Slowly but steadily global economy is recovering from the Covid-19 crisis. Vaccination campaigns are gaining traction all over the world, meanwhile, new cases seem to be slowing down. Additionally, Democrats are getting closer to passing a $1.9 trillion relief package. In this context, US stocks extend record highs, Bond yields grow and oil climbs above $60.

There is only one problem people don’t take into consideration: inflation expectations tick up with recovery prospects. Some expect that inflation could reach 50% this year, well above the 29% estimated by the government. Even though, during the latest intervention Jerome Powell affirmed his commitment to keeping interest rates low for the near future even as he expressed hope for a strong economic recovery.

What are the tools the Federal Reserve could use to control inflation?

First thing first, it is important to mention that the Fed has three functions:

- Conduct the nation’s monetary policy

- Provide and maintain an effective and efficient payments system

- Supervise and regulate banking operations

Part of the mission given to the Federal Reserve by Congress is also to keep prices stable – meaning to keep prices from rising or falling too quickly. When inflation is too high, the Federal Reserve would normally raise interest rates to slow the economy and bring inflation down. When inflation is too low, the Federal Reserve typically lowers interest rates to stimulate the economy and move inflation higher.

Additionally, the Fed could slow this growth by decreasing the money supply. It means to reduce the total amount of credit allowed into the market. By reducing the liquidity in the financial system, it makes more expensive to get loans. As a result, economic growth and demand slow, and pressure on prices decreases.

The interest rate increase would normally trigger both businesses and consumers to cut back on spending. This will cause earnings to fall and stock prices to drop, at least in the short term. At the same time, rising interest rates typically lead to rising yields on fixed-income investments, such as certificates of deposit, Treasury bonds, and corporate bonds.

Current reasons for the inflation rise:

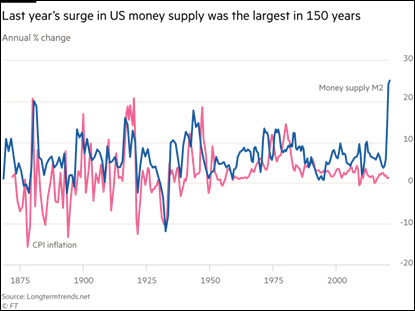

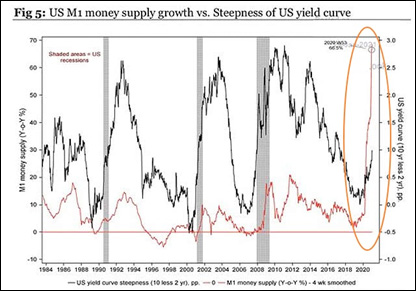

- Tremendous stimulus monetary policies

- Money printing, historically low-interest rates, large Fed balance sheet from asset purchases

- Increased money velocity

- Supply-chain bottlenecks that should put upward pressure on prices

- Costs are also rising. Metals, including iron ore and copper, have gotten more expensive, as have commodities like cotton and lumber

- The productive capacity of the economy fell due to the pandemic (bankruptcies, foreclosures, etc.)

- Dollar depreciation

- Vaccination campaigns

- Economic recovery

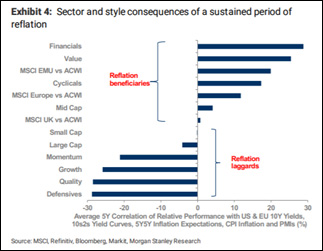

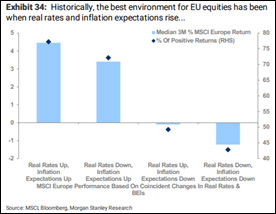

The question then should be asked, how to protect your portfolio?

Obviously, you would need to search for assets and investment vehicles that perform better than inflation over the long-term, thus those that have a positive real return. An example could be (but not limited to) Treasury Inflation Protection Securities (TIPS) and Series I Savings Bonds. Look for stocks that offer dividends greater than the inflation rate. Other options could be appreciation-oriented assets, as well as real assets and variable-interest-rate assets.

Hot Features

Hot Features