Ethereum Whales Absorb $1 Million Loss As Market Caution Intensifies

January 14 2025 - 5:00PM

NEWSBTC

The current market action of Ethereum has generated significant

interest, especially among its large investors. A whale liquidated

10,070 ETH, resulting in an approximate loss of $1 million. The

sell-off transpired as Ethereum’s price faltered in sustaining

momentum, hovering around $3,280 during the transaction. Related

Reading: Rebound Alert: US Bitcoin ETF Interest Picks Up Speed In

2025 A Whale’s Desperate Maneuver The decision to sell a large

amount of ETH is notable. This particular whale knows the market

well; it took out 24,029 ETH from Binance a few weeks ago, which is

worth about $81 million. Even with this new deal, the whale still

has 13,959 ETH, which is worth about $45 million. The speed with

which this sell-off has been carried out suggests that there may be

underlying factors influencing their strategy. Whales are dumping

$ETH at a loss! 9 hours ago, 3 wallets(likely belonging to the same

whale) sold 10,070 $ETH for 33M $DAI at $3,280, losing $1M. This

whale withdrew 24,029 $ETH($81.3m) from #Binance via 10 new wallets

3 weeks ago and currently holds 13,959 $ETH($45.48M).…

pic.twitter.com/5lqFegRu3i — Lookonchain (@lookonchain) January 13,

2025 Bringing Down Market Sentiment The crypto market as a whole is

unstable, and Ethereum’s price is following suit. The value of ETH

has dropped by 2.50% in the last 24 hours, and it is now worth

about $3,177. This drop is the lowest price level in a week and

shows why investors are worried about their assets. The mood in the

market is changing from excitement to caution as many traders get

ready for more price retreats. The Broader Perspective There are

other instances of this sell-off. Other prominent players in the

Ethereum ecosystem are also unloading their holdings. As part of a

systematic transfer strategy, TRON founder Justin Sun recently sent

about $320 million in Ethereum to exchanges. These actions suggest

that many whales are responding to market conditions by selling

their holdings rather than holding onto them in anticipation of

potential future gains. Analysts remain somewhat confident in spite

of these sell-offs and the overall negative trend. Some predict

that Ethereum might hit all-time highs—possibly surpassing $10,000

by the middle of 2025—if market sentiment improves and selling

pressure lessens. This optimistic outlook is contingent upon future

developments and innovations within the Ethereum ecosystem. Related

Reading: Litecoin Price Falters Amid Doubts Over LTC ETF Approval

Anticipated Advancements Ahead Ethereum remains appealing to

developers and long-term investors. With so many upcoming updates,

there is increasing optimism that these advances, which include

usability-oriented changes, will increase network confidence.

Vitalik Buterin, one of Ethereum’s co-founders, has also advocated

for integrating cutting-edge technology like artificial

intelligence into Ethereum to increase its appeal. Despite recent

price swings, whales continue to express cautious but steady

interest in Ethereum. Investors and analysts are closely monitoring

its trajectory due to continuous changes and changing market

conditions, as there is still a large chance for a rebound.

Featured image from Pexels, chart from TradingView

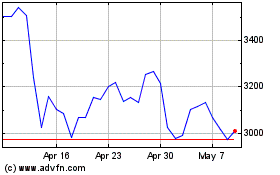

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025