Every week tens of events happen that affect our well-being. In this context, economists, financiers, and analysts try to predict the impact of them, possible risks, and, most importantly, what is going to happen.

Despite Christmas, last week was rich in news and announcements. On Tuesday, the U.K. has identified a new variant of the coronavirus that, apparently, spreads more quickly. It could not but evoke fresh fears on COVID-19 pandemic duration, as a spike in cases forces the government to act, in some cases re-imposing lockdowns/quarantine measures. This time was no exception. Despite the fact that Boris Johnson refused to rule out new national lockdown, he did impose “tougher regulations across a large swath of England”. In a few words, non-essential shops will have to close, and socializing is further curtailed. You don’t need to be an expert to say that consequences will be terrifying for local businesses.

In the meantime, over 40 countries decided to ban UK arrivals, among them France, Germany, Italy, and India. Against this background, sterling suffered another big drop. To be more precise, the currency lost over 2% against the dollar on Monday. Brent oil prices, on the other hand, fell below $50 per barrel. This could be due to the fact that the transport of goods across the English Channel was suspended. Overall, the currency’s prospects fell due to increasing uncertainty.

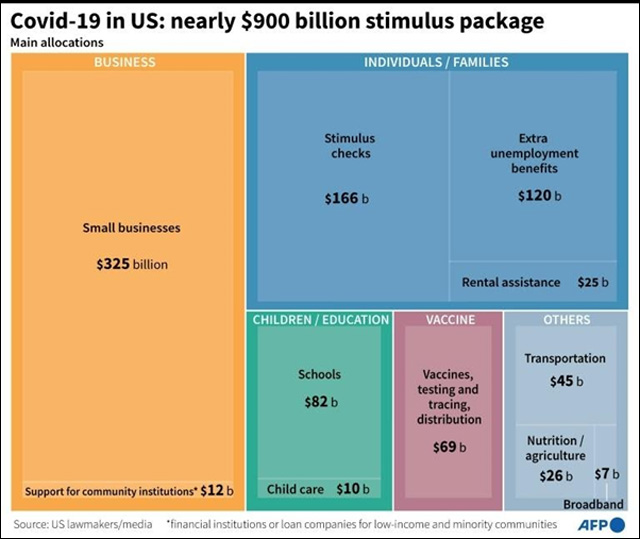

Another fear was that current vaccines wouldn’t be able to protect people against the new variant of the virus. Even S&P and DJI fell almost 3%. Another reason for the decrease could be a $900 Billion Stimulus Package approved by the US Congress. Long story short, it will include a new round of pandemic relief payments, as well as supplemental federal unemployment benefits at $300 a week for 11 weeks.

Besides that, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. It expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. Most importantly, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.

The only problem is that Trump decided to threaten to veto the $900 billion Covid relief bill:

“I’m asking Congress to amend this bill and increase the ridiculously low $600 to $2000 or $4000 per couple,” Trump said in a video released on Twitter. “I’m also asking Congress to immediately get rid of the wasteful and unnecessary items in this legislation or to send me a suitable bill.” Considered that we are at Christmas, it’s very improbable that anything will be approved until January 3rd (Members of Congress begin their terms of office on January 3). Having said that, January will be quite volatile.

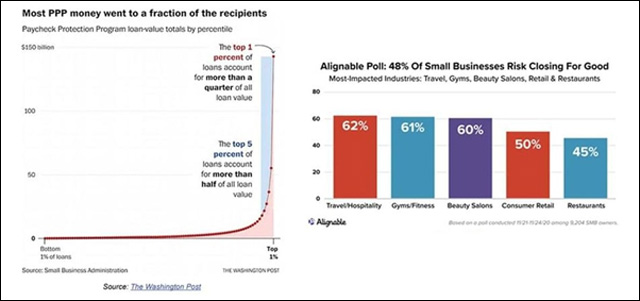

Meanwhile, based on this week’s Alignable Q4 Revenue Poll of 9,201 small business owners, 48% could shut down permanently before the year’s end. And the reason is that more than half of the money from the Treasury Department’s coronavirus emergency fund for small businesses went to just 5% of the recipients:

Another important update was the final approval of the Brexit deal. According to Boris Johnson statement,

“We have taken back control of our money, borders, laws, trade, and our fishing waters

– The deal is fantastic news for families and businesses in every part of the UK. We have signed the first free trade agreement based on zero tariffs and zero quotas that have ever been achieved with the EU

– The deal is the biggest bilateral trade deal signed by either side, covering trade worth £668bn in 2019.

– The deal also guarantees that we are no longer in the lunar pull of the EU, we are not bound by EU rules, there is no role for the European Court of Justice and all of our key red lines about returning sovereignty have been achieved. It means that we will have full political and economic independence on 1st January 2021.”

It should be added that the EC proposed to apply the Agreement on Trade and Cooperation between the EU and Britain after Brexit within 2 months – until 28 February 2021, because the parties will not have time to complete the ratification of the document before December 31, 2020 (the end of the transitional period for Brexit).

Now let’s talk about the future and why the January rally can take place in 2021. First thing first, funds raise money this month and will have to distribute the liquidity depending on the client’s portfolio, etc. Other topics will be the Scotland referendum (crucial for Gas&Oil companies), Brexit ending, OPEC meeting (January 4th), vaccination, presidential inauguration, and lockdown decision in Germany (January 5th) (will have a direct effect on euro). Also, it’s possible that due to high liquidity more stocks will skyrocket even those that actually don’t deserve it. Overall, watch out for January 20.

Hot Features

Hot Features