If the economy is a living organism, central banks should be considered doctors whose mission is to provide the financial system with dedicated and prompt advisory and attention. Instead of clinical data, they rely on macro and micro indicators that help to measure the health of an economy. Finally, when intervention is necessary, instead of painkillers they would appeal to fiscal and monetary policies.

The only problem is that regulating the money supply and setting interest rates does not always eliminate “the disease”, but simply postpones it. For instance, in the case of coronavirus, stimulus measures did help the economy to recover but at what cost. The weak dollar battered markets and reinforced inflation, even though unemployment is still at crisis levels.

Normally, a stronger economy tends to make the corporate debt more attractive than government debt, decreasing demand for country debt and raising rates. A weaker economy, on the other hand, pushes yields down. It is worth mentioning that higher yields make the currency more attractive to income-seeking investors.

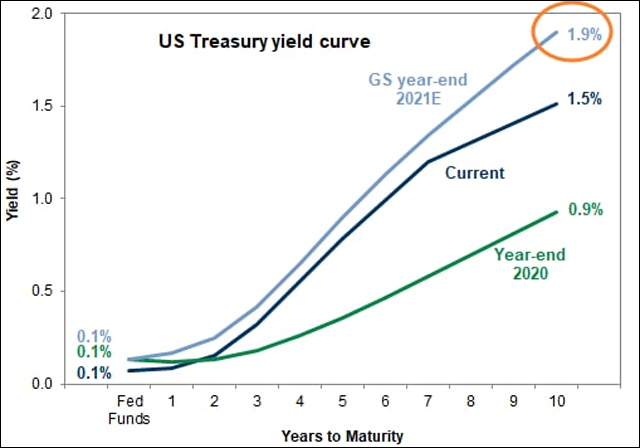

Over the past week, the 10-year Treasury yield jumped to the highest level in more than a year. A week earlier, it triggered a rapid sell-off in many tech stocks, while expectations of higher interest rates and higher borrowing costs put pressure on the valuations of emerging companies. In Europe, yields are also growing and this presents a serious challenge for the recovery of the economy as borrowing costs rise.

It is believed that if the bond market selloff intensifies leading up to the March 17th FOMC decision, the Fed may finally have to push back against the move in Treasury yields. If the Fed does not inspire investors on the 16-17, that is, there are risks of high volatility, and half the market will rush to short long government bonds, the dollar will jump, and the NASDAQ will collapse and the Fed will not intervene to 1.8-2.0% of treasury yield.

Hot Features

Hot Features