- Revenue totalled €5,776.8 million, down slightly (0.5%) from

2023. The change calculated on an organic basis1 was

identical.

- The Group’s operating margin on business activity rose 3.0% to

€564.7 million, equating to a margin of 9.8% (up 0.4 percentage

points from 2023).

- Net profit attributable to the Group from continuing operations

increased 68.4% to €309.3 million. Net profit attributable to the

Group, including net profit from discontinued operations, rose

36.6% to €251.0 million.

- Free cash flow was very strong, at €432.1 million (€390.2

million in 2023) and net financial debt was reduced by 59.6% to

€382.2 million.

- Proposed dividend in respect of financial year 2024: €4.65 per

share (2023: €4.65).

Regulatory News:

At its meeting on 26 February 2025 chaired by Pierre Pasquier,

Sopra Steria Group SA’s (Paris:SOP) Board of Directors approved the

financial statements for the financial year ended 31 December

2024.2

Cyril Malargé, Chief Executive Officer of Sopra Steria Group,

commented:

“Sopra Steria proved resilient in 2024 even as market conditions

deteriorated, particularly in the fourth quarter. Group revenue

held up well thanks to our business strategy focused on our top 100

strategic clients, which enabled us to renew a significant number

of major contracts and extend some of our positions.

Against this backdrop, we delivered robust operating

performance. We achieved the target we set three years ago of

delivering an operating margin on business activity of around 10%,

free cash flow exceeded 7% of revenue and the return on capital

employed before tax rose to 21.5%.

We also reaffirmed our strategy over the course of the year.

Sopra Steria is keen to establish itself as a European leader in

consulting and digital services and position itself as a trusted,

credible European alternative to global operators. This positioning

is aimed at harnessing technology and artificial intelligence to

help major public and private sector organisations navigate

transformation.

The company’s transformation in support of this goal is already

underway. It encompasses our offerings, our operating model, human

resources and industrialisation and includes an external growth

component. In 2024, the shift from a service-based approach to high

value-added offers translated in particular into the creation of

two cross-functional service lines: Digital Platform Services,

representing revenue of over €600 million, and Cybersecurity,

representing revenue of over €200 million. A Group Chief Operating

Officer was appointed to accelerate the evolution of our operating

model. In human resources, we increased our experts’ technology

certifications by 32% and trained all our employees in artificial

intelligence. Lastly, all the Group’s developers now have access to

development platforms augmented by generative AI agents.

Faced with an uncertain environment in this early part of 2025,

we are determined to drive the Group’s transformation to generate

more value for our clients, more opportunities for our employees

and improved performance for our shareholders.”

Sopra Steria: 2024 consolidated full-year results

2024

2023restated* 2023reported

Amount

Margin

Change vs 2023 (rep'd)

Amount

Margin

Amount

Margin

Key income statement items Revenue €m

5,776.8

-0.5%

5,469.0

5,805.3

Organic growth %

-0.5%

-

Operating profit on business activity €m

564.7

9.8%

3.0%

526.0

9.6%

548.2

9.4%

Profit from recurring operations €m

514.9

8.9%

10.2%

462.8

8.5%

467.2

8.0%

Operating profit €m

460.3

8.0%

39.5%

384.3

7.0%

329.9

5.7%

Net profit from continuing activities attributable to the Group €m

309.3

5.4%

68.4%

258.1

4.7%

183.7

3.2%

Net profit attributable to the Group €m

251.0

4.3%

36.6%

183.7

3.4%

183.7

3.2%

Weighted average number of shares in issue excl. treasury

shares m

20.14

-0.4%

20.2

20.22

Basic earnings per share €

12.46

37.2%

9.08

9.08

Recurring earnings per share €

20.35

31.2%

19.19

15.51

Key balance sheet items 12/31/2024

31/12/2023 restated* 31/12/2023 reported Net

financial debt €m

382.2

-59.6%

946.0

946.0

Equity attributable to the Group €m

1,927.4

2.7%

1,876.7

1,876.7

* On a 2024 accounting standards basis (IFRS 5)

Detailed breakdown of operating performance in 2024

Consolidated revenue totalled €5,776.8 million, down a

modest 0.5% compared with the reported 2023 figure. Changes in

scope had a €15.7 million negative impact. Acquisitions added

€320.6 million of revenue (CS Group, Tobania, and Ordina after

adjusting to exclude “agent” revenue totalling -€82 million over 12

months3). The sale of the Sopra Banking Software business reduced

revenue by €336.3 million. Currency fluctuations had a positive

impact of €18.1 million. At constant scope and exchange rates,

revenue growth was -0.5%.

Operating profit on business activity came to €564.7

million, up 3.0% relative to 2023. This gives an operating margin

on business activity of 9.8%, up 0.4 percentage points, thus

achieving the target set three years ago (target for 2024 set in

2022: “Operating margin on business activity of around 10%”).

In France (42% of the Group total), revenue came in at

€2,437.9 million, equating to negative organic growth of 1.6%.

Revenue declined 2.0% in the fourth quarter, hit by a sharp

slowdown in the aeronautics sector, where quarterly volumes are

thought to have reached a low point. Excluding aeronautics, the

reporting unit’s revenue held more or less steady in the fourth

quarter (up 0.5%). Over the full year, sector trends were positive

in defence and the public sector. Other sectors lost ground. The

reporting unit’s operating margin on business activity came out at

9.0% (9.6% in 2023), mainly as a result of the decline in activity

in the aeronautics sector. Meanwhile, CS Group confirmed a

1.9-point uplift in its profitability compared with 2023.

Revenue for the United Kingdom (17% of the Group total)

was €962.1 million, down 0.5%. Revenue was down 9.4% in the fourth

quarter, mainly as a result of a particularly high basis of

comparison for the SSCL platform (up 25.2% in the fourth quarter of

2023). It also reflects the expiration of a major contract, while

another major contract, originally scheduled for the fourth

quarter, was pushed back to the beginning of the second quarter of

2025. Overall, across the full year, the public sector contracted

while the private sector posted strong growth. The reporting unit’s

operating margin on business activity improved by 1.1 points to

12.1%.

In Europe (35% of the Group total), revenue grew 0.5% on

an organic basis to €2,049.0 million. The most buoyant growth was

in Scandinavia, Spain and Italy, where revenue grew by between 8%

and 10%. Other countries saw revenue decline by between 3% and 5%.

The reporting unit’s operating margin on business activity was

9.1%, up 0.4 points from 2023.

The Solutions reporting unit (6% of the Group total)

posted revenue of €327.8 million, representing organic growth of

1.1%. Human Resources Solutions posted growth of 3.6%. Property

Management Solutions contracted by 1.7%. Excluding the impact of

changes in scope (reallocation of business previously within the

scope of SBS following its disposal), the reporting unit’s

operating margin on business activity improved by 1.6 points

compared with 2023.

Comments on the components of net profit attributable to the

Group in 2024

Profit from recurring operations came in at €514.9

million, equating to growth of 10.2%. It included a €17.3 million

share-based payment expense (versus €43.0 million in 2023) and a

€32.5 million amortisation expense on allocated intangible assets

(versus €38.0 million in 2023).

Operating profit came in at €460.3 million, up 39.5%,

after a net expense of €54.7 million for Other operating income and

expenses (compared with a net expense of €137.4 million in 2023),

which included a capital gain of €11.1 million, not allocated to

any reporting unit, in connection with the disposal of 74Software

shares.4

Net interest expense was €38.6 million (versus €35.9

million in 2023).

The tax expense totalled €96.8 million, for an effective

tax rate of 23.0%. Restated for non-recurring items, the normative

tax rate was 26%.

Net profit/loss from associates amounted to a loss of

€6.7 million (compared with profit of €6.7 million in 2023).

Minority interests totalled €9.0 million.

Net profit attributable to the Group from continuing

operations came in at €309.3 million, up 68.4%, giving a margin

of 5.4%.

Net profit/(loss) from discontinued operations came in at

a loss of €58.3 million.

Consolidated net profit came in at €259.9 million, up

37.5%, and net profit attributable to the Group came to

€251.0 million, up 36.6%, after deducting €9.0 million attributable

to non-controlling interests.

Basic earnings per share came to €12.46, compared with

€9.08 in 2023 (up 37.2%).

Workforce

At end-December 2024, the Group’s net headcount came to 50,9885

employees, compared with 51,768 employees at year-end 2023. Around

7,900 staff were employed at international service centres,

unchanged at constant scope from 2023. The workforce attrition

rate6 was 14.1%, compared with 15.7% in the previous year.

Proposed dividend in respect of financial year 2024

At the next General Meeting of Shareholders, to be held on

Wednesday, 21 May 2025, Sopra Steria will propose the payment of a

dividend of €4.65 per share (vs €4.65 per share in respect of

financial year 2023). The ex-dividend date will be 3 June 2025. The

dividend will be paid as of 5 June 2025.

Financial position and return on capital employed

Free cash flow was very strong, at €432.1 million (compared with

€390.2 million in 2023). This reflects a 3.6% increase in EBITDA

and includes exceptional cash flow of around €45 million linked to

the scheduled conclusion of a major migration programme in

Germany.

Net financial debt totalled €382.2 million, down 59.6% from its

level at 31 December 2023. At that date, it was equal to 19.3% of

equity and 0.61x pro forma EBITDA for 2024 before the impact of

IFRS 16 (with the financial covenant stipulating a maximum of

3x).

Return on capital employed (RoCE) before tax came out at 21.5%,

compared with 16.5% in 2023.

Change in scope

The sale of Sopra Banking Software, announced on 21 February

2024 as part of Sopra Steria’s process of refocusing its activities

on digital services and solutions, was finalised on 2 September

2024. The activities sold were recognised in discontinued

operations (in accordance with IFRS 5) with effect from the

financial statements for the first half of 2024.

The total amount received by Sopra Steria in 2024 in connection

with the refocusing of its activities (sale of SBS, sale of 16.7%

of 74Software and sale of 74Software subscription rights in

connection with the latter’s capital increase) was €410.6 million.

Sopra Steria retains an 11.1% stake in 74Software’s share

capital.

On 30 January 2025, Sopra Steria announced its intention to

acquire management consulting firm Aurexia, which specialises in

financial services. This project would expand Sopra Steria Next’s

capacity and expertise as well as its positioning and ability to

serve France’s leading financial institutions. With 140 consulting

professionals, Aurexia’s forecast revenue for 2024 is around €20

million, with 80% of this total generated in France. The proposed

acquisition is expected to be completed in the second quarter of

2025.

Share buyback programme

The €150 million share buyback programme launched on 2 October

2024 concluded on 28 January 2025. During the share buyback period,

which ran from 2 October 2024 to 28 January 2025, Sopra Steria

bought back 858,163 shares (4.2% of capital) at an average price of

€174.79 per share, for a total amount of €150 million. The shares

bought back under this programme will be retired in 2025.

Strategy

Sopra Steria is keen to establish itself as a European leader in

consulting and digital services and position itself as a trusted,

credible European alternative to global operators. The Group is

prioritising its foothold in four strategic markets (Public Sector,

Financial Services, Defence & Security, Aeronautics &

Space), where stakes relating to sovereignty and responsible

digital technology are becoming increasingly critical in Europe. To

this end, it focuses on delivering high value-added offerings and

an industrial and sustainable approach to implementing technology.

The Group aims to act and innovate in such a way as to be able to

influence how society makes use of technology.

Social and environmental footprint

Sopra Steria sees its contribution to society as sustainable,

human-focused and purposeful, guided by the firm belief that making

digital solutions work for people is a source of opportunity and

progress.

With regard to the environment, CDP7 confirmed in February 2025

that Sopra Steria had made its A List – recognising the world’s

most transparent and most proactive companies in climate action –

for the 8th year in a row.

This recognition notably reflects the Group’s Net-Zero target8

of achieving a 54% reduction in its greenhouse gas emissions from

Scopes 1 & 2 and a 37.5% reduction for Scope 3 by 2030. At

end-December 2024, the Group had achieved a 52.7% reduction in

Scope 1 & 2 emissions and a 23.9% reduction in Scope 3

emissions.

In the social arena, the proportion of women in the 3% most

senior positions increased 1.3 points in 2024 to 21.4%, while the

proportion in the 10% most senior positions increased 0.8 points to

22.3%.

Medium-term financial targets

Over the period 2026-2028, Sopra Steria aims to achieve the

following:

- Annual organic revenue growth of between 2% and 5%

- Operating margin on business activity of between 10% and

11%

- Free cash flow of between 5% and 7% of revenue

- Return on capital employed (RoCE) before tax of around 20%

Financial targets for 2025

The European market is expected to remain unfavourable in the

first half of the year as a result of a still uncertain climate,

particularly in France.

Against this backdrop, Sopra Steria has set itself the following

targets:

- Organic revenue growth of between -2.5% and +0.5% (with the

first quarter expected to be the lowest point in the year, with

revenue to come in between -5% and -6%)

- Operating margin on business activity of between 9.3% and 9.8%,

including a dilutive effect of around 0.3 points arising from

increases in employers’ payroll contributions enacted by the UK and

French governments for 2025

- Free cash flow of between 5% and 7% of revenue

Meeting to report 2024 full-year results

The 2024 full-year results will be presented to financial

analysts and investors in a French/English webcast on Thursday, 27

February 2025 at 8:30 a.m. CET.

- Register for the French-language webcast here

- Register for the English-language webcast here

Or by phone:

- French-language phone number: +33 (0)1 70 37 71 66

- English-language phone number: +44 (0)33 0551 0200

Practical information about the presentation and webcast can be

found in the ‘Investors’ section of the Group’s website:

https://www.soprasteria.com/investors

Upcoming financial releases

Wednesday, 30 April 2025 (8:30 a.m.): Meeting to report Q1 2025

revenue

Wednesday, 21 May 2025 (2:30 p.m.): General Meeting of

Shareholders

Friday, 25 July 2025 (8:30 a.m.): Meeting to report H1 2025

results

Wednesday, 29 October 2025 (8:30 a.m.): Meeting to report Q3

2025 revenue

Glossary

- Restated revenue: Revenue

for the prior year, expressed on the basis of the scope and

exchange rates for the current year.

- Organic revenue growth:

Increase in revenue between the period under review and restated

revenue for the same period in the prior financial year.

- EBITDA: This measure, as

defined in the Universal Registration Document, is equal to

consolidated operating profit on business activity after adding

back depreciation, amortisation and provisions included in

operating profit on business activity.

- Free cash flow: Free cash

flow is defined as net cash from operations; less investments (net

of disposals) in property, plant and equipment, and intangible

assets; less lease payments; less net interest paid; and less

additional contributions to address any deficits in defined-benefit

pension plans.

- Operating profit on business

activity: This measure, as defined in the Universal

Registration Document, is equal to profit from recurring operations

adjusted to exclude the share-based payment expense for stock

options and free shares and charges to amortisation of allocated

intangible assets.

- Profit from recurring

operations: This measure is equal to operating profit

before other operating income and expenses, which includes any

particularly significant items of operating income and expense that

are unusual, abnormal, infrequent or not foreseeable, presented

separately in order to give a clearer picture of performance based

on ordinary activities.

- Basic recurring earnings per

share: This measure is equal to basic earnings per share

before other operating income and expenses net of tax.

- Return on capital employed

(RoCE): (Profit from recurring operations before tax +

Profit from equity-accounted companies) / (Equity + Net financial

debt)

- Downtime: Number of days

between two contracts (excluding training, sick leave, other leave

and pre-sales) divided by the total number of business days.

Disclaimer

This document contains forward-looking information subject to

certain risks and uncertainties that may affect the Group’s future

growth and financial results. Readers are reminded that licence

agreements, which often represent investments for clients, are

signed in greater numbers in the second half of the year, with

varying impacts on end-of-year performance. Actual outcomes and

results may differ from those described in this document due to

operational risks and uncertainties. More detailed information on

the potential risks that may affect the Group’s financial results

can be found in the 2023 Universal Registration Document filed with

the Autorité des Marchés Financiers (AMF) on 15 March 2024 (see

pages 40 to 46 in particular). Sopra Steria does not undertake any

obligation to update the forward-looking information contained in

this document beyond what is required by current laws and

regulations. The distribution of this document in certain countries

may be subject to the laws and regulations in force. Persons

physically present in countries where this document is released,

published or distributed should enquire as to any applicable

restrictions and should comply with those restrictions.

About Sopra Steria

Sopra Steria, a major tech player in Europe with 51,000

employees in nearly 30 countries, is recognised for its consulting,

digital services and solutions. It helps its clients drive their

digital transformation and obtain tangible and sustainable

benefits. The Group provides end-to-end solutions to make large

companies and organisations more competitive by combining in-depth

knowledge of a wide range of business sectors and technologies with

a collaborative approach. Sopra Steria places people at the heart

of everything it does and is committed to putting digital to work

for its clients in order to build a positive future for all. In

2024, the Group generated revenue of €5.8 billion.

The world is how we shape it

Sopra Steria (SOP) is listed on Euronext Paris (Compartment A) –

ISIN: FR0000050809

For more information, visit us at www.soprasteria.com

*** Copyright © 2025 Sopra Steria. All rights reserved. Sopra

Steria and its logo are registered trademarks of Sopra Steria.

Annexes

Sopra Steria: Impact on revenue of changes in scope and exchange

rates – FY 2024 €m

2024

2023

Growth

Revenue

5,776.8

5,805.3

-0.5%

Changes in exchange rates

18.1

Revenue at constant exchange rates

5,776.8

5,823.4

-0.8%

Changes in scope

402.7

Change in scope - Application of IFRS 15 (mode agent)

-82.1

Classification as assets held for sale - IFRS 15

-336.3

Revenue at constant exchange rates, scope and accounting

standards

5,776.8

5,807.7

-0.5%

Sopra Steria: Changes in exchange rates – FY 2024

For €1 / % Average rate Average rate

Change 2024 2023 Pound sterling

0.8466

0.8698

+ 2.7%

Norwegian krone

11.6290

11.4248

- 1.8%

Swedish krona

11.4325

11.4788

+ 0.4% Danish krone

7.4589

7.4509

- 0.1%

Swiss franc

0.9526

0.9718

+ 2.0%

Sopra Steria: Revenue by reporting unit (€m

/ %) – Q4 2024 Q4 2024 Q4 2023restated* Q4

2023reported Organic growth Totalgrowth

France

615.4

627.7

617.5

-2.0%

-0.3%

United Kingdom

234.6

259.1

249.1

-9.4%

-5.8%

Europe

530.8

534.8

548.9

-0.7%

-3.3%

Solutions

89.7

89.0

79.6

+0.8% +12.8% Sopra Banking Software

-

-

124.7

-

-

Sopra Steria Group

1,470.5

1,510.6

1,619.8

-2.7%

-9.2%

* Revenue at 2024 scope, exchange rates and accounting policies

(IFRS 5 & mode agent)

Sopra Steria: Revenue by

reporting unit (€m / %) – FY 2024

2024

2023restated* 2023reported Organic growth

Totalgrowth France

2,437.9

2,477.6

2,384.3

-1.6%

+2.2% United Kingdom

962.1

966.5

940.9

-0.5%

+2.3% Europe

2,049.0

2,039.4

1,746.9

+0.5% +17.3% Solutions

327.8

324.2

288.2

+1.1% +13.8% Sopra Banking Software

-

-

445.1

-

-

Sopra Steria Group

5,776.8

5,807.7

5,805.3

-0.5%

-0.5%

* Revenue at 2024 scope, exchange rates and accounting policies

(IFRS 5 & mode agent)

Sopra Steria:

Performance by reporting unit – FY 2024

2024

2023restated* 2023reported €m % €m % €m %

France Revenue

2,437.9

2,426.3

2,384.3

Operating profit on business activity

220.4

9.0%

235.6

9.7%

229.5

9.6%

Profit from recurring operations

201.6

8.3%

207.7

8.6%

196.8

8.3%

Operating profit

182.1

7.5%

198.9

8.2%

189.4

7.9%

United Kingdom Revenue

962.1

940.9

940.9

Operating profit on business activity

116.9

12.1%

103.2

11.0%

103.2

11.0%

Profit from recurring operations

107.8

11.2%

89.4

9.5%

89.4

9.5%

Operating profit

100.7

10.5%

79.1

8.4%

79.1

8.4%

Other Europe Revenue

2,049.0

1,777.5

1,746.9

Operating profit on business activity

186.4

9.1%

151.7

8.5%

152.2

8.7%

Profit from recurring operations

165.7

8.1%

139.0

7.8%

140.0

8.0%

Operating profit

128.5

6.3%

105.0

5.9%

118.1

6.8%

Solutions Revenue

327.8

324.2

288.2

Operating profit on business activity

41.0

12.5%

35.4

10.9%

39.4

13.7%

Profit from recurring operations

39.9

12.2%

26.7

8.2%

36.6

12.7%

Operating profit

38.0

11.6%

1.4

0.4%

36.2

12.6%

* On a 2024 accounting standards basis (IFRS 5)

Sopra Steria:

Consolidated income statement – FY 2024

2024

2023restated* 2023reported €m % €m % €m %

Revenue

5,776.8

5,469.0

5,805.3

Staff costs

-3,611.7

-3,345.4

-3,577.1

Operating expenses

-1,413.6

-1,431.9

-1,501.4

Depreciation, amortisation and provisions

-186.8

-165.7

-178.6

Operating profit on business activity

564.7

9.8%

526.0

9.6%

548.2

9.4%

Share-based payment expenses

-17.3

-34.3

-43.0

Amortisation of allocated intangible assets

-32.5

-28.9

-38.0

Profit from recurring operations

514.9

8.9%

462.8

8.5%

467.2

8.0%

Other operating income and expenses

-54.7

-78.5

-137.4

Operating profit

460.3

8.0%

384.3

7.0%

329.9

5.7%

Cost of net financial debt

-35.4

-19.5

-19.5

Other financial income and expenses

-3.2

6.1

-16.3

Tax expense

-96.8

-114.2

-111.7

Net profit from associates

-6.7

6.7

6.7

Net profit of continuing activities

318.2

5.5%

263.5

4.8%

189.1

3.3%

Net profit of discontinued activities

-58.3

-74.4

-

Consolidated net profit

259.9

4.5%

189.1

3.5%

189.1

3.3%

Attributable to the Group

251.0

4.3%

183.7

3.4%

183.7

3.2%

Non-controlling interests

9.0

5.4

5.4

Weighted avg nb of shares in issue excl. treasury shares (m)

20.14

20.22

20.22

Basic earnings per share (€)

12.46

9.08

9.08

* On a 2024 accounting standards basis (IFRS 5)

Sopra

Steria: Change in net financial debt (€m) – FY 2024

2024

2023

2023

restated* reported Operating profit on business

activity

564.7

526.0

548.2

Depreciation, amortisation and provisions (excl. allocated

intangible assets)

185.7

161.3

176.1

EBITDA

750.5

687.3

724.3

Non-cash items

-6.0

7.3

0.4

Tax paid

-85.7

-72.2

-82.6

Change in operating working capital requirement

54.2

7.6

44.9

Reorganisation and restructuring costs

-63.6

-57.1

-62.8

Net cash flow from operating activities

649.3

573.0

624.2

Lease payments

-127.2

-96.7

-106.0

Change relating to investing activities

-58.3

-70.1

-93.7

Net interest

-21.7

-1.8

-22.0

Additional contributions related to defined-benefit pension plans

-10.0

-12.3

-12.3

Free cash flow

432.1

392.1

390.2

Capital increase

-180.0

-0.0

-

Impact of changes in scope

136.7

-1,056.2

-1,049.2

Financial investments

2.3

-12.0

-11.8

Dividends paid

-96.3

-98.4

-94.5

Dividends received

0.3

2.7

2.7

Purchase and sale of treasury shares

-132.4

-26.1

-26.1

Impact of changes in foreign exchange rates & others

-2.2

-4.0

-5.2

Impact of SBS net financial debt classified under discontinued

operations

403.3

8.0

0.0

Change in net financial debt

563.8

-794.0

-794.0

* On a 2024 accounting standards basis (IFRS 5)

Net financial

debt at beginning of period

946.0

152.0

152.0

Net financial debt at end of period

382.2

946.0

946.0

Sopra Steria: Simplified balance sheet (€m) –

31/12/2024 12/31/2024 31/12/2023restated*

31/12/2023reported Goodwill

2,348.2

2,586.2

2,668.9

Allocated intangible assets

174.3

232.1

124.8

Other fixed assets

345.2

307.9

304.3

Right-of-use assets

384.4

457.1

457.1

Equity-accounted investments

1.0

185.9

185.9

Fixed assets

3,253.0

3,769.2

3,740.9

Net deferred tax

73.1

70.0

98.3

Trade accounts receivable (net)

1,291.4

1,372.4

1,372.4

Other assets and liabilities

-1,562.5

-1,556.4

-1,556.4

Working capital requirement (WCR)

-271.1

-184.0

-184.0

Assets + WCR

3,055.0

3,655.2

3,655.2

Equity

1,984.5

1,925.1

1,925.1

Pensions – Post-employment benefits

135.9

167.8

167.8

Provisions for contingencies and losses

125.2

113.3

113.3

Lease liabilities

427.3

503.0

503.0

Net financial debt

382.2

946.0

946.0

Capital invested

3,055.0

3,655.2

3,655.2

* On a 2024 accounting standards basis (IFRS 3)

Sopra

Steria: Workforce breakdown – 31/12/2024 12/31/2024

12/31/2023 France

19,949

20,370

Europe

22,928

23,052

Outside Europe

224

367

International Services Centres

7,887

7,979

Total

50,988

51,768

Sopra Banking Software

3,792

Interns

249

273

Total with SBS & interns

51,237

55,833

1 Alternative performance measures are defined at the end of

this document. 2 Audit procedures have been carried out and the

audit report is being issued. 3 Recognition of revenue generated by

Ordina through the sale of external expertise was harmonised with

effect from 1 January 2024. This revenue is recognised on a net

basis where it meets the IFRS 15 definition of revenue generated by

an agent. 4 Formerly “Axway”. 5 Workforce excluding interns, in

accordance with the requirements of the CSRD. Including interns,

the workforce totalled 51,237 at 31 December 2024 and 52,041 at 31

December 2023. 6 Attrition rate including employees who left within

6 months of hiring, in accordance with the requirements of the

CSRD. 7 Every year, more than 24,800 companies and organisations

around the world provide details on their environmental performance

to CDP for independent assessment against its scoring methodology

for the benefit of investors, purchasers and other stakeholders. 8

Target approved by the Science Based Targets initiative (SBTi) on

16 June 2023 and aligned with the aim of limiting the increase in

the average global temperature to 1.5°C (reduction targets

baseline: 2019).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226764580/en/

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16

Press Relations Caroline Simon (Image 7)

caroline.simon@image7.fr +33 (0)1 53 70 74 65

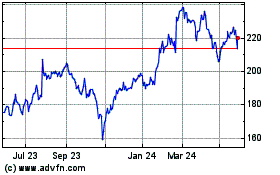

Sopra Steria (EU:SOP)

Historical Stock Chart

From Feb 2025 to Mar 2025

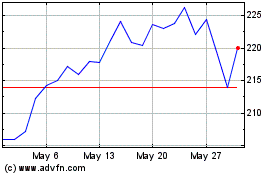

Sopra Steria (EU:SOP)

Historical Stock Chart

From Mar 2024 to Mar 2025