It was a busy week for the markets, especially in terms of geopolitics.

First, Vladimir Putin announced the suspension of Russia’s participation in the New START nuclear arms reduction treaty with the United States, while threatening to resume nuclear tests if the United States does so first.

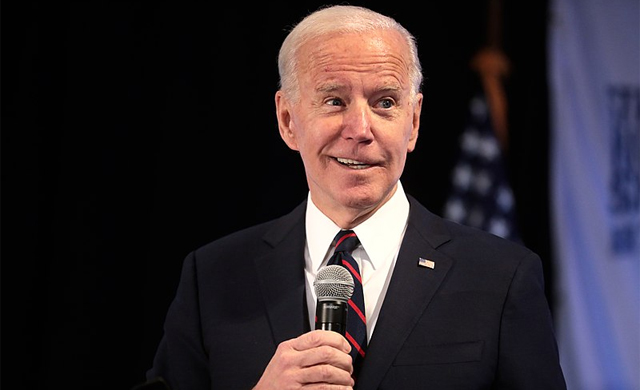

Second, the president of the world’s leading economy, Joe Biden, promised that Washington and its allies will continue to support Kyiv and assured that Russia will never defeat Ukraine. At the same time, he anticipated new sanctions against the aggressor.

On the monetary policy side, as anticipated, the minutes of the February 1st Fed meeting confirmed the regulator’s hawkish stance: the fight against inflation is not over, and rates will rise further. How much further – will depend on the state of the economy and the labor market.

St. Louis Fed President James Bullard, for example, advocated raising rates to a range of 5.25%-5.5%. According to him, the Fed needs to get inflation back under control this year. Otherwise, the situation of the 1970s, when interest rates had to be raised again and again, could be repeated.

No wonder, nervousness has returned to the debt market. Over the last month, the 10-year US government bond yield has risen by more than 12% and is now approaching 4%. Going forward, this could trigger a correction in equities and subprime bonds.

This is because rising Treasury yields reduce the attractiveness of alternative assets and rising corporate bond yields indicate higher borrowing costs for companies. The initiative to increase the US stock buyback tax from 1% to 4% could add fuel to the fire, as it could result in a reallocation of profits from buybacks to dividends.

Hot Features

Hot Features