The negotiations over the U.S. debt ceiling keep breaking sticks and stones…

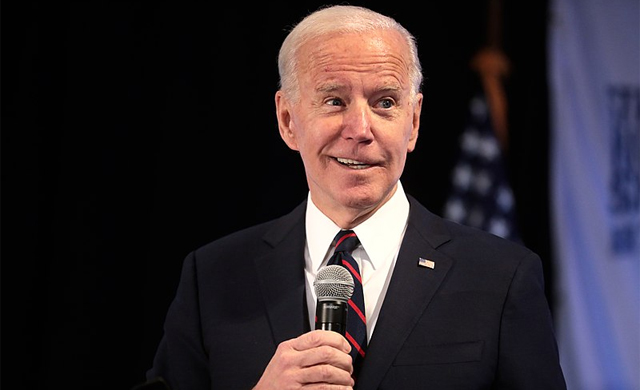

Today, Joe Biden will meet with McCarthy to discuss the issue and try to reach an agreement. Before leaving Japan after the G7 summit, Mr. President expressed his willingness to cut spending and make necessary fiscal adjustments. However, he rejected the latest offer from the Republicans as “unacceptable”.

The team of “donkeys” is willing to cut over $1 trillion in spending and reduce the deficit by $3 trillion, but won’t accept a plan that protects Big Oil subsidies while putting the healthcare of 21 million Americans at risk. Clearly, each side will try to get the best terms for itself, so no “sudden miracle” is expected.

The government can pay its debts until early June, so the drama could continue for the next two weeks. In the meantime, Treasury Secretary Janet Yellen continues to urge common sense and stresses the urgency of the White House reaching an agreement, as the U.S. is unlikely to live to mid-June to pay its bills.

On the monetary policy front, the economic calendar suggests that there will be five appearances by Fed members this week, including Bullard (said this morning that regulator will have to raise rates more this year – possibly two more 0.25% rate hikes to fight inflation), Bostic, and Barkin on Monday, and Logan on Tuesday.

The highlight of the week will be on Wednesday, with the release of the minutes of the latest FOMC meeting. If there are indications that the Fed is ready to end its aggressive tightening strategy, it could boost market optimism and put an end to speculation about the importance of the June meeting.

However, the threat of recession remains a concern. In Europe, several ECB policymakers, including President Lagarde, will appear throughout the week. The future of the monetary policy tightening cycle in the euro zone remains uncertain, with markets expecting only one or two more hikes.

Hot Features

Hot Features