Once Paul Samuelson, one of the most prominent economists in history, said that the stock market had predicted nine of the past five recessions. Since then nothing has changed: “experts” all over the world warn of upcoming correction, but time goes by and nothing happens. The reason is simple, as long as central banks are pouring money into the system, the bullish trend won’t be a broker.

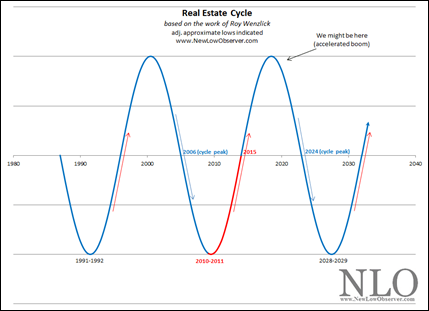

Still, indicators urge that something is not going right and that soon certain markets may fall. In particular, the so-called “Wenzlik Cycle” shows that the US real estate market is about to start falling. According to the following chart, at the stage in the cycle, housing price begins a phase of accelerated increases.

Who is Roy Wenzlick and why should we blindly believe in the real estate cycle? First, you shouldn’t. It is just a hypothesis that not necessarily will take place. Over 80 years ago, Roy Wenzlick was an outstanding real estate analyst. His 1936 book, The Coming Real Estate Boom, became the New York Times bestseller among economists. Wenzlik proved that a wave-like form of movement characterizes construction, and it takes much longer than the movement of a large economic cycle.

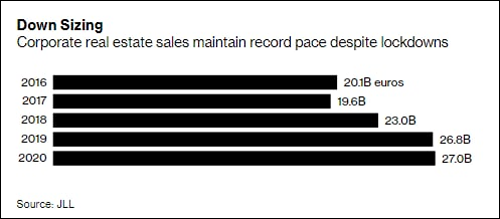

Still, many analysts disagree claiming that low mortgage rates and the rise of remote workers will keep home sales booming this year. Others believe that the economic recovery will bring even more good news for housing. Also, according to WSJ, the U.S. housing market is 3.8 million single-family homes short of what is needed to meet the country’s demand. Builders struggle to keep up… According to broker Jones Lang LaSalle, corporations sell commercial real estate at a record pace.

The question now is when the real estate market reaches all-time highs and starts correcting…

Hot Features

Hot Features