Britain’s largest retailer, Tesco (LSE:TSCO) watched its share price drop by 1.34% today after announcing a third consecutive quarter of declining sales. Despite acknowledging that Tesco has lost an average of nearly one million customers per week, CEO, Philip Clarke, has been trying about as hard as I have ever seen anyone try to cover the news with rose-colored paint.

©

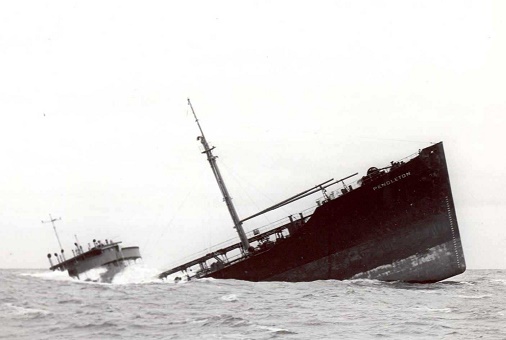

Is Tesco the New Titanic?

We should all have learned in 1912 that nothing is unsinkable. Despite disastrous results that have driven the company share price to drop nearly 100 points since 22 May 2013, Clarke had the unmitigated gall to begin the first quarter report, saying: “A quarter of significant improvement for customers, with a greater focus on building long-term loyalty, through:

- Significant price cuts on the lines that matter most

- Enhanced rewards through Clubcard Fuel Save

- Cheaper online grocery services

- Over 100 more stores refreshed”

Phil, did you not realize that some people would read the rest of the report?

One institutional investor said that he has “

never been so gloomy about Tesco’s prospects in 20 years.” On top of the report, the declining share price, and investor observations, Kantar Worldpanel’s most recent till-roll statistics indicate that Tesco has lost a full 1.5% of its market share compared to the same period last year.

David, I’ve got news for you. It doesn’t matter. Someone can stab you in the heart or you can do it yourself. One is called homicide. The other is called suicide. In the end, the results are the same. The public apparently understands that.

Neither does it matter how pretty a picture tried to paint with the introduction to its report. The facts are the facts. We don’t need to know what the cause is, but Philip Clarke better know how to fix the problem. We can see that Tesco is bleeding out. The question is what is the man at the top going to do about it.

HSBC analyst, David McCarthy, suggested that “The indications are that like-for-like could get worse in the second quarter, with accelerating deflation, more disruption from refits and competition intensifying.”

Under further scrutiny, Tesco’s problems are, like the infamous iceberg, much larger than they appear. The Telegraph reported that “Tesco sales [are] falling in the UK, but Malaysia, South Korea, Thailand, Slovakia and Ireland. One by one, businesses that were once hailed as a success have fallen into decline.”

My final caveat

Don’t forget that at least some of the crew on the Titanic were trying to keep the passengers from panicking, even when the ship was already sinking.

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Ltd. ADVFN Ltd does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.

Hot Features

Hot Features