NAB 1st Half Profit Up 19%, Increases Dividend -- Update

May 03 2023 - 6:13PM

Dow Jones News

By Alice Uribe

SYDNEY--National Australia Bank lifted its dividend by almost

14%, and reported a 19% increase in interim profit, helped partly

by a strong performance in its business banking unit and higher

interest rates.

Australia's second largest lender by market capitalization said

its net profit rose to 3.97 billion Australian dollars (US$2.64

billion) in the six months through March, from A$3.55 billion a

year prior. Analysts had expected an interim net profit of A$4.10

billion, according to FactSet's consensus estimate.

The bank declared an interim dividend of A$0.83 per share,

compared with A$0.73 a year earlier.

"Our results have benefited from the execution of our strategy

over multiple years. This includes consistent investment in

long-term growth opportunities, while making choices for more

targeted growth against the backdrop of a slowing economy and

increasing competition," said Chief Executive Ross McEwan. "The

higher interest rate environment has also been an important

near-term driver of revenue this period."

Cash earnings--a measure closely tracked by analysts that strips

out non-core items such as revenue hedges and treasury shares--rose

by 17% to A$4.07 billion.

NAB's business and private banking unit was a standout with

interim cash earnings up 20% to A$1.71 billion, but the lender's

personal banking unit saw a 0.4% drop in cash earnings to A$785

million for the first half, which it attributed partly to home

lending competition, offsetting the impact of the higher interest

rate environment.

NAB's half-year net interest margin--the difference between the

interest income generated and the amount of interest paid out to

lenders--rose 14 basis points to 1.77%

NAB, like other lenders, has benefited from the rising interest

rate environment. The Reserve Bank of Australia this week surprised

financial markets, raising its official cash rate by 25 basis

points to 3.85%, resuming an aggressive campaign of increases after

pausing in April.

But some analysts see that mortgage competition, particularly in

refinancing, may crimp future margins and earnings. At the same

time, banks may also see pressure on credit quality, as customers

grapple with higher mortgage repayments, inflation-related cost

squeezes.

NAB on Thursday said that there were signs that inflation is

beginning to moderate, which it said may mean Australia's official

cash rate is near its peak.

"While there is still uncertainty over the extent to which

higher interest and living costs will impact consumer spending, it

now seems increasingly likely that Australia will avoid a

pronounced economic correction," said NAB.

On capital, Mr. McEwan said levels were above NAB's targets,

while liquidity remained strong, with collective provision coverage

remaining well above pre Covid-19 levels. The lender's FY 2023 term

funding task is "well advanced," he said with A$23 billion raised

in the first half.

NAB's Common Equity Tier 1 capital ratio was 12.21%, down from

12.48% the previous year.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

May 03, 2023 18:58 ET (22:58 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

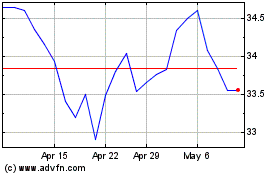

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Dec 2023 to Dec 2024