false

0001604191

0001604191

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 1, 2024

| |

Entero Therapeutics, Inc. |

|

| |

(Exact name of registrant as specified in its charter) |

|

| Delaware |

|

001-37853 |

|

46-4993860 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

777 Yamato Road, Suite 502

Boca Raton, Florida |

|

33431 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (561) 589-7020

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

ENTO |

|

Nasdaq

Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.04 Triggering Events That Accelerate

or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

As previously disclosed in

Entero Therapeutics, Inc.’s (the “Company”) Current Report on Form 8-K filed with the SEC on March 14, 2024, the Company

acquired ImmunogenX, Inc. in a merger transaction, the terms of which included, among other things, the Company’s wholly owned subsidiary,

ImmunogenX, LLC (“ImmunogenX”), assuming the debt of ImmunogenX, Inc. On August 2, 2024, ImmunogenX received a Notice of Default

and Acceleration (the “Notice”) relating to that certain Credit Agreement, dated as of October 3, 2022 (as amended, modified,

supplemented or restated from time to time, the “Credit Agreement”) by and among Mattress Liquidators, Inc. (“Lender”)

and ImmunogenX, Inc.

The Notice informed ImmunogenX

that one or more events of default under the Credit Agreement (“Event of Defaults”) were existing and continuing. Such outstanding

Events of Default include, among others, ImmunogenX suffering an adverse change in its financial condition which would reasonably be expected

to have a Material Adverse Effect (as defined in the Credit Agreement).

The Notice indicated that,

as a result of the outstanding Events of Default, pursuant to the terms of Section 8.3 of the Credit Agreement, (a) the outstanding principal

balance of the loan made under the Credit Agreement, all interest and fees related thereto, and all other outstanding obligations are

accelerated and declared immediately due and payable, and that the Lender demands immediate payment of all obligations, and (b) the Lender

is increasing the effective interest rate to the Default Rate (as defined in the Credit Agreement). The Credit Agreement affords ImmunogenX

thirty (30) days to cure Events of Default (the “Cure Period”), with a possible extension of an additional thirty (30) days,

provided that in no event shall the Cure Period be greater than sixty (60) days in the aggregate. If ImmunogenX is not able to cure the

Events of Default within the Cure Period, ImmunogenX may also be deemed to be in default of the stockholder notes ImmunogenX, Inc. entered

into with Jack Syage and Peter Felker as part of the acquisition of ImmunogenX, Inc. by the Company (the “Stockholder Notes”),

the entry into such notes having been previously disclosed by the Company on its Current Report on Form 8-K filed with the SEC on March

14, 2024. If ImmunogenX is deemed to have defaulted under the Stockholder Notes, the holders of the Stockholder Notes may, at their option

and upon notice to ImmunogenX, declare the outstanding principal of, and all accrued interest on, the Stockholder Notes immediately due

and payable.

As of the date of the Notice,

the aggregate outstanding obligations under the Credit Agreement were approximately $6,997,583 (comprised of (i) $5,360,000 in respect

of outstanding principal, (ii) $1,637,583 of accrued and unpaid interest, and (iii) other, presently unliquidated, amounts for fees and

expenses (including legal fees) payable in accordance with the Credit Agreement and related documents). This outstanding amount does not

include any additional obligations incurred following the date of the Notice (including additional interest, which shall continue to accrue

on the outstanding obligations following the date of the Notice).

Item 3.01 Notice of Delisting or Failure to

Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As a result of the below-reported

resignations of two members of the board of directors (the “Board”) of

the Company, the Company notified The Nasdaq Stock Market of the Company’s non-compliance with Nasdaq Rule 5605(c)(2) (the “Rule”),

which requires a Nasdaq-listed company to have an audit committee of the board of directors comprised of at least three independent directors

meeting the eligibility requirements of the Rule.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers’ Compensatory Arrangements of Certain Officers.

Board Resignations

On August 2, 2024, Charles

J. Casamento and Terry Coelho resigned as members of the Board of the Company, effective immediately. Mr. Casamento’s and Ms. Coelho’s

departures were not the result of any disagreement with management or the Board on any matter relating to the Company’s operations,

policies or practices.

Consulting Agreements and Termination of Employment

Agreements

On August 2, 2024, as part

of the reduction in workforce described below, the Board approved the termination of (i) the employment agreement, dated October 8, 2019,

by and between the Company and Chief Executive Officer James Sapirstein (the “Sapirstein Employment Agreement”) and (ii) the

offer letter, dated March 13, 2024, by and between the Company and President Jack Syage (the “Syage Offer Letter”).

In connection with the termination

of the Sapirstein Employment Agreement, on August 2, 2024, the Company and Mr. Sapirstein entered into a Consulting Agreement (the “Sapirstein

Consulting Agreement”), pursuant to which Mr. Sapirstein will be paid $400 an hour monthly for services rendered to the Company.

Should travel be required, Mr. Sapirstein will additionally be compensated $200 per hour for travel time plus expenses and the federal

mileage rate for car travel. The Sapirstein Consulting Agreement is for an initial term of six months, subject to early termination by

either party for any reason at any time, and may be extended on a month-to-month basis upon mutual agreement of the parties after the

expiration of the initial six-month term.

The foregoing description

of the Sapirstein Consulting Agreement is not complete and is qualified in its entirety by reference to the full text of such agreement,

a copy of which is filed herewith as Exhibit 10.1 and is incorporated by reference herein.

Unused Vacation Payments

On August 2, 2024, as part

of the reduction in workforce described below, the Board approved the payout of unused vacation time for all employees accrued through

August 1, 2024, including Mr. Sapirstein, Dr. Syage, and Chief Financial Officer Sarah Romano. The Company paid Mr. Sapirstein, Dr. Syage,

and Ms. Romano $69,230, $1,920, and $45,590, respectively, to compensate for their unused vacation time accrued through August 1, 2024.

Item 8.01 Other Events.

On August 1, 2024, in order

to reduce costs and conserve resources, the Company approved the termination of all non-essential Company employees and determined to

vacate its Boca Raton office. The Company has also paused any non-essential research and development activities. The Company is exploring

all possibilities to maximize value for all of the Company’s stakeholders, including but not limited to raising capital, restructuring

the Company’s indebtedness and other restructuring options, and identifying and evaluating other potential strategic alternatives.

Item 9.01 Financial

Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Entero Therapeutics, Inc. |

| |

|

| August 7, 2024 |

By: |

/s/ James Sapirstein |

| |

Name: |

James Sapirstein |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

CONSULTING AGREEMENT

This consulting agreement

(the “Agreement”) is effective as of August 2, 2024 (the “Effective Date”) by and between Entero

Therapeutics, Inc., a Delaware corporation with its principal place of business located at 777 Yamato Road, Suite 502, Boca Raton, FL

33431 (the “Company”) and James Sapirstein with an address at 5310 Boca Marina Circle N, Boca Raton, FL 33487(the “Consultant”).

WHEREAS, the Company is engaged

in the business of research and development of targeted non-systematic therapeutics for the treatment of patients with gastrointestinal

disorders (the “Business”);

WHEREAS, the Consultant to

provide services to the Company as hereinafter provided.

NOW, THEREFORE, in consideration

of the premises and mutual covenants set forth herein and other good and valuable consideration, the receipt and sufficiency of which

are hereby acknowledged, the Company and the Consultant hereby agree as follows:

The term of this Agreement

(the “Term”) shall commence as of the Effective Date and shall continue for an initial period of six (6) months (the

“Engagement Period”), provided, however, the Company or Consultant may in its sole discretion and for

any reason terminate this Agreement at any time. Notwithstanding any such termination, Consultant will be entitled to compensation (as

detailed in Section 3 below) due for the period up to the date of termination if this Agreement. The parties may mutually agree in writing

to extend the Engagement Period on a month-to-month basis upon expiration of the initial Engagement Period.

| 2. | PERFORMANCE OF SERVICES. |

The Company hereby engages

the Consultant and the Consultant hereby accepts engagement as a consultant for the Company for the Term. It is understood and agreed,

and it is the express intention of the parties to this Agreement, that the Consultant is an independent contractor, and not an employee

or agent of the Company for any purpose whatsoever. In such capacity, Consultant shall perform all duties and obligations as described

on Exhibit A hereto (the “Services”) and agrees to be available at such times as may be reasonably scheduled

by the Company. The Consultant is required to perform all duties in an efficient, professional, businesslike and trustworthy manner. In

the course of his/her interaction with Company, the Consultant will not disclose or make use of any information, documents or materials

which it is under any obligation to any other party, including his/her previous, prospective or current employer, to maintain confidence.

The manner and means by which the Consultant chooses to perform the Services shall be in his/her sole discretion and control.

In connection with Consultant’s

engagement hereunder, the Company shall compensate Consultant as follows:

(a)

Consultant will provide to the Company invoices for Services rendered hereunder. As full compensation for the Services, the Company

will pay Consultant at a rate of $400.00 per hour for Services performed, to be accrued and invoiced on a monthly basis, as indicated

herein, or at such other time as agreed by the parties. Consultant shall document and record all time spent in the performance of the

Services to the reasonable satisfaction of the Company. Unless otherwise agreed to by the parties, on or about the last day of each calendar

month during the performance of the Services hereunder, Consultant will provide to the Company an invoice for Services rendered and expenses

incurred during the preceding month. Payment of invoices submitted for Services will be made within thirty (30) days of the Company's

receipt of such invoice. Should travel be required, the consultant will be compensated at $200 per hour for travel time plus expenses

and Federal mileage rate for car travel.

(b)

The Company will reimburse Consultant for any pre-approved travel or other reasonable expenses and the Consultant shall submit

such expenses (with appropriate supporting documentation) to the Company monthly for reimbursement.

During the Consultant’s

performance of the Services hereunder, the Consultant may have access to or become familiar with information of a confidential or proprietary

nature which pertains to the Business operations of the Company, its parents, subsidiaries, and affiliates and their respective clients

including, without limitation, information relating to investment practices, decisions or research, financial information, technological

research, clients or other business information, which shall include Proprietary Information (as defined below) (the “Confidential

Information”). The Consultant agrees not to disclose any Confidential Information, directly or indirectly, or use it in any

way, either during the Term of this Agreement or any time thereafter, except as required in the performance of the Services for the Company

and as approved in writing by the Company. Furthermore, the Consultant agrees that upon ceasing to perform the Services for the Company,

the Consultant will return to the Company any documents, materials or data (and copies of such documents, materials or data) containing

Confidential Information or belonging to the Company, its parents, subsidiaries, and affiliates and their respective clients. In the event

Consultant receives a request or other notice to disclose Confidential Information as required by law, Consultant shall give the Company

immediate notice so the Company may obtain a protective order or other remedy. Each of the parties shall keep the existence and terms

of this Agreement confidential, except as required by applicable law, regulation or legal process. The Consultant acknowledges that any

material violation or threatened material violation of the foregoing will result in irreparable harm to the other party for which there

is no adequate remedy at law and will entitle the Company to obtain an injunction and such other relief as may be available to the Company.

The obligations of the parties regarding the Confidential Information shall terminate three (3) years from the date of this Agreement.

(a)

Company shall own all right, title and interest (including patent rights, copyrights, trade secret rights, mask work rights, trademark

rights, sui generis database rights and all other intellectual property rights of any sort throughout the world) relating to any

and all inventions (whether or not patentable), works of authorship, mask works, designations, designs, know-how, ideas and information

made or conceived or reduced to practice, in whole or in part, by or for or on behalf of Consultant during the Term of this Agreement

that relate to the subject matter of or arise out of or in connection with the Services or any Proprietary Information (as defined below)

(collectively, “Inventions”) and Consultant will promptly disclose and provide all Inventions to Company. Consultant

hereby makes all assignments necessary to accomplish the foregoing ownership. Consultant shall assist Company, at Company’s reasonable

expense, to further evidence, record and perfect such assignments, and to perfect, obtain, maintain, enforce and defend any rights assigned.

Consultant hereby irrevocably designates and appoints Company as its agents and attorneys-in-fact, coupled with an interest, to act for

and on Consultant’s behalf to execute and file any document and to do all other lawfully permitted acts to further the foregoing

with the same legal force and effect as if executed by Consultant and all other creators or owners of the applicable Invention.

(b)

Consultant agrees that all Inventions and all other business, technical and financial information (including, without limitation,

the identity of and information relating to customers or employees) developed, learned or obtained by or for or on behalf of Consultant

during the period that Consultant is to be providing the Services that relate to Company or the Business or demonstrably anticipated Business

of Company or in connection with the Services or that are received by or for Company in confidence, constitute “Proprietary Information.”

Consultant shall hold in confidence and not disclose or, except in performing the Services, use any Proprietary Information. However,

Consultant shall not be obligated under this paragraph with respect to information Consultant can document is or becomes readily publicly

available without restriction through no fault of Consultant. Upon the Company’s written request, Consultant will promptly provide

to Company all items and copies containing or embodying Proprietary Information, except that Consultant may keep one copy of the Proprietary

information in its legal files for recordkeeping and compliance purposes and may retain its personal copies of its compensation records

and this Agreement. Consultant also recognizes and agrees that Consultant has no expectation of privacy with respect to Company’s

telecommunications, networking or information processing systems (including, without limitation, stored computer files, email messages

and voice messages) and that Consultant’s activity, and any files or messages, on or using any of those of Company’s systems

may be monitored at any time without notice.

(c)

To the extent allowed by law, Section 5.a and any license granted Company hereunder includes all rights of paternity, integrity,

disclosure and withdrawal and any other rights that may be known as or referred to as “moral rights,” “artist’s

rights,” “droit moral,” or the like. Furthermore, Consultant agrees that notwithstanding any rights of publicity, privacy

or otherwise (whether or not statutory) anywhere in the world, to the extent any of the foregoing is ineffective under applicable law,

Consultant hereby provides any and all ratifications and consents necessary to accomplish the purposes of the foregoing to the extent

possible. Consultant will confirm any such ratifications and consents from time to time as requested by Company. If any other person is

in any way involved in any Services, Consultant will obtain the foregoing ratifications, consents and authorizations from such person

for Company’s exclusive benefit.

(d)

If any part of the Services or Inventions or information provided hereunder is based on, incorporates, or is an improvement or

derivative of, or cannot be reasonably and fully made, used, reproduced, distributed and otherwise exploited without using or violating

technology or intellectual property rights owned by or licensed to Consultant (or any person involved in the Services) and not assigned

hereunder, Consultant hereby grants Company and its successors a perpetual, irrevocable, worldwide royalty-free, non-exclusive, sublicensable

right and license to exploit and exercise all such technology and intellectual property rights in support of Company’s exercise

or exploitation of the Services, Inventions, other work or information performed or provided hereunder, or any assigned rights (including

any modifications, improvements and derivatives of any of them).

| 6. | CONSULTANT’S REPRESENTATION AND WARRANTIES. |

Consultant is not under any

legal obligation, including any obligation of confidentiality or non-competition, which would prevent Consultant from executing or performing

this Agreement, or which would render such execution or performance a breach of contract with any third party, or which would give any

third party any rights in any intellectual property which might be developed by Consultant hereunder.

Consultant shall perform the

Services hereunder in accordance with the terms of this Agreement and applicable regulations, guidelines and licensing requirements and

will perform the Services in a professional and workmanlike manner.

Consultant has all requisite

power and authority to execute, deliver and perform this Agreement, and this Agreement has been duly authorized, executed and delivered

by Consultant and is Consultant’s legal, valid and binding obligation, and is enforceable as to Consultant in accordance with its

terms.

Notices to any party hereunder

shall be deemed to be sufficiently given if delivered personally, sent via electronic mail (email) or sent by first class mail, with proper

postage affixed, to the address of such party set forth herein, or to such other address as may be specified by either party by notice

to the other party hereto. Notices shall be deemed given when delivered, if delivered personally, or on the third business day after mailing,

as provided above.

| |

If to Provider:

|

James Sapirstein

310 Boca Marina Circle N

Boca Raton, FL 33487

Email: jesapirstein@gmail.com

Phone: (781) 635-4346 |

| |

|

|

| |

If to Company:

|

Entero Therapeutics, Inc.

777 Yamato Road, Suite 502

Boca Raton, FL 33431

Attn: Finance Department

Email: sromano@firstwavebio.com

Phone: (508) 341-3627

|

In the event any provision

of this Agreement is determined by a court of competent jurisdiction to be unenforceable, the parties will negotiate in good faith to

restore the unenforceable provision to an enforceable state and to provide reasonable additions or adjustments to the terms of the other

provisions of this Agreement so as to render the whole Agreement valid and binding to the fullest extent possible, and in any event, this

Agreement shall be interpreted to be valid and binding to the fullest extent possible.

The Consultant hereby agrees

to indemnify and hold harmless the Company and its officers, directors, employees and affiliates of, from and against, any and all liabilities,

damages, losses, charges, fees, costs and expenses of whatever kind or nature (including reasonable attorneys’ and investigatory

fees and expenses) which the Company and its officers, directors, employees and affiliates shall at any time sustain or incur arising

out of this Agreement. The Company hereby agrees that the Consultant shall not be liable for any acts or omissions by him except to the

extent of the Consultant’s gross negligence, willful misconduct or breach of this Agreement. The Company hereby agrees to indemnify

the Consultant from and against, any and all liabilities, damages, losses, charges, fees, costs and expenses of whatever kind or nature

(including reasonable attorneys’ and investigatory fees and expenses) which the Consultant shall at any time sustain or incur arising

out of this agreement except to the extent they arise out of or in connection with the Consultant’s gross negligence, willful misconduct

or breach of this Agreement.

Consultant agrees that in

performing the Services pursuant to this Agreement, Consultant shall comply with (a) all laws, rules and regulations governing the activities

engaged in pursuant to this Agreement, including without limitation, all applicable securities laws, rules and regulations, including

those governing the use of material, non-public information; (b) Company’s policies and procedures to the extent made known to the

consultant (as same may be modified, from time to time); and (c) any non-disclosure or confidentiality agreements to which Company or

its agents may be subject with respect to any confidential information the Consultant may receive. The Consultant has not entered into

and agrees that he/she will not enter into, any agreement, either oral or written, in conflict herewith. Consultant acknowledges that

United States securities laws and the rules and regulations promulgated thereunder prohibit any person with material, non-public information

about a company from purchasing, selling, trading, or entering into options, puts, calls or other derivatives in respect of securities

of such issuer or from communicating such information to any other person or entity.

This Agreement shall be governed

by and construed pursuant to the laws of the State of Florida, applicable to agreements made and performed wholly within such State, without

giving effect to conflicts of law principles that would result in the application of the substantive laws of another jurisdiction. Any

dispute under this Agreement shall be resolved by appropriate proceeding in the State of Florida.

This Agreement may not be

changed orally but may be changed only in writing executed by the party to be charged with enforcement.

If any terms and conditions

of this Agreement shall be held to be illegal, invalid or otherwise unenforceable by a court of competent jurisdiction, all remaining

terms and conditions shall remain in full force and effect.

This Agreement shall inure

to the benefit of and be binding upon the Company and the Consultant and the Company’s successors and assigns. Because the services

to be provided by the Consultant are personal in nature, this Agreement and the rights and obligations of the Consultant under it may

not be assigned by the Consultant.

IN WITNESS WHEREOF, the parties hereto have duly

executed this Agreement as of the dates set forth below.

| Entero Therapeutics, Inc. |

|

Consultant: |

|

|

|

James Sapirstein |

| |

|

|

|

|

| |

|

|

|

|

| By: |

/s/ Sarah Romano |

|

By: |

/s/

James Sapirstein |

| |

|

|

|

|

| Name: |

Sarah Romano |

|

Name: |

James Sapirstein |

| |

|

|

|

|

| Title: |

CFO |

|

Title: |

CEO |

| |

|

|

|

|

| Date: |

8/1/2024 |

|

Date: |

8/1/2024 |

EXHIBIT A

Services

Services to be provided, include, but are not limited to the following:

| · | A broad range of consulting services rendered in connection with clinical drug development |

| · | Other related Business matters undertaken by the Company |

v3.24.2.u1

Cover

|

Aug. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity File Number |

001-37853

|

| Entity Registrant Name |

Entero Therapeutics, Inc.

|

| Entity Central Index Key |

0001604191

|

| Entity Tax Identification Number |

46-4993860

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

777 Yamato Road

|

| Entity Address, Address Line Two |

Suite 502

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33431

|

| City Area Code |

561

|

| Local Phone Number |

589-7020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ENTO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

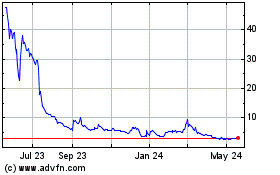

First Wave BioPharma (NASDAQ:FWBI)

Historical Stock Chart

From Mar 2025 to Apr 2025

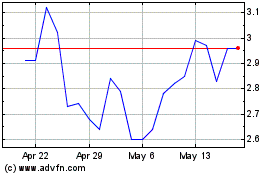

First Wave BioPharma (NASDAQ:FWBI)

Historical Stock Chart

From Apr 2024 to Apr 2025