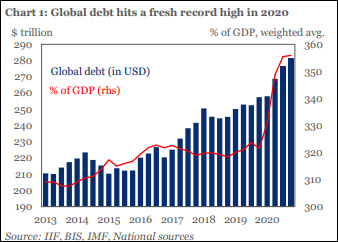

Extraordinary fiscal and monetary measures help the global economy to weather an unprecedented crisis, but at what cost? Global debt skyrocketed to a new record high of $281 trillion in 2020. Total private and public debt for the 61 countries rose approximately by $24 trillion last year, making up over a quarter of the $88 trillion rises over the past decade. Debt outside the financial sector hit $214 trillion, up from $194 trillion in 2019.

We could even say that level of indebtedness surpassed even World War II. The global debt-to-GDP ratio surged by 35 percentage points (%pts) to over 355% of GDP in 2020. For instance, back in 2008 and 2009, the increase in global debt ratio was limited to 10%pts and 15%pts, respectively.

In this context, hundreds of economists proposed to cancel the government debt held by the European Central Bank. Additionally, eurozone member states would commit to reinvesting an equal amount of money into long-term, sustainable investments. It may be hard to believe but even the President of the European Parliament David Sassoli said that debt forgiveness was “an interesting working hypothesis”. Christine Lagarde, Fabio Panetta, and French governor François Villeroy de Galhau, on the other hand, have clearly objected to the proposal.

To date, the ECB holds over €2,800 billion of the public debt of governments or around 30% of public debt in the Eurozone. What we should keep in mind is that Europe’s debt cancellation would basically mean recognition of insolvency. At the same, it is important to mention that canceling the debt is prohibited by the bylaws of the European Central Bank. Changing this state of affairs would require enormously strong bargaining power in order for unanimity to be reached by the European Council for Treaty change.

As well noted by Daniel Lacalle, “The ECB bought its debt with the creditworthiness of the economic agents of the entire euro area. This is essential to understand why debt is not a simple accounting note and the ECB cannot cancel it at will. If the ECB were to remove this debt from its balance sheet, it would destroy its assets, and with it the confidence in its viability as well as its ability to remain a leading central bank.”

At the same time, it would destroy ECB´s global position as a lender and guarantor of last resort, because there is no more faith. In other words, its assets become an insolvent piece of garbage. Thus, debt cancellation would demolish the credibility of the euro system and the ECB.

“If the ECB were to eliminate part of the bonds purchased from Spain or Italy from its balance sheet, it would be to acknowledge the country’s insolvency, but it would also reflect the impossibility of continuing to buy such bonds in the future.”

Another problem could be that once inflation surges, the ECB would need to sell the bonds in order to reduce the money base, but if bonds have been canceled there would be nothing to sell and the central bank will have to reduce the money base in another way. In particular, it could issue its own interest-bearing bonds. Thus, the central bank will have to pay interest in the future. As a result, it would transfer less profit to the treasuries.

In conclusion, I doubt very much that one day we will see debt forgiveness. Besides insolvency fears, it could shift the burden of the debt service from one branch of government to another. In the euro area, it would have the added implication of a back-door mutualization of government credit risk – after all, excess bank reserves are largely in core countries while government bonds are held by the local central banks.

Hot Features

Hot Features