AAVE Price Soars 26% In A Single Week — Will Rising FOMO Lead To A Bust?

December 14 2024 - 6:00AM

NEWSBTC

The cryptocurrency market has been fairly positive over the past

week, with the decentralized finance (DeFi) sector and tokens

particularly impressive over the last seven-day span. Aave price,

for instance, seems to have taken off after making a somewhat tame

performance in the remarkably bullish month of “Moonvember.”

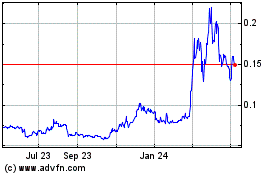

According to data from CoinGecko, the price of AAVE has increased

by more than 26% over the past week. However, the latest on-chain

data suggests that the DeFi token may face some hurdles in its

bullish trajectory and suffer a slight setback in the short term.

Is AAVE Price Going To Witness A Correction? In a recent post on

the X platform, prominent crypto analyst Ali Martinez revealed that

the investor sentiment around the Aave token has become

increasingly positive following its latest price upswing. This

on-chain observation is based on the Social Volume and Weighted

Sentiment metrics. Related Reading: Bitcoin Daily Bollinger Bands

Expand, Why BTC Price Could Rise To $120,000 As Early As Next Week

The Social Volume metric measures the total number of mentions of a

particular crypto asset on various social media platforms in the

last 24 hours. In essence, it tracks the degree of discussion

surrounding a cryptocurrency on social media. Meanwhile, weighted

sentiment is a product of sentiment score and social volume.

Typically, there is a significant shift in this metric when the

social volume is high and there is a specific average sentiment

(either positive or negative). Based on data from Santiment, the

social volume and positive sentiment around the AAVE price action

have grown significantly over the past few days. As shown in the

chart below, this soaring positive sentiment correlates with the

Aave price surge over the past week. According to Martinez, a brief

price correction might be on the cards for Aave, especially with

the crypto crowd seemingly hyped about the DeFi token’s price

performance. This is based on the notion — backed by historical

data — that crypto prices often in the opposite direction of the

crowd. Recent price action data shows that the Aave price might be

falling into something of a consolidation range, having failed to

hold above the $380 mark on Friday. As of this writing, the Aave

token is valued at $365, reflecting a mere 0.4% increase in the

past 24 hours. DeFi Coins Back At It? Most of the attention has

gone to the meme coins — and deservedly so — in this bull cycle.

However, it appears that prominent DeFi coins are beginning to pull

their weight and stake a claim for the spotlight. Related Reading:

Dogecoin Bullish Takeover: DOGE To Outperform Bitcoin By 2,400% —

Here’s How The past week saw many large-cap DeFi tokens, besides

AAVE, grow in market value. According to data from IntoTheBlock,

the market capitalization of the DeFi token sector nearly doubled

to $20 billion in the past week. Featured image from Unsplash,

chart from TradingView

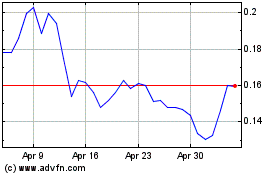

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025