Aemetis Allocated $10.5 Million IRA Section 48C Tax Credits by DOE and IRS for Biofuels Plant Efficiency Projects

April 09 2024 - 7:00AM

via NewMediaWire -- Aemetis, Inc. (NASDAQ: AMTX), a renewable

natural gas and renewable fuels company focused on low and negative

carbon intensity products, today announced that it received an

allocation of $10.5 million of Inflation Reduction Act (IRA) tax

credits by the U.S. Department of Energy (DOE) and the Internal

Revenue Service (IRS) under the first phase of IRA Section 48C

awards.

The Aemetis Five Year Plan projects that Aemetis will receive a

total of $450 million of IRA tax credits to support funding of its

renewable fuels projects. In October 2023, Aemetis completed the

sale of $63 million of IRA tax credits to a single buyer and

received $55 million in funding.

Aemetis was awarded the $10.5 million allocation of transferable

tax credits to support the Mechanical Vapor Recompression (MVR)

energy efficiency project and other energy efficiency projects at

the Aemetis Keyes ethanol production facility in California. The

competitive process for funding was managed by the DOE as an

advisor to the IRS which selected recipients based on an extensive

and detailed review of each project.

“The Inflation Reduction Act funds new job creation and supports

new investment in projects in almost every state,” stated Eric

McAfee, Chairman and Chief Executive Officer of Aemetis, Inc. “Late

last year we demonstrated the conversion of IRA tax credits into

funding for our projects, so monetization of the tax credits

supports long term debt financing and, in the case of the MVR

project, is expected to significantly increase operating cash flow

from our existing biofuels plant in California.”

The MVR project and related upgrades are expected to cost about

$30 million, with design engineering already completed and

equipment procurement underway for planned installation in the

first half of 2025. In addition to the $10.5 million of IRA tax

credits, Aemetis already has been awarded $6 million of grant

funding by the California Energy Commission (CEC) and has been

approved for up to $3.2 million of additional funding from the

Pacific Gas & Electric Energy Efficiency Program, pending

project completion and verification of energy savings.

The MVR project is expected to reduce fossil natural gas use at

the Keyes plant by 80% and lower the carbon intensity of the

biofuels produced by the Keyes plant by more than 20%, which

together is expected to substantially improve operating cash

flow.

The Inflation Reduction Act established Section 48C tax credit

grants to fund energy efficiency and low carbon intensity renewable

energy projects. The Section 48C tax credits are transferable from

project developers to entities with income tax liabilities in order

to provide funding to projects.

About Aemetis

Headquartered in Cupertino, California, Aemetis is a renewable

natural gas, renewable fuel and biochemicals company focused on the

acquisition, development and commercialization of innovative

technologies that replace petroleum-based products and reduce

greenhouse gas emissions. Founded in 2006, Aemetis is operating and

actively expanding a California biogas digester network and

pipeline system to convert dairy waste gas into Renewable Natural

Gas. Aemetis owns and operates a 65 million gallon per year ethanol

production facility in California’s Central Valley near Modesto

that supplies about 80 dairies with animal feed. Aemetis owns and

operates a 60 million gallon per year production facility on the

East Coast of India producing high quality distilled biodiesel and

refined glycerin for customers in India and Europe. Aemetis is

developing the sustainable aviation fuel (SAF) and renewable diesel

fuel biorefinery in California to utilize renewable hydrogen,

hydroelectric power, and renewable oils to produce low carbon

intensity renewable jet and diesel fuel. For additional information

about Aemetis, please visit www.aemetis.com.

Safe Harbor Statement

This news release contains forward-looking statements, including

statements regarding assumptions, projections, expectations,

targets, intentions or beliefs about future events or other

statements that are not historical facts. Forward-looking

statements include, without limitation, projections of financial

results in 2024 and future years; statements relating to the

development, engineering, financing, construction and operation of

the Aemetis ethanol, biogas, SAF and renewable diesel, and carbon

sequestration facilities; and our ability to promote, develop and

deploy technologies to produce renewable fuels and biochemicals.

Words or phrases such as “anticipates,” “may,” “will,” “should,”

“believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,”

“projects,” “showing signs,” “targets,” “view,” “will likely

result,” “will continue” or similar expressions are intended to

identify forward-looking statements. These forward-looking

statements are based on current assumptions and predictions and are

subject to numerous risks and uncertainties. Actual results or

events could differ materially from those set forth or implied by

such forward-looking statements and related assumptions due to

certain factors, including, without limitation, competition in the

ethanol, biodiesel and other industries in which we operate,

commodity market risks including those that may result from current

weather conditions, financial market risks, customer adoption,

counter-party risks, risks associated with changes to federal

policy or regulation, and other risks detailed in our reports filed

with the Securities and Exchange Commission, including our Annual

Reports on Form 10-K, and in our other filings with the SEC. We are

not obligated, and do not intend, to update any of these

forward-looking statements at any time unless an update is required

by applicable securities laws.

External Investor

RelationsContact:Kirin SmithPCG Advisory

Group(646) 863-6519ksmith@pcgadvisory.com

Company Investor Relations/Media

Contact:Todd Waltz(408) 213-0940investors@aemetis.com

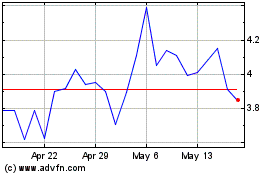

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

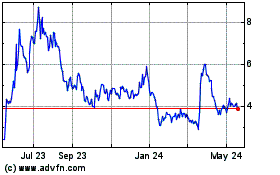

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Nov 2023 to Nov 2024