- Net revenues of Euro 1,644 million, up 6.5% versus prior year,

with total shipments of 3,383 units

- Adjusted EBIT(1) of Euro 467 million, up 10.3% versus prior

year, with adjusted EBIT(1) margin of 28.4%

- Adjusted net profit(1) of Euro 375 million and adjusted diluted

EPS(1) at Euro 2.08

- Adjusted EBITDA(1) of Euro 638 million, up 7.1% versus prior

year, with adjusted EBITDA(1) margin of 38.8%

- Industrial free cash flow(1) generation of Euro 364

million

“The third quarter once again shows growing

results for Ferrari, driven by a strong product mix and increased

personalizations" said Benedetto Vigna, CEO of Ferrari. "It

confirms our commitment to deliver on the promises we made at our

Capital Markets Day in 2022, along with the exceptional order book

visibility well into 2026, continuous product innovation – as

evidenced by the F80 supercar just unveiled – and process

innovation, with the strengthening of our in-house electrification

expertise. The shutdown of the Maranello gas-fueled trigeneration

plant, ahead of target, also marks a further step towards our 2030

carbon neutrality goal”.

|

For the three months ended |

(In Euro million, |

For the nine months ended |

|

September 30, |

unless otherwise stated) |

September 30, |

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

3,383 |

3,459 |

(76) |

(2%) |

Shipments (in units) |

10,427 |

10,418 |

9 |

0% |

|

1,644 |

1,544 |

100 |

7% |

Net revenues |

4,941 |

4,447 |

494 |

11% |

|

467 |

423 |

44 |

10% |

EBIT / Adj. EBIT(1) |

1,420 |

1,245 |

175 |

14% |

|

28.4% |

27.4% |

100 bps |

EBIT / Adj. EBIT(1) margin |

28.7% |

28.0% |

70 bps |

|

375 |

332 |

43 |

13% |

Net profit / Adj. net profit(1) |

1,140 |

963 |

177 |

18% |

|

2.08 |

1.82 |

0.26 |

14% |

Basic EPS (in Euro) / Adj. basic EPS(1) (in Euro) |

6.32 |

5.28 |

1.04 |

20% |

|

2.08 |

1.82 |

0.26 |

14% |

Diluted EPS (in Euro) / Adj. diluted EPS(1) (in Euro) |

6.31 |

5.28 |

1.03 |

20% |

|

638 |

595 |

43 |

7% |

EBITDA(1) / Adj. EBITDA(1) |

1,912 |

1,721 |

191 |

11% |

|

38.8% |

38.6% |

20 bps |

EBITDA(1) / Adj. EBITDA(1) margin |

38.7% |

38.7% |

0 bps |

Maranello (Italy), November 5,

2024 – Ferrari N.V. (NYSE/EXM: RACE) (“Ferrari” or the

“Company”) today announces its consolidated preliminary results(2)

for the third quarter and nine months ended September 30, 2024.

Shipments(3)(4)

|

For the three months ended |

Shipments |

For the nine months ended |

|

September 30, |

(units) |

September 30, |

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

1,426 |

1,398 |

28 |

2% |

EMEA |

4,654 |

4,570 |

84 |

2% |

|

1,070 |

1,096 |

(26) |

(2%) |

Americas(5) |

3,048 |

2,927 |

121 |

4% |

|

281 |

395 |

(114) |

(29%) |

Mainland China, Hong Kong and Taiwan(6) |

876 |

1,130 |

(254) |

(22%) |

|

606 |

570 |

36 |

6% |

Rest of APAC |

1,849 |

1,791 |

58 |

3% |

|

3,383 |

3,459 |

(76) |

(2%) |

Total Shipments |

10,427 |

10,418 |

9 |

0% |

Shipments totaled 3,383 units in Q3 2024, down

2.2% versus the prior year. Quarterly shipments reflected the

deliberate geographic allocations. In the quarter EMEA(4) was up 28

units, Americas(4) was down 26 units, Mainland China, Hong Kong and

Taiwan decreased by 114 units and Rest of APAC(4) increased by 36

units.

The Ferrari Purosangue, the Roma Spider and the

296 GTS drove deliveries in the quarter. Shipments of the SF90 XX

Stradale increased and first few deliveries of the SF90 XX Spider

commenced. The 812 Competizione A decreased, approaching the end of

lifecycle, while the 812 Competizione and Roma phased out. The

allocations of the Daytona SP3 increased versus prior year, in line

with plans.

The product portfolio in the quarter included

eight internal combustion engine (ICE) models and five hybrid

engine models, which represented 45% and 55% of total shipments,

respectively.

Total net revenues

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

|

|

Change |

|

|

|

Change |

|

2024 |

2023 |

at constant |

|

2024 |

2023 |

at constant |

|

|

|

currency |

|

|

|

currency |

|

1,400 |

1,330 |

5% |

6% |

Cars and spare parts(7) |

4,256 |

3,830 |

11% |

13% |

|

174 |

145 |

20% |

21% |

Sponsorship, commercial and brand(8) |

487 |

422 |

15% |

16% |

|

70 |

69 |

2% |

2% |

Other(9) |

198 |

195 |

2% |

2% |

|

1,644 |

1,544 |

7% |

7% |

Total net revenues |

4,941 |

4,447 |

11% |

13% |

Net revenues for Q3 2024 were Euro 1,644

million, up 6.5% or 7.0% at constant currency(1).

Revenues from Cars and spare parts(7) were Euro

1,400 million (up 5.2% or 5.8% at constant currency(1)), thanks to

a richer product and country mix as well as increased

personalizations.

Sponsorship, commercial and brand(8) revenues

reached Euro 174 million, up 20.4% or 20.9% at constant currency(1)

mainly attributable to new sponsorships.

Currency – including translation and transaction

impacts as well as foreign currency hedges – had a slightly

negative net impact of Euro 8 million, mostly related to the US

Dollar and Japanese Yen.

Adjusted EBITDA(1) and

Adjusted EBIT(1)

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

|

|

Change |

|

|

|

Change |

|

2024 |

2023 |

at constant |

|

2024 |

2023 |

|

at constant |

|

|

|

currency |

|

|

|

|

currency |

|

638 |

595 |

7% |

9% |

EBITDA(1) / Adj. EBITDA(1) |

1,912 |

1,721 |

11% |

15% |

|

467 |

423 |

10% |

13% |

EBIT / Adj. EBIT(1) |

1,420 |

1,245 |

14% |

20% |

Q3 2024 Adjusted EBITDA(1) reached Euro 638

million, up 7.1% versus the prior year and with an Adjusted

EBITDA(1) margin of 38.8%.

Q3 2024 Adjusted EBIT(1) was Euro 467 million,

increased 10.3% versus the prior year and with an Adjusted EBIT(1)

margin of 28.4%.

Volume was slightly negative (Euro 10 million),

in line with the shipments decrease versus the prior year.

The Mix / price variance performance was

positive (Euro 60 million), mainly reflecting the enrichment of the

product mix, sustained by the Daytona SP3 and few sales of the 499P

Modificata, increased personalizations and the positive country mix

driven by Americas.

Industrial costs / research and development

expenses decreased (Euro 11 million), primarily due to lower

depreciation and amortization, in line with certain models phase

out.

SG&A grew (Euro 23 million) mainly

reflecting the continuous initiatives for software, digital

infrastructure and organizational development, as well as brand

investments.

Other changes were positive (Euro 14 million),

mainly driven by the combined effect of new sponsorships and lower

costs due to the revised Formula 1 in-season ranking

assumptions.

Net financial charges for the quarter, were

approximately Euro 1 million compared to net financial income of

Euro 3 million of the prior year which also included the gain on

bond cash tender realized in Q3 2023.

The tax rate(10) in the quarter was 19.5%,

mainly reflecting the estimate of the benefit attributable to the

Patent Box and tax incentives for eligible research and development

costs and investments.

As a result, the Adjusted Net profit(1) for the

quarter was Euro 375 million, up 13.0% versus the prior year, and

the Adjusted diluted earnings per share(1) for the quarter reached

Euro 2.08, compared to Euro 1.82 in Q3 2023.

Industrial free cash flow(1) for the quarter was

strong at Euro 364 million, driven by the increased Adjusted

EBITDA(1) and a positive change in working capital, provisions and

other for Euro 12 million, partially offset by capital

expenditures(11) of Euro 249 million and net cash interests and

taxes for Euro 27 million.

Net Industrial Debt(1) as of September 30, 2024

was Euro 246 million, compared to a Euro 441 million as of June 30,

2024, also reflecting the share repurchases of Euro 147 million. As

of September 30, 2024, total available liquidity was Euro 2,079

million (Euro 1,882 million as of June 30, 2024), including undrawn

committed credit lines of Euro 550 million.

Even more confidence in the 2024

guidance, based on the following assumptions for the

year:

- Positive product and country mix, along with stronger

personalizations

- Racing activities, including new sponsorships, impacted by

lower Formula 1 ranking in 2023 despite higher number of races in

the 2024 calendar

- Lifestyle activities expected to increase top line contribution

while investing to accelerate development

- Cost inflation to persist

- Continuous brand investments and higher racing expenses

- Robust Industrial free cash flow generation, partially offset

by increased capital expenditures and higher tax payment

|

(€B, unless otherwise stated) |

2023A |

2024 GUIDANCE |

|

NET REVENUES |

6.0 |

>6.55 |

|

ADJ. EBIT (margin %) |

1.6227.1% |

≥1.82≥27.5% |

|

ADJ. DILUTED EPS (€) |

6.90(12) |

≥7.90(12) |

|

ADJ. EBITDA (margin %) |

2.2838.2% |

≥2.50 ≥38% |

|

INDUSTRIAL FCF |

0.93 |

Up to 0.95 |

Q3 2024 highlights:

- On September 2, 2024 Ferrari

announced that, effective January 1, 2025, UniCredit S.p.A. will

partner with Ferrari to be at its side in its Formula 1 racing

activities under a multi-year agreement.

Subsequent Events:

- On October 1, 2024 Ferrari

announced to have switched off the trigeneration plant at its

Maranello factory in order to continue replacing a significant

proportion of methane gas consumption with renewable energy

sources, consistent with Ferrari’s decarbonization plan announced

at the Capital Markets Day in 2022.

- On October 17, 2024 Ferrari

unveiled the F80 and wrote a new chapter in the history of

legendary supercars bearing the Prancing Horse badge. The F80 will

be produced in a limited run of just 799 examples and joins the

pantheon of icons such as the GTO, F40 and LaFerrari by showcasing

the best that the Maranello-based marque has achieved in terms of

technology and performance.

- On October 23, 2024 Ferrari

announced the multi-year renewal of its partnership with Shell,

effective from 1 January 2026, covering Scuderia Ferrari HP,

Ferrari Hypercar and the Ferrari Challenge Series.

- Under the fifth tranche of the new

multi-year common share repurchase program announced on September

30, 2022, from October 1, 2024 to November 1, 2024 the Company

purchased 157,278 common shares for a total consideration of Euro

66.4 million. At November 1, 2024 the Company held in treasury an

aggregate of 14,678,349 common shares equal to 5.71% of the total

issued share capital including the common shares and the special

voting shares, net of shares assigned under the Company’s equity

incentive plan.

About Ferrari Ferrari is among

the world’s leading luxury brands focused on the design,

engineering, production and sale of the world’s most recognizable

luxury performance sports cars. Ferrari brand symbolizes

exclusivity, innovation, state-of-the-art sporting performance and

Italian design. Its history and the image enjoyed by its cars are

closely associated with its Formula 1 racing team, Scuderia

Ferrari, the most successful team in Formula 1 history. From the

inaugural year of Formula 1 World Championship in 1950 through the

present, Scuderia Ferrari has won 248 Grand Prix races, 16

Constructors’ World titles and 15 Drivers’ World titles. Ferrari

designs, engineers and produces its cars in Maranello, Italy, and

sells them in over 60 markets worldwide.

Forward Looking StatementsThis

document, and in particular the section entitled “2024 Guidance”,

contain forward-looking statements. These statements may include

terms such as “may”, “will”, “expect”, “could”, “should”, “intend”,

“estimate”, “anticipate”, “believe”, “remain”, “continue”, “on

track”, “successful”, “grow”, “design”, “target”, “objective”,

“goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”,

“guidance” and similar expressions. Forward-looking statements are

not guarantees of future performance. Rather, they are based on the

Group’s current expectations and projections about future events

and, by their nature, are subject to inherent risks and

uncertainties. They relate to events and depend on circumstances

that may or may not occur or exist in the future and, as such,

undue reliance should not be placed on them. Actual results may

differ materially from those expressed in such statements as a

result of a variety of factors, including: the Group’s ability to

preserve and enhance the value of the Ferrari brand; the Group’s

ability to attract and retain qualified personnel; the success of

the Group’s racing activities; the Group’s ability to keep up with

advances in high performance car technology, to meet the challenges

and costs of integrating advanced technologies, including hybrid

and electric, more broadly into its car portfolio over time and to

make appealing designs for its new models; the impact of

increasingly stringent fuel economy, emissions and safety

standards, including the cost of compliance, and any required

changes to its products, as well as possible future bans of

combustion engine cars in cities and the potential advent of

self-driving technology; increases in costs, disruptions of supply

or shortages of components and raw materials; the Group’s ability

to successfully carry out its low volume and controlled growth

strategy, while increasing its presence in growth market countries;

changes in general economic conditions (including changes in some

of the markets in which the Group operates) and changes in demand

for luxury goods, including high performance luxury cars, which is

highly volatile; macro events, pandemics and conflicts, including

the ongoing conflicts in Ukraine and in the Middle East and the

related issues potentially impacting sourcing and transportation;

competition in the luxury performance automobile industry; changes

in client preferences and automotive trends; the Group’s ability to

preserve its relationship with the automobile collector and

enthusiast community; disruptions at the Group’s manufacturing

facilities in Maranello and Modena; climate change and other

environmental impacts, as well as an increased focus of regulators

and stakeholders on environmental matters; the Group’s ability to

maintain the functional and efficient operation of its information

technology systems and to defend from the risk of cyberattacks,

including on its in-vehicle technology; the ability of its current

management team to operate and manage effectively and the reliance

upon a number of key members of executive management and employees;

the performance of the Group’s dealer network on which the Group

depends for sales and services; product warranties, product

recalls, and liability claims; the sponsorship and commercial

revenues and expenses of the Group’s racing activities, as well as

the popularity of motor sports more broadly; the performance of the

Group’s lifestyle activities; the Group’s ability to protect its

intellectual property rights and to avoid infringing on the

intellectual property rights of others; the Group’s continued

compliance with customs regulations of various jurisdictions; labor

relations and collective bargaining agreements; the Group’s ability

to ensure that its employees, agents and representatives comply

with applicable law and regulations; changes in tax, tariff or

fiscal policies and regulatory, political and labor conditions in

the jurisdictions in which the Group operates; the Group’s ability

to service and refinance its debt; exchange rate fluctuations,

interest rate changes, credit risk and other market risks; the

Group’s ability to provide or arrange for adequate access to

financing for its clients and dealers, and associated risks; the

adequacy of its insurance coverage to protect the Group against

potential losses; potential conflicts of interest due to director

and officer overlaps with the Group’s largest shareholders; and

other factors discussed elsewhere in this document.

The Group expressly disclaims and does not

assume any liability in connection with any inaccuracies in any of

the forward-looking statements in this document or in connection

with any use by any third party of such forward-looking statements.

Any forward-looking statements contained in this document speak

only as of the date of this document and the Company does not

undertake any obligation to update or revise publicly

forward-looking statements. Further information concerning the

Group and its businesses, including factors that could materially

affect the Company’s financial results, is included in the

Company’s reports and filings with the U.S. Securities and Exchange

Commission, the AFM and CONSOB.

For further information:Media Relationstel.: +39 0536

241053Email: media@ferrari.com

Investor Relationstel.: +39 0536 241395Email: ir@ferrari.com

www.ferrari.com

Capex and R&D

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

2024 |

2023 |

|

2024 |

2023 |

|

249 |

205 |

Capital expenditures(11) |

712 |

553 |

|

119 |

103 |

of which capitalized development costs(13) (A) |

352 |

323 |

|

128 |

129 |

Research and development costs expensed (B) |

401 |

381 |

|

247 |

232 |

Total research and development (A+B) |

753 |

704 |

|

84 |

92 |

Amortization of capitalized development costs (C) |

247 |

248 |

|

212 |

221 |

Research and development costs as recognized

in the consolidated income statement (B+C) |

648 |

629 |

Non-GAAP financial measures

Operations are monitored through the use of

various non-GAAP financial measures that may not be comparable to

other similarly titled measures of other companies.

Accordingly, investors and analysts should

exercise appropriate caution in comparing these supplemental

financial measures to similarly titled financial measures reported

by other companies.

We believe that these supplemental financial

measures provide comparable measures of financial performance which

then facilitate management’s ability to identify operational

trends, as well as make decisions regarding future spending,

resource allocations and other operational decisions.

Certain totals in the tables included in this

document may not add due to rounding.

Key performance metrics and

reconciliations of NON-GAAP financial measures

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

2024 |

2023 |

|

2024 |

2023 |

|

1,644 |

1,544 |

Net revenues |

4,941 |

4,447 |

|

827 |

779 |

Cost of sales |

2,465 |

2,216 |

|

135 |

119 |

Selling, general and administrative costs |

402 |

346 |

|

212 |

221 |

Research and development costs |

648 |

629 |

|

6 |

4 |

Other expenses/(income), net |

12 |

15 |

|

3 |

2 |

Results from investments |

6 |

4 |

|

467 |

423 |

EBIT/Adjusted EBIT |

1,420 |

1,245 |

|

1 |

(3) |

Financial expenses/(income), net |

3 |

10 |

|

466 |

426 |

Profit before taxes |

1,417 |

1,235 |

|

91 |

94 |

Income tax expenses |

277 |

272 |

|

19.5% |

22.0% |

Effective tax rate |

19.5% |

22.0% |

|

375 |

332 |

Net profit / Adjusted net profit |

1,140 |

963 |

|

2.08 |

1.82 |

Basic / Adjusted basic EPS (€) |

6.32 |

5.28 |

|

2.08 |

1.82 |

Diluted / Adjusted diluted EPS (€) |

6.31 |

5.28 |

|

638 |

595 |

EBITDA / Adjusted EBITDA |

1,912 |

1,721 |

|

628 |

586 |

of which EBITDA (Industrial activities only) |

1,882 |

1,695 |

Total net revenues, EBITDA, Adj. EBITDA,

EBIT and Adj. EBIT at constant currency eliminate the

effects of changes in foreign currency (transaction and

translation) and of foreign currency hedges.

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

|

2024 |

|

|

2024 |

|

2024 |

at constant |

|

2024 |

at constant |

|

|

currency |

|

|

currency |

|

1,400 |

1,393 |

Cars and spare parts |

4,256 |

4,278 |

|

174 |

173 |

Sponsorship, commercial and brand |

487 |

486 |

|

70 |

70 |

Other |

198 |

199 |

|

1,644 |

1,636 |

Total net revenues |

4,941 |

4,963 |

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

|

2024 |

|

|

2024 |

|

2024 |

at constant |

|

2024 |

at constant |

|

|

currency |

|

|

currency |

|

638 |

630 |

Adjusted EBITDA |

1,912 |

1,930 |

|

467 |

459 |

Adjusted EBIT |

1,420 |

1,438 |

EBITDA is defined as net profit

before income tax expense, financial expenses/(income), net and

amortization and depreciation. Adjusted EBITDA is

defined as EBITDA as adjusted for certain income and costs, which

are significant in nature, expected to occur infrequently, and that

management considers not reflective of ongoing operational

activities.

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

375 |

332 |

43 |

Net profit |

1,140 |

963 |

177 |

|

91 |

94 |

(3) |

Income tax expense |

277 |

272 |

5 |

|

1 |

(3) |

4 |

Financial expenses/(income), net |

3 |

10 |

(7) |

|

171 |

172 |

(1) |

Amortization and depreciation |

492 |

476 |

16 |

|

638 |

595 |

43 |

EBITDA |

1,912 |

1,721 |

191 |

|

- |

- |

- |

Adjustments |

- |

- |

- |

|

638 |

595 |

43 |

Adjusted EBITDA |

1,912 |

1,1721 |

191 |

Adjusted Earnings Before Interest and Taxes or

“Adjusted EBIT” represents EBIT as adjusted for

certain income and costs which are significant in nature, expected

to occur infrequently, and that management considers not reflective

of ongoing operational activities.

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

467 |

423 |

44 |

EBIT |

1,420 |

1,245 |

175 |

|

- |

- |

- |

Adjustments |

- |

- |

- |

|

467 |

423 |

44 |

Adjusted EBIT |

1,420 |

1,245 |

175 |

Adjusted Net profit represents

net profit as adjusted for certain income and costs (net of tax

effect) which are significant in nature, expected to occur

infrequently, and that management considers not reflective of

ongoing operational activities.

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

375 |

332 |

43 |

Net profit |

1,140 |

963 |

177 |

|

- |

- |

- |

Adjustments |

- |

- |

- |

|

375 |

332 |

43 |

Adjusted net profit |

1,140 |

963 |

177 |

Basic and diluted

EPS(14)

are determined as per the table here below. Adjusted

EPS represents EPS as adjusted for certain income and

costs (net of tax effect) which are significant in nature, expected

to occur infrequently, and that management considers not reflective

of ongoing operational activities.

|

For the three months ended |

(Euro million, unless otherwise stated) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

374 |

330 |

44 |

Net profit attributable to the owners of the Company |

1,137 |

959 |

178 |

|

179,586 |

181,046 |

|

Weighted average number of common shares (thousand) |

179,928 |

181,432 |

|

|

2.08 |

1.82 |

0.26 |

Basic EPS (in Euro) |

6.32 |

5.28 |

1.04 |

|

- |

- |

- |

Adjustments |

- |

- |

- |

|

2.08 |

1.82 |

0.26 |

Adjusted basic EPS (in Euro) |

6.32 |

5.28 |

1.04 |

|

179,840 |

181,315 |

|

Weighted average number of common shares for diluted earnings per

common share (thousand) |

180,182 |

181,701 |

|

|

2.08 |

1.82 |

0.26 |

Diluted EPS (in Euro) |

6.31 |

5.28 |

1.03 |

|

- |

- |

- |

Adjustments |

- |

- |

- |

|

2.08 |

1.82 |

0.26 |

Adjusted diluted EPS (in

Euro) |

6.31 |

5.28 |

1.03 |

Net Industrial (Debt)/Cash,

defined as total Debt less Cash and Cash Equivalents (Net

(Debt)/Cash), further adjusted to exclude the debt and cash and

cash equivalents related to our financial services activities (Net

(Debt)/Cash of Financial Services Activities).

|

(Euro million) |

Sept. 30,2024 |

Jun. 30,2024 |

Mar. 31, 2024 |

Dec. 31, 2023 |

|

Debt |

(3,096) |

(3,129) |

(2,623) |

(2,477) |

| of

which leased liabilities as per IFRS 16 |

(131) |

(126) |

(117) |

(73) |

| Cash

and Cash Equivalents |

1,529 |

1,332 |

1,366 |

1,122 |

|

Net (Debt)/Cash |

(1,567) |

(1,797) |

(1,257) |

(1,355) |

| Net

(Debt)/Cash of Financial Services Activities |

(1,321) |

(1,356) |

(1,295) |

(1,256) |

|

Net Industrial (Debt)/Cash |

(246) |

(441) |

38 |

(99) |

Free Cash Flow and Free

Cash Flow from Industrial Activities are two of

management’s primary key performance indicators to measure the

Group’s performance. Free Cash Flow is defined as cash flows from

operating activities less investments in property, plant and

equipment (excluding right-of-use assets recognized during the

period in accordance with IFRS 16 — Leases), intangible assets and

joint ventures. Free Cash Flow from Industrial Activities is

defined as Free Cash Flow adjusted to exclude the operating cash

flow from our financial services activities (Free Cash Flow from

Financial Services Activities).

|

For the three months ended |

(Euro million) |

For the nine months ended |

|

September 30, |

|

September 30, |

|

2024 |

2023 |

|

2024 |

2023 |

|

587 |

481 |

Cash flow from operating activities |

1,433 |

1,190 |

|

(249) |

(205) |

Investments in property, plant and equipment and intangible

assets(11) |

(712) |

(553) |

|

338 |

276 |

Free Cash Flow |

721 |

637 |

|

(26) |

(25) |

Free Cash Flow from Financial Services Activities |

(85) |

(71) |

|

364 |

301 |

Free Cash Flow from Industrial

Activities(15) |

806 |

708 |

On November 5, 2024, at 3:00 p.m. CET,

management will hold a conference call to present the Q3 2024

results to financial analysts and institutional investors. Please

note that registering in advance is required to access the

conference call details. The call can be followed live and a

recording will subsequently be available on the Group’s website

https://www.ferrari.com/en-EN/corporate/investors. The supporting

document will be made available on the website prior to the

call.

1 Refer to specific paragraph on

non-GAAP financial measures. The term EBIT is used as a synonym for

operating profit. There were no adjustments impacting EBITDA,

EBITDA margin, EBIT, EBIT margin, Net profit, Basic EPS and Diluted

EPS in the periods presented.2 These results have been

prepared in accordance with International Financial Reporting

Standards (IFRS) as issued by the International Accounting

Standards Board and IFRS as endorsed by the European

Union3 Excluding strictly limited racing cars (such as

the XX Programme and the 499P Modificata), one-off and pre-owned

cars 4 EMEA includes: Italy, UK, Germany, Switzerland,

France, Middle East (includes the United Arab Emirates, Saudi

Arabia, Bahrain, Lebanon, Qatar, Oman and Kuwait), Africa and

European markets not separately identified; Americas includes:

United States of America, Canada, Mexico, the Caribbean and Central

and South America; Rest of APAC mainly includes: Japan, Australia,

Singapore, Indonesia, South Korea, Thailand, India and

Malaysia5 Of which 941 units in Q3 2024 (+6 units or

+0.6% vs Q3 2023) and 2,613 units in 9M 2024 (+116 units or +4.6%

vs 9M 2023) in the United States of America6 Of which

190 units in Q3 2024 (-152 units or -44.4% vs Q3 2023) and 633

units in 9M 2024 (-296 units or -31.9% vs 9M 2023) in Mainland

China7 Includes net

revenues generated from shipments of our cars, any personalization

generated on these cars, as well as sales of spare parts8

Includes net

revenues earned by our racing teams (mainly in the Formula 1 World

Championship and the World Endurance Championship) through

sponsorship agreements and our share of the Formula 1 World

Championship commercial revenues, as well as net revenues generated

through the Ferrari brand, including fashion collections,

merchandising, licensing and royalty income9

Primarily relates

to financial services activities, management of the Mugello

racetrack and other sports-related activities, as well as net

revenues generated from the rental of engines to other Formula 1

racing teams and from the sale of engines to Maserati. Starting

from 2024, residual net revenues generated from the sale of engines

are presented within other net revenues as a result of the

expiration of the supply contract with Maserati in December 2023.

As a result, net revenues generated from engines of Euro 28 million

for the three months ended September 30, 2023 and Euro 88 million

for the nine months ended September 30, 2023, that were previously

presented as “Engines” net revenues, have been presented within

“Other” net revenues to conform to the current presentation.10 The

effective tax rate benefited from the coexistence of two successive

Patent Box tax regimes, which provide tax benefits for companies

using intangible assets. The Patent Box regime firstly introduced

by the Italian Law No. 190/2014 was implemented by the Group from

2020 to 2024, recognizing the tax benefit over three annual

installments. The new Patent Box regime regulated by Law Decree No.

146, effective from October 22, 2021, provides for a 110% super tax

deduction for costs relating to eligible intangible assets and

allows for a transitional period where both regimes

coexist.11 Capital expenditures excluding right-of-use

assets recognized during the period in accordance with IFRS 16 -

Leases12 Calculated using the weighted average diluted

number of common shares as of December 31, 2023 (181,511

thousand)13 Capitalized as intangible assets

14 For the three and nine months

ended September 30, 2024 and 2023 the weighted average number of

common shares for diluted earnings per share was increased to take

into consideration the theoretical effect of the potential common

shares that would be issued for outstanding share-based awards

granted by the Group (assuming 100 percent of the target awards

vested)15 Free cash

flow from industrial activities for the three and nine months ended

September 30, 2024 includes €2M related to withholding taxes, which

are expected to be paid in the following quarters. Free cash flow

from industrial activities for the three and nine months ended

September 30, 2023 includes €1M related to withholding taxes, which

were paid in the following quarters.

- 2024_11_05 - Ferrari Q3 2024 Results Press Release

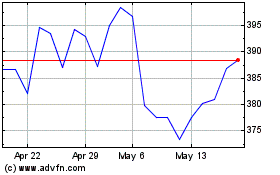

Ferrari NV (BIT:RACE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ferrari NV (BIT:RACE)

Historical Stock Chart

From Dec 2023 to Dec 2024