We enter the fourth and the last quarter of the year, however same problems persist – pandemic is not gone and more countries register a rise in cases; the future of the U.S. elections is unclear with Trump taken to Walter Reed medical center and will be hospitalized ‘for the next few days’. Stakes on Joe Biden’s victory over Donald Trump increase. Boris Johnson and Ursula von der Leyen have approved a further month of Brexit negotiations; Lukashenko is still “President” of Belarus, whilst most of the conflicts, including the one between Armenia and Azerbaijan are still going on. In other words, the apocalypse has not yet been canceled.

Let’s start with the coronavirus, the thing that brought us to where we are today. COVID19 has affected everything we do, including how we breathe on walks outside. So far, 34 million people have been tested positive in 188 countries and more than one million of them died. The US has the world’s highest death toll, even president Donald Trump and First Lady Melania Trump tested positive for coronavirus on 1 October. Outside the US, Spain announced Madrid lockdown measures; Germany declared 11 European risk zones; Northern Ireland recorded the worst daily case toll. The UK’s prime minister, Boris Johnson, on the other hand, is considering a new lockdown. People all over the world, meanwhile, protest against and for lockdown restrictions.

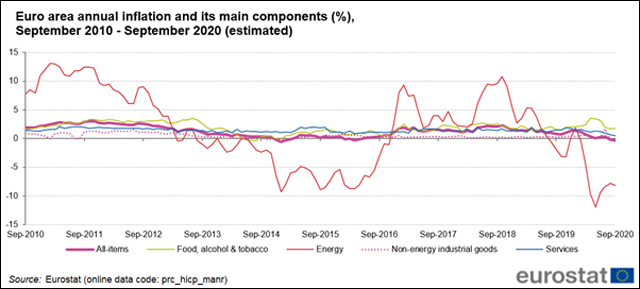

The COVID-19 pandemic has also triggered changes in consumer behavior and spending. In this context, the euro area annual inflation is expected to be -0.3 % in September 2020, down from -0.2 % in August 2020. Overall, inflation in the 19-nation eurozone missed the target despite increasingly aggressive stimulus from the central bank, which has pushed its main interest rate below zero and bought more than 3 trillion euros ($3.5 trillion) worth of assets.

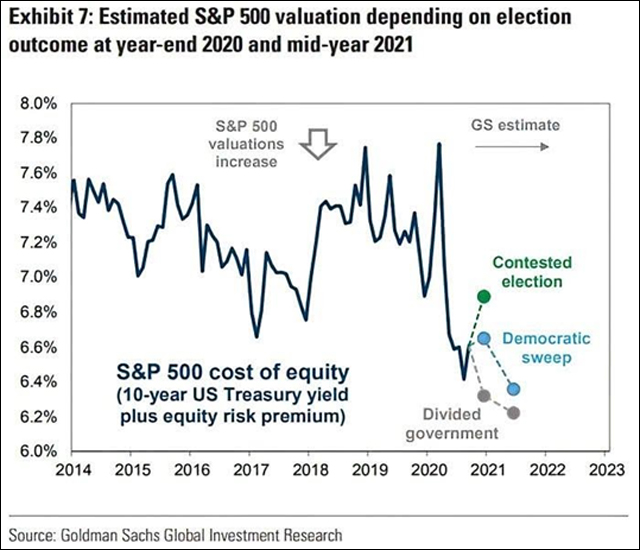

On the geopolitical level, the US is facing the same uncertainties. Democrats and Republicans still can’t agree on a new stimulus package, despite the fact that time is running out. Without any doubt, the withdrawal of current subsidies will have a negative impact on consumption and business in the following quarter. Will be curious to see what happens if Trump loses the elections .

Chart of the week

Macroeconomic Data & Events

Fresh macroeconomic data will help to understand how economies are reacting to the second wave of coronavirus. Traders will focus on the US presidential election, where Pence and Harris face off in the Vice Presidential debate. The key data and events of the week include the Reserve Bank of Australia meeting and FOMC minutes, as well as service sector PMI surveys.

October 5: Euro area and France retail sales (Aug), Euro area and France retail sales (Aug), Spain consumer confidence (Sep), US ISM non-manufacturing PMI (Sep), and Eurogroup meeting.

October 6: Construction PMI for Eurozone, France, Germany, Italy, and the UK (Sep), Sector PMI for Global, Europe (Sep), Australia monetary policy decision, Germany factory orders (Aug), and US trade, JOLTS job openings (Aug).

October 7: Germany and Spain industrial output (Aug), France trade balance (Aug), Italy retail sales (Aug), US FOMC minutes (15-16 Sep), ECB non-monetary policy meeting, and US vice presidential debate (will it be equally cringing?).

October 8: Japan Eco watchers survey (Sep), Germany exports, imports, trade balance (Sep), BoE FPC statement, and US initial jobless claims.

October 9: Caixin/China services PMI (Sep), RBA financial stability review, UK trade balance, France and Italy industrial output (Aug), Brazil inflation (Sep), and US wholesale inventories (Aug).

Hot Features

Hot Features