You may have forgotten about him, but he still plays an important role in US politics. Just like an intelligent megalomaniac mouse from “pinky and the brain”, he is possessed by the idea of once again taking over the world. He is known for many things, but there is a particular one that brought him to the presidency – speaker talent. His name is Donald J. Trump.

Normally, ex-presidents would simply disappear from sight, but Donald Trump is an unusual man. And don’t get me wrong, it doesn’t have to be something necessarily bad. Either way, this time the reason for his reappearance was Georgia’s restrictive voting law.

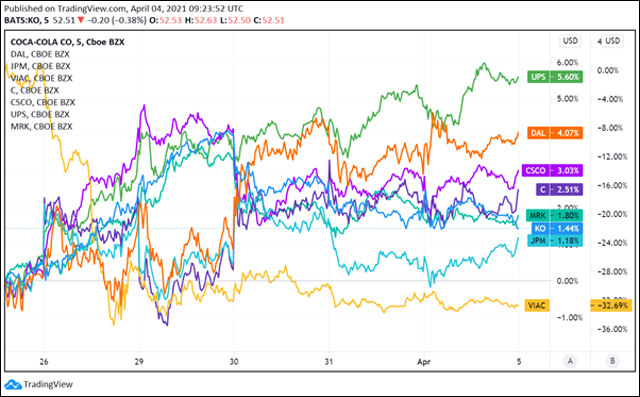

Last Friday, Mr. Trump urged a boycott of “woke companies” that have taken a stand and Major League Baseball for moving its All-Star Game out of Georgia. In particular, he targeted Major League Baseball, Coca-Cola, Delta Airlines, JPMorgan Chase, ViacomCBS, Citigroup, Cisco, UPS, and Merck. As of now, these calls not affect the asset price.

Of course, it is naive to believe that all of Trump’s supporters will blindly follow his call, but if at least 15-20% of them listen to the advice, then this can hit the profits of companies. Curiously, the implications for JPMorgan and Citigroup could be even worse than for all other companies. It is not a secret for anyone that if a bank immediately takes out 10% of the money invested in it, then such a bank can easily fall apart.

Under the current QE, most likely banks will be able to find means in the system to plug holes, but this, in turn, may result in a short-term loss of liquidity in the market as a whole, which is fraught with bloated SP500, Dow Jones, NASDAQ.

The second topic that needs to be discussed is The U.S. dollar’s share of currency reserves.

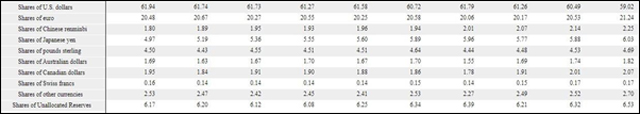

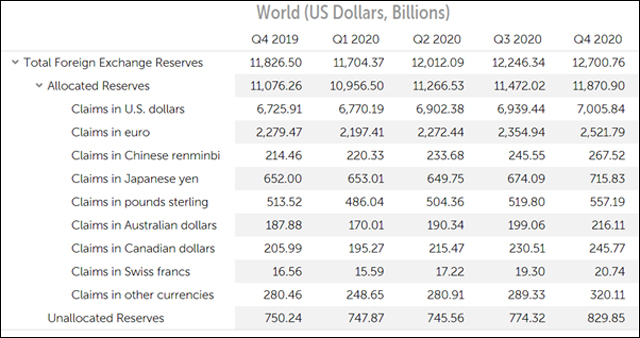

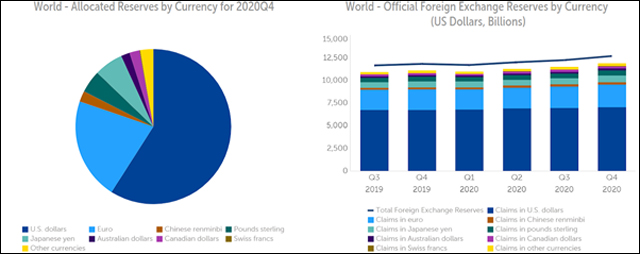

According to the latest reserve data from the IMF, foreign central banks had more dollars in reserves than ever before at the end of last year, over $7 trillion. The more timely custodian holdings at the Federal Reserve, on the other hand, show that Treasuries held for foreign central banks reached a new record high last month.

Even though, the dollar’s share of global currency reserves decreased in the fourth quarter to around 59%, the lowest in 25 years. One of the main reasons was doubts about how long the dollar can maintain its status as the pre-eminent reserve currency. Since 2014, the dollar’s share has declined from 66% to 59%, on average 1 percentage point per year. It is important to bear in mind that the US dollar’s status as the dominant global reserve currency is a crucial enabler for the US government to keep financing its public debt.

Some believe that the drop in the dollar’s share of global reserves is temporary and was driven by its slide against most currencies in the fourth quarter. The question now is how did the image change in the first quarter of 2021…

The Chinese renminbi, meanwhile, is gaining momentum in currency markets, with more yuan changing hands than ever before in London, the world’s leading foreign exchange center. Nevertheless, the renminbi’s share is still only 2.25%, despite the magnitude and global influence of China’s economy.

Hot Features

Hot Features