Shares of FTSE 250 firm, Centamin plc (LSE:CEY), have climbed back again today after the company announced its gold export has resumed after being halted last week by customs authorities, loosely linked to a fuel dispute with Egypt’s state-owned oil firm Egyptian General Petroleum Corporation (EGCP).

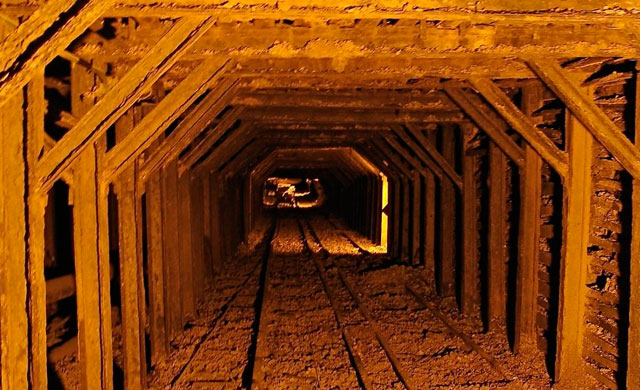

Centamin shares reached a four-year low last week, 13th December, after the company suspended operations at its flagship gold mine in the eastern desert of Egypt some 700 kilometres from the capital, Cairo, due to a lack of fuel supply withheld by EGPC.

EGCP, which controls production and licencing of oil and gas contracts in the country, demanded a retrospective claim on Centamin for fuel supplied between January 2009 and January 2012 totaling US$65 million and halted supply of fuel to Centamin’s Sukari Gold Mine, forcing the company to shut down its mining activity following the receipt of the demand it claimed illegal.

Political

Several market analysts, including ADVFN’s Tom Winnifrith, say the troubles that plagued Centamin was due to a change in political leadership in the Islamic country he referred to as an Islamofascist regime.

Centamin has invested about US$700 million since it ventured in the Arab state in 2005, with first gold production in 2010.Since then the Sukari Gold mine, which is owned in a 50-50 split with state-owned Egyptian Mineral Resource Authority (EMRA), has produced over 350,000 ounces of the precious yellow metal.

As early as July this year, Centamin had known a threat in the 30-year concession agreement it has to operate the mine, culminating in a court decision in October, saying that Centamin missed to submit a written approval from the Ministry of Petroleum and Mineral Resources.

An appeal lodged by Centamin in response to the court decision is yet to be decided by the Egyptian courts but the company believes it will be on its favour as they held the original lease documentation that shows the approval by the Petroleum and Mineral Resources Minister.

Sporadic Stoppage

Meanwhile, gold exports from the Sukari mine have been intermittently halted due to legal constraints faced by Centamin.

Before the 13th December gold export stoppage, Centamin also halted exports in November following the court order. Earlier this year, in March, labour unrest ensued following a breakdown of salary talks with workforce.

The company, however, has not revised its projected total output for the year end – at 200,000 ounces. As at 30th September 2012, the company has already produced 177,415 ounces, 23% higher compared to the same period last year.

Volatile

Whilst the company sits on multi-million ounces of gold reserves in Egypt, the company remains volatile.

Shares plummeted to a four-year low of 27.70 pence on 13th December, following the suspension of operations, just a few pence higher than the lowest recorded share price at the height of financial crisis in 2008, at 22.25 pence.

At 12:00 PM London time, over 20 million shares were traded and pushed the price up 27% to 44 pence, still 16.5% lower than the pre-suspension value back on the 12th December.

Mr. Winnifrith, who earlier said the stock could be worth about 150 pence, still maintains a negative outlook on the stock and recommends a sell, citing not management incompetence or lack of asset but rather of the unstable political conditions of the country where the mine is located.

A day after Centamin received the demand letter and the suspension of fuel supply, the company stated its supplier, Chevron, was given a green light to supply fuel again to the company and that EGCP’s claim has been dropped – a series of events one can only say arbitrary.

“We expect both fuel supply and normal operations at Sukari to resume in the coming days, once payment for the latest shipment has been received and working capital in the operating company, Sukari Gold Mines, has subsequently been replenished,” Centamin, which has about US$180 million in cash and is debt-free as of 30th September 2012, said in a statement.

Hot Features

Hot Features