-

Advanced oncology pipeline including more than 20 active Phase 2

and Phase 3 clinical trials with a strategic focus on two priority

pan-tumor programs: next-generation immunomodulator candidate

BNT327 and mRNA cancer immunotherapies

-

Multiple data readouts expected in 2025 and 2026 aimed at providing

clinical proof of BioNTech’s pipeline strategy and advancing the

Company towards becoming a diversified multi-product oncology

portfolio company by 2030

-

Completed acquisition of Biotheus securing full control of

next-generation immunomodulator candidate BNT327, a bispecific

antibody targeting PD-L1 and VEGF-A1

-

Successfully launched JN.1- and KP.2-adapted COVID-19 vaccines

across different countries and regions and maintained global market

leadership

-

Fourth quarter and full year 2024 revenues of €1.2 billion and

€2.8 billion**, respectively

-

Full year 2024 net loss of €0.7 billion and diluted loss per share

of €2.77 ($3.00)1

-

Cash and cash equivalents plus security investments of

€17.4 billion as of December 31, 20242

-

Expects 2025 total revenues between €1.7 billion and €2.2

billion

Conference call and webcast scheduled for March 10, 2025, at

8:00 a.m. EDT (1:00 p.m. CET)

MAINZ, Germany, March 10, 2025 (GLOBE

NEWSWIRE) -- BioNTech SE (Nasdaq: BNTX, “BioNTech” or “the

Company”) today reported financial results for the three months and

full year ended December 31, 2024, and provided an update on

its corporate progress.

“From the very beginning, BioNTech’s vision has

been to translate our science into survival and become an

immunotherapy powerhouse. In 2024, we made significant progress

towards our vision through important oncology pipeline

advancements, including the initiation of global Phase 3 clinical

trials for our anti-PD-L1/VEGF-A bispecific antibody candidate

BNT327 and key data updates from our mRNA cancer immunotherapy

programs,” said Prof. Ugur Sahin, M.D., CEO and Co-Founder of

BioNTech. “We expect 2025 to be a data-rich year with multiple

important updates from our priority programs, which we believe have

disruptive potential and could improve the standard of care, if

successfully developed and approved.”

Financial Review for Fourth Quarter and Full

Year 2024 Financial Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| in

millions €, except per share data |

|

|

Fourth Quarter 2024 |

|

|

Fourth Quarter 2023 |

|

|

Full Year 2024 |

|

|

Full Year2023 |

| Total

revenues |

|

|

1,190.0 |

|

|

1,479.0 |

|

|

2,751.1 |

|

|

3,819.0 |

| Net

profit / (loss) |

|

|

259.5 |

|

|

457.9 |

|

|

(665.3) |

|

|

930.3 |

| Diluted

earnings / (loss) per share |

|

|

1.08 |

|

|

1.88 |

|

|

(2.77) |

|

|

3.83 |

Total revenues reported were €1,190.0

million for the three months ended December 31, 2024, compared

to €1,479.0 million for the comparative prior year period. For the

year ended December 31, 2024, revenues were €2,751.1 million,

compared to €3,819.0 million for the comparative prior year

period. The decrease in revenues was primarily driven by lower

sales of the Company’s COVID-19 vaccines due to reduced market

demand. In addition, write-downs by BioNTech’s collaboration

partner Pfizer Inc. (“Pfizer”) significantly reduced the Company’s

gross profit share which negatively influenced its revenues.

Cost of sales were €243.5 million

for the three months ended December 31, 2024, compared to

€179.1 million for the comparative prior year period. For the

year ended December 31, 2024, cost of sales were

€541.3 million, compared to €599.8 million for the

comparative prior year period. Cost of sales were influenced by

COVID-19 vaccine sales and inventory write-downs and scrapping.

Research and development (“R&D”)

expenses were €611.8 million for the three months ended

December 31, 2024, compared to €577.8 million for the

comparative prior year period. For the year ended December 31,

2024, R&D expenses were €2,254.2 million, compared to

€1,783.1 million for the comparative prior year period.

R&D expenses were mainly influenced by advancing clinical

studies for the Company’s late-stage oncology product candidates.

Further contributions to the increase came from higher personnel

expenses resulting from an increase in headcount.

Sales, general and administrative

(“SG&A”)3 expenses, in total, amounted to €132.1 million

for the three months ended December 31, 2024, compared to

€142.3 million for the comparative prior year period. For the

year ended December 31, 2024, SG&A expenses were

€599.0 million, compared to €557.7 million for the

comparative prior year period. SG&A expenses were mainly

influenced by the setup and enhancement of commercial IT platforms

and personnel expenses resulting from an increase in headcount.

Other operating results amounted to

negative €54.0 million during the three months ended

December 31, 2024, compared to negative €53.6 million for the

comparative prior year period. For the year ended December 31,

2024, other operating result amounted to negative €670.9 million

compared to negative €188.0 million for the prior year period. The

decrease was mainly due to the settlement of contractual disputes

and related expenses to such disputes and other litigations. The

amounts for contractual disputes are net of the related

reimbursements expected to be received.

Income taxes were accrued with an amount

of €41.7 million in tax expenses for the three months ended

December 31, 2024, compared to €205.3 million in accrued

tax expenses for the comparative prior year period. For the year

ended December 31, 2024, income taxes were realized with an

amount of €12.4 million in tax income for the year ended

December 31, 2024, compared to €255.8 million of accrued tax

expenses for the comparative prior year period.

Net profit was €259.5 million for the

three months ended December 31, 2024, compared to €457.9

million net profit for the comparative prior year period. For the

year ended December 31, 2024, net loss was €665.3

million, compared to a net profit of €930.3 million for the

comparative prior year period.

Cash and cash equivalents plus security

investments2 as of December 31, 2024, reached

€17,359.2 million, comprising of €9,761.9 million in cash

and cash equivalents, €6,536.2 million in current security

investments and €1,061.1 million in non-current security

investments.

Diluted earnings per share was €1.08 for

the three months ended December 31, 2024, compared to €1.88

for the comparative prior year period. For the year ended

December 31, 2024, diluted loss per share was €2.77, compared

to diluted earnings per share of €3.83 for the comparative prior

year period.Shares outstanding as of December 31, 2024,

were 239,970,804, excluding 8,581,396 shares held in treasury.

“Through strategic investments in our priority

programs like our next-generation immunomodulator candidate BNT327,

we strive to meaningfully improve treatments for patients,” said

Jens Holstein, CFO of BioNTech. “Our strong financial position

enables us to fuel our R&D activities and to prepare for

multiple product launches in the coming years. With our targeted

investments we aim to create long-term value for the benefit of

BioNTech’s stakeholders.”

2025 Financial Year Guidance4

|

Total revenues for the 2025 financial year |

|

€1,700 million - €2,200 million |

BioNTech expects its revenues for the full 2025

financial year to be in the range of €1,700 - €2,200 million and

revenue phasing similar to 2024, primarily concentrated in the last

three to four months, driving the full year revenue figure. The

revenue guidance assumes: relatively stable vaccination rates,

pricing levels and market share compared to 2024; estimated

inventory write-downs and other charges by BioNTech’s collaboration

partner Pfizer that negatively influence BioNTech’s revenues;

anticipated revenues from a pandemic preparedness contract with the

German government; and anticipated revenues from the BioNTech Group

service businesses.

Planned 2025 Financial Year Expenses and

Capex

|

R&D expenses |

|

|

€2,600 million - €2,800 million |

|

|

SG&A expenses |

|

|

€650 million - €750 million |

|

|

Capital expenditures for operating activities |

|

|

€250 million - €350 million |

|

BioNTech expects to continue to focus

investments on R&D and scaling the business for late-stage

development and commercial readiness in oncology, while continuing

to be cost disciplined. Strategic capital allocation will remain a

key driver of the Company’s trajectory. As part of BioNTech’s

strategy, the Company may continue to evaluate appropriate

corporate development opportunities with the aim of driving

sustainable long-term growth and create future value.

The full audited consolidated financial

statements as of and for the year ended December 31,

2024, can be found in BioNTech’s Annual Report on Form 20-F

filed today with the United States Securities and Exchange

Commission (“SEC”) and available at www.sec.gov.

Endnotes1 Calculated applying the average

foreign exchange rate for the year ended December 31, 2024, as

published by the German Central Bank (Deutsche Bundesbank).

2 Payments associated with the closing of the

Biotheus acquisition and with the resolved settlement of a

contractual dispute with the National Institutes of Health (“NIH”)

are expected to result in a cash outflow of approximately $1.6

billion to be reflected in cash & cash equivalents in the

Company’s first quarter 2025 financial results. The settlement

payment of $467 million related to a contractual dispute with the

University of Pennsylvania is expected to be reflected in the

Company’s second quarter 2025 financial results. In connection with

these settlements, BioNTech expects to be reimbursed approximately

$535 million by its partner during 2025 and 2026.

3 Sales, general and administrative expenses

(“SG&A”) include sales and marketing expenses as well as

general and administrative expenses.

4 Excludes external risks that are not yet known

and/or quantifiable, including, but not limited to the effects of

ongoing and/or future legal disputes and related activities,

certain potential one-time effects and charges related to portfolio

prioritization, as well as potential changes to the law or

governmental policy, including public health policy, at the state

or national level, and evolving public sentiment around vaccines

and mRNA technology, in the United States and/or elsewhere. It

includes effects identified from licensing arrangements,

collaborations or potential M&A transactions to the extent

disclosed and may be subject to update. The Company does not expect

to report a positive net income figure for the 2025 financial

year.

Operational Review for the Fourth Quarter

2024, Key Post Period-End Events and 2025 Outlook

Selected Oncology Pipeline UpdatesIn

2024, the Company’s pipeline continued to mature towards later

stages of clinical development with a focus on two priority

programs: our investigational next-generation immunomodulator

candidate BNT327 and mRNA cancer immunotherapies. BioNTech’s

oncology pipeline currently contains over 20 ongoing Phase 2 and 3

clinical trials. In 2025, the Company plans to continue progressing

its pipeline towards commercialization, with its first oncology

launch expected in 2026.

Next-Generation Immunomodulators

BNT327 is a bispecific antibody candidate

combining PD-L1 checkpoint inhibition with VEGF-A

neutralization.

-

In December 2024, BioNTech initiated a global randomized Phase 3

clinical trial (NCT06712355) evaluating BNT327 plus chemotherapy

compared to atezolizumab plus chemotherapy in first-line

extensive-stage small cell lung cancer (“ES-SCLC”).

-

In December 2024, BioNTech initiated a global randomized Phase 2/3

clinical trial (NCT06712316) evaluating BNT327 plus chemotherapy

compared to pembrolizumab plus chemotherapy in first-line non-small

cell lung cancer (“NSCLC”).

-

In December 2024, at the San Antonio Breast Cancer Symposium

(“SABCS”), interim data were presented from the Phase 1/2 clinical

trial (NCT05918133) evaluating BNT327 in combination with

chemotherapy in a cohort of patients with locally advanced,

previously untreated triple-negative breast cancer (“TNBC”). In 42

patients, first-line treatment with BNT327 combined with

nab-paclitaxel chemotherapy showed encouraging antitumor activity

and survival outcomes regardless of PD-L1 status, together with a

manageable safety profile.

-

A global randomized Phase 3 clinical trial evaluating BNT327 in

first-line TNBC is on track to start in 2025.

-

Data from the ongoing global Phase 2 dose optimization clinical

trials evaluating BNT327 in combination with chemotherapy in

first-line small cell lung cancer (“SCLC”) (BNT327-01, NCT06449209)

and TNBC (BNT327-02, NCT06449222) are planned to be published in

2025.

-

Data from two Phase 2 clinical trials conducted in China in first-

and second-line SCLC (NCT05844150, NCT05879068, respectively) are

expected to be presented at the European Lung Cancer Congress

(“ELCC”) taking place March 26-29, 2025 in Paris, France.

Title: Phase 2 study of the efficacy and safety

of BNT327 plus systemic chemotherapy as first-line therapy for

ES-SCLCPresentation Date: March 28, 2025Poster Number: 302PAuthor:

Y. Cheng

Title: Updated Phase 2 efficacy and safety

results of BNT327 combined with paclitaxel as second-line therapy

in SCLCPresentation Date: March 28, 2025Poster Number: 332PAuthor:

Y. Cheng

-

First clinical data from the ongoing global Phase 1/2 expansion

cohorts (NCT05438329) evaluating the combination of BNT327 and

BNT325/DB-1305, a TROP2-targeted antibody-drug conjugate (“ADC”)

candidate, are planned to be published in 2025.

-

Additional clinical trials exploring novel combinations of BNT327

with the ADC candidates BNT323/DB-1303 (trastuzumab pamirtecan)

targeting HER2, BNT324/DB-1311 targeting B7-H3 or BNT326/YL202

targeting HER3 are planned to start in 2025.

BNT316/ONC-392 (gotistobart) is an

anti-CTLA-4 monoclonal antibody candidate being developed in

collaboration with OncoC4, Inc. (“OncoC4”).

-

In December 2024, the U.S. Food and Drug Administration (“FDA”)

lifted the partial clinical hold on the OncoC4-sponsored Phase 3

clinical trial (PRESERVE-003; NCT05671510) evaluating the efficacy

and safety of BNT316/ONC-392 as monotherapy in patients with

metastatic NSCLC that progressed under previous PD-(L)1-inhibitor

treatment. Based on the available clinical trial data and upon

alignment with the FDA, the companies will solely continue

enrollment of patients with squamous NSCLC.

mRNA Cancer Immunotherapies

Autogene cevumeran (BNT122/RO7198457) and BNT111

are investigational immunotherapies for the treatment of cancer

based on BioNTech’s systemically administered uridine mRNA-lipoplex

technology.

Autogene cevumeran is an individualized

neoantigen-specific mRNA cancer immunotherapy candidate being

developed in collaboration with Genentech, Inc. (“Genentech”), a

member of the Roche Group (“Roche”).

-

In December 2024, the first patient was treated in a global

randomized Phase 2 clinical trial (IMCODE004; NCT06534983)

evaluating autogene cevumeran in combination with nivolumab

compared to nivolumab alone as an adjuvant treatment in high-risk

muscle-invasive urothelial carcinoma (“MIUC”).

-

In January 2025, a manuscript summarizing the results of a Phase 1

clinical trial (NCT03289962) evaluating autogene cevumeran in

combination with atezolizumab in patients with advanced solid

tumors was published in Nature Medicine (Lopez et al., 2025). In

February 2025, a manuscript denoting follow up data from an

investigator-initiated Phase 1 clinical trial (NCT04161755, Rojas

et al., 2023) evaluating autogene cevumeran in combination with

atezolizumab in patients with pancreatic ductal adenocarcinoma

(“PDAC”) in an adjuvant treatment setting was published in Nature

(Sethna et al., 2025).

-

First data from the ongoing global randomized Phase 2 clinical

trial (NCT04486378) evaluating autogene cevumeran as an adjuvant

treatment compared to watchful waiting after standard of care

chemotherapy in resected circulating tumor DNA+ (“ctDNA”) stage II

(high-risk) and III colorectal cancer (“CRC”) are anticipated in

late 2025 or early 2026.

BNT111 is based on BioNTech’s fully

owned, off-the-shelf FixVac platform, and encodes four

melanoma-associated antigens.

-

BioNTech plans to present data from the ongoing Phase 2 clinical

trial (BNT111-01; NCT04526899) at a medical conference in 2025. In

2024, an initial topline readout was provided noting that the

clinical trial had met its primary efficacy outcome measure,

demonstrating a statistically significant improvement in overall

response rate (“ORR”) in patients with anti-PD-(L)1

refractory/relapsed, unresectable stage III or IV melanoma treated

with BNT111 in combination with cemiplimab as compared to

historical control in this treatment setting.

Antibody-Drug Conjugates

BNT323/DB-1303 (trastuzumab

pamirtecan) is an ADC candidate targeting HER2 that is being

developed in collaboration with Duality Biologics (Suzhou) Co. Ltd.

(“DualityBio”).

-

BNT323/DB-1303 is being evaluated in a Phase 1/2 clinical trial

(NCT05150691) in patients with advanced/unresectable, recurrent or

metastatic HER2-expressing solid tumors. Data from patients with

HER2-expressing (IHC3+, 2+, 1+ or ISH-positive) advanced

endometrial carcinoma are expected in 2025. A confirmatory Phase 3

clinical trial (NCT06340568) is planned to start in 2025.

-

Preparation of a potential Biologics License Application (“BLA”)

submission for BNT323/DB-1303 as a second line or subsequent

therapy in HER2-expressing advanced endometrial cancer in

2025.

BNT324/DB-1311 is an ADC candidate

targeting B7-H3 that is being developed in collaboration with

DualityBio. The program has received Fast Track designation from

the FDA for the treatment of patients with advanced

castration-resistant prostate cancer (“CRPC”) who have progressed

on or after standard systemic regimens and Orphan Drug designation

for the treatment of patients with advanced esophageal squamous

cell carcinoma.

-

In December 2024, preliminary data from the first-in-human,

open-label Phase 1/2 clinical trial (NCT05914116) were presented at

the 2024 European Society for Medical Oncology (“ESMO”) Asia

Congress, demonstrating encouraging efficacy and a manageable

safety profile across a range of advanced solid tumors.

Cell Therapies

BNT211 consists of a CAR-T cell product

candidate targeting CLDN6-positive solid tumors in combination with

a CAR-T cell-amplifying RNA cancer immunotherapy encoding

CLDN6.

-

In January 2025, the FDA granted Regenerative Medicine Advanced

Therapy (“RMAT”) designation for BNT211. The RMAT designation is

designed to expedite the development and review process for

promising pipeline products, including cell therapies.

-

A pivotal Phase 2 clinical trial in patients with testicular germ

cell tumors is expected to start in 2025 based on encouraging

clinical activity observed in this patient population in the

ongoing Phase 1 clinical trial (NCT04503278). The Phase 1 clinical

trial is ongoing to evaluate BNT211 in other CLDN6+ cancer types,

including NSCLC and gynecologic cancers.

Selected Infectious Diseases Pipeline

Updates

BioNTech and Pfizer developed, manufactured and

delivered JN.1- and KP.2-adapted COVID-19 vaccines which received

multiple regulatory approvals and marketing authorizations in more

than 40 countries and regions. In 2024, BioNTech and Pfizer

delivered approximately 180 million variant-adapted COVID-19

vaccine doses worldwide.

BioNTech and Pfizer continue to invest in the

research and development of next-generation and combination

COVID-19 vaccine candidates.

Corporate Update for the Fourth Quarter 2024

and Key Post Period-End Events

-

In November 2024, BioNTech signed an agreement to acquire Biotheus

and obtain full global rights to BNT327 and to all other candidates

from Biotheus’ pipeline, as well as to its in-house antibody

generation platform and bispecific ADC capability. The transaction

amounted to an upfront consideration of $800 million, plus

additional performance-based payments of up to $150 million. The

acquisition was completed in February 2025.

Upcoming Investor and Analyst Events

-

Sustainability Report 2024 Publication: March 24, 2025

-

Annual General Meeting: May 16, 2025

-

Innovation Series AI Day: October 1, 2025

-

Innovation Series R&D Day: November 18, 2025

Conference Call and Webcast

InformationBioNTech invites investors and the general public to

join a conference call and webcast with investment analysts today,

March 10, 2025, at 8:00 a.m. EDT (1:00 p.m. CET) to report its

financial results and provide a corporate update for the fourth

quarter and full year 2024.

To access the live conference call via

telephone, please register via this link. Once registered, dial-in

numbers and a PIN number will be provided.

The slide presentation and audio of the webcast

will be available via this link.

Participants may also access the slides and the

webcast of the conference call via the “Events & Presentations”

page of the Investor section of the Company’s website at

www.BioNTech.com. A replay of the webcast will be available shortly

after the conclusion of the call and archived on the Company’s

website for 30 days following the call.

About BioNTechBiopharmaceutical New

Technologies (BioNTech) is a global next generation immunotherapy

company pioneering novel investigative therapies for cancer and

other serious diseases. BioNTech exploits a wide array of

computational discovery and therapeutic modalities with the intent

of rapid development of novel biopharmaceuticals. Its diversified

portfolio of oncology product candidates aiming to address the full

continuum of cancer includes mRNA cancer immunotherapies,

next-generation immunomodulators and targeted therapies such as

antibody-drug conjugates (ADCs) and innovative chimeric antigen

receptor (CAR) T cell therapies. Based on its deep expertise in

mRNA development and in-house manufacturing capabilities, BioNTech

and its collaborators are researching and developing multiple mRNA

vaccine candidates for a range of infectious diseases alongside its

diverse oncology pipeline. BioNTech has established a broad set of

relationships with multiple global and specialized pharmaceutical

collaborators, including Duality Biologics, Fosun Pharma,

Genentech, a member of the Roche Group, Genevant, Genmab, MediLink,

OncoC4, Pfizer and Regeneron.

For more information, please visit www.BioNTech.com.

Forward-Looking StatementsThis press

release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, as amended,

including, but not limited to, statements concerning: BioNTech’s

expected revenues and net profit/(loss) related to sales of

BioNTech’s COVID-19 vaccine, referred to as COMIRNATY where

approved for use under full or conditional marketing authorization,

in territories controlled by BioNTech’s collaboration partners,

particularly for those figures that are derived from preliminary

estimates provided by BioNTech’s partners; the rate and degree of

market acceptance of BioNTech’s COVID-19 vaccine and, if approved,

BioNTech’s investigational medicines; expectations regarding

anticipated changes in COVID-19 vaccine demand, including changes

to the ordering environment and expected regulatory recommendations

to adapt vaccines to address new variants or sublineages; the

initiation, timing, progress, results, and cost of BioNTech’s

research and development programs, including BioNTech’s current and

future preclinical studies and clinical trials, including

statements regarding the expected timing of initiation, enrollment,

and completion of studies or clinical trials and related

preparatory work and the availability of results, and the timing

and outcome of applications for regulatory approvals and marketing

authorizations; BioNTech’s expectations regarding potential future

commercialization in oncology, including goals regarding timing and

indications; the targeted timing and number of additional

potentially registrational clinical trials, and the registrational

potential of any clinical trial BioNTech may initiate; discussions

with regulatory agencies; BioNTech’s expectations with respect to

intellectual property; the impact of BioNTech’s collaboration and

licensing agreements; the development, nature and feasibility of

sustainable vaccine production and supply solutions; the deployment

of AI across BioNTech’s preclinical and clinical operations;

BioNTech’s estimates of revenues, research and development

expenses, selling, general and administrative expenses and capital

expenditures for operating activities; BioNTech’s expectations

regarding upcoming payments relating to litigation settlements;

BioNTech’s expectations for upcoming scientific and investor

presentations; and BioNTech’s expectations of net profit/(loss). In

some cases, forward-looking statements can be identified by

terminology such as “will,” “may,” “should,” “expects,” “intends,”

“plans,” “aims,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential,” “continue,” or the negative of these terms

or other comparable terminology, although not all forward-looking

statements contain these words.

The forward-looking statements in this press

release are based on BioNTech’s current expectations and beliefs of

future events, and are neither promises nor guarantees. You should

not place undue reliance on these forward-looking statements

because they involve known and unknown risks, uncertainties, and

other factors, many of which are beyond BioNTech’s control and

which could cause actual results to differ materially and adversely

from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to: the uncertainties inherent in research and development,

including the ability to meet anticipated clinical endpoints,

commencement and/or completion dates for clinical trials, projected

data release timelines, regulatory submission dates, regulatory

approval dates and/or launch dates, as well as risks associated

with preclinical and clinical data, including the data discussed in

this release, and including the possibility of unfavorable new

preclinical, clinical or safety data and further analyses of

existing preclinical, clinical or safety data; the nature of the

clinical data, which is subject to ongoing peer review, regulatory

review and market interpretation; BioNTech’s pricing and coverage

negotiations regarding its COVID-19 vaccine with governmental

authorities, private health insurers and other third-party

payors; the future commercial demand and medical need for

initial or booster doses of a COVID-19 vaccine; competition from

other COVID-19 vaccines or related to BioNTech’s other product

candidates, including those with different mechanisms of action and

different manufacturing and distribution constraints, on the basis

of, among other things, efficacy, cost, convenience of storage and

distribution, breadth of approved use, side-effect profile and

durability of immune response; the timing of and BioNTech’s ability

to obtain and maintain regulatory approval for its product

candidates; the ability of BioNTech’s COVID-19 vaccines to prevent

COVID-19 caused by emerging virus variants; BioNTech’s and its

counterparties’ ability to manage and source necessary energy

resources; BioNTech’s ability to identify research opportunities

and discover and develop investigational medicines; the ability and

willingness of BioNTech’s third-party collaborators to continue

research and development activities relating to BioNTech's

development candidates and investigational medicines; the impact of

COVID-19 on BioNTech’s development programs, supply chain,

collaborators and financial performance; unforeseen safety issues

and potential claims that are alleged to arise from the use of

products and product candidates developed or manufactured by

BioNTech; BioNTech’s and its collaborators’ ability to

commercialize and market BioNTech’s COVID-19 vaccine and, if

approved, its product candidates; BioNTech’s ability to manage its

development and related expenses; regulatory and political

developments in the United States and other countries; BioNTech’s

ability to effectively scale its production capabilities and

manufacture its products and product candidates; risks relating to

the global financial system and markets; and other factors not

known to BioNTech at this time.

You should review the risks and uncertainties

described under the heading “Risk Factors” in BioNTech’s Report on

Form 20-F for the period ended December 31, 2024 and in

subsequent filings made by BioNTech with the SEC, which are

available on the SEC’s website at www.sec.gov. These

forward-looking statements speak only as of the date hereof. Except

as required by law, BioNTech disclaims any intention or

responsibility for updating or revising any forward-looking

statements contained in this press release in the event of new

information, future developments or otherwise.

CONTACTS

Investor RelationsMichael

HorowiczInvestors@biontech.de

Media Relations Jasmina Alatovic Media@biontech.de

Target abbreviation directory

|

Anti-PD-(L)1 |

Anti-programmed cell death protein (death-ligand) 1 |

|

B7-H3 |

B7 Homolog 3 |

|

CLDN6 |

Antigen Claudin 6 |

|

CTLA-4 |

Cytotoxic T-lymphocyte–associated antigen 4 |

|

HER2 |

Human Epidermal Growth Factor Receptor 2 |

|

HER3 |

Human Epidermal Growth Factor Receptor 3 |

|

PD-L1 |

Programmed death-ligand 1 |

|

TROP2 |

Trophoblast cell-surface antigen 2 |

|

VEGF-A |

Vascular endothelial growth factor A |

Consolidated Statements of Profit or

Loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended December 31, |

|

|

Years ended December 31, |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| (in millions €, except per share

data) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

Revenues |

|

|

1,190.0 |

|

|

1,479.0 |

|

|

2,751.1 |

|

|

3,819.0 |

|

Cost of sales |

|

|

(243.5) |

|

|

(179.1) |

|

|

(541.3) |

|

|

(599.8) |

| Research

and development expenses |

|

|

(611.8) |

|

|

(577.8) |

|

|

(2,254.2) |

|

|

(1,783.1) |

| Sales and

marketing expenses |

|

|

(21.3) |

|

|

(18.0) |

|

|

(67.9) |

|

|

(62.7) |

| General

and administrative expenses |

|

|

(110.8) |

|

|

(124.3) |

|

|

(531.1) |

|

|

(495.0) |

| Other

operating expenses |

|

|

(91.6) |

|

|

(57.6) |

|

|

(811.5) |

|

|

(293.0) |

| Other operating income |

|

|

37.6 |

|

|

4.0 |

|

|

140.6 |

|

|

105.0 |

| Operating

profit / (loss) |

|

|

148.6 |

|

|

526.2 |

|

|

(1,314.3) |

|

|

690.4 |

|

Finance income |

|

|

165.2 |

|

|

162.2 |

|

|

664.0 |

|

|

519.6 |

| Finance expenses |

|

|

(12.6) |

|

|

(25.2) |

|

|

(27.4) |

|

|

(23.9) |

| Profit /

(Loss) before tax |

|

|

301.2 |

|

|

663.2 |

|

|

(677.7) |

|

|

1,186.1 |

|

Income taxes |

|

|

(41.7) |

|

|

(205.3) |

|

|

12.4 |

|

|

(255.8) |

| Net profit / (loss) |

|

|

259.5 |

|

|

457.9 |

|

|

(665.3) |

|

|

930.3 |

|

Earnings / (Loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic

earnings / (loss) per share |

|

|

1.08 |

|

|

1.90 |

|

|

(2.77) |

|

|

3.87 |

| Diluted

earnings / (loss) per share |

|

|

1.08 |

|

|

1.88 |

|

|

(2.77) |

|

|

3.83 |

Consolidated Statements of Financial

Position

|

|

|

|

|

|

|

|

| |

|

|

December 31, |

|

|

December 31, |

| (in millions €) |

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

Goodwill |

|

|

380.6 |

|

|

362.5 |

| Other

intangible assets |

|

|

790.4 |

|

|

804.1 |

| Property,

plant and equipment |

|

|

935.3 |

|

|

757.2 |

|

Right-of-use assets |

|

|

248.1 |

|

|

214.4 |

| Contract

assets |

|

|

9.8 |

|

|

— |

| Other

financial assets |

|

|

1,254.0 |

|

|

1,176.1 |

| Other non-financial assets |

|

|

26.3 |

|

|

83.4 |

|

Deferred tax assets |

|

|

81.7 |

|

|

81.3 |

| Total

non-current assets |

|

|

3,726.2 |

|

|

3,479.0 |

|

Current assets |

|

|

|

|

|

|

|

Inventories |

|

|

283.3 |

|

|

357.7 |

| Trade and

other receivables |

|

|

1,463.9 |

|

|

2,155.7 |

| Contract

assets |

|

|

10.0 |

|

|

4.9 |

| Other

financial assets |

|

|

7,021.7 |

|

|

4,885.3 |

| Other

non-financial assets |

|

|

212.7 |

|

|

280.9 |

| Income tax assets |

|

|

50.0 |

|

|

179.1 |

| Cash and

cash equivalents |

|

|

9,761.9 |

|

|

11,663.7 |

|

Total current assets |

|

|

18,803.5 |

|

|

19,527.3 |

| Total

assets |

|

|

22,529.7 |

|

|

23,006.3 |

| |

|

|

|

|

|

|

| Equity

and liabilities |

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

| Share

capital |

|

|

248.6 |

|

|

248.6 |

| Capital

reserve |

|

|

1,398.6 |

|

|

1,229.4 |

| Treasury

shares |

|

|

(8.6) |

|

|

(10.8) |

| Retained

earnings |

|

|

19,098.0 |

|

|

19,763.3 |

| Other reserves |

|

|

(1,325.5) |

|

|

(984.6) |

|

Total equity |

|

|

19,411.1 |

|

|

20,245.9 |

|

Non-current liabilities |

|

|

|

|

|

|

| Lease

liabilities, loans and borrowings |

|

|

214.7 |

|

|

191.0 |

| Other financial liabilities |

|

|

46.9 |

|

|

38.8 |

|

Provisions |

|

|

20.9 |

|

|

8.8 |

| Contract liabilities |

|

|

183.0 |

|

|

398.5 |

|

Other non-financial liabilities |

|

|

87.5 |

|

|

13.1 |

| Deferred

tax liabilities |

|

|

42.4 |

|

|

39.7 |

| Total

non-current liabilities |

|

|

595.4 |

|

|

689.9 |

|

Current liabilities |

|

|

|

|

|

|

| Lease

liabilities, loans and borrowings |

|

|

39.5 |

|

|

28.1 |

| Trade

payables and other payables |

|

|

426.7 |

|

|

354.0 |

| Other financial liabilities |

|

|

1,443.4 |

|

|

415.2 |

|

Income tax liabilities |

|

|

4.5 |

|

|

525.5 |

|

Provisions |

|

|

144.8 |

|

|

269.3 |

| Contract

liabilities |

|

|

294.9 |

|

|

353.3 |

| Other

non-financial liabilities |

|

|

169.4 |

|

|

125.1 |

| Total

current liabilities |

|

|

2,523.2 |

|

|

2,070.5 |

| Total

liabilities |

|

|

3,118.6 |

|

|

2,760.4 |

| Total

equity and liabilities |

|

|

22,529.7 |

|

|

23,006.3 |

Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended December 31, |

|

|

Years ended December 31, |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| (in

millions €) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

profit / (loss) |

|

|

259.5 |

|

|

457.9 |

|

|

(665.3) |

|

|

930.3 |

| Income

taxes |

|

|

41.7 |

|

|

205.3 |

|

|

(12.4) |

|

|

255.8 |

| Profit

/ (Loss) before tax |

|

|

301.2 |

|

|

663.2 |

|

|

(677.7) |

|

|

1,186.1 |

|

Adjustments to reconcile profit before tax to net cash

flows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization of property, plant, equipment,

intangible assets and right-of-use assets |

|

|

165.4 |

|

|

78.8 |

|

|

298.0 |

|

|

183.4 |

|

Share-based payment expenses |

|

|

23.5 |

|

|

14.2 |

|

|

100.9 |

|

|

51.4 |

|

Net foreign exchange differences |

|

|

(32.1) |

|

|

66.3 |

|

|

(109.5) |

|

|

(298.0) |

|

(Gain) / Loss on disposal of property, plant and equipment |

|

|

(0.1) |

|

|

0.2 |

|

|

(0.3) |

|

|

3.8 |

|

Finance income excluding foreign exchange differences |

|

|

(149.7) |

|

|

(162.2) |

|

|

(648.5) |

|

|

(519.6) |

|

Finance expense excluding foreign exchange differences |

|

|

12.6 |

|

|

3.4 |

|

|

27.4 |

|

|

7.9 |

|

Government grants |

|

|

(4.7) |

|

|

5.4 |

|

|

(31.5) |

|

|

2.4 |

|

Unrealized (gain) / loss on derivative instruments at fair value

through profit or loss |

|

|

3.9 |

|

|

(21.2) |

|

|

4.6 |

|

|

175.5 |

|

Working capital adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Decrease in trade and other receivables, contract assets and other

assets |

|

|

(879.9) |

|

|

(288.0) |

|

|

387.7 |

|

|

5,374.0 |

|

Decrease in inventories |

|

|

19.9 |

|

|

58.0 |

|

|

74.5 |

|

|

81.9 |

|

Increase in trade payables, other financial liabilities, other

liabilities, contract liabilities, refund liabilities and

provisions |

|

|

167.7 |

|

|

412.8 |

|

|

758.4 |

|

|

118.9 |

|

Interest received and realized gains from cash and cash

equivalents |

|

|

121.6 |

|

|

91.8 |

|

|

474.9 |

|

|

258.2 |

|

Interest paid and realized losses from cash and cash

equivalents |

|

|

(6.6) |

|

|

(1.7) |

|

|

(13.5) |

|

|

(5.4) |

|

Income tax paid |

|

|

(198.4) |

|

|

(65.1) |

|

|

(389.2) |

|

|

(482.9) |

|

Share-based payments |

|

|

(10.9) |

|

|

(5.0) |

|

|

(154.5) |

|

|

(766.2) |

|

Government grants received |

|

|

3.3 |

|

|

— |

|

|

106.0 |

|

|

— |

| Net cash flows from operating

activities |

|

|

(463.3) |

|

|

850.9 |

|

|

207.7 |

|

|

5,371.4 |

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase

of property, plant and equipment |

|

|

(66.6) |

|

|

(83.8) |

|

|

(286.5) |

|

|

(249.4) |

| Proceeds

from sale of property, plant and equipment |

|

|

0.7 |

|

|

0.1 |

|

|

1.2 |

|

|

(0.7) |

| Purchase

of intangible assets and right-of-use assets |

|

|

(24.5) |

|

|

(106.5) |

|

|

(165.8) |

|

|

(455.4) |

|

Acquisition of subsidiaries and businesses, net of cash

acquired |

|

|

— |

|

|

— |

|

|

— |

|

|

(336.9) |

|

Investment in other financial assets |

|

|

(2,068.8) |

|

|

(3,418.2) |

|

|

(12,370.3) |

|

|

(7,128.4) |

| Proceeds

from maturity of other financial assets |

|

|

2,765.9 |

|

|

913.3 |

|

|

10,740.2 |

|

|

1,216.3 |

| Net cash flows used in investing

activities |

|

|

606.7 |

|

|

(2,695.1) |

|

|

(2,081.2) |

|

|

(6,954.5) |

| Financing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from loans and borrowings |

|

|

— |

|

|

0.2 |

|

|

— |

|

|

0.3 |

| Repayment

of loans and borrowings |

|

|

— |

|

|

— |

|

|

(2.3) |

|

|

(0.1) |

| Payments

related to lease liabilities |

|

|

(7.3) |

|

|

(12.3) |

|

|

(43.6) |

|

|

(40.3) |

| Share repurchase program |

|

|

— |

|

|

(0.8) |

|

|

— |

|

|

(738.5) |

| Net cash

flows used in financing activities |

|

|

(7.3) |

|

|

(12.9) |

|

|

(45.9) |

|

|

(778.6) |

|

Net increase / (decrease) in cash and cash equivalents |

|

|

136.1 |

|

|

(1,857.1) |

|

|

(1,919.4) |

|

|

(2,361.7) |

| Change in

cash and cash equivalents resulting from exchange rate

differences |

|

|

13.6 |

|

|

(15.4) |

|

|

14.8 |

|

|

(14.5) |

| Change in

cash and cash equivalents resulting from other valuation

effects |

|

|

(12.4) |

|

|

40.4 |

|

|

2.8 |

|

|

164.8 |

| Cash and

cash equivalents at the beginning of the period |

|

|

9,624.6 |

|

|

13,495.8 |

|

|

11,663.7 |

|

|

13,875.1 |

| Cash

and cash equivalents as of December 31 |

|

|

9,761.9 |

|

|

11,663.7 |

|

|

9,761.9 |

|

|

11,663.7 |

1 All target abbreviations are compiled in an abbreviation

directory at the end of this press release.** All numbers in this

press release have been rounded.

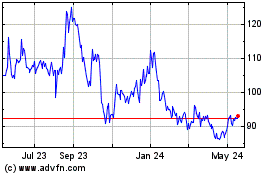

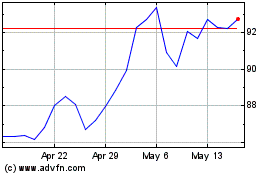

BioNTech (NASDAQ:BNTX)

Historical Stock Chart

From Feb 2025 to Mar 2025

BioNTech (NASDAQ:BNTX)

Historical Stock Chart

From Mar 2024 to Mar 2025