By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Rout in FANG stocks beats up Nasdaq; Chesapeake Energy plunges

36% to lead S&P 500 losses

U.S. stocks tumbled Monday afternoon, putting the S&P 500 on

track for its lowest close in 22 months, as a fresh drop in oil

prices amid continuing fears of economic slowdown sparked a global

flight into bonds and gold.

The Nasdaq Composite logged the heaviest losses as the theme of

a collapse in the so-called FANG stocks -- Facebook Inc. (FB),

Amazon.com Inc. (AMZN) Netflix Inc. (NFLX) and Google parent

Alphabet Inc. (GOOGL) -- continued for a second straight

session.

The S&P 500 tumbled 44 points, or 2.3%, to 1,835, led by

losses in the financial sector. If the index closes at that level,

it would mark its lowest settlement since April 2014. The S&P

remains above its Jan. 20 intraday low of 1812.29.

Energy stocks were also battered: Chesapeake Energy Corp.

plunged 36% and Williams Companies (WMB) sank 25%.

The Dow Jones Industrial Average skidded 368 points, or 2.4%, to

15,831, its lowest level since its Jan. 20 closing low of

15,766.74.

Colin Cieszynski, chief market strategist at CMC Markets said

stocks falling below their Jan. 20th lows "could indicate if we are

really heading into a big bear market or nearing the end of a big

correction within a bull market." A bear market is generally

defined as a decline of at least 20% from a recent peak, while a

correction is a 10% slide.

In particular, the S&P's Jan. 20 intraday low of 1812.29 is

a "significant short-term technical formation" after which there is

"a downside pattern" that makes the chances of reversal much

slimmer, said Frank Cappelleri, technical analyst at Instinet.

While stocks slumped, demand for so-called haven assets surged,

pushing gold prices to a nearly nine-month high,

(http://www.marketwatch.com/story/gold-jumps-to-near-4-month-high-as-investors-turn-to-safety-2016-02-08)

and Treasury yields

(http://www.marketwatch.com/story/10-year-treasury-yield-falls-to-one-year-low-2016-02-08),

which move inversely to prices, to a 12-month low.

The Nasdaq Composite slumped 131 points, or 3%, to 4,231.

Facebook shares fell 5% Monday afternoon, while Twitter Inc. (TWTR)

tumbled 2.7%, coming off an all-time low touched earlier in the

session. Alphabet was down 2.5% and Netflix was dipping in and out

of negative territory.

"Is the market throwing out the baby with the bath water?" said

James Meyer, chief investment officer at Tower Bridge Advisors,

referring to the "rapid fall in prices for the highflying tech and

biotech names that have been leading the market for the past 12

months."

The First Trust Dow Jones Internet Index Fund ETF(FDN) which

includes a basket of some of the biggest publicly traded Internet

companies, was down nearly 20% year-to-date.

"The former leaders of the previous bull cycle are the ones that

get taken to the woodshed in the last phase of the downturn," Meyer

said.

Financials were the worst-performing sector on the S&P 500,

down 3.2%, as ultralow interest rates and widening credit spreads

have fueled concerns about banks' balance sheets. Financial giants

Visa Inc. (V) and Goldman Sachs Group (GS) were leading the Dow

industrials losses, down more than 6%.

The banking sector selloff started in Europe, where the region's

banking gauge, the Stoxx Europe 600 Banks Index has logged six

straight weeks of declines, its longest weekly losing stretch since

2008

(http://www.marketwatch.com/story/why-a-selloff-in-european-banks-is-ominous-2016-02-07).

But the sector is getting hit hard in the U.S. as well, as

investors realize that the Federal Reserve might have to hold off

on the interest-rate hikes that banks were anticipating to boost

their balance sheets, said Sahak Manuelian, managing director of

equity trading at Wedbush Securities. The SPDR Financial Select

Sector exchange-traded fund (XLF) has tumbled 15% year to date.

Read: Bank stocks rocked by recession fears

(http://www.marketwatch.com/story/bank-stocks-rocked-by-recession-fears-2016-02-03)

As oil prices sank again

(http://www.marketwatch.com/story/oil-pops-above-31-a-barrel-as-traders-keep-close-watch-on-the-dollar-2016-02-08)

amid continuing fears about the global oversupply of crude, the

energy sector was hit, down 1% on the day.

Monday's losses came on the heels of the biggest weekly drop in

a month for U.S. equities

(http://www.marketwatch.com/story/wall-street-gets-the-jitters-ahead-of-key-jobs-data-2016-02-05).

The Nasdaq Composite fell 3.3% on Friday and logged a 5.4% weekly

drop, its biggest in a month,

Investors will be looking ahead to comments from Federal Reserve

Chairwoman Janet Yellen on Wednesday and Thursday, when she

testifies to Congress about the economy and monetary policy. Last

week's jobs data prompted questions about the Fed's future

interest-rate policy, as Friday's data showed slower jobs growth,

but decent wage inflation.

There is no data scheduled for Monday, nor any Fed speeches. The

week will end with retail sales data.

Read:Why consumers may keep economy from sinking

(http://www.marketwatch.com/story/why-consumers-may-keep-economy-from-sinking-2016-02-07)

Stocks to watch

Shares of Chesapeake Energy Corp. (CHK) tanked as the

natural-gas producer scrambled to dispel concerns

(http://www.marketwatch.com/story/chesapeake-shares-crater-bonds-tank-as-investor-concerns-mount-2016-02-08)

it was on the brink of bankruptcy.

Hasbro Inc. (HAS) gained 1.3% after the company beat earnings

and revenue estimates, boosted by sales of Star Wars toys.

BioCryst Pharmaceuticals Inc. (BCRX) shares plummeted 68% after

the pharmaceutical company reported failure in a study for a new

drug to treat a rare genetic condition

(http://www.marketwatch.com/story/biocryst-fails-in-study-for-new-drug-to-treat-rare-genetic-condition-2016-02-08).

Apollo Education Group Inc. (APOL) shares jumped 22% after the

company said it would be taken private in a $1.1 billion deal

(http://www.marketwatch.com/story/apollo-education-group-to-be-taken-private-2016-02-08).

Read:Disney, Coca-Cola headline consumer-heavy earnings week

(http://www.marketwatch.com/story/disney-coca-cola-headline-consumer-heavy-earnings-week-2016-02-07)

Other markets

European markets also tumbled, with the Stoxx Europe 600 index

dropping to a 15-month low

(http://www.marketwatch.com/story/european-stocks-drop-to-15-month-low-2016-02-08).

and the Germany's DAX 30 index (DAX) closing in bear-market

territory.

The Nikkei 225 index

(http://www.marketwatch.com/story/japan-australia-stocks-start-the-day-down-on-fed-uncertainty-2016-02-07)

closed up 1%, boosted by upbeat earnings, while many other markets

in Asia were closed for the Lunar New Year holiday. See: When are

Chinese markets closed for holiday?

(http://www.marketwatch.com/story/when-is-chinas-stock-market-closed-for-lunar-new-year-2016-02-05)

Data over the weekend showed China's foreign currency reserves

fell by $99.469 billion in January, hitting the lowest level in

more than three years

(http://www.marketwatch.com/story/chinas-foreign-currency-reserves-drop-9947-bln-2016-02-06).

The dollar

(http://www.marketwatch.com/story/dollar-rises-as-tokyo-stocks-recover-2016-02-08)

pulled back against its major rivals, tumbling to a one-year low

against the yen, which was viewed as a haven asset.

(END) Dow Jones Newswires

February 08, 2016 13:48 ET (18:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

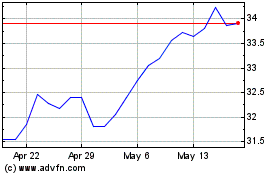

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

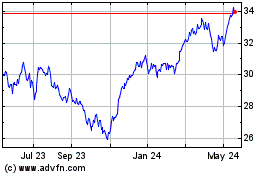

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024