Latin America-focussed precious metal explorer Condor Gold (LSE:CNR) exceeded its target resource base from its La India Project in Nicaragua but the standard used was that of the Canadian Institute of Mining, Metallurgy, and Petroleum (CIM), the company said today.

In a statement, Condor stated it now has over 2.4 million ounces of gold at an average grade of 4.6 grams per tonne (g/t) from the 100% controlled La India Project, three weeks after the company concluded its drilling programme.

However, the resource estimate prepared by SRK Consulting (UK) Ltd. dropped the Joint Ore Reserves Committee, or JORC code, in assesing the La India resource base and adopted Canada’s CIM standards in defining the resource material.

“The independent resource has been reported to CIM standards for the first time as opposed to JORC Code in order to broaden the appeal of the Company to North American investors,” Condor’s Chairman and Chief Executive, Mark Child stated.

According to the report, there are about 534,000 ounces of the yellow metal at an average grade of 3.9 g/t in the indicated category, out of the 954,000 ounces at 3.6 g/t total resource recoverable through open pit mining.

Over 1.4 million ounces of gold at 5.5 g/t can also be recovered through underground mining, the report said.

“This provides the Company with a higher degree of certainty that La India Project can be fast tracked towards production and due to the high gold grade should be attractive from an economic perspective,” Mr. Child said, commenting on the report.

Condor also stated the La India Project has considerable potential to expand its resource and the company is now developing three gold vein sets, which will be the targets of the next drilling programme.

Back in London, shares gained 8.4% to £1.93 by midday, after jumping 11.5% to £1.98 at 8:30 AM GMT, following the news.

Company Spotlight

Condor Gold plc is a gold and silver exploration company focussing on Central America with assets in Nicaragua and El Salvador. A moratorium on exploration and mining activities in El Salvador put operations in the country to a halt and the company is now focussing its assets in Nicaragua.

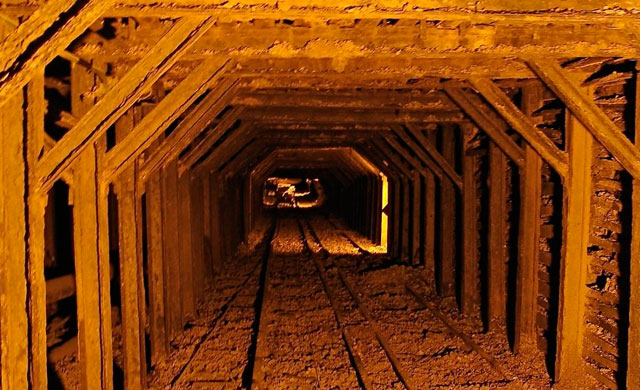

The La India Project consists of six 100% owned concessions which form the historical La India Mining District. Three other projects in Nicaragua are being operated by Condor for a 100% stake and the company has a 20% interest in the La Libertad-Santo Domingo District

Hot Features

Hot Features