Form 8-K - Current report

September 03 2024 - 7:00AM

Edgar (US Regulatory)

false

0001141284

0001141284

2024-08-30

2024-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

August 30, 2024

Actelis Networks, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41375 |

|

52-2160309 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

4039 Clipper Court, Fremont, CA 94538

(Address of principal executive offices)

(510) 545-1045

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

ASNS |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

As

previously disclosed, on May 23, 2024, Actelis Networks, Inc. (the “Company”), issued a press release to announce that

it had entered into a binding term sheet (the “Term Sheet”) with Quality Industrial Corp, a Nevada corporation traded on

the OTC under the symbol QIND (“Target”), and Ilustrato Pictures International Inc., a Nevada corporation

(“Seller”, and, together with the Company and Target, the “Parties”), pursuant to which the Company will

acquire from Seller and additional shareholders of Target shares of Target constituting between 61% to 75% of the issued and

outstanding shares of the Target’s share capital. The companies initially intended to close the transaction, pending

regulatory requirements and due diligence, within 60 days.

As previously disclosed, on

each of July 19, 2024, August 2, 2024, and August 16, 2024, the Parties agreed to extend the non-solicitation and no-shop

periods provided in the Term Sheet to additional periods, the last period being until August 30, 2024.

On August 30, 2024, the Parties agreed to extend the non-solicitation and no-shop periods provided in the Term Sheet until October 1, 2024, except that if certain conditions will not be met by September 15, 2024, the non-solicitation and no-shop periods shall terminate on September

15, 2024. In addition, the Parties agreed that the targeted date for signing and closing of the transaction shall be October 1, 2024, unless otherwise

mutually terminated earlier by the Parties.

There

can be no assurance that a definitive agreement will be entered into or that the proposed transaction will be consummated.

The

information in this Item 7.01 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed

to be incorporated by reference into the filings of the Company under the Securities Act, or the Exchange Act, regardless of any general

incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information

of the information in this Item 7.01.

Cautionary Statement

Concerning Forward-Looking Statements

This Current Report contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities

laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking

statements. Forward-looking statements are not historical facts, and are based upon management’s current expectations, beliefs and

projections, many of which, by their nature, are inherently uncertain. Such expectations, beliefs and projections are expressed in good

faith. Forward-looking statements are based on current expectations and assumptions that, while considered reasonable are inherently uncertain.

New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. There can be

no assurance that management’s expectations, beliefs and projections will be achieved, and actual results may differ materially

from what is expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties

that could cause actual performance or results to differ materially from those expressed in the forward-looking statements. These and

other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in

this Current Report. Factors that may cause actual results to differ materially from current expectations include, but are not limited

to, various factors beyond management’s control including general economic conditions; the outcome of any legal proceedings that

may be instituted against Target, Seller or Actelis following the announcement of the term sheet; the inability to complete the term sheet;

the risk that the acquisition will disrupts current plans and operations as a result of the announcement and consummation of the acquisition;

the inability to recognize the anticipated benefits of the acquisition, which may be affected by, among other things, competition, the

ability of the combined company to grow and manage growth, maintain relationships with customers and suppliers and retain key employees;

costs related to the acquisition; the possibility that Actelis may be adversely affected by other economic, business, and/or competitive

factors and other risks and uncertainties indicated from time to time. Any such forward-looking statements represent management’s

estimates as of the date of this Current Report. While the Company may elect to update such forward-looking statements at some point in

the future, unless required by law, it disclaims any obligation to do so, even if subsequent events cause its views to change. Thus, no

one should assume that the Company’s silence over time means that actual events are bearing out as expressed or implied in such

forward-looking statements. These forward-looking statements should not be relied upon as representing the Company’s views as of

any date subsequent to the date of this Current Report. More detailed information about the Company and the risk factors that may affect

the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission

(SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders

are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ACTELIS NETWORKS, INC. |

| |

|

| Dated: September 3, 2024 |

By: |

/s/ Tuvia Barlev |

| |

Name: |

Tuvia Barlev |

| |

Title: |

Chief Executive Officer |

2

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

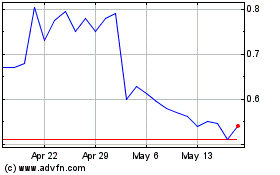

Actelis Networks (NASDAQ:ASNS)

Historical Stock Chart

From Mar 2025 to Apr 2025

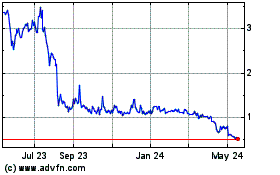

Actelis Networks (NASDAQ:ASNS)

Historical Stock Chart

From Apr 2024 to Apr 2025