Commodity Currencies Slide

July 22 2024 - 10:19PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Tuesday, due to a sharp drop in commodity

prices.

Crude oil prices eased, declining for the third consecutive

session on concerns about the outlook for oil demand and renewed

hopes of a ceasefire in Gaza.

West Texas Intermediate Crude oil futures for August ended down

$0.35 or at $79.78 a barrel.

In the Asian trading today, the Australian dollar fell to more

than a 5-week low of 103.61 against the yen and a 1-1/2-month low

of 1.6427 against the euro, from yesterday's closing quotes of

104.16 and 1.6402, respectively. If the aussie extends its

downtrend, it is likely to find support around 100.00 against the

yen and 1.66 against the euro.

Against the U.S. and the Canadian dollars, the aussie slipped to

nearly a 4-week low of 0.6628 and nearly a 3-week low of 0.9124

from Monday's closing quotes of 0.6639 and 0.9137, respectively.

The aussie may test support near 0.64 against the greenback and

0.90 against the loonie.

The NZ dollar fell to nearly a 3-month low of 0.5964 against the

U.S. dollar, a 2-1/2-month low of 93.22 against the yen and an

8-month low of 1.8257 against the euro, from yesterday's closing

quotes of 0.5976, 93.78 and 1.8219, respectively. If the kiwi

extends its downtrend, it is likely to find support around 0.58

against the greenback, 92.00 against the yen and 1.83 against the

euro.

Against the euro, the kiwi edged down to 1.1125 from Monday's

closing value of 1.1108. The kiwi is likely to find support near

the 1.12 against the aussie.

The Canadian dollar fell to a 1-1/2-month low of 113.49 against

the yen and an 8-month low of 1.4996 against the euro, from

yesterday's closing quotes of 114.02 and 1.4985, respectively. If

the loonie extends its downtrend, it is likely to find support

around 111.00 against the yen and 1.50 against the euro.

Against the U.S. dollar, the loonie edged down to 1.3771 from

Tuesday's closing value of 1.3762. The loonie is likely to find

support near the 1.38 region.

Looking ahead, U.S. Redbook report, U.S. flash consumer

confidence for July, existing homes sales for June and U.S.

Richmond Fed manufacturing index for July are slated for release in

the New York session.

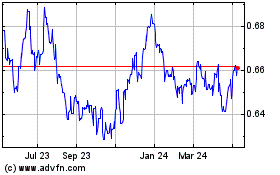

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Jun 2024 to Jul 2024

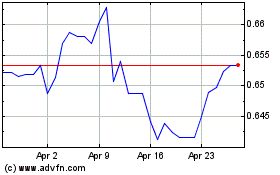

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Jul 2023 to Jul 2024