As filed with the Securities and Exchange Commission

on February 12, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of registrant as specified in its charter)

| Luxembourg |

|

98-0554932 |

(State or other jurisdiction

of incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

33, Boulevard Prince Henri

L-1724 Luxembourg

Grand Duchy of Luxembourg

(352) 20 60 20 55

(Address of Principal Executive Offices) (Zip Code)

2009 Equity Incentive Plan

(Full title of the plan)

Altisource Portfolio Solutions, Inc.

2300 Lakeview Parkway, Suite 756

Alpharetta, GA, 30009

(Name and address of agent for service)

(770) 612-7007

(Telephone number, including area code, of agent

for service)

With a copy to:

Max Kirchner

Keith Pisani

Paul Hastings LLP

100 Bishopsgate

London EC2N 4AG

United Kingdom

+44 20 3023 5100 |

Margaretha Wilkenhuysen

NautaDutilh Avocats Luxembourg S.à r.l.

2 Rue Jean Bertholet

L-1233 Luxembourg

Grand Duchy of Luxembourg

+352 26 12 29 1 |

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| |

|

|

|

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

|

|

| |

|

Emerging growth company |

¨ |

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

REGISTRATION OF ADDITIONAL SECURITIES

EXPLANATORY NOTE

On

January 3, 2025, Altisource Portfolio Solutions S.A., a Luxembourg société anonyme (the “Registrant”) filed

with the Securities and Exchange Commission (the “Commission”) a Definitive Proxy Statement on Schedule 14A that included

a proposal (the “Proposal”) to increase the number of shares of the Registrant’s common stock (“Common Stock”)

reserved for issuance under Altisource Portfolio Solutions S.A. Amended and Restated 2009 Equity Incentive Plan (the “2009 Equity

Incentive Plan”) by 4,645,875 shares from 11,666,667 shares to 16,312,542 shares. It is expected that the Registrant’s shareholders

will approve the Proposal at the Registrant’s Special General Meeting of Shareholders scheduled for February 18, 2025.

This

Registration Statement on Form S-8 (this “Registration Statement”) is filed pursuant to General Instruction E of Form S-8

for the purpose of registering 4,645,875 additional shares of Common Stock expected to be issuable pursuant to the 2009 Equity Incentive

Plan. In accordance with General Instruction E of Form S-8, the content of the Registrant’s previously filed Registration Statement

on Form S-8 (File No. 333-161175), as filed with the Commission on August 7, 2009 and Registration Statement on Form S-8 (File No. 333-279892), as filed with the Commission on May 31, 2024, are hereby incorporated herein by reference.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The following documents filed by the Registrant

with the Commission are hereby incorporated by reference into this Registration Statement:

| (a) |

The Registrant’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Commission on March 7, 2024; |

| |

|

| (b) |

The Registrant’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the Commission on April 25, 2024; |

| |

|

| (c) |

The Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the Commission on July 25, 2024; |

| |

|

| (d) |

The Registrant’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 filed with the Commission on October 24, 2024; |

| |

|

| (e) |

The portions of the Company’s Definitive Proxy Statement on Schedule 14A, filed with the Commission on April 17, 2024, that are incorporated by reference into the Company’s Annual Report on Form 10-K for the year ended December 31, 2023; |

| |

|

| (f) |

The Registrant’s Current Reports on Form 8-K filed with the SEC on May 30, 2024, December 17, 2024, December 23, 2024, January 30, 2025 and February 4, 2025; and |

| |

|

| (g) |

The description of the Registrant’s Common Stock set forth in Exhibit 4.1 to the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2023 (File No. 001-34354), filed with the SEC on March 7, 2024, including any amendments or reports filed for the purpose of updating such description. |

All other reports and other documents subsequently

filed by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the filing of a post-effective

amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold,

shall be deemed to be incorporated by reference into this Registration Statement and to be a part of this Registration Statement from

the date of the filing of such reports and documents, except as to any portion of any future annual or quarterly report to stockholders

or document or current report furnished under Items 2.02 or 7.01 of Form 8-K that is not deemed filed under such provisions.

For the purposes of this Registration Statement,

any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or

superseded to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be

incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed,

except as so modified or superseded, to constitute a part of this Registration Statement.

You should rely only on the information provided

or incorporated by reference in this Registration Statement or any related prospectus. The Registrant has not authorized anyone to provide

you with different information. You should not assume that the information in this Registration Statement or any related prospectus is

accurate as of any date other than the date on the front of the document.

You may contact the Registrant in writing or orally

to request copies of the above-referenced filings, without charge (excluding exhibits to such documents unless such exhibits are specifically

incorporated by reference into the information incorporated into this Registration Statement). Requests for such information should be

directed to:

Altisource Portfolio Solutions S.A.

33, Boulevard Prince Henri

L-1724 Luxembourg

Grand Duchy of Luxembourg

(352) 20 60 20 55

ITEM 8. EXHIBITS.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its

behalf by the undersigned, thereunto duly authorized in Luxembourg City, Luxembourg, on February 12, 2025.

| |

Altisource Portfolio Solutions S.A. |

| |

|

|

| |

By: |

/s/ William B. Shepro |

| |

Name: |

William B. Shepro |

| |

Title: |

Chairman and Chief Executive Officer |

POWER OF ATTORNEY

Know

All Persons By These Presents, that each of Joseph L. Morettini, Roland Müller-Ineichen, John G. Aldridge Jr. and Mary

C. Hickok constitutes and appoints William B. Shepro and Michelle D. Esterman, and each of them, and that William B. Shepro constitutes

and appoints Michelle D. Esterman, and that Michelle D. Esterman constitutes and appoints William B. Shepro, as his or her true

and lawful attorney-in-fact and agent, upon the action of such appointee, with full power of substitution and resubstitution, to do any

and all acts and things and execute, in the name of the undersigned, any and all instruments which each of said attorneys-in-fact and

agents may deem necessary or advisable in order to enable the Registrant to comply with the Securities Act of 1933, as amended (the “Securities

Act”), and any requirements of the Securities and Exchange Commission (the “Commission”) in respect thereof, in connection

with the filing with the Commission of this Registration Statement on Form S-8 under the Securities Act, including specifically but

without limitation, power and authority to sign the name of the undersigned to such Registration Statement, and any amendments to such

Registration Statement (including post-effective amendments), and to file the same with all exhibits thereto and other documents in connection

therewith, with the Commission, to sign any and all applications, Registration Statements, notices or other documents necessary or advisable

to comply with applicable state securities laws, and to file the same, together with other documents in connection therewith with the

appropriate state securities authorities, granting unto each of said attorneys-in-fact and agents full power and authority to do and to

perform each and every act and thing requisite or necessary to be done in and about the premises, as fully and to all intents and purposes

as the undersigned might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents may

lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| SIGNATURE |

|

TITLE |

|

DATE |

| |

|

|

|

|

| /s/ William B. Shepro |

|

Chairman and Chief Executive Officer |

|

February 12, 2025 |

| William B. Shepro |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Michelle D. Esterman |

|

Chief Financial Officer |

|

February 12, 2025 |

| Michelle D. Esterman |

|

(Principal Accounting and Financial Officer) |

|

|

| |

|

|

|

|

| /s/ Joseph L. Morettini |

|

Director |

|

February 12, 2025 |

| Joseph L. Morettini |

|

|

|

|

| |

|

|

|

|

| /s/ Roland Müller-Ineichen |

|

Lead Independent Director |

|

February 12, 2025 |

| Roland Müller-Ineichen |

|

|

|

|

| |

|

|

|

|

| /s/ Mary C. Hickok |

|

Director |

|

February 12, 2025 |

| Mary C. Hickok |

|

|

|

|

| |

|

|

|

|

| /s/ John G. Aldridge, Jr. |

|

Director |

|

February 12, 2025 |

| John G. Aldridge, Jr. |

|

|

|

|

Exhibit 5.1

2, rue Jean Bertholet

L - 1233 Luxembourg

T +352 26 12 29 1

F +352 26 68 43 31 | | Luxembourg, 12 February 2025 |

| | | To Altisource Portfolio Solutions S.A.

33, Boulevard

Prince Henri

L-1724 Luxembourg

(the "Company") |

Ladies and Gentlemen,

Altisource Portfolio Solutions S.A. –

S-8 Registration Statement – 2025

We have acted as special Luxembourg legal counsel

in Luxembourg to Altisource Portfolio Solutions S.A., a public limited liability company (société anonyme),

incorporated under the laws of Luxembourg, having its registered office at 33, boulevard Prince Henri, L-1724 Luxembourg, and registered

with the Companies Register (Registre de Commerce et des Sociétés) under number B72391, in connection with the S-8

Registration Statement and the filing thereof with the SEC.

This opinion letter is rendered to you in order

to be filed with the SEC as an exhibit to the S-8 Registration Statement in connection with the amendment of the Plan with a view to increase

the number of the Company’s shares of common stock, without nominal value (the "Shares") that may be issued under

the Plan by an additional 4,645,875 Shares.

Capitalised terms used in this opinion letter

have the meanings set forth in Exhibit A. Section headings used in this opinion letter are for ease of reference only

and are not to affect its construction or be taken into consideration in its interpretation.

We have taken instructions solely from the Company.

This opinion letter is strictly limited to the

legal matters stated in it only in relation to the S-8 Registration Statement and may not be read as extending by implication to any legal

matters not specifically referred to in it. Nothing in this opinion letter should be taken as expressing an opinion in respect of any

representations or warranties, or other information, contained in any document.

NautaDutilh Avocats Luxembourg S.à r.l.

shall not be held liable for any damage relating to the communication of data or documents. NautaDutilh Avocats Luxembourg S.à r.l.

is incorporated as a société à responsabilité limitée (private limited liability company) in

Luxembourg, with registered office at 2, rue Jean Bertholet L-1233 Luxembourg and registered with the Luxembourg Trade and Companies

Register under number B 189905, with a share capital of EUR 12,500 and registered with the Luxembourg bar on List V. All services

rendered by NautaDutilh Avocats Luxembourg S.à r.l. are subject to the general terms and conditions of NautaDutilh Avocats

Luxembourg S.à r.l., which include, amongst other provisions, a limitation of liability clause and can be consulted at www.nautadutilh.com

(under "General Conditions") and will be provided free of charge upon request.

2

This opinion letter may be filed as an exhibit

to the S-8 Registration Statement and we also consent to the reference to NautaDutilh in the S-8 Registration Statement.

It does not purport to address all matters of

Luxembourg law that may be of relevance to the Company with respect to the S-8 Registration Statement.

In rendering the opinions expressed herein, we

have exclusively reviewed the Corporate Documents and the Public Records, and we have assumed that the Corporate Documents reflect the

reality of the transactions contemplated thereby. We have not investigated or verified any factual matter, whether or not disclosed to

us, in the course of our review, and we assume that any such matter is accurate, complete and up-to-date as of the date hereof.

This opinion letter sets out our opinion on certain

matters of the laws with general applicability in Luxembourg as at the date hereof and as presently interpreted under published authoritative

case law of Luxembourg courts, the General Court and the Court of Justice of the European Union. The opinions and statements expressed

in this opinion letter are limited in all respects to and are to be construed and interpreted in accordance with Luxembourg law. We do

not express any opinion on (i) any taxation matters or taxation consequences relating to the S-8 Registration Statement or any other

tax matters, (ii) regulatory compliance with any licensing requirements (in particular under the Financial Sector Act or the Business

Licences Act), or (iii) securitization law. We do not undertake to revise, update or amend this opinion letter in connection with

or to notify or inform of, any developments and/or changes under Luxembourg law subsequent to the date hereof.

This opinion letter may only be relied upon and

our willingness to render this opinion letter is subject to the condition that the Company accepts that any legal relationship arising

out of or in connection with this opinion letter (whether contractual or non-contractual), including the below submission to jurisdiction,

is governed by Luxembourg law and that any issues of interpretation or liability arising out of or in connection with this opinion letter

are submitted to the exclusive jurisdiction of the competent courts of Luxembourg-City, Luxembourg. No person other than NautaDutilh Avocats

Luxembourg S.à r.l. may be held liable in connection with this opinion letter.

In this opinion letter, legal concepts are expressed

in English terms and not in their French or German terms. Luxembourg legal concepts concerned may not be identical in meaning to the concepts

described by the English terms as they exist under the law of other jurisdictions. There are always irreconcilable linguistic differences

between legal terms or concepts in different jurisdictions. In the event of a conflict or inconsistency, the relevant expression shall

be deemed to refer only to the Luxembourg legal concepts described by the same English terms. We accept no liability for such conflicts

or inconsistencies.

3

Assumptions

For the purposes of this opinion letter, we have

assumed that:

| a. | all documents reviewed by us as execution versions of documents or as fax, photo or electronic copies

of originals are in conformity with the executed originals thereof and such originals are complete and authentic; |

| b. | the Company is not subject to, nor does it meet the criteria to be subject to, any proceedings for general

settlement or composition with creditors (concordat préventif de faillite), controlled management (gestion contrôlée)

or moratorium or reprieve from payment (sursis de paiement) out-of-court mutual agreement (réorganisation extra-judiciaire

par accord amiable), judicial reorganisation in the form of a stay to enter into a mutual agreement (sursis en vue de la conclusion

d’un accord amiable), judicial reorganisation by collective agreement (réorganisation judiciaire par accord collectif),

judicial reorganisation by transfer of assets or activities (réorganisation judiciaire par transfert sous autorité de

justice), conciliation (conciliation) or protective measures (mesures en vue de préserver les entreprises) and

has not been or is not adjudicated bankrupt or been made subject to any other insolvency proceedings (including without limitation administrative

dissolution without liquidation proceedings (procédure de dissolution administrative sans liquidation)) under any applicable

law or otherwise been limited in its rights to dispose of its assets; |

| c. | the place of central administration (siège de l'administration centrale), the place of effective

management (siège de direction effective) and (for the purposes of the Recast Insolvency Regulation) the centre of main

interests (centre des intérêts principaux) of the Company are located at the place of its registered office (siège

statutaire) in Luxembourg and the Company has no establishment (within the meaning of the Recast Insolvency Regulation) outside Luxembourg; |

| d. | the Articles of Association, and the Public Records of the Company are each true, complete and up-to-date

as at the date hereof and at each Relevant Moment and such information has not been materially altered since; |

4

| e. | the authorized share capital (“capital autorisé”) as laid down in art.6 of the

Articles of association allows for the issue of the Shares (other than the shares held as treasury shares) on the date of this opinion

letter; and no internal regulations have been adopted by the Company’s shareholders or board of directors, or any committee which

would affect the Resolutions or the Articles of Association, and will be in force at each relevant Moment; |

| f. | at each Relevant Moment, the Resolutions (as defined in Exhibit B hereto) are and will be

in full force and effect and have not been and will not be amended, revoked or declared null and void, and correctly reflect the resolutions

taken by the persons authorized to do so, and the factual statements made and the confirmations given in the Resolutions are and will

be complete, correct and up-to-date; |

| g. | none of the directors (administrateurs) of the Company had a conflict of interest regarding the

matters covered by the Resolutions and none of them has had a conflict of interest with respect thereto since; |

| h. | all factual matters and statements relied upon or assumed in this opinion letter are and were true and

complete on the date of filing of the S-8 Registration Statement (and any document in connection therewith) and the date of this opinion

letter; |

| i. | no provision of law (other than Luxembourg law) would at each Relevant Moment adversely affect or have

any negative impact on the opinions we express in this opinion letter; |

| j. | at each Relevant Moment, each of the assumptions, made in this opinion letter will be true and correct

in all aspects by reference to the facts and circumstances then existing. |

5

Opinions

Based upon the foregoing and subject to the qualifications

set forth herein and to any matters, documents or events not disclosed to us, we express the following opinions:

Corporate Status

| 1. | The Company is validly existing as a public limited liability company (société anonyme)

under the laws of Luxembourg. |

Shares

| 2. | Following effectiveness of the S-8 Registration Statement, and subject to (i) the approval by the

board of directors of the Company of the issuance of the Shares, (ii) the receipt by the Company of payment in full for the Shares

and (ii) the approval of the Plan by the Company’s shareholders, and when issued, transferred or allotted, as the case may

be and accepted in accordance with the Plan, the Resolutions, the Articles of Association and the laws of Luxembourg, the Shares will

be validly issued or allotted, transferred, subscribed for, fully paid up and non-assessable. |

Corporate Action

| 3. | The Company has taken all corporate or other action required by its Articles of Association and Luxembourg

law in connection with approving, authorizing and entering into the Plan and the amendments thereto to include an additional 4,645,875

Shares. |

Qualifications

The opinions expressed above are subject to the

following qualifications:

| A. | As Luxembourg lawyers we are not qualified or able to assess the true meaning and purport of the terms

of the S-8 Registration Statement under the applicable law and we have made no investigation of such meaning and purport. Our review of

the S-8 Registration Statement and of any other documents subject or expressed to be subject to any law other than Luxembourg law has

therefore been limited to the terms of such documents as they appear to us on their face. |

| B. | Corporate documents (including but not limited to a notice of a winding-up order or resolution, notice

of the appointment of a liquidator, receiver, administrator, or administrative receiver and mandataire judiciaire or conciliateur

under Luxembourg law) may not be held immediately at the Companies Register or are not subject to be deposited/held at the Companies Register

and there may also be a delay in the relevant document to be deposited with the Companies Register or appearing on the file of the Company

with the Companies Register, which may therefore be incomplete and/or inaccurate, and the Extract, and the Negative Certificate may not

constitute conclusive evidence of the facts reflected therein. |

6

| C. | Under Article 19-3 of the Companies Register Act, documents and extracts of documents will only be

valid vis-à-vis third parties from the day of their publication in the RESA unless the Company proves that the relevant

third parties had prior knowledge thereof. Third parties may however rely upon documents, such as the Resolutions, or extracts thereof,

which have not yet been published in the RESA. Such documents are not enforceable against third parties during 15 (fifteen) days following

publication if they prove that it was impossible for them to have knowledge thereof. |

| D. | An enquiry with the Companies Register is not capable of conclusively revealing whether or not a winding-up

petition or a petition for the making of an administration or bankruptcy order or similar action has been presented or is threatened to

be presented; therefore, any reliance on the Negative Certificate should be made with regard to the functionality of the Companies Register. |

| E. | Any activity by the Company contrary to criminal law as well as any serious violation (contravention

grave) by the Company of the provisions of the Luxembourg Commercial Code, of the laws governing commercial companies (including without

limitation with respect to any business licence requirement) and of the Financial Sector Act may lead to the liquidation and winding-up

of the Company. The assessment of whether any violation of said requirements is serious, is left to the discretion of the courts. For

the purpose of this opinion letter, we have not verified whether or not the Company has complied with all requirements of Luxembourg law

applicable to the domiciliation of companies. |

| F. | The term "non-assessable" has no equivalent in the Luxembourg language and for purposes of this

opinion letter such term should be interpreted to mean that a holder of a share will not by reason of merely being such a holder be subject

to assessment or calls by the Company or its creditors for further payment on such share. |

| G. | We express no opinion or view on the operational rules and procedures of any clearing or settlement

system or agency. |

7

| Yours

faithfully, |

|

| |

|

| /s/

Margaretha (Greet) Wilkenhuysen |

|

| |

|

| NautaDutilh

Avocats Luxembourg S.à r.l. |

|

| Authorized

Signatory: |

|

| Margaretha

(Greet) Wilkenhuysen |

|

8

Exhibit A

List of Definitions

| "Articles of Association" |

has the meaning attributed thereto in Exhibit B |

| "Business Licences Act" |

the Luxembourg Act of 2 September 2011 regulating access to the professions of craftsman, trader, industrialist as well as certain liberal professions, as amended |

| "Companies Register" |

the Luxembourg Register of Commerce and Companies (R.C.S. Luxembourg) |

| "Company" |

Altisource Portfolio Solutions S.A., a public limited liability company (société anonyme) incorporated under the laws of Luxembourg, having its registered office at 33, boulevard Prince Henri, L-1724 Luxembourg, and registered with the Companies Register (Registre de Commerce et des Sociétés) under number B72391 |

| "Corporate Documents" |

has the meaning attributed thereto in Exhibit B |

| "Extract" |

has the meaning attributed thereto in Exhibit B |

| "Financial Sector Act" |

the Luxembourg Act of 5 April 1993 regarding the financial sector, as amended |

| "Luxembourg" |

the Grand Duchy of Luxembourg |

| "Luxembourg Commercial Code" |

the Luxembourg Commercial Code (Code de Commerce) |

| "NautaDutilh" |

NautaDutilh Avocats Luxembourg S.à r.l. |

| "Negative Certificate" |

has the meaning attributed thereto in Exhibit B |

9

| "Plan" |

the Altisource Portfolio Solutions S.A. Amended and Restated 2009 Equity Incentive Plan initially adopted on 7 August 2009, as amended from time to time, to include another 4,645,875 shares in the Company. |

| "Public Records" |

has the meaning attributed thereto in Exhibit B |

| "Recast Insolvency Regulation" |

the Regulation (EU) 2015/848 of the European Parliament and of the Council of 20 May 2015 on insolvency proceedings (recast), as amended by Regulation (EU) 2021/2260 of the European Parliament and of the Council of 15 December 2021 |

| "Relevant Moment" |

each time when Shares were, or will be, issued, transferred or allotted, as the case may be |

| "RESA" |

the Luxembourg Electronic Register of Companies and Associations (Recueil Electronique des Sociétés et Associations) |

| "Resolutions" |

has the meaning attributed thereto in Exhibit B |

| "S-8 Registration Statement" |

the Company's registration statement on Form S-8 filed or to be filed with the SEC on or about the date of this opinion letter |

| "SEC" |

the United States Securities and Exchange Commission |

10

Exhibit B

List of Corporate Documents

and Public Records

List of corporate documents

and public records of Altisource Portfolio Solutions S.A.:

| 1. | an electronic copy of the (restated) articles of association of the Company dated 17 May 2022 (the

"Articles of Association"); |

| 2. | an electronic copy of (a) the resolutions of the directors (administrateurs) of the Company

dated 16 December 2024 (the "Board Resolutions 1"), and (b) the resolutions of the directors (administrateurs)

of the Company dated 29 January 2025 (the "Board Resolutions 2" and together with the Board Resolutions 1, the "Resolutions"); |

| 3. | an electronic copy of a certificate of non-registration of judgments, or administrative dissolution

without liquidation, issued by the Companies Register for the Company on 12 February 2025 and reflecting the situation of 11

February 2025, and stating that the Company has not been declared bankrupt (en faillite) has not been subject to

administrative dissolution without liquidation proceedings (procédure de dissolution administrative sans liquidation)

and that it has not applied for reprieve from payment (sursis de paiement) or such other proceedings listed in

Article 13, items 4 to 12, 16 and 17 of the Companies Register Act (the "Negative Certificate"); and |

| 4. | an electronic copy of a register extract for

the Company issued by the Companies Register dated 12 February 2025 (the "Extract"). |

The Articles of Association and the Resolutions

are collectively referred to as the "Corporate Documents".

The Negative Certificate and the Extract are collectively

referred to as the "Public Records".

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in this Registration Statement

on Form S-8 of Altisource Portfolio Solutions S.A. of our report dated March 7, 2024, relating to the consolidated financial

statements of Altisource Portfolio Solutions S.A., appearing in the Annual Report on Form 10-K of Altisource Portfolio Solutions

S.A. for the year ended December 31, 2023.

/s/ RSM US LLP

Jacksonville, Florida

February 12, 2025

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Altisource Portfolio Solutions S.A.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

Security

Type |

Security Class

Title |

Fee Calculation

Rule |

Amount

Registered(1) |

Proposed

Maximum

Offering Price

Per Unit |

Maximum Aggregate

Offering Price |

Fee Rate |

Amount of

Registration Fee |

| Equity |

Common Stock, $1.00 par value per share |

457(h) |

4,645,875 (2) |

$0.791 (3) |

$3,674,887.13 |

0.00015310 |

$562.63 |

| Total Offering Amounts |

$3,674,887.13 |

— |

$562.63 |

| Total Fees Previously Paid |

— |

— |

— |

| Total Fee Offsets |

— |

— |

— |

| Net Fee Due |

— |

— |

$562.63 |

| (1) |

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement on Form S-8 (the “Registration Statement”) shall also cover any additional shares of the Registrant’s common stock, $1.00 par value per share (“Common Stock”), that become issuable under the Altisource Portfolio Solutions S.A. Amended and Restated 2009 Equity Incentive Plan (the “2009 Plan”), by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without receipt of consideration that increases the number of outstanding shares of the Registrant’s Common Stock. |

| |

|

| (2) |

Represents shares of Common Stock reserved for awards available for future issuance under the Plan. |

| |

|

| (3) |

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(h) of the Securities Act. The proposed maximum offering price per share and the proposed maximum aggregate offering price are calculated based on $0.79 per share, the average of the high and low prices of the Common Stock as reported on the Nasdaq Global Select Market on February 5, 2025, a date within five business days prior to the filing of this Registration Statement. |

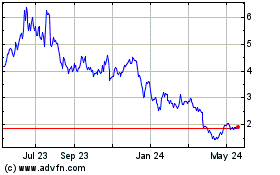

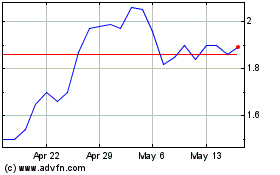

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Mar 2024 to Mar 2025