Bidder In Disney Sale Faults Charter -- WSJ

April 12 2019 - 2:02AM

Dow Jones News

By Joe Flint

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 12, 2019).

One of the bidders for regional sports networks that Walt Disney

Co. is selling has lodged a complaint with federal regulators

alleging that cable operator Charter Communications Inc. is

undermining the sale process by threatening to drop the channels

from its systems.

In letters to the Federal Communications Commission and the

Justice Department, Big3 Basketball LLC alleged that Charter's

conduct is depressing prices in the auction and suggested the

situation could benefit Charter's largest shareholder, Liberty

Media Corp., which is also a bidder.

Big3 said it has engaged in negotiations with Charter over the

price the cable company would pay to carry the sports networks

should Big3 be the winning bidder. Big3 said the discussions broke

down and it now fears the channels will lose carriage.

"Charter's conduct risks effectively excluding Big3 from the

bidding process and tainting the auction," the company told the

FCC. "It has been suggested to Big3's ownership that Charter has

disseminated its threat to drop the (regional sports networks) to

other members of the industry, thereby suppressing auction prices,

chilling bidding, and ultimately hurting Disney's ability to secure

the best price for the (channels)," the letter said.

In a statement, Charter said it "welcomes the opportunity to

discuss a future carriage agreement for these networks with

whomever ultimately owns them including Big3. Regardless of who

owns the programming, we approach all negotiations with the same

singular objective of reaching carriage agreements that best meet

the needs of our customers."

Big3, which runs a 3-on-3 basketball league with backing from

entrepreneur Jeff Kwatinetz and rapper and actor Ice Cube, told the

FCC it lacks the leverage to compel Charter to carry the regional

sports networks.

Disney is divesting 22 regional sports networks it acquired as

part of its purchase of 21st Century Fox entertainment assets in

order to comply with the government's conditions for approval of

the deal.

One of the networks -- the YES channel in New York -- is near a

deal to be sold to the New York Yankees, who already own 20%, and

Sinclair Broadcast Group Inc., RedBird Capital Partners LLC and

Amazon.com Inc. The deal values the channel at $3.5 billion.

Other bidders for the channels include Sinclair and Major League

Baseball. Final bids are due on April 15, people familiar with the

process said.

Write to Joe Flint at joe.flint@wsj.com

(END) Dow Jones Newswires

April 12, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

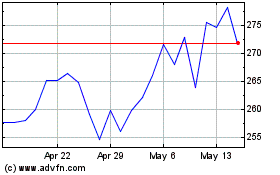

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

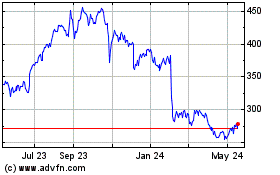

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024