Chindata Group Announces Completion of Going Private Transaction

December 18 2023 - 10:00PM

Chindata Group Holdings Limited (“Chindata Group” or the “Company”)

(Nasdaq: CD), a leading carrier-neutral hyperscale data center

solution provider in Asia-Pacific emerging markets, today announced

the completion of its merger (the “Merger”) with BCPE Chivalry

Merger Sub Limited (“Merger Sub”), a wholly owned subsidiary of

BCPE Chivalry Bidco Limited (“Parent”), pursuant to the previously

announced agreement and plan of merger dated as of August 11, 2023

(the “Merger Agreement”), by and among the Company, Parent and

Merger Sub. As a result of the Merger, the Company ceased to be a

publicly traded company and became a wholly owned subsidiary of

Parent.

Under the terms of the Merger Agreement, which

was approved by the Company’s shareholders at an extraordinary

general meeting held on December 4, 2023, each of the Company’s

Class A ordinary shares and Class B ordinary shares (collectively,

the “Shares”) issued and outstanding immediately prior to the

effective time of the Merger (the “Effective Time”), other than (i)

the Shares deemed contributed to BCPE Chivalry Topco Limited by the

Rollover Shareholders (as defined in the Merger Agreement), (ii)

Shares (including Shares represented by American depositary shares

(each, an “ADS”), each representing two Class A ordinary shares)

held by Parent, Merger Sub, the Company or any of their

subsidiaries, (iii) Shares (including ADSs corresponding to such

Shares) held by the Company or The Bank of New York Mellon (the

“Depositary”) and reserved for issuance and allocation pursuant to

the 2020 Share Option Plan adopted by the Company and effective as

of January 1, 2020 (the Shares described in clauses (i) through

(iii), the “Excluded Shares”), (iv) Shares owned by holders who

have validly exercised and not effectively withdrawn or otherwise

lost their rights to dissent from the Merger pursuant to Section

238 of the Companies Act (As Revised) of the Cayman Islands (the

“CICA”), and (v) Shares represented by ADSs, has been cancelled and

ceased to exist in exchange for the right to receive US$4.30 per

Share in cash without interest and net of any applicable

withholding taxes. Each ADS issued and outstanding immediately

prior to the Effective Time (other than ADSs representing Excluded

Shares), together with each Class A ordinary share represented by

such ADS, has been cancelled in exchange for the right to receive

US$8.60 per ADS in cash (less $5.00 or less per 100 ADSs cancelled

and any other fees and charges payable pursuant to the terms of the

deposit agreement, dated September 29, 2020, among the Company, the

Depositary and all holders from time to time of ADSs issued

thereunder) without interest and net of any applicable withholding

taxes. The Excluded Shares have been cancelled without payment of

any consideration from the Company therefor and the Dissenting

Shares have been cancelled and will entitle the former holders

thereof to receive the fair value thereon determined in accordance

with the provisions of Section 238 of the CICA.

Each record holder of Shares and registered

holder of ADSs as of the Effective Time of the Merger who is

entitled to the merger consideration will receive a letter of

transmittal specifying how the delivery of the merger consideration

will be effected and instructions for surrendering their Shares or

ADSs, as applicable, in exchange for the applicable merger

consideration. Record holders of Shares and ADSs should wait to

receive the letters of transmittal before surrendering their Shares

or ADSs. A holder of ADSs held in “street name” by a broker, bank

or other nominee will not be required to take any additional action

to receive the applicable merger consideration and should address

any questions concerning the receipt of the merger consideration to

its broker, bank or other nominee.

The Company also announced today that it has

requested that trading of its ADSs on the Nasdaq Global Select

Market (“Nasdaq”) be suspended as of December 18, 2023 (New York

time). The Company has requested that Nasdaq file a Form 25 with

the Securities and Exchange Commission (the “SEC”) notifying the

SEC of the delisting of the Company’s ADSs on Nasdaq and the

deregistration of the Company’s registered securities. The

deregistration will become effective 90 days after the filing of

the Form 25 or such shorter period as may be determined by the SEC.

The Company intends to suspend its reporting obligations under the

Securities Exchange Act of 1934, as amended, by filing a Form 15

with the SEC in approximately ten days following the filing of the

Form 25. The Company’s obligations to file with the SEC certain

reports and forms, including Form 20-F and Form 6-K, will be

suspended immediately as of the filing date of the Form 15 and will

terminate once the deregistration becomes effective.

About Chindata Group

Chindata Group is a leading carrier-neutral

hyperscale data center solution provider in Asia-Pacific emerging

markets and a first mover in building next-generation hyperscale

data centers in China, India and Southeast Asia markets, focusing

on the whole life cycle of facility planning, investment, design,

construction and operation of ecosystem infrastructure in the IT

industry. Chindata Group provides its clients with business

solutions in major countries and regions in Asia-Pacific emerging

markets, including asset-heavy ecosystem chain services such as

industrial bases, data centers and network services.

Chindata Group operates two sub-brands:

“Chindata” and “Bridge Data Centres”. Chindata operates

hyper-density IT cluster infrastructure in the Greater Beijing

Area, the Yangtze River Delta Area and the Greater Bay Area, the

three key economic areas in China, and has become the engine of the

regional digital economies. Bridge Data Centres, with its top

international development and operation talents in the industry,

owns fast deployable data center clusters in Malaysia and India,

and seeks business opportunities in other Asia-Pacific emerging

markets.

Safe Harbor Statement

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident,”

“potential,” “continue” or other similar expressions. Among other

things, the business outlook and quotations from management in this

announcement, as well as Chindata Group’s strategic and operational

plans, contain forward-looking statements. Chindata Group may also

make written or oral forward-looking statements in its periodic

reports to the SEC, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including but not limited to

statements about Chindata Group’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: Chindata Group’s goals and strategies; its future

business development, financial condition and results of

operations; the expected growth and competition of the data center

and IT market; its ability to generate sufficient capital or obtain

additional capital to meet its future capital needs; its ability to

maintain competitive advantages; its ability to keep and strengthen

its relationships with major clients and attract new clients; its

ability to locate and secure suitable sites for additional data

centers on commercially acceptable terms; government policies and

regulations relating to Chindata Group’s business or industry;

general economic and business conditions in the regions where

Chindata Group operates and globally and assumptions underlying or

related to any of the foregoing. Further information regarding

these and other risks is included in Chindata Group’s filings with

the SEC. All information provided in this press release and in the

attachments is as of the date of this press release, and Chindata

Group undertakes no obligation to update any forward-looking

statement, except as required under applicable

law.

For Enquiries, Please

Contact:

Chindata IR

Team ir@chindatagroup.com Mr. Dongning

Wang dongning.wang@chindatagroup.com

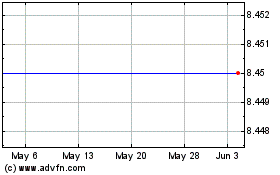

Chindata (NASDAQ:CD)

Historical Stock Chart

From Mar 2025 to Apr 2025

Chindata (NASDAQ:CD)

Historical Stock Chart

From Apr 2024 to Apr 2025