Without a doubt, one of the most significant events of the past week was the battle between WallStreetBets and Wall Street. Long story short, an army of traders from Reddit pumped GameStop’s stock price in a matter of days, triggering halts in trading and causing serious problems for the short-sellers betting against it.

However, short-sellers weren’t the only victims of the “attack”. In particular, high-speed trading firms that execute orders for individual investors experienced some technical issues due to exploding volume in “pumped stocks”. A normal thing for the crypto market became a nightmare for a series of hedge funds. It looks like from now big sharks will include social media monitoring in their investment strategy.

White House representative, Jen Psaki, said on January 27 that Treasury Secretary Janet Yellen and other members of the Biden administration are watching the huge movements of funds in GameStop and some other stocks.

“Market participants should be careful to avoid such activity. Likewise, issuers must ensure compliance with the federal securities laws for any contemplated offers or sales of their own securities.”

Overall, stock markets closed the week on a negative note, or, at least with some corrections, not only in Europe but the US and Asia also. In the case of Europe, one of the major issues remains to be delays to vaccine dose deliveries. Basically, manufacturers are not fulfilling their contracts. On the good side, EMA has recommended granting conditional marketing authorization for COVID-19 Vaccine AstraZeneca to prevent coronavirus disease 2019 (COVID-19) in people from 18 years of age. This is the third COVID-19 vaccine that EMA has recommended for authorization.

In the US, so expected stimulus package is still far from earning approval. It looks like the new president can’t accommodate Republicans to support his $1.9 trillion aid package. What is the solution then? Try to find a way to pass the bill without Republican votes. For that, the House passes a budget resolution next week. In terms of vaccines, President Biden said that the distribution and delivery of vaccinations were going to take longer than he expected. Dr. Fauci, in turn, said he was concerned about the impact of some new coronavirus mutations on the existing efficacy of the present vaccines. It is worth mentioning that even impressive results from companies like General Electric and Johnson & Johnson couldn’t overshadow those concerns.

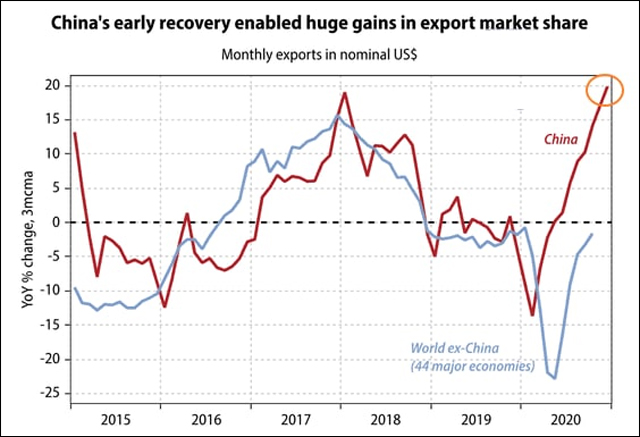

Talking about China, as expected, the Asian giant didn’t hold a promise to buy hundreds of billions of dollars in American products as part of an initial trade deal it reached with the United States last January. This could be a serious challenge for the Biden administration to confront. Another important event was the People’s Bank of China withdrawal of Rmbhttps://www.tradingview.com/symbols/CNYUSD/78bn ($12bn) of net liquidity through its open market operations. As a result, stocks across China decreased after the central bank tightened financial conditions and an official raised concerns that loose liquidity could inflate an asset bubble. So, these are the issues to closely follow.

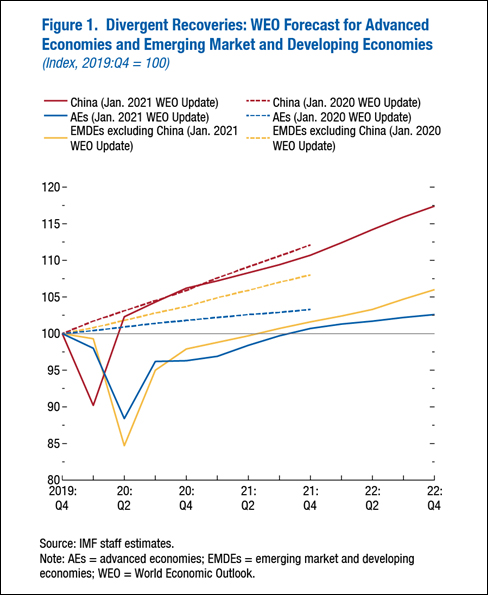

IMF, meanwhile, released a World Economic Outlook update. According to the report, amid exceptional uncertainty, the global economy is projected to grow 5.5 percent in 2021 and 4.2 percent in 2022. The 2021 forecast is revised up 0.3 percentage point relative to the previous forecast, reflecting expectations of a vaccine-powered strengthening of activity later in the year and additional policy support in a few large economies. In few words, they call for policy actions and multilateral cooperation to bring the pandemic under control everywhere.

Charts of the week

Events to follow next week:

- Follow the evolution in the delivery and vaccination rates.

- The eurozone’s Q4 GDP and final PMI readings.

- US non-farm payrolls.

- Central bank rate-setting meetings from the UK, Australia, and India.

- 4Q20 earnings results.

Hot Features

Hot Features