Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

February 18 2025 - 2:56PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-266487

Dated February 18, 2025

Exelon Corporation

Pricing Term Sheet

$500,000,000 5.125% Notes Due 2031

$500,000,000 5.875% Notes Due 2055

|

Issuer:

|

Exelon Corporation |

Exelon Corporation |

| Expected Ratings*: |

Baa2 (Moody’s); BBB+ (S&P) |

Baa2 (Moody’s); BBB+ (S&P) |

| Principal Amount: |

$500,000,000 |

$500,000,000 |

| Security Type: |

Notes |

Notes |

| Trade Date: |

February 18, 2025 |

February 18, 2025 |

| Settlement Date**: |

February 21, 2025 (T+3) |

February 21, 2025 (T+3) |

| Coupon: |

5.125% |

5.875% |

| Maturity Date: |

March 15, 2031 |

March 15, 2055 |

| Interest Payment Dates: |

Semi-annually on March 15 and September 15, commencing September 15,

2025 |

Semi-annually on March 15 and September 15, commencing September 15,

2025 |

| Benchmark Treasury: |

4.25% due January 31, 2030 |

4.50% due November 15, 2054 |

| Benchmark Treasury Price and Yield: |

99-12 3/4 / 4.386% |

95-23+ / 4.769% |

| Spread to Benchmark Treasury: |

75 basis points |

113 basis points |

| Yield to Maturity: |

5.136% |

5.899% |

| Offering Price: |

99.938% of Principal Amount |

99.658% of Principal Amount |

| Optional Redemption: |

At any time prior to February 15, 2031 (one month prior to the

maturity date) (the “Par Call Date”), at a make whole price equal to the greater of (a) the sum of the present values

of the remaining scheduled payments of principal and interest thereon discounted to the redemption date (assuming the notes matured on

the Par Call Date) on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 12.5

basis points less (b) interest accrued to the date of redemption, and 100% of the principal amount of the notes to be redeemed, plus,

in each case, accrued and unpaid interest to the redemption date.

At any time on or after the Par Call Date, at 100% of the principal

amount, plus accrued and unpaid interest to the redemption date.

|

Any time prior to September 15, 2054 (six months prior to the

maturity date) (the “Par Call Date”), at a make whole price equal to the greater of (a) the sum of the present values

of the remaining scheduled payments of principal and interest thereon discounted to the redemption date (assuming the notes matured on

the Par Call Date) on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 20 basis

points less (b) interest accrued to the date of redemption, and 100% of the principal amount of the notes to be redeemed, plus, in

each case, accrued and unpaid interest to the redemption date.

At any time on or after the Par Call Date, at 100% of the principal

amount, plus accrued and unpaid interest to the redemption date.

|

|

Issuer:

|

Exelon Corporation |

Exelon Corporation |

| CUSIP/ISIN: |

30161NBR1 / US30161NBR17 |

30161NBS9 / US30161NBS99 |

|

Joint Bookrunners: |

Barclays Capital Inc.

BNP Paribas Securities Corp.

BofA Securities, Inc.

J.P. Morgan Securities LLC |

Barclays Capital Inc.

BNP Paribas Securities Corp.

BofA Securities, Inc.

J.P. Morgan Securities LLC |

|

Morgan Stanley & Co. LLC

SMBC Nikko Securities America, Inc. |

Morgan Stanley & Co. LLC

SMBC Nikko Securities America, Inc. |

| |

|

| Co-Managers: |

AmeriVet Securities, Inc.

Apto Partners, LLC

Telsey Advisory Group LLC |

AmeriVet Securities, Inc.

Apto Partners, LLC

Telsey Advisory Group LLC |

* Note: A securities rating is not a recommendation

to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

**We expect to deliver the notes on or about February 21,

2025, which will be the third business day following the date of this term sheet (“T+3”). Under Rule 15c6-1 under the

Exchange Act, trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade

expressly agree otherwise. Accordingly, purchasers who wish to trade notes on any day other than the business day preceding the settlement

date will be required, by virtue of the fact that the notes initially will settle in T+3, to specify an alternate settlement cycle at

the time of any such trade to prevent failed settlement and should consult their own advisors.

The issuer has filed a registration statement

(including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus

in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and

this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any

underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Barclays

Capital Inc. toll-free at 1-888-603-5847, BNP Paribas Securities Corp. toll-free at 1-800-854-5674, BofA Securities, Inc. toll-free

at 1-800-294-1322, J.P. Morgan Securities LLC collect at 1-212-834-4533 and Morgan Stanley & Co. LLC toll-free at 1-866-718-1649.

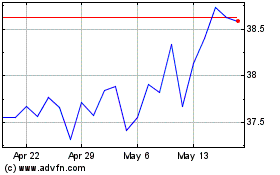

Exelon (NASDAQ:EXC)

Historical Stock Chart

From Jan 2025 to Feb 2025

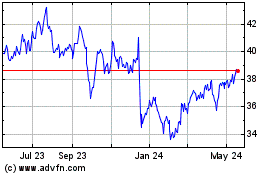

Exelon (NASDAQ:EXC)

Historical Stock Chart

From Feb 2024 to Feb 2025