Clean Invest Africa Plc Group Update

March 24 2022 - 5:00AM

UK Regulatory

TIDMCIA

24 March 2022

Clean Invest Africa Plc

Group Update

Clean Invest Africa plc (AQUIS: CIA) is pleased to provide an investor update.

At a corporate level the Company has been busy raising finance for current and

new projects. The Company has recently welcomed a new strategic investor who is

attracted to the potential of CIA and its subsidiaries, particularly now with

significantly renewed interest and opportunities across a number of geographies

given worldwide energy demands. Further discussions with potential investors

are underway and may result in improved financing prospects of the Company.

The CIA chairman, Shaikh Mohamed Abdulla Khalifa AlKhalifa welcomed the recent

strategic investment and said "The future potential of the CoalTech technology

is very exciting and we are seeing substantial renewed and active interest from

across the globe. The Company is working hard with its partners to secure its

first project with major prospects in India, Columbia and South Africa, showing

specific short term potential."

In addition shareholders should note that the final step in the 2019

Acquisition was obtaining the necessary approvals from the South African

Reserve Bank ("SARB") for the acquisition of Coal Agglomeration South Africa

(Pty) Ltd. It was expected that SARB approval would be granted after around 12

months, and in 2020. This has been delayed by Covid. A further announcement

will be made in due course as it is expected the transaction will complete by

approximately Q3 2022. Pursuant to the Acquisition there are still a further

13,291,745 Ordinary Shares to be issued to the SA Resident Vendors once the

necessary approvals from SARB have been granted.

Trading Update Regarding its current holding in the CoalTech Group of

Companies.

CoalTech has advanced significantly in its project development in India,

Columbia and South Africa and has developed prospects in Indonesia, Greece and

Australia. The strategy of CoalTech is to secure long-term, large-scale

customer relationships with whom it will develop one or more full scale plants

each with long term offtake arrangements. Securing any one of these projects

will be transformative, with any such project likely to have a project value in

tens of millions of USD and involving the processing of large-scale fines or

tailings, typically over 1 million tonnes and operational over an extended

period of a decade or more.

The CoalTech technology originally was only believed to be applied to coal

fines or coal waste. As previously announced, it has been adapted by CoalTech

to pelletise other, higher value and more in demand, materials, such as

high-grade ores, precious metals, minerals and solid based natural resources.

CoalTech is continuing to evaluate opportunities for pelletised Ilmenite,

chrome, iron ore, manganese, as well as other base, ferrous and precious metals

and biomass. An advanced ilmenite project is described below and a live chrome

trial is about to get underway. Together these are indicators of far greater

and longer-term potential for the Company's investment, beyond coal, than

previously considered.

The initial stages of most CoalTech commercial discussions, whether for coal or

other materials, typically involve CoalTech running test batches. These batches

often start small, for example 10's of kilos and then increase to sample

production size batches of, typically, 10's of tonnes. Once batches are

completed, the outputs are exhaustively tested by CoalTech and by the potential

client. This process is a considerable proportion of the CoalTech overhead and

consumes the majority of the available production of the Bulpan production

facility. Test batches are run with raw material shipped from a specific mine

somewhere in the world and the output shipped back to the mine. The entire

process takes time and funding, and we are delighted to announce that we have

now advanced several of the testing phase projects and are proceeding to

commercial negotiation and discussion on the final phase of business model,

plant construction and rollout.

Three Key Commercial Opportunities in India, Columbia and South Africa.

INDIA

Large Scale Multi-plant Coal fines pelletizing project: Together with its local

partner Exagogi, CoalTech has received a Purchase Order from Tata Steel for

carrying out a commercial testing programme with Tata coal fines to be carried

out at the Bulpan Plant in South Africa. The successful outcome of the testing

programme will pave the way for the commercial negotiation with Tata on a

project comprising the development of possibly 3 coal fines pelletising plants

at their sites in India with a capacity of 28,000 tonnes per month each. Each

28,000 tonnes per month plant shows the following estimated financial key

performance indicators: Total investment cost of approx. USD 16,000,000 with

Net Margin ratio around 39%, ROE: 56% and Payback time: 1.87 years and a

discounted cash flow value (DCF) of 51 million USD over a 10-year period. The

total project would therefore indicate a DCF of 153m USD over a decade.

COLOMBIA

Mindesa - Thermal coal project: A trial project has reached completion.

Commercial negotiations are underway. An Off-take agreement is under discussion

and terms are expected to be finalized shortly, likely by 2nd half of April

2022. Project scope is for a 3,000-5,000 tonnes per month plant (final capacity

will be determined during the design stage) to be developed at the Mindesa

site, with the following estimated financial key performance indicators: Total

investment cost of approx. USD 6,000,000), with Net Margin ratio around 41%,

ROE: 26% and Payback time: 3.67 years and a discounted cash flow value (DCF) of

6 million USD over 10 year period.

SOUTH AFRICA

Ilmenite project: Ilmenite is a higher value resource than coal. Testing work

has restarted at CoalTech's Bulpan plant, on a 10,000 tonnes trial project over

the next 2-3 months (completion expected circa June 2022). This phase will

include the development of a project plan for a dedicated 3,000-5,000 tonnes

per month pelletising plant at Richards Bay in South Africa. The final project

scale will be determined during the design stage and initial parameters include

the following estimated financial key performance indicators. Total project

investment cost of approx. USD 6,500,000, with Net Margin ratio around 35%,

ROE: 23% and Payback time: 4.3 years and a discounted cash flow value (DCF) of

6,000,000 USD over 10-year period.

Final numbers for each project will be adjusted to include project funding

costs once parameters and inputs are agreed. The Company is confident given the

structure of the deals with offtake in place before commencement, that it can

raise the majority of the project costs through project financing.

Other early-stage commercial opportunities are ongoing.

Further projects are underway at various stages of progress including for

example in South Africa where a chrome test project is underway. Should tests

be successful, negotiations should commence on a 20,000 tonnes trial project.

Further successful advances into the precious metals markets could be highly

lucrative. In addition, CoalTech is engaged in small scale testwork on low

grade coal "(LGC") with a client, of circa 100kg of upgraded fines. Success

here could be significant as a successful trial outcome would open access to a

substantial volume of coal fines, currently not utilized due to low grade

calorific value. Current dialogue with client is for a dedicated 28,000 tonne

per month plant, with an offtake for twenty years. Also in South Africa in the

past weeks CoalTech has bid for production of a minimum of 30,0000 tonnes of

pellets over 6-7 months based on an RFP for a potential future client.

In addition to South Africa, projects elsewhere include a large scale prospect

in India, a mining operation transaction in East Africa, a further project in

Columbia for metallurgical coal, a recent lignite project in Greece and a long

term at scale fines recovery prospect in Australia. CoalTech has also recently

submitted a budgetary proposal for the development of a 500 tonnes per month

mobile testing unit for a prospective client in Asia. These testing units are

relatively cost effective and can be shipped anywhere in the world in a small

number of shipping containers.

Finally, CoalTech has seen a renewed interest in its offering, in Europe,

following the geopolitical events of the past months and including the

announcement by the German and Italian governments to re-open coal fired power

plants due to potential energy supply shortages as a result of the

Russia-Ukraine crisis. CoalTech has commenced steps to withdraw from its

Russian joint venture, this has no material impact on the overall CoalTech

pipeline above.

CIA Chief Executive Officer Filippo Fantechi remarked that "this trading update

indicates the scale and scope of the promising lucrative future horizon for

CoalTech."

The directors of the Company accept responsibility for the contents of this

announcement.

ENQUIRIES :

Clean Invest Africa plc

Filippo Fantechi - Chief Executive Officer: +973 3 9696273

Peterhouse Capital Limited

Guy Miller: +44 20 7469 0930

END

(END) Dow Jones Newswires

March 24, 2022 06:00 ET (10:00 GMT)

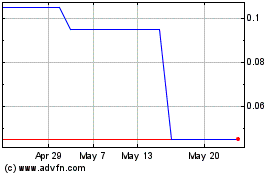

Clean Invest Africa (AQSE:CIA)

Historical Stock Chart

From Apr 2024 to May 2024

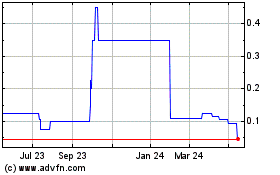

Clean Invest Africa (AQSE:CIA)

Historical Stock Chart

From May 2023 to May 2024