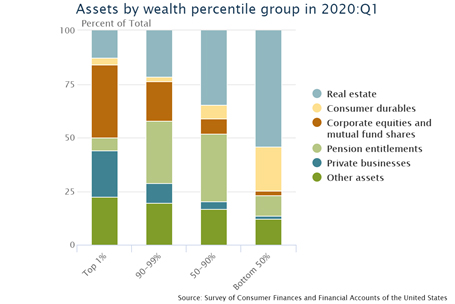

Chart of the week

Macroeconomic Data & Events

If you think you know what will happen next, think twice. Uncertainty is the new reality. When things improve, something new emerges. They gave a breath of fresh air to the economy but the second wave of corona came, once again scaring the world with the new lockdown.

The question then should be asked, how is the global economy doing? Hopefully, the worldwide PMI surveys and the all-important US non-farm payroll report will give a comprehensive view. In the upcoming week, we will also get GDP for India, Brazil, Australia and South Korea, together with policy action from Australia.

August 31: China NBS manufacturing PMI (Aug), Japan consumer confidence (Aug), housing starts (Jul), Germany and Spain inflation (Aug), Italy GDP (Final, Q2), India GDP (Q1 FY20-21) and US Dallas Fed manufacturing index (Aug).

September 1: South Korea trade (Aug), Australia interest rate decision, Germany unemployment rate (Aug), UK mortgage approvals and lending (Jul), Euro area and Italy jobless rate (Jul), Euro area inflation (Flash, Aug), US ISM manufacturing PMI (Aug), Brazil GDP (Q2), trade balance (Aug).

September 2: Australia GDP (Q2), Germany retail sales (Jul), Spain unemployment rate (Aug), US ADP job report (Aug), and Fed Beige Book.

September 3: Euro area retail sales (Jul), US ISM non-manufacturing PMI (Aug), US trade balance (Jul), jobless claims (29-Aug).

September 4: PMI for Global, Europe and Asia (Aug), Germany factory orders (Jul), US nonfarm payrolls, jobless rate, participation rate, earnings (Aug) and Russia inflation (Aug).

Hot Features

Hot Features