false

2024

FY

0001065078

0001065078

2024-01-01

2024-12-31

0001065078

2024-06-30

0001065078

2025-02-24

0001065078

2023-01-01

2023-12-31

0001065078

2024-10-01

2024-12-31

0001065078

2024-12-31

0001065078

2023-12-31

0001065078

us-gaap:CommonStockMember

2022-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001065078

us-gaap:RetainedEarningsMember

2022-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001065078

2022-12-31

0001065078

us-gaap:CommonStockMember

2023-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001065078

us-gaap:RetainedEarningsMember

2023-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001065078

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001065078

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001065078

us-gaap:CommonStockMember

2024-01-01

2024-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-12-31

0001065078

us-gaap:RetainedEarningsMember

2024-01-01

2024-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-12-31

0001065078

us-gaap:CommonStockMember

2024-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2024-12-31

0001065078

us-gaap:RetainedEarningsMember

2024-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-12-31

0001065078

nssi:ILiADBiotechnologiesLLCMember

2024-12-31

0001065078

nssi:LitigationSettlementsMember

2024-01-01

2024-12-31

0001065078

nssi:LitigationSettlementsMember

2023-01-01

2023-12-31

0001065078

srt:MinimumMember

2024-12-31

0001065078

srt:MaximumMember

2024-12-31

0001065078

srt:MinimumMember

2024-01-01

2024-12-31

0001065078

srt:MaximumMember

2024-01-01

2024-12-31

0001065078

nssi:StockIncentivePlan2022Member

2024-12-31

0001065078

nssi:StockIncentivePlan2013Member

2024-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

2024-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

2023-12-31

0001065078

nssi:CostBasisMember

2024-12-31

0001065078

nssi:GrossUnrealizedGainsMember

2024-12-31

0001065078

nssi:GrossUnrealizedLossesMember

2024-12-31

0001065078

nssi:FairValueMember

2024-12-31

0001065078

nssi:CostBasisMember

2023-12-31

0001065078

nssi:GrossUnrealizedLossesMember

2023-12-31

0001065078

nssi:FairValueMember

2023-12-31

0001065078

nssi:GrossUnrealizedGainsMember

2023-12-31

0001065078

nssi:ILiADBiotechnologiesLLCMember

2023-12-31

0001065078

nssi:IliadMember

nssi:ClassCUnitsMember

2024-12-31

0001065078

nssi:IliadMember

2024-01-01

2024-12-31

0001065078

nssi:IliadMember

2023-01-01

2023-12-31

0001065078

2022-03-01

2022-03-25

0001065078

2013-05-01

2024-12-31

0001065078

2022-05-01

0001065078

srt:ChiefExecutiveOfficerMember

nssi:NewEmploymentAgreementMember

2022-03-02

2022-03-22

0001065078

srt:ChiefExecutiveOfficerMember

2024-01-01

2024-12-31

0001065078

srt:ChiefExecutiveOfficerMember

2023-01-01

2023-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

2022-03-02

2022-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2022-03-02

2022-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2023-03-02

2023-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2024-03-02

2024-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2022-03-02

2022-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

2022-03-02

2022-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

nssi:ShareBasedCompensationAwardTrancheFourMember

2022-03-02

2022-03-22

0001065078

srt:VicePresidentMember

2024-01-01

2024-12-31

0001065078

srt:VicePresidentMember

2023-01-01

2023-12-31

0001065078

srt:ChiefFinancialOfficerMember

2023-01-01

2023-12-31

0001065078

nssi:CitadelSecuritiesMember

2024-12-20

2024-12-24

0001065078

nssi:GoogleMember

2014-04-04

2014-12-03

0001065078

nssi:FacebookMember

2017-05-08

2017-05-09

0001065078

nssi:AristaNetworksMember

2022-10-01

2022-11-30

0001065078

nssi:FourPartiesMember

2024-01-01

2024-12-31

0001065078

nssi:FourPartiesMember

2023-01-01

2023-12-31

0001065078

nssi:BoardOfDirectorsMember

2023-06-14

0001065078

2011-08-01

2024-12-31

0001065078

nssi:BoardOfDirectorsMember

2024-02-20

2024-02-23

0001065078

nssi:BoardOfDirectorsMember

2024-08-25

2024-08-27

0001065078

us-gaap:SubsequentEventMember

nssi:BoardOfDirectorsMember

2025-02-10

2025-02-19

0001065078

us-gaap:SubsequentEventMember

us-gaap:RestrictedStockUnitsRSUMember

2025-02-10

2025-02-19

0001065078

us-gaap:SubsequentEventMember

nssi:SettlementAgreementMember

2025-02-20

2025-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

nssi:Integer

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ___________.

Commission File Number: 1-15288

NETWORK-1 TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

11-3027591 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(I.R.S.

Employer

Identification

Number) |

| |

|

|

65 Locust Avenue, Third Floor

New Canaan, Connecticut 06840

|

| (Address

of Principal Executive Offices) |

Registrant's telephone number, including area code:

(203) 920-1055

Securities registered pursuant to Section 12(b) of the

Act:

| Title

of each class |

Trading

symbol |

Name

of each exchange on which registered |

| Common

Stock $.01 par value |

NTIP |

NYSE

American |

| |

|

|

Securities registered under Section 12(g) of the Act:

Common Stock, $.01 par value

(Title of Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act

of 1934. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☐ |

Smaller reporting company ☒ |

| Emerging growth

company ☐ |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in this filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D.1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

☒

The aggregate market value of the voting and non-voting common stock held

by non-affiliates computed by reference to the price at which the common stock was last sold as of June 30, 2024 was approximately $28,027,116

based on the closing price as reported on NYSE American Exchange. Shares of voting stock held by each officer and director

and by each person, who as of June 30, 2024, the last business day of the Registrant’s most recently completed second quarter, may

be deemed to have beneficially owned more than 10% of the voting stock have been excluded. This determination of affiliate status is not

necessarily a conclusive determination of affiliate status for any other purpose.

The number of shares outstanding of Registrant's common stock as of February

24, 2025 was 22,981,271.

NETWORK-1

TECHNOLOGIES, INC.

2023

FORM 10-K

TABLE

OF CONTENTS

Page

No.

PART

I

PART

I

Forward-looking

statements:

THIS

ANNUAL REPORT ON FORM 10-K CONTAINS STATEMENTS ABOUT FUTURE EVENTS AND EXPECTATIONS WHICH ARE “FORWARD-LOOKING STATEMENTS”.

ANY STATEMENT IN THIS 10-K THAT IS NOT A STATEMENT OF HISTORICAL FACT MAY BE DEEMED TO BE A FORWARD-LOOKING STATEMENT WITHIN THE MEANING

OF SECTION 27A OF THE SECURITIES EXCHANGE ACT OF 1933, AS AMENDED, OR SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED. FORWARD-LOOKING

STATEMENTS PROVIDE CURRENT EXPECTATIONS OF FUTURE EVENTS BASED ON CERTAIN ASSUMPTIONS AND INCLUDE ANY STATEMENT THAT DOES NOT DIRECTLY

RELATE TO ANY HISTORICAL OR CURRENT FACT. STATEMENTS CONTAINING SUCH WORDS AS “MAY,” “WILL,” “EXPECT,”

“BELIEVE,” “ANTICIPATE,” “INTEND,” “COULD,” “ESTIMATE,” “CONTINUE”

OR “PLAN” AND SIMILAR EXPRESSIONS OR VARIATIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS

ARE BASED ON THE BELIEFS AND ASSUMPTIONS OF OUR MANAGEMENT BASED ON INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT. SUCH FORWARD-LOOKING

STATEMENTS ARE SUBJECT TO CURRENT RISKS, UNCERTAINTIES AND ASSUMPTIONS RELATED TO VARIOUS FACTORS SET FORTH IN THIS REPORT AND IN OTHER

FILINGS MADE BY US WITH THE SECURITIES AND EXCHANGE COMMISSION. BASED UPON CHANGING CONDITIONS, SHOULD ANY ONE OR MORE OF THESE RISKS

OR UNCERTAINTIES MATERIALIZE, INCLUDING THOSE DISCUSSED AS “RISK FACTORS” IN ITEM 1A AND ELSEWHERE IN THIS REPORT, OR SHOULD

ANY OF OUR UNDERLYING ASSUMPTIONS PROVE INCORRECT, ACTUAL RESULTS MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THIS REPORT. WE UNDERTAKE

NO OBLIGATION TO UPDATE, AND WE DO NOT HAVE A POLICY OF UPDATING OR REVISING THESE FORWARD-LOOKING STATEMENTS. READERS ARE CAUTIONED

NOT TO PLACE UNDUE RELIANCE ON FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE THE STATEMENT WAS MADE. UNLESS THE CONTEXT

OTHERWISE REQUIRES, THE TERMS “NETWORK-1”, “COMPANY”, “WE”, “OUR”, AND “US”

MEAN NETWORK-1 TECHNOLOGIES, INC. AND ITS WHOLLY-OWNED SUBSIDIARIES, MIRROR WORLDS TECHNOLOGIES, LLC AND HFT SOLUTIONS, LLC.

ITEM

1. BUSINESS

Our

principal business is the development, licensing and protection of our intellectual property assets. We presently own one hundred and

six (106) U.S. patents, fifty-four (54) of such patents have expired, and sixteen (16) foreign patents relating to (i) our M2M/IoT Patent

Portfolio relating to, among other things, enabling technology for authenticating and using eSIM (embedded Subscriber Identification

Module) technology in IoT, Machine-to-Machine and other mobile devices, including smartphones, tablets and computers, as well as automobiles;

(ii) our HFT Patent Portfolio covering certain advanced

technologies

relating to high frequency trading, which inventions specifically address technological problems associated with speed and latency and

provide critical latency gains in trading systems where the difference between success and failure may be measured in nanoseconds; (iii)

our Cox Patent Portfolio relating to enabling technology for identifying media content on the Internet and taking further action to be

performed after such identification; (iv) our Remote Power Patent covering the delivery of power over Ethernet (PoE) cables for the purpose

of remotely powering network devices, such as wireless access ports, IP phones and network based cameras; and (v) our Mirror Worlds

Patent Portfolio relating to foundational technologies that enable unified search and indexing, displaying and archiving of documents

in a computer system.

We

have invested $7,000,000 in ILiAD Biotechnologies, LLC (“ILiAD”), a clinical stage biotechnology company with an exclusive

license to seventy-four (74) patents. On December 31, 2024, we owned approximately 6.5% of the outstanding units of ILiAD on a non-fully

diluted basis and 4.9% of the outstanding units on a fully diluted basis (after giving effect to the exercise of all outstanding options

and warrants).

Our

current strategy includes continuing our efforts to monetize our intellectual property. In addition, we continue to seek to

acquire additional intellectual property assets to develop, commercialize, license or otherwise monetize. Our strategy includes working

with inventors and patent owners to assist in the development and monetization of their patented technologies. Our patent acquisition

and development strategy is to focus on acquiring high quality patents which management believes have the potential to generate significant

licensing opportunities as we have achieved with respect to our Remote Power Patent and our Mirror Worlds Patent Portfolio. In addition,

we may also enter into strategic relationships with third parties to develop, commercialize, license or otherwise monetize their intellectual

property.

We

have been dependent upon our Remote Power Patent for a significant portion of our revenue. Our Remote Power Patent has generated revenue

in excess of $188,000,000 from May 2007 through December 31, 2024. We no longer receive revenue for our Remote Power Patent for any infringement

period subsequent to March 7, 2020 (the expiration date of the patent). During the year ended December 31, 2024 and 2023, our Remote

Power Patent generated all of our revenue. Our future revenue is largely dependent on our ability to monetize our other patent assets.

We

have pending litigations involving our assertion of infringement claims concerning certain patents within our HFT Patent Portfolio. In

addition, we have a pending appeal to the U.S. Court of Appeals for the Federal Circuit of the District Court judgment of non-infringement

dismissing our case against Google and YouTube involving certain patents within our Cox Patent Portfolio (see “Legal Proceedings”

at page 20 of this Annual Report).

At

December 31, 2024, we had cash and cash equivalents and marketable securities of $40,600,000 and working capital of $40,066,000. Based

on our current cash position, we believe that we will have sufficient cash to fund our operations for the foreseeable future.

Overview

of Our Patents

We

currently own one hundred and six (106) U.S. patents and sixteen (16) foreign patents relating to patents within our M2M/IoT Patent

Portfolio, HFT Patent Portfolio, Cox Patent Portfolio, Mirror Worlds Patent Portfolio and our Remote Power Patent. With respect to

our one hundred and six (106) U.S. patents, fifty-four (54) of such patents have expired. However, we can assert expired patents

against third parties but only for past damages up to the expiration date. In 2024, our revenue was achieved from claims related to

our expired Remote Power Patent and we have appealed to the U.S. Court of Appeals for the Federal Circuit the District Court order

dismissing our claims involving certain expired patents within our Cox Patent Portfolio (see “Legal Proceedings” at

page 20 hereof).

M2M/IoT

Patent Portfolio

Our

M2M/IoT Patent Portfolio, acquired in December 2017 from M2M and IoT Technologies, LLC (“M2M”), relates to, among other things,

enabling technology for authenticating and using eSIM (embedded Subscriber Identification Module) technology in IoT, Machine-to-Machine

and other mobile devices including smartphones, tablets and computers, as well as automobiles. The M2M/IoT Patent Portfolio currently

consists of forty-one (41) issued U.S. patents, six (6) pending U.S. patent applications, and fifteen (15) registered foreign patents.

Since we acquired the M2M/IoT Patent Portfolio in December 2017, we have been issued twenty-nine (29) additional U.S. patents with respect

to the portfolio. We anticipate further issuances of additional claims for this portfolio. The expiration dates of the forty-one (41)

issued U.S. patents currently within our M2M/IoT Patent Portfolio range from September 2033 to May 2034.

We

have an obligation to pay M2M 14% of the first $100 million of net proceeds (after deduction of expenses) and 5% of net proceeds greater

than $100 million from Monetization Activities (as defined) related to our M2M/IoT Patent Portfolio. In addition, M2M will be entitled

to receive from us $250,000 of additional consideration upon the occurrence of certain future events related to the patent portfolio.

John

Nix, the Managing Member of M2M, provides consulting services to us with respect to our M2M/IoT Patent Portfolio. Mr. Nix is an entrepreneur

and inventor, and founder and Chief Executive Officer of Vobal Technologies, LLC. In 2016, Mr. Nix was recognized as “Creator of

the Year” by the Intellectual Property Law Association of Chicago for his intellectual property related to eSIM technology.

HFT

Patent Portfolio

On

March 25, 2022, we acquired the HFT Patent Portfolio. This portfolio covers certain advanced technologies relating to high frequency

trading, which inventions specifically address technological problems associated with speed and latency and provide critical latency

gains in trading systems where the difference between success and failure may be measured in nanoseconds. The HFT Patent Portfolio

currently includes eleven (11) issued U.S. patents and two pending U.S. patents. The expiration dates within our HFT Patent Portfolio

range from October 2039 to February 2040.

In

addition to the purchase price that we paid at closing, we have an obligation to pay the seller an additional cash payment of $500,000

and $375,000 of our common stock contingent upon achieving certain milestones with respect to the HFT Patent Portfolio. We also have

an obligation to pay the seller 15% of the first $50 million of net proceeds (after deduction of expenses) generated from the patent

portfolio and 17.5% of net proceeds greater than $50 million.

Cox

Patent Portfolio

Our

Cox Patent Portfolio, acquired from Dr. Ingemar Cox in February 2013, currently consists of thirty-nine (39) U.S. patents relating

to enabling technology for identifying media content on the Internet, such as audio and video, and taking further actions to be

performed based on such identification. All of the patents within our Cox patent portfolio have expired. We have a pending appeal to

the Federal Circuit of a District Court ruling dismissing our case against Google Inc. and YouTube, LLC involving assertion of

certain patents within our Cox Patent Portfolio (see “Legal Proceedings” at page 20 hereof). The patents within our Cox

Patent Portfolio are based on a patent application filed in 2000. Since the acquisition of the Cox Patent Portfolio in February

2013, we have been issued thirty-four (34) additional patents relating to this portfolio. The claims in these thirty-four (34)

additional patents are generally directed towards systems of content identification and performing actions following

therefrom.

We

are obligated to pay Dr. Cox 12.5% of the net proceeds generated by us from licensing, sale or enforcement of the Cox Patent Portfolio.

Dr. Cox provides consulting services to us with respect to the Cox Patent Portfolio and assists our efforts to develop the patent portfolio.

Dr.

Cox is currently a Professor at the University of Copenhagen and University College London where he is head of its Information and

Decision Systems Group. He is also Director of the EPSRC Digital Health Hub for AMR (Antimicrobial resistance). Dr. Cox was formerly

a member of the Technical Staff at AT&T Bell Labs and a Fellow at NEC Research Institute. He is a Fellow of the ACM, IEEE, the

IET (formerly IEE), and the British Computer Society and is a member of the UK Computing Research Committee. In 2019, Dr. Cox was

the recipient of the Tony Kent Strix Award in recognition of his contribution to the field of information retrieval. He was founding

co-editor in chief of the IEE Proc. on Information Security and was an associate editor of the IEEE Trans. on Information Forensics

and Security. He is co-author of a book entitled “Digital Watermarking” and its second edition “Digital

Watermarking and Steganography”. He is an inventor or co-inventor of over seventy (70) U.S. patents.

Remote

Power Patent

Our

Remote Power Patent (U.S. Patent No. 6,218,930) covers the delivery of power over Ethernet cables for the purpose of remotely powering

network devices such as wireless access ports, IP phones and network based cameras. Our Remote Power Patent expired on March 7, 2020.

Notwithstanding the expiration of the Remote Power Patent in March 2020, in October and November 2022, we asserted the patent in nine

separate actions against ten defendants for damages prior to March 7, 2020 and have reached settlement agreements with nine of the defendants

(see “Legal Proceedings” at page 20 hereof).

On

June 13, 2003, the Institute of Electrical Engineers (IEEE), a non-profit, technical professional association, approved the 802.3af Power

over Ethernet standard (the “Standard”), which covers technologies deployed in delivering power over Ethernet networks. The

Standard provides for the Power Sourcing Equipment (PSE) to be deployed in switches or as standalone midspan hubs to provide power to

remote devices such as wireless access points, IP phones and network-based cameras. The technology is commonly referred to as Power over

Ethernet (“PoE”). In 2009, the IEEE Standards Association approved 802.3at, a new PoE standard which, among other things,

increased the available power for delivery over Ethernet networks. We believe that our Remote Power Patent covers several of the key

technologies covered by both the 802.3af and 802.3at standards.

Mirror

Worlds Patent Portfolio

Our

Mirror Worlds Patent Portfolio, acquired in May 2013, consists of ten (10) U.S. patents and covers foundational technologies that enable

unified search and indexing, displaying and archiving of documents in a computer system. All of our patents within our Mirror Worlds

Patent Portfolio have expired. Our 227 Patent, within this portfolio, was previously asserted in litigations against Apple Inc.

and Microsoft Corporation which were settled resulting in aggregate payments to us of $29,650,000. In December 2024, the U.S. Circuit

Court of Appeals for the Federal Circuit affirmed the judgment of the District Court granting Meta Platform’s Inc.’s (formerly

Facebook) motion for summary judgment of non- infringement dismissing Network-1 claims against Meta involving certain patents within

our Mirror Worlds Patent Portfolio.

The

inventions relating to document stream operating systems covered by our Mirror Worlds Patent Portfolio resulted from the work done by

Yale University computer scientist, Professor David Gelernter, and his then graduate student, Dr. Eric Freeman, in the mid-1990s. Certain

aspects of the technologies developed by David Gelernter were commercialized in their company's product offering called “Scopeware.”

Technologies embodied in Scopeware are now common in various computer and web-based operating systems.

As

part of our acquisition of the Mirror Worlds Patent Portfolio in 2013, we also entered into an agreement with Recognition Interface,

LLC (“Recognition”), an entity that financed the commercialization of the Mirror Worlds patent portfolio prior to its sale

to Mirror Worlds, LLC and also retained an interest in the licensing proceeds of the Mirror Worlds patent portfolio. Pursuant to the

terms of the agreement with us, we are obligated to pay Recognition an interest in the net proceeds realized from our monetization of

the Mirror Worlds Patent Portfolio as follows: (i) 10% of the first $125 million of net proceeds; (ii) 15% of the next $125 million of

net proceeds; and (iii) 20% of any portion of the net proceeds in excess of $250 million. Since entering into the agreement with Recognition

in May 2013, we have paid Recognition an aggregate of $3,127,000 with respect to such net proceeds interest in our Mirror Worlds Patent

Portfolio (no such payments were made during the years 2024 and 2023).

Network-1

Strategy

Our

strategy is to capitalize on our intellectual property assets by entering into licensing arrangements with third parties that utilize

our intellectual property's proprietary technologies as well as any additional proprietary technologies covered by patents which may

be acquired by us in the future. Our current patent acquisition and development strategy is to focus on acquiring high quality patents

which management believes have the potential to generate significant licensing opportunities as has been the case with our Remote Power

Patent and Mirror Worlds Patent Portfolio. Our Remote Power Patent has generated licensing revenue in excess of $188,000,000 from May

2007 through December 31, 2024. Since the acquisition of our Mirror Worlds Patent Portfolio in May 2013, we have received licensing and

other revenue of $47,150,000 through December 31, 2024. In addition, we may enter into third party strategic relationships with inventors

and patent owners to assist in the development and monetization of their patent technologies. Based on our cash position, we review opportunities

to acquire additional intellectual property as well as evaluate other strategic alternatives.

In

connection with our activities relating to the protection of our intellectual property assets, or the intellectual property assets of

third parties with whom we may have strategic relationships in the future, it may be necessary to assert patent infringement claims against

third parties whom we believe are infringing our patents or those of our strategic partners. We are currently involved in several litigations

to protect our patents including certain patents within our HFT Patent Portfolio and an appeal to the Federal Circuit of a District Court

dismissal involving certain patents within our Cox Patent Portfolio (see “Legal Proceedings” at page 20 (hereof). We have

previously successfully asserted litigation with respect to our Remote Power Patent and our Mirror Worlds Patent Portfolio.

Revenue

Concentration

Revenue

from our Remote Power Patent as a result of a litigation settlement with a defendant constituted 100% of our revenue for the year ended

December 31, 2024.

We

anticipate that our future revenue will continue to be derived from a few parties.

Competition

With

respect to our ability to acquire additional intellectual property assets or enter into strategic relationships with third parties to

monetize their intellectual property assets, we face considerable competition from other companies, many of which have significantly

greater financial and other resources than we have. The patent licensing and enforcement industry has grown and there has been a material

increase in the number of companies seeking to acquire intellectual property assets from third parties or to provide financing to third

parties seeking to monetize their intellectual property. Entities including, among others, Acacia Research Corporation (NASDAQ:ACTG),

Intellectual Ventures, WI-LAN Inc., VirnetX Holdings Corporation (NYSE MKT:VHC) and RPX Corporation, seek to acquire intellectual

property or partner with third parties to license or enforce intellectual property rights. In addition, we also compete with strategic

corporate buyers with respect to the acquisition of intellectual property assets. It is expected that others will enter this market as

well. Many of these competitors have significantly greater financial and human resources than us.

We

may also compete with litigation funding firms such as Burford Capital Limited, Validity Finance, LLC, Fortress Investment Group, LLC,

Parabellum Capital LLC and Bentham Capital LLC, venture capital firms and hedge funds for intellectual property acquisitions and licensing

opportunities. Many of these competitors also have greater financial resources and human resources than us.

Regulatory

Environment

If

new legislation, regulations or rules are implemented either by Congress, the USPTO or the courts that impact the patent application

process, the patent enforcement process or the rights of patent holders, these changes could negatively affect our business,

financial condition and results of operations. Certain legislation, regulations, and rulings by the courts and actions by the USPTO

have materially increased the risk and cost of enforcement of patents. U.S. patent laws were amended by the Leahy-Smith America

Invents Act, referred to as the “America Invents Act”, which became effective on March 16, 2013. The America Invents Act

included a number of significant changes to U.S. patent law. In general, it addressed issues surrounding the enforceability of

patents and the increase in patent litigation by, among other things, establishing new procedures for patent litigation and new

administrative post-grant review procedures to challenge the patentability of issued patents outside of litigation, including Inter

Partes Review (IPR) and Covered Business Method Review (CBM) proceedings which provide third parties a timely and cost

effective alternative to district court litigation to challenge the validity of an issued patent. The America Invents Act and its

implementation increased the uncertainties and costs surrounding the enforcement of patent rights has made it more difficult to

successfully enforce our patents.

In

addition, future changes in patent law could adversely impact our business. Such changes may not be advantageous to us and may make it

more difficult to obtain adequate patent protection to enforce our patents. Increased focus on the growing number of patent lawsuits,

particularly by non-practicing entities (NPEs), may result in legislative changes which increase the risk and costs of asserting patent

litigation.

Investment

in ILiAD Biotechnologies

During

the period December 2018 to date, we made aggregate investments of $7,000,000 in ILiAD, a privately held clinical stage biotechnology

company dedicated to the prevention and treatment of human disease caused by Bordetella pertussis. ILiAD is currently focused

on validating its proprietary intranasal vaccine, BPZE1, for the prevention of pertussis (whooping cough). Pertussis is a life-threatening

disease caused by the highly contagious respiratory bacterium Bordetella pertussis. ILiAD has the exclusive license to seventy-four

(74) issued patents and has fifty-four (54) pending patent applications. On December 31, 2024, we owned approximately 6.5% of the outstanding

units of ILiAD on a non-fully diluted basis and 4.9% of the outstanding units on a fully diluted basis (after giving effect to the exercise

of all outstanding options, and warrants). In connection with our investment, Corey Horowitz, our Chairman and Chief Executive Officer,

became a member of ILiAD’s Board of Managers and receives the same compensation for service on the Board as the other non-management

Board members.

BPZE1

was developed in the laboratory of Camille Locht, PhD, at the Institut Pasteur de Lille (IPL) and French National Institute of Health

and Medical research. BPZE1 is a live-attenuated intranasal vaccine designed to overcome deficiencies of current pertussis vaccines,

including poor durability of protection and failure to prevent nasopharyngeal Bordetella pertussis infections that lead to escape

mutants and transmission to vulnerable infants.

On

August 24, 2022, ILiAD consummated a private equity financing of $42,800,000, of which a multi-national pharmaceutical company invested

$30,000,000.

Corporate

Information

We

were incorporated under the laws of the State of Delaware in July 1990. Our principal executive offices are located at 65 Locust Avenue,

Third Floor, New Canaan, Connecticut 06840 and our telephone number is (203) 920-1055.

Available

Information

We

file or furnish various reports, such as registration statements, quarterly and current reports, proxy statements and other materials

with the SEC. Our website address is www.network-1.com. You may obtain, free of charge on our Internet website, copies

of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, Section 16 filings

and amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably

practicable after we electronically file such material with, or furnish it to, the SEC. The information we post on our website is intended

for reference purposes only; none of the information posted on our website is part of this Annual Report or incorporated by reference

herein.

In

addition to the materials that are posted on our website, you may read and copy any materials we file with the SEC at the SEC's Public

Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by

calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and other information statements,

and other information regarding issuers, including us, that file electronically with the SEC. The address of the SEC’s Internet

site is http://www.sec.gov.

Employees

and Consultants

We

currently have two full-time employees and two consultants providing monthly services to us.

Our

operations and financial results are subject to various material risks and uncertainties, including those described below, which could

adversely affect our business, financial condition, results of operations, cash flow, and the trading price of our common stock. You

should carefully consider the material risks and uncertainties described below in addition to the other information set forth in this

Annual Report on Form 10-K, including, but not limited to, the section titled “Management’s Discussion and Analysis of Financial

Condition and Results of Operations.” The material risks described below are not the only risks we face. Additional risks that

we do not know of or that we currently believe are immaterial may also impair our business operations. If any of the following risks

actually occur, our business, financial condition, results of operations and cash flow could be materially adversely affected, and the

trading price of our common stock could decline significantly.

Risks

Related to Our Business

Our

revenue is uncertain as it is dependent upon litigation outcomes involving our patents which we cannot predict.

Our

revenue is dependent upon our litigation outcomes. We currently have pending patent infringement litigations involving our HFT Patent

Portfolio and a pending appeal of dismissal of litigation involving our Cox Patent Portfolio (see “Legal Proceedings” at

page 20 hereof). Patent litigation is inherently risky and uncertain and we cannot assure you that any of our current or future litigation

will result in a favorable outcome for us. Accordingly, our revenue is uncertain.

If

we are unable to protect our patents, our business would be negatively impacted.

We

believe our patents are valid, enforceable and valuable. Despite this belief, third parties typically defend assertion of our patents

by asserting defenses, among others, of non-infringement and invalidity. In addition, in the future certain of our patents may be subject

to USPTO post-grant inter partes review proceedings (IPRs) which could result in all or a part of our patents being invalidated

or the claims being limited. Unfavorable outcomes in our litigation or IPRs may reduce our ability to enforce our patents or have other

adverse consequences. If we are unable to protect our patents or otherwise realize value for them, our business, financial condition

and operating results would be negatively impacted.

We

may not achieve successful outcomes of litigations involving our HFT Patent Portfolio or be able to monetize our M2M/IoT Patent Portfolio,

which would have a material negative impact on our ability to achieve significant revenue and net income in the future.

On

December 26, 2024, we commenced patent litigations against Citadel Securities, LLC and Jump Trading, LLC in the United States District

Court for the Northern District of Illinois for infringement of certain patents within our HFT Patent Portfolio (see “Legal Proceedings”

at page 20 hereof). We also intend to make efforts to monetize our M2M/IoT Patent Portfolio. We may not achieve successful outcomes in

these patent litigations involving our HFT Patent Portfolio or be able to monetize our M2M/IoT Patent Portfolio which would have a material

negative impact on our ability to achieve significant revenue and net income in the future.

The

outcome of our substantial investment in ILiAD is uncertain.

We

have invested $7,000,000 in ILiAD, a privately held clinical stage biotechnology company, with focus on validating its proprietary intranasal

vaccine (BPZE1) for the prevention of pertussis (whopping cough). Notwithstanding the aforementioned, ILiAD still faces material risks

going forward. Accordingly, our investment in ILiAD remains subject to substantial risks.

We

have been dependent upon our Remote Power Patent for a significant portion of our revenue in the past and we may not be able to generate

future revenue from our other patents.

Our

Remote Power Patent has generated revenue for us in excess of $188,000,000 from May 2007 through December 31, 2024. Revenue from our

Remote Power Patent constituted 100% of our revenue for 2024 ($100,000) and 2023 ($2,601,000). We had no revenue in 2022 and revenue

from our Remote Power Patent constituted 100% of our revenue for 2021 ($36,029,000), 2020 ($4,403,000) and 2019 ($3,037,000). As a result

of the expiration of our Remote Power Patent on March 7, 2020, we no longer receive revenue from such patent for any period subsequent

to the expiration date. Our failure to successfully monetize our other patents, including our HFT Patent Portfolio and M2M/IoT Patent

Portfolio, would have a negative impact on our business, financial condition and operating results.

We

may not be able to capitalize in the future on our strategy to acquire high quality patents with significant licensing opportunities

or enter into strategic relationships with third parties to license or otherwise monetize their intellectual property.

Based

upon the success we achieved from licensing our Remote Power Patent (twenty-eight (28) license agreements and in excess of $188,000,000

of revenue through December 31, 2024), the revenue we generated from our Mirror Worlds Patent Portfolio ($47,150,000), establishing a

patent portfolio currently consisting of one hundred and six (106) U.S. patents and sixteen (16) foreign patents, and our cash position,

we believe we have the expertise and sufficient capital to compete in the patent monetization market and to enter strategic relationships

with third parties to develop, commercialize, license or otherwise monetize their patents. Our strategy is to focus on acquiring high

quality patent assets which management believes have the potential for significant licensing opportunities. However, we may not be able

to acquire such additional high quality patents or, if acquired, we may not achieve material revenue or profit from such patents. Acquisitions

of patent assets are competitive, time consuming, complex and costly to consummate. High quality patents with significant licensing

opportunities are difficult to find and are often very competitive to acquire. In addition, such acquisitions present material

risks. Even if we acquire such additional patent assets, we may not be able to achieve significant licensing revenue or even generate

sufficient revenue related to such patent assets to offset the acquisition costs and the legal fees and expenses which may be incurred

to enforce, license or otherwise monetize such patents. In addition, we may not be able to enter into strategic relationships with third

parties to license or otherwise monetize their intellectual property and, even if we consummate such strategic relationships, we may

not achieve material revenue or profit from such relationships.

The

patent monetization cycle is long, costly and unpredictable.

There

is generally a significant time lag between acquiring a patent portfolio and recognizing revenue from those patent assets. During this

time lag, significant costs are likely to be incurred which may have a negative impact on our results of operations, cash flow

and financial position. Furthermore, the outcome of our efforts to monetize our patents is uncertain and we may not be successful.

Our

quarterly and annual operating and financial results, including our revenue, are difficult to predict and are likely to fluctuate significantly

in future periods.

Our

quarterly and annual operating and financial results are difficult to predict and may fluctuate significantly from period to period.

Our revenue, net income and results of operations may widely fluctuate, including years where we may have no revenue, as a result of

a variety of factors that are outside our control, including the timing and our ability to achieve successful outcomes from current and

future patent litigation, our ability and timing in consummating future license agreements for our intellectual property assets, the

timing and extent of payments received by us from licensees, whether we will achieve a successful outcome of our investment in ILiAD,

and the timing and our ability to achieve revenue from future strategic relationships.

In

the future we could be classified as a Personal Holding Company resulting in a 20% tax on our PHC Income that we do not distribute to

our shareholders.

The

personal holding company (“PHC”) rules under the Internal Revenue Code impose a 20% tax on a PHC’s undistributed personal

holding company income (“UPHCI”), which means, in general, taxable income subject to certain adjustments and reduced by certain

distributions to shareholders. For a corporation to be classified as a PHC, it must satisfy two tests: (1) that more than 50% in value

of its outstanding shares must be owned directly or indirectly by five or fewer individuals at any time during the second half of the

year (after applying constructive ownership rules to attribute stock owned by entities to their beneficial owners and among certain family

members and other related parties) (the “Ownership Test”) and (2) at least 60% of its adjusted ordinary gross income for

a taxable year consists of dividends, interest, royalties, annuities and rents (the “Income Test”). During the second

half of 2024, based on available information concerning our shareholder ownership, we did not satisfy the Ownership Test. In addition,

we did not satisfy the Income Test for 2024. Thus, we were not a PHC for 2024. However, we may be determined to be a PHC in the future. If

we were determined to be a PHC in 2025 or any future year, we would be subject to an additional 20% tax on our UPHCI. In such event,

we may issue a special cash dividend to our shareholders in an amount equal to the UPHCI rather than incur the 20% tax.

We

are dependent upon our CEO and Chairman.

Our

success is largely dependent upon the personal efforts of Corey M. Horowitz, our Chairman, Chief Executive Officer and Chairman of our

Board of Directors. On March 22, 2022, we entered into a new four year employment agreement with Mr. Horowitz pursuant to which

he continues to serve as our Chairman and Chief Executive Officer. The loss of the services of Mr. Horowitz would have a material adverse

effect on our business and prospects. We do not maintain key-man life insurance on the life of Mr. Horowitz.

Cash

dividends may not be continued to be paid.

Our

dividend policy consists of semi-annual cash dividends of $0.05 per share ($0.10 per share annually) which have been paid in March and

September of each year. We have paid such semi-annual dividends since our dividend policy was enacted in December 2016. At this

time, we anticipate continuing to pay dividends consistent with our policy. However, our dividend policy undergoes a periodic review

by our Board of Directors and is subject to change at any time depending upon our earnings, financial requirements and other factors

existing at the time. We may not be in a position to continue to pay dividends in the future.

Legislation,

regulations, court rulings and actions by the USPTO have materially increased the risk and cost of enforcement of patents and may continue

to do so in the future.

Legislation,

regulations, court rulings and actions by the USPTO have materially increased the risk and cost of enforcing patents. U.S. patent laws

were amended by the Leahy-Smith America Invents Act, referred to as the America Invents Act, which became effective on March 16, 2013.

The America Invents Act included a number of significant changes to U.S. patent law. In general, it addressed issues surrounding the

enforceability of patents and the increase in patent litigation by, among other things, establishing new procedures for patent litigation

and new administrative post-grant review procedures to challenge the patentability of issued patents outside of litigation, including

Inter Partes Review (IPR) proceedings, which provide third parties a timely, cost effective alternative to district court litigation

to challenge the validity of an issued patent. In addition, the America Invents Act changed the way that parties may be joined in patent

infringement actions, and increased the likelihood that such actions will need to be brought against individual parties allegedly infringing

by their respective individual actions or activities. The America Invents Act and its implementation also increased the uncertainties

and costs surrounding the enforcement of patent rights, which have made it more difficult to successfully prosecute our patents.

The

increasing development of artificial intelligence could impact our business.

Our

patents are central to our business strategy of licensing our intellectual property rights or enforcing such rights against those that

we believe are infringing. However, rapid advancements in the field of artificial intelligence (AI) and machine learning (ML) have the

potential to impact our current business model in various ways. AI technologies are increasingly capable of developing solutions that

either design around existing patents or create alternative technologies that may not infringe our intellectual property. Furthermore, the proliferation of AI may lead to the emergence of new market participants with innovative

solutions that challenge our patents' validity or enforceability. Such challenges could result in lengthy legal battles or the invalidation

of our patents, thereby impacting our potential future revenue.

AI

driven legal analytics tools can also empower potential infringers with sophisticated insights into the strengths and weaknesses of our

patent claims, potentially reducing our leverage in litigation and licensing negotiations. Investors are advised that our financial results could be adversely affected

if we are unable to adapt to the rapid changes brought about by AI and ML technologies, and our ability to enforce our patent rights

is consequently diminished.

Changes

in patent law could adversely impact our business.

Patent

laws may continue to change and may alter the protections afforded to owners of patent rights. Such changes may not be advantageous to

us and may make it more difficult to obtain adequate patent protection to enforce our patents. Increased focus on the growing number

of patent lawsuits, particularly by non-practicing entities (NPEs), may result in further legislative changes which increase the risk

and costs of asserting patent litigation.

Our

pending patent infringement litigations are time consuming and costly.

We

have pending litigations involving our HFT Patent Portfolio and a pending appeal to the Federal Circuit of dismissal of our litigation

against Google and YouTube involving certain patents within our Cox Patent Portfolio (see “Legal Proceedings” at page 20

of this Annual Report). While we have contingent legal fee arrangements, or a contingency plus a fixed cash amount arrangement, with

our patent litigation counsel in each litigation, we are responsible for all or a portion of the expenses which are anticipated to be

material. In addition, the time and effort required of our management to effectively pursue these litigations is likely to be significant

and it may adversely affect other business opportunities.

We

face intense competition to acquire intellectual property and enter into strategic relationships.

With

respect to our ability to acquire additional intellectual property or enter into strategic relationships with third parties to monetize

their intellectual property, we face considerable competition from other companies, many of which have significantly greater financial

and other resources than we have. We face a number of competitors in the patent licensing and enforcement business seeking to acquire

intellectual property rights from third parties. Many of these competitors have significantly more financial and human resources than

us.

We

may also compete with strategic corporate buyers, litigation funding firms, venture capital firms and hedge funds for intellectual property

acquisitions and licensing opportunities. Many of these competitors also have greater financial resources and human resources than us.

Our

markets are subject to rapid technological change and our technologies face potential technology obsolescence.

The

markets covered by our intellectual property are characterized by rapid technological changes, changing customer requirements, frequent

new product introductions and enhancements, and evolving industry standards. The introduction of products embodying new technologies

and the emergence of new industry standards may render our technologies obsolete or less marketable.

In

addition, other companies may develop competing technologies that offer better or less expensive alternatives to the technologies covered

by our intellectual property. Moreover, technological advances or entirely different approaches developed by other companies or adopted

by various standards groups could render our patents obsolete, less marketable or unenforceable.

The

burdens of being a public company may adversely affect us including our ability to pursue litigation.

As

a public company, our management must devote substantial time, attention and financial resources to comply with U.S. securities laws.

This may have a material adverse effect on management's ability to effectively and efficiently pursue its business. In addition, our

disclosure obligations under U.S. securities laws require us to disclose information publicly that will be available to litigation opponents.

We may, from time to time, be required to disclose information that may have a material adverse effect on our litigation strategies.

This information may enable our litigation opponents to develop effective litigation strategies that are contrary to our interests.

General

Risk Factors

Investors

may have limited influence on stockholder decisions because ownership of our common stock is concentrated.

As

of February 15, 2025, our executive officers and directors beneficially owned 31.9% of our outstanding common stock. As a

result, these stockholders may be able to exercise substantial control over all matters requiring stockholder approval, including the

election of directors and approval of significant corporate transactions, such as a merger or other sale of our company or its assets.

This concentration of ownership will limit other stockholders' ability to influence corporate matters and may have the effect of delaying

or preventing a third party from acquiring control over us.

Our

common stock may be delisted from the NYSE American exchange if we fail to comply with continued listing standards.

Our

common stock is currently traded on the NYSE American exchange under the symbol “NTIP”. If we fail to meet any of the continued

listing standards of the NYSE American exchange, our common stock could be delisted. Such delisting could adversely affect the price

and trading (including liquidity) of our common stock.

There

are inherent uncertainties involved in estimates, judgments and assumptions used in the preparation of financial statements in accordance

with U.S. GAAP. Any changes in estimates, judgments and assumptions could have a material adverse effect on our business, financial condition,

and operating results.

The

preparation of financial statements in accordance with accounting principles generally accepted in the United States involves making

estimates, judgments and assumptions that affect reported amounts of assets (including intangible assets), liabilities and related reserves,

revenues, expenses, and income. Estimates, judgments, and assumptions are inherently subject to change in the future, and any such changes

could result in corresponding changes to the amounts of assets, liabilities, expenses, and income. Any such changes could have a material

adverse effect on our business, financial condition, and operating results.

Provisions

in our corporate charter, by-laws and in Delaware law could make it more difficult for a third party to acquire us, discourage a takeover

and adversely affect existing stockholders.

Our

certificate of incorporation authorizes the Board of Directors to issue up to 10,000,000 shares of preferred stock. The preferred

stock may be issued in one or more series, the terms of which may be determined at the time of issuance by our Board of Directors, without

further action by stockholders, and may include, among other things, voting rights (including the right to vote as a series on particular

matters), preferences as to dividends and liquidation, conversion and redemption rights, and sinking fund provisions, any of which could

adversely affect holders of our common stock. Although there are currently no shares of preferred stock outstanding, future holders of

preferred stock may have rights superior to our common stock and such rights could also be used to restrict our ability to merge with

or sell our assets to third parties.

We

are also subject to the “anti-takeover” provisions of Section 203 of the Delaware General Corporation Law, which could prevent

us from engaging in a “business combination” with a 15% or greater stockholder for a period of three years from the date

such person acquired that status unless appropriate board or stockholder approvals are obtained.

In

addition, our By-laws contain advance notice requirements for director nominations and for new business to be brought up at

stockholder meetings. Stockholders wishing to submit director nominations or raise matters to a vote of stockholders must provide

notice to us within specified date windows and in very specific forms in order to have that matter voted on at a stockholders

meeting.

The

aforementioned provisions could deter unsolicited takeovers or delay or prevent changes in our control or management, including transactions

in which stockholders might otherwise receive a premium for their shares over the then current market price. These provisions may also

limit the ability of stockholders to delay, deter or prevent a change of control, or approve transactions that they may deem to be in

their best interests.

Our

stock price may be volatile.

The

market price of our common stock may be highly volatile and could fluctuate widely in price in response to various factors, many of which

are beyond our control, including, but not limited to, the following:

| • | the

outcome of our litigations against Citadel Securities, LLC and Jump Trading, LLC involving

certain patents within our HFT Patent Portfolio; |

| • | our

ability to monetize our M2M/IoT Patent Portfolio; |

| • | the

outcome of our appeal to the Federal Circuit of the District Court dismissal of our litigation

against Google and YouTube involving certain patents within our Cox Patent Portfolio; |

| • | our

ability to achieve a successful outcome of our investment in ILiAD; |

| • | our

ability to acquire additional intellectual property; |

| • | our

ability to enter into strategic relationships with third parties to license or otherwise

monetize their intellectual property; |

| • | variations

in our quarterly and annual operating results; |

| • | our

ability to continue to pay cash dividends; |

| • | our

ability to raise capital if needed; |

| • | sales

of our common stock; |

| • | the

increasing development of artificial intelligence could impact our business; |

| • | legislative,

regulatory and competitive developments; and |

| • | economic

and other external factors. |

In

addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the

operating performance of particular companies. These market fluctuations may also have a material and adverse effect on the market price

of our common stock.

| ITEM

1B. | UNRESOLVED

STAFF COMMENTS |

None.

Based

on our small size (two employees and two consultants), we rely extensively on information technology systems managed by third party major

service providers to securely process, store and transmit our data to conduct business. Our employees and consultants utilize end point

security tools, such as firewalls and anti-virus protection, to protect our data. We have recently implemented overall risk procedures

which incorporate certain uniform processes. To date, we have not engaged any consultants, auditors or other third parties in connection

with our risk management system or processes.

In

connection with our use of third party service providers, we have certain processes in place to oversee and identify cybersecurity risks

from threats and incidents. To date, we have not been materially impacted by risks from cybersecurity threats or incidents and we are

not aware of cybersecurity threats or incidents that are reasonably likely to materially affect our business. However, there could be

cybersecurity threats or incidents in the future that may adversely affect our business.

Our

Executive Vice President oversees risks of cybersecurity threats and reports quarterly, and as necessary, to the Board of Directors,

including promptly reporting any cybersecurity incidents that may pose a significant risk to us. Our Executive Vice President has over

ten years of experience with developers of access management, network security and data protection solutions.

Our

principal executive offices are located in New Canaan, Connecticut, where we lease approximately 2,000 square feet of office space at

a base rent of $5,500 per month pursuant to a lease amendment, dated May 1, 2022, which term expires on April 30, 2025. We believe that

our office facility is suitable and appropriate to support our current needs.

HFT

Patent Portfolio Litigation

On

December 24, 2024, our wholly-owned subsidiary, HFT Solutions, LLC (“HFT”), initiated patent litigations against Citadel

Securities, LLC and Jump Trading, LLC in the United States District Court for the Northern District of Illinois for infringement of U.S.

Patent No. 10,931,286, U.S. Patent No. 11,128,305, and U.S. Patent No. 11,575,381. The asserted patents are part of the HFT Patent Portfolio

acquired by us in March 2022. The HFT Patent Portfolio relates to, among other things, certain advanced technologies relating to high

frequency trading, which inventions specifically address technological problems associated with speed and latency and provide critical

latency gains in trading systems where the difference between success and failure may be measured in nanoseconds.

Cox

Patent Portfolio Litigation

On

April 4, 2014 and December 3, 2014, we initiated litigation against Google Inc. (“Google”) and YouTube, LLC (“YouTube”)

in the U.S. District Court for the Southern District of New York for infringement of several of our patents within our Cox Patent Portfolio

which relate to the identification of media content on the Internet. The lawsuit alleged that Google and YouTube had infringed and continued

to infringe certain of our patents by making, using, selling and offering to sell unlicensed systems and related products and services,

which included YouTube’s Content ID system.

The

litigations against Google and YouTube were subject to court ordered stays which were in effect from July 2, 2015 until January 2, 2019

as a result of proceedings then pending at the Patent Trial and Appeal Board (PTAB) and appeals to the U.S. District Court of Appeals

for the Federal Circuit. Pursuant to a joint stipulation and order, entered on January 2, 2019, the parties agreed, among other things,

that the stays with respect to the litigations were lifted. In January 2019, the two litigations against Google and YouTube were consolidated.

The consolidated actions proceeded and discovery was subsequently completed. On April 24, 2024, following a motion for summary judgment

by the defendants, the U.S. District Court for the Southern District of New York issued a judgment dismissing our patent infringement

claims finding that the asserted claims of two of the patents are invalid for indefiniteness and granting summary judgment that the asserted

claims of another asserted patent are not infringed by Google’s accused system. The Court’s ruling disposes of all of our

claims in the case. On May 14, 2024, we filed a notice of appeal to the U.S. Court of Appeals for the Federal Circuit and the appeal

is pending.

Remote

Power Patent Litigation

In

October and November 2022, we initiated nine separate litigations against ten defendants for infringement of our Remote Power Patent

seeking monetary damages based upon reasonable royalties, as follows: (i) on October 6, 2022, we initiated such litigation against Arista

Networks, Inc., Fortinet, Inc., Honeywell International Inc. and Ubiquiti Inc. in the United States District Court, District of Delaware;

(ii) on October 27, 2022, and November 3, 2022, we initiated such litigation against TP-Link USA Corporation and Hikvision USA, Inc.

in the United States District Court for the Central District of California; (iii) on November 4, 2022, we initiated such litigation against

Panasonic Holdings Corporation and Panasonic Corporation of North America in the United States District Court for the Eastern District

of Texas (Marshall Division); and (iv) on November 8, 2022 and November 16, 2022, we initiated such litigation against Antaira Technologies,

LLC and Dahua Technology USA in the United States District Court for the Central District of California.

During

the year ended December 31, 2023, we entered into settlement agreements with eight of the defendants resulting in aggregate settlement

payments to us of $2,601,000 and a conditional payment of $150,000. On February 21, 2025, we received the conditional payment of $150,000

from a defendant as the conditions were satisfied in accordance with the settlement agreement. During the year ended December 31, 2024,

we entered into a settlement agreement with one additional defendant resulting in a settlement payment to us of $100,000. On January

14, 2025, the U.S. District Court for the District of Delaware granted Ubiquiti’s partial motion for summary judgment on indirect

infringement. On February 13, 2025, the Court granted the parties joint motion to dismiss the litigation.

Mirror

Worlds Patent Portfolio Litigation

On

May 9, 2017, Mirror Worlds Technologies, LLC, our wholly-owned subsidiary, initiated litigation against Facebook, Inc. (“now Meta

Platforms, Inc., “Meta”) in the U.S. District Court for the Southern District of New York, for infringement of U.S. Patent

No. 6,006,227, U.S. Patent No. 7,865,538 and U.S. Patent No. 8,255,439 (among the patents within our Mirror Worlds Patent Portfolio).

The lawsuit alleges that the asserted patents are infringed by Meta’s core technologies that enable Meta’s Newsfeed and Timeline

features. We seek, among other things, monetary damages based upon reasonable royalties.

On

August 11, 2018, the U.S. District Court for the Southern District of New York District Court issued an order granting Meta’s motion

for summary judgment of non-infringement and dismissed the case. On January 23, 2020, the U.S. Court of Appeals for the Federal Circuit

ruled in our favor and reversed the summary judgment finding on non-infringement of the District Court and remanded the litigation to

the Southern District of New York for further proceedings.

On

March 7, 2022, the U.S. District Court for the Southern District of New York entered a ruling granting in part and denying in part a

motion for summary judgment by Meta. In its ruling, the District Court (i) denied Meta’s motion that the asserted patents were

invalid by concluding that all asserted claims were patent eligible under §101 of the Patent Act and (ii) granted summary

judgment of non-infringement in favor of Meta and dismissed the case. On April 4, 2022, we filed an appeal of the District Court

decision to the U.S. Court of Appeals for the Federal Circuit. On December 4, 2024, the U.S. Court of Appeals for the Federal

Circuit affirmed the judgment of the District Court granting Meta’s motion for summary judgment of non-infringement dismissing

our claims against Meta.

| ITEM 4. | MINE

SAFETY DISCLOSURES |

None.

PART

II

| ITEM 5. | MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES |

Market

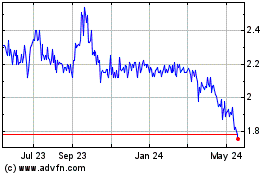

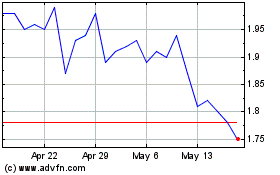

Information. Our common stock is listed for trading on the NYSE American exchange under the symbol “NTIP”. On February

24, 2025, the closing price for our common stock as reported on the NYSE American exchange was $1.38 per share. The number of

record holders of our common stock was 36 as of February 24, 2025. In addition, we believe there were in excess of approximately 1200

holders of our common stock in “street name” as of February 24, 2025.

Dividend

Policy. Our dividend policy consists of semi-annual cash dividends of $0.05 per share ($0.10 per share annually) which

have been paid in March and September of each year. On February 23, 2024, our Board of Directors declared a semi-annual

cash dividend of $0.05 per share with a payment date of March 29, 2024 to all common shareholders of record as of March 15, 2024. On

August 27, 2024, our Board of Directors declared a semi-annual cash dividend of $0.05 per share with a payment date of September

26, 2024 to all common shareholders of record as of September 12, 2024. On February 19, 2025, our Board of Directors declared a semi-annual

cash dividend of $0.05 per share with a payment date of March 28, 2025 to all common shareholders of record as of March 14, 2025.

At this time, we anticipate continuing to pay dividends consistent with our policy. However, our dividend policy undergoes a periodic

review by our Board of Directors and is subject to change at any time depending upon our earnings, financial requirements and other factors

existing at the time.

As

of December 31, 2024, we had accrued dividends of $121,000 for unvested restricted stock units with dividend equivalent rights.

Recent

Issuances of Unregistered Securities. There were no unregistered sales of equity securities during the quarter ended December 31,

2024.

Stock

Repurchases. On June 14, 2023, our Board of Directors authorized an extension and increase of our share repurchase program (“Share

Repurchase Program”) to repurchase up to $5,000,000 of shares of our common stock over the subsequent 24 month period. The common

stock may be repurchased from time to time in open market transactions or privately negotiated transactions in our discretion. The timing

and amount of the shares repurchased is determined by management (excluding repurchases under our 10b5-1 plans) based on its evaluation

of market conditions and other factors. Our Share Repurchase Program may be increased, suspended or discontinued at any time.

During

the months of October, November and December 2024, we repurchased common stock pursuant to our Share Repurchase Program as indicated

below:

Period |

Total

Number of Shares Purchased |

Average

Price Paid Per Share |

Total

Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum

Number (or Approximate Dollar Value) of Shares) that May Yet Be Purchased Under the Plans or Programs |

October

1, 2024 to

October 31, 2024 |

142,274 |

$1.35 |

142,274 |

$3,120,855

|

November

1, 2024 to

November 30, 2024 |

12,653 |

$1.32 |

12,653 |

$3,104,155 |

December

1, 2024 to

December 31, 2024 |

1,449 |

$1.30 |

1,449 |

$3,102,266 |

| Total |

156,376 |

$1.35 |

156,376 |

|

During

the year ended December 31, 2024, we repurchased an aggregate of 733,436 shares of our common stock pursuant to our Share Repurchase

Program at a cost of $1,270,438 (exclusive of commissions) or an average price per share of $1.73.

Since

the inception of our Share Repurchase Program (August 2011) to December 31, 2024, we have repurchased an aggregate of 10,374,232 shares

of our common stock at a cost of $19,983,354 (exclusive of commissions) or an average per share price of $1.93.

On

December 23, 2024, we entered into a written trading plan (the “10b5-1 Plan”) under Rule 10b5-1 of the Securities Exchange

Act of 1934 (the” Exchange Act”). Adopting a trading plan that satisfies the conditions of Rule 10b5-1 allows a company to

repurchase its shares at times when it might otherwise be prevented from doing so due to self-imposed trading black-outs or pursuant

to insider trading laws. Purchases under the 10b5-1 Plan may be made during the following periods: (1) beginning on January 2, 2025 until

two trading days after we issue a press release announcing our financial results for the year ended December 31, 2024, and (2) beginning

on April 1, 2025 until two trading days after we issue a press release announcing our financial results for the quarter ended March 31,

2025. Under the 10b5-1 Plan, our third party broker may purchase up to 1,000,000 shares of our common stock, subject to certain price,

market, volume and timing constraints, in accordance with the terms of the plan and subject to Rule 10b5-1 and Rule 10b-18 of the Exchange

Act.

Equity

Compensation Plan Information

The

following table summarizes share and exercise price information for our equity compensation plans as of December 31, 2024.

| |

|

Number

of

securities

to be

issued

upon

exercise

of

outstanding

options

and rights

|

|

Weighted-average

exercise

price of

outstanding

options

and

rights

|

|

Number

of securities remaining available for future issuance under equity compensation plans (excluding

securities reflected in column(a))

|

| |

|

(a) |

|

(b) |

|

(c) |

| |

|

|

|

|

|

|

Equity

compensation plans

approved by security holders |

|

487,500

(1)

|

|

$

— (2) |

|

2,110,000 (3)

|

| |

|

|