Fears of a second wave of COVID-19 haven been overshadowed by the possibility of a broader armed conflict between Armenia and Azerbaijan over the breakaway Nagorno-Karabakh region. Multiple countries have already called on Yerevan and Baku to end hostilities and immediately restart dialog, but the escalation continues. Turkey already said they support Azerbaijan, meanwhile, Russia is within the framework of the CSTO, so with Armenia.

In this context, stocks of the major defense stocks rebounded a bit, but still far from the pre-crisis levels.

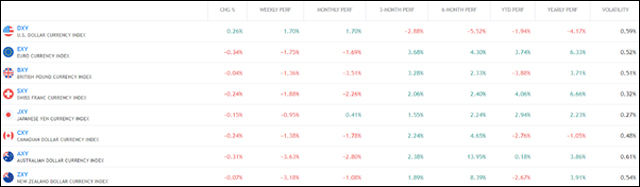

It is worth mentioning, this region is a corridor for pipelines transporting oil and gas to world markets. Will it affect energy markets? Earlier this week, due to the fall in demand and economic outlook amid the coronavirus resurgence, oil prices dropped. A shift by investors to safer assets adds pressure to oil prices. A stronger dollar makes oil, priced in U.S. dollars, less attractive to global buyers.

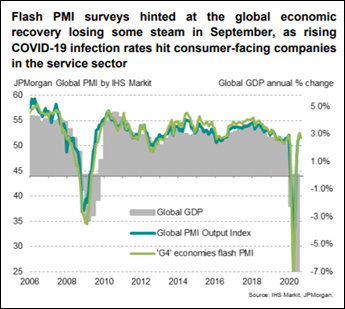

In terms of macroeconomic data, in the US, the composite PMI fell to 54.4 from 56 in August, Europe’s PMI decreased to 47.6, down from 50.5 in September. The composite index fell to 50.1 (vs. 51.9), a less significant decline due to an increase in manufacturing.

The number of U.S. workers filing initial claims for unemployment benefits grew by 4,000 to 870,000 (previously 866,000) in the week ended Sept. 19. Continuing claims for the week ended Sept. 12 fell by 167,000 to 12.6 million on a seasonally adjusted basis, compared with an upwardly revised 12.75 million in the week ended Sept. 5. Millions are still unemployed or are at risk of job loss as businesses struggle to survive with no additional government stimulus.

House Democrats, meanwhile, are looking to start a new round of negotiations over one more round of coronavirus stimulus spending by drafting a new, roughly $2.4 trillion package. Even though, major banks recently lowered their forecasts for near-term economic growth, accepting that the fiscal aid their previous estimates relied on is unlikely to arrive.

In the case of Europe, unemployment has not risen much since the COVID-19 outbreak, despite the devastating impact on the Eurozone’s economy. According to Daniel Lacalle, the euro area 7.8% official unemployment rate could double when those furloughed jobs end and the businesses that kept those workers find in need to close permanently. New lockdowns could be the black swan.

Chart of the week

Macroeconomic Data & Events

This week’s most important data will be US jobs, EMU preliminary CPI, and Japan’s Tankan. Besides that, we will keep an eye on China’s PMI and other countries, of which only have preliminary releases. Finally, the first US presidential debate will take place on September 29.

September 28: US Dallas Fed manufacturing index (Sep), South Korea business confidence (Sep), BoJ summary of opinions (16-17 Sep).

September 29: US first presidential debate, France consumer confidence (Sep), Germany and Spain inflation (Prelim, Sep), UK mortgage lending and approvals (Aug), Euro area economic sentiment (Sep), US goods trade balance, wholesale inventories (Adv, Aug), Japan industrial output (Prelim, Aug).

September 30: China Caixin and NBS manufacturing PMI (Sep), Japan housing starts (Aug), Germany retail sales (Aug), UK GDP (Final, Q2), France and Italy inflation (Prelim, Sep), BoE FPC meeting, Euro area inflation (Flash, Sep), US ADP employment report, Chicago PMI (Sep) and US GDP (Final, Q2).

October 1: Euro area, Italy, and Japan jobless rate (Aug), US personal income and spending, US ISM manufacturing PMI (Sep).

Hot Features

Hot Features