Ethereum On-Chain Metrics Looking Strong – Momentum Building For ETH?

December 14 2024 - 9:00AM

NEWSBTC

Ethereum is attempting to break above the critical $4,000 level as

it edges closer to its all-time high. The market has shown

skepticism regarding Ethereum’s performance in this cycle, with

some analysts predicting it might underperform compared to previous

bullish phases. Despite this doubt, Ethereum has proven its

resilience, consistently finding demand at key support levels and

maintaining a bullish price structure. Related Reading: Dogecoin

Will See New ATH Soon – Top Trader Sets $2 Target Adding to the

optimism, on-chain data from IntoTheBlock highlights a strong

foundation for Ethereum’s network activity this week. Metrics such

as active addresses, transaction volumes, and net flows suggest a

healthy ecosystem, reinforcing the potential for ETH to continue

its upward trajectory. These indicators reveal increasing

participation and growing confidence among investors, even amid

broader market uncertainties. As Ethereum approaches a critical

resistance, all eyes are on whether it can maintain momentum and

push past $4,000. If successful, this breakout could reignite

bullish sentiment and pave the way for ETH to retest its all-time

highs, silencing doubters in the process. However, failure to clear

this hurdle might result in further consolidation, keeping traders

on edge as they anticipate Ethereum’s next major move. Ethereum

Data Signals Strength Ethereum has been steadily climbing in recent

weeks, fueled by a strong bullish trend that began earlier this

month. The price momentum is catching the attention of top analysts

and investors, who are closely watching for a breakout above yearly

highs as ETH edges closer to its all-time high (ATH). The

anticipation in the market is palpable, with many viewing this as a

pivotal moment for Ethereum to solidify its position in this bull

cycle. Top analyst Ali Martinez recently shared on-chain metrics

from IntoTheBlock, revealing a robust outlook for Ethereum’s

network this week. Active addresses have increased by 4.24%,

signaling heightened participation and interest among users.

Similarly, new addresses have risen by 2.65%, suggesting growing

adoption and investor activity. Notably, zero-balance addresses

have decreased by 4.06%, indicating that dormant wallets are coming

back to life, and ETH is being reactivated for transactions or

investments. These positive metrics highlight building momentum for

Ethereum, reinforcing the belief that it is poised for a

significant price move. If ETH successfully breaks above its yearly

highs, it could trigger a powerful rally, potentially setting new

records. However, a failure to maintain upward momentum could see

Ethereum retreat to consolidate further before attempting another

breakout. Related Reading: Solana To New ATH Before Christmas –

Analyst Expects $300 Soon With its fundamentals strengthening and

the market aligning for a breakout, Ethereum appears ready to make

its next major move. Whether it’s targeting new all-time highs or

finding support for another push, the coming weeks will likely be

crucial in determining Ethereum’s trajectory for the remainder of

the bull cycle. As sentiment builds, all eyes remain on Ethereum’s

ability to capitalize on its growing momentum. ETH Testing

Supply Ethereum (ETH) is currently trading at $3,920, showing

resilience after several failed attempts to break above the

critical $4,000 resistance level. This price point remains a

psychological and technical barrier for ETH, and clearing it is

essential to confirm the continuation of its bullish uptrend. The

market’s attention is focused on Ethereum’s ability to reclaim the

$4,000 level, which would likely serve as a catalyst for a strong

rally toward new yearly highs. However, the inability to decisively

breach this resistance has kept ETH in a consolidative phase,

leaving some uncertainty about its next move. If Ethereum fails to

maintain its current momentum and breaks above $4,000 in the coming

sessions, the price could face increased selling pressure. A

retracement toward lower demand levels around $3,500 is likely in

such a scenario. This level has previously acted as a robust

support zone, and a retest could provide the foundation for another

upward attempt. Related Reading: Dogecoin Whales Bought 210 million

DOGE During Recent Correction – Bullish Signal? As the market

awaits a decisive move, Ethereum remains in a critical position.

Breaking $4,000 would reinvigorate bullish sentiment, while failure

to do so could signal further consolidation or correction before

the next significant price action unfolds. Featured image from

DALL-E, chart from TradingView

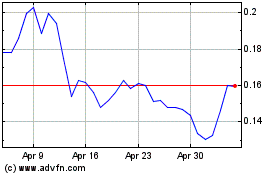

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024