There are tons of indicators, “experts” and gurus on the markets that every day/week/month share their forecasts. The only problem is that if they were sure about the future most probably they would bet everything they have that things will go this way and not that. Some could say it does not happen because of a possible conflict of interest. But, once again, let’s be honest with each other, who seeks, finds the way. Thus, we come to the conclusion that the only thing certain is nothing is certain.

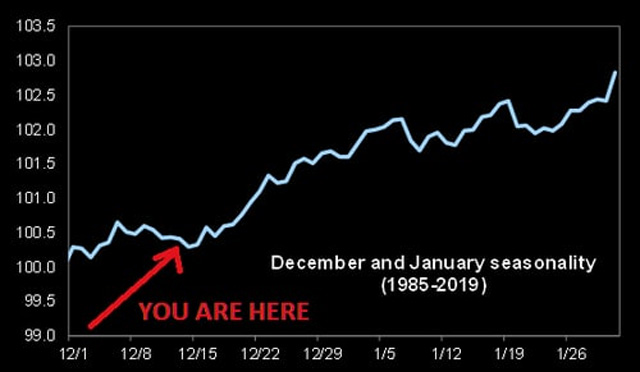

For example, Stock Trader’s Almanac reminds us of the seasonality in US stocks, according to which January is expected to be bullish (based on a sample of 1985-2019), but what if things go not as planned. In particular, what if vaccines fail to be efficient against new variants of the coronavirus. What if Brexit ends up with no-deal? What if Trump finally decides to invoke martial law? What if the US starts a war against Iran? What if investors realize that the market is expensive and overheated? Those are assumptions that could change the whole sentiment in a matter of days if not hours.

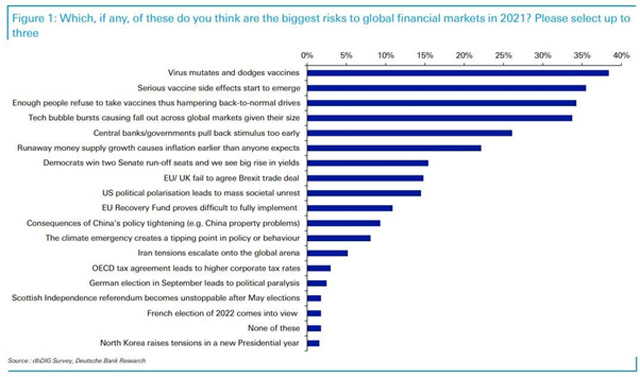

In the last monthly survey, Deutsche Bank asked clients to identify what they “think are the biggest risks to the global financial markets in 2021.” And that is what they came up with:

All the vaccine-related concerns filled out the top three. Barron’s, on the other hand, says if vaccines vanquish the coronavirus, as expected, and the economy rebounds, the S&P 500 index could rise another 10% in 2021.

For now, concerns come back to the forefront. To be more precise, the United Kingdom is facing a rapid increase in COVID-19 cases in South East England. Apparently, it has been caused by a new variant of coronavirus, defined by multiple spike protein mutations. As a result, Germany, France, is considering the possibility of limiting air traffic with Britain. The Netherlands and Belgium have already banned passenger flights with Britain. London, meanwhile, began emergency lockdown, meaning over 16 million Britons will have to stay at home.

Another issue could be the negative effect of coronavirus vaccines. According to new data from the Centers for Disease Control and Prevention (CDC), thousands of people have been unable to work or perform daily activities, or required care from a healthcare professional, after getting the new COVID-19 vaccine. In this context, The Food and Drug Administration began investigating allergic reactions to the Pfizer coronavirus vaccine.

Meanwhile, we are still waiting on how the Brexit saga will end, and if the US Congress finally decides about stimulus efforts, boosting the federal government’s spending authorization. For now, both the Federal Reserve and the Bank of England left their rates unchanged. The Fed’s chair, Jerome H. Powell, said that the central bank would keep its effort to bolster demand going “for some time,” adding that “the next few months are likely to be very challenging.” Howbeit, both organisms claimed they would use their full range of tools to support the economy.

In terms of macro, the number of Americans applying for unemployment benefits rose again last week to 885,000, the highest weekly total since September. The reason is quite obvious – the second wave of coronavirus, the absence of a new stimulus package, and growing uncertainty. The Philadelphia Fed’s business activity index fell 15 points to 11.1 in December. The UK November retail sales fell by 3.8%. The Germany IFO survey for December, on the other hand, rose to 91.3 from 90, and the expectations component improved to 92.8 from a revised 91.8.

Finally, we could mention the worst-ever US government cyber-attack. Key federal agencies, from the Department of Homeland Security to the agency that oversees America’s nuclear weapons arsenal, were reportedly targeted, as were powerful tech and security companies including Microsoft. Fits of all, it is important because it could deteriorate even further relations between the US and Russia in case the last will be proved to be the attackers.

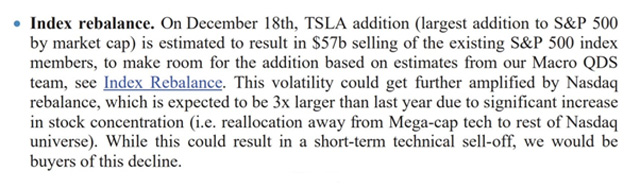

And Tesla became the biggest company ever added to the S&P 500.

Hot Features

Hot Features