false

0001604191

0001604191

2024-09-09

2024-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

September 9, 2024

| |

Entero Therapeutics, Inc. |

|

| |

(Exact name of registrant as specified in its charter) |

|

| Delaware |

|

001-37853 |

|

46-4993860 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

777 Yamato Road, Suite 502

Boca Raton, Florida |

|

33431 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (561) 589-7020

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

ENTO |

|

Nasdaq

Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On

September 10, 2024, Entero Therapeutics, Inc., a Delaware corporation (the “Company”) issued a press release announcing its

entry into a binding letter of intent with DataVault Holdings, Inc. (the “Letter of Intent”) (the “Press Release”).

The Press Release is attached hereto as Exhibit 99.1 and is being furnished herewith.

The

information in this Item 7.01 of this Current Report on Form 8-K (the “Current Report”) and the Press Release being furnished

herewith shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained

in this Item 7.01 and in the Press Release attached as Exhibit 99.1 to this Current Report shall not be incorporated by reference into

any filing with the Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of

any general incorporation language in such filing.

Item 8.01 Other Events.

On

September 9, 2024, the Company entered into the Letter of Intent with Data Vault Holdings, Inc. (“DVHI”) for the licensing

of certain clinical trial software owned by DVHI and associated intellectual property (the “Assets”). The Letter of Intent

contemplates a worldwide exclusive license to the Assets with the right to grant sublicenses, and a right of first refusal for the Company

to fully acquire the Assets in exchange for the issuance of $250,000 of shares of the Company’s junior convertible preferred stock

(the “Preferred Shares”) priced at a price per preferred share equal to 180% of the five (5) trading day VWAP of the Company’s

common stock (the “Common Share Price”), immediately preceding the closing of the Proposed Transaction multiplied by 1,000

(the “Preferred Share Price”), and single digit royalties on net sales (the “Proposed Transaction”). Entry into

definitive documentation for the Proposed Transaction will be conditioned upon the Company receiving no less than $500,000 of strategic

investment (the “Strategic Investment”), with a target of ultimately securing up to $3 million of strategic investment with

the assistance of DVHI.

Contingent

upon approval by the Company's shareholders, each share of junior convertible preferred stock will be convertible into shares of the Company’s

common stock, par value $0.0001 per share (the “Common Stock”) in a one for one thousand (1:1,000) exchange (the “Conversion

Ratio”), subject to certain adjustments. If, following receipt of stockholder approval, at the six month anniversary of the date

of the closing of the Proposed Transaction the five (5) trading day VWAP of the Company’s Common Stock immediately preceding that

date (the “Six Month Anniversary Stock Price”) is less than the Common Share Price, the Conversion Ratio then in effect will

be automatically adjusted such that the total number of shares that are issuable upon conversion of the Preferred Shares will equal $250,000

divided by the Six Month Anniversary Stock Price.

The

terms of the Proposed Transaction are subject to a number of contingencies, including the completion of customary due diligence and the

negotiation and execution of definitive agreements. Upon execution of the definitive agreement, the completion of the transaction will

be subject to, among other matters, satisfaction of the conditions negotiated therein, receipt of the Strategic Investment on terms satisfactory

to the Company, and receipt of all third party (including governmental and regulatory) approvals, licenses, consents, and clearances,

as and when applicable. There can be no assurance that the Proposed Transaction will be completed on the terms contemplated in the Letter

of Intent or otherwise.

Item 9.01 Financial

Statements and Exhibits.

* Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Entero Therapeutics, Inc. |

| |

|

| September 10, 2024 |

By: |

/s/ James Sapirstein |

| |

Name: |

James Sapirstein |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Entero Therapeutics Signs Letter of Intent to

License and Commercialize Remote Patient and Machine Vision Clinical Trial Management Platform from Data Vault Holdings

Entero Therapeutics to integrate applications

in planned Phase 3 study of latiglutenase for celiac disease and explore additional uses of technology in clinical trial compliance

BOCA RATON, Fla., September 10, 2024 (GLOBE NEWSWIRE)

– Entero Therapeutics, Inc., (NASDAQ: ENTO), (“Entero Therapeutics” or the “Company”), a clinical-stage

biopharmaceutical company specializing in the development of targeted, non-systemic therapies for gastrointestinal (GI) diseases,

today announced its entry into a binding letter of intent (the “Letter of Intent”) with Data Vault Holdings, Inc. (“Data

Vault”), a privately held technology holding company, to exclusively license two technology product suites owned by Data Vault --

QOLPOM® and FotoDigm,® (the “Proposed Transaction”). Entero Therapeutics will

work with Data Vault before and after the closing of the Proposed Transaction to secure funding for the customization of this clinical

trial compliance software that includes a focus on the use of DigitalTwins and high-performance computing. In parallel, Entero Therapeutics

plans to develop applications for its own near-term use with gastrointestinal (GI) clinical trials beginning with the planned Phase 3

trial for latiglutenase for the treatment of celiac disease.

Under the terms of the Letter of Intent, Entero

Therapeutics, upon execution of a definitive agreement, would receive an exclusive, global license to pilot the technology platform in

Entero Therapeutics’ clinical trials, and to develop and commercialize Data Vault’s QOLPOM® and FotoDigm®

patented pharmaceutical regime compliance software for use in clinical trials with third-parties in the pharma and biotech sectors.

In consideration, Entero Therapeutics will issue to Data Vault shares of the Company’s convertible preferred stock priced at a premium

to the market and single digit revenue sharing royalties on net sales. The Proposed Transaction is expected to close by the end of September,

and the entry into definitive documentation will be conditioned upon fulfillment requirements of no less than $500K of strategic investment

into Entero Therapeutics (the “Strategic Investment”), with a target of ultimately securing up to $3 million of further strategic

investment with DataVault’s assistance. The terms of the Proposed Transaction provide for Data Vault to support the Company’s

pursuit of the Strategic Investment. The Strategic Investment would provide Entero Therapeutics with access to both capital and technology

for a pilot program and the initiation and potential improvement of the Company’s future clinical trials.

James Sapirstein, Chairman and CEO of Entero Therapeutics,

added, “We are very pleased to have the opportunity to secure an exclusive, worldwide license from Data Vault for its clinical trial

compliance technology platform. Compliance is a major issue in drug development – it directly impacts the time, cost and success

of clinical trials. We believe that the software platform has the potential to improve outcomes for our Phase 3 latiglutenase trial in

celiac disease, along with the other GI therapeutic indications that we are planning to pursue. Both companies are committed to working

together to customize the software for the latiglutenase trial. Our clinical trials would be the testing ground for these products and

we believe that if they are validated in the clinic, they will have much broader commercial applications for other pharma companies across

multiple disease indications.”

Mr. Sapirstein added, “We are very impressed

with the potential of Data Vault’s IP portfolio – some of which has been historically validated across multiple sectors and

most recently in the Data Vault-WisA Technologies transaction, where other Data Vault IP not included in the Proposed Transaction was

acquired. FotoDigm IP that was recently issued has a broad scope and has been cited by major IT and healthcare players as references.

We are confident that the two assets have the potential to advance the state of the art in clinical trial monitoring and compliance and

could create a commercial opportunity with pharma and biotech companies in the industry.”

The Company’s use of the compliance

platform would enable Entero Therapeutics to demonstrate the potential effectiveness and commercial scalability for incorporation in

new software applications for a wide range of clinical-trial compliance across multiple therapeutic indications. Under the terms of

the Letter of Intent, Entero Therapeutics would assume responsibility for all future clinical trial and commercial development in

this sector and would be exclusively authorized to out-license to third parties within. The potential licensing agreement would

include an activation triggered upon a capital infusion through strategic investment in Entero Therapeutics, and access to capital,

technology and out-licensing within the biopharmaceutical field. The solution has been designed to assist with Entero

Therapeutics’ completion of its medical trials in the present and future. The Letter of Intent also provides for a right of

first refusal for Entero Therapeutics to fully-acquire the QOLPOM® and Fotodigm® assets

from Data Vault Holdings, subject to certain conditions as set forth in the Letter of Intent.

QOLPOM® and FotoDigm®

were developed by the late and Honorable Arizona State Senator David Bradley, a behavioral healthcare administrator and the father

of Data Vault Holdings’ Chief Executive Officer. QOLPOM® (Quality of Life and Peace of Mind) was developed to solve

critical behavioral problems within the remote patient monitoring space leveraging machine learning and IoT sensory capabilities. Fotodigm®

is a patented machine vision technology (U.S. patent number 11,437,139 Method and Apparatus for Biometric Data Collection Combing

Visual Data with Historical Health Records Metadata) and has been cited by AT&T, Medtronic, Indiana University and Express Scripts

amongst others. A second patent (U.S. patent number 12,040,088 issued on Jul 16, 2024) includes foundational and expanded claims and a

platform designed to reduce the costs and streamline processes of data collection, verification on a highly scalable and replicable technology

for clinical trial data management.

The terms of the Proposed Transaction are subject

to a number of contingencies, including the completion of customary due diligence and the negotiation and execution of definitive agreements.

Upon execution of the definitive agreement, the completion of the transaction will be subject to, among other pre-closing requirements,

satisfaction of the conditions negotiated therein, receipt of the Strategic Investment on terms satisfactory to Entero Therapeutics, and

receipt of all third-party (including governmental) approvals, licenses, consents, and clearances, as and when applicable. There can be

no assurance that the Proposed Transaction will be completed on the terms contemplated in the Letter of Intent or otherwise.

About Entero Therapeutics, Inc.

Entero Therapeutics is a clinical-stage biopharmaceutical

company specializing in the development of targeted, non-systemic therapies for gastrointestinal (GI) diseases. The Company currently

has a therapeutic development pipeline with multiple late-stage clinical programs built around three proprietary technologies: latiglutenase,

a Phase 3-ready, potentially first-in-class, targeted, oral biotherapeutic for celiac disease; capeserod, a selective 5-HT4 receptor

partial agonist being developed for gastroparesis; and adrulipase, a recombinant lipase enzyme designed to enable the digestion of fats

and other nutrients in cystic fibrosis and chronic pancreatitis patients with exocrine pancreatic insufficiency. Entero Therapeutics

is headquartered in Boca Raton, Florida. For more information visit www.enterothera.com.

About Data Vault Holdings Inc.

Data Vault Holdings thrives by strategically

managing a diverse portfolio that includes a robust patent network and innovative ventures. Data Vault Holdings’ success stems

from Data Vault Holdings’ ability to bridge intellectual property protection with market opportunities, driving transformative

innovations across sectors. By fostering a culture of creativity and collaboration, Data Vault Holdings continuously redefines industry

standards and propel forward-thinking solutions that resonate globally. Through Data Vault Holdings’ integrated approach, Data

Vault Holdings remains at the forefront of driving impactful advancements and shaping the future of innovation. WisA Technologies recently announced the execution of a definitive asset purchase agreement for the purchase of Data Vault Holdings’ information

technology intellectual property for its spatial audio technology business for $210 million dollars. For more information visit: www.datavaultholdings.com.

About Honorable Senator David Bradley

The

former Senator died of pancreatic cancer that did as it often does, eluded early detection,

a disease that can exhibit aggressive growth that makes it one of the more life-threatening of GI cancers.

To learn more about David Bradley visit www.senatorbradley.com.

Forward-Looking Statements

This press release of and by the Company may

contain certain statements relating to future results which are forward-looking statements. It is possible that the Company’s actual

results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these

forward-looking statements, depending on factors including whether a definitive agreement for the Proposed Transaction will be entered

into; whether the Proposed Transaction, or any other contemplated transaction, may be completed with different terms, in an untimely manner,

or not at all; whether the Company will be able to realize the benefits of the Proposed Transaction described herein; the Company’s

current and future capital requirements and its ability to raise additional funds to satisfy its capital needs; whether there are delays

in the engagement of a new independent registered public accounting firm; whether there are any further delays in the preparation and

filing of the Company’s Form 10-Q; whether the Company will be able to realize the expected benefits of its acquisition of ImmunogenX;

the Company’s ability to integrate the assets and contemplated commercial operations acquired from ImmunogenX into the Company’s

business; whether the Company will be able to effectively and timely service its debt; whether results obtained in preclinical and nonclinical

studies and clinical trials will be indicative of results obtained in future clinical trials; whether preliminary or interim results from

a clinical trial will be indicative of the final results of the trial; whether the Company will be able to maintain compliance with Nasdaq’s

continued listing criteria and the effect of a delisting from Nasdaq on the market for the Company’s securities; whether the Company

will be able to satisfy the terms of any plan of compliance it submits to Nasdaq; whether Nasdaq will accept any plan of compliance the

Company submits, or provide any other accommodations to the Company; the size of the potential markets for the Company’s drug candidates

and its ability to service those markets; and the effects of the First Wave Bio, Inc. acquisition, the related settlement and their effect

on the Company’s business, operating results and financial prospects. Additional information concerning the Company and its business,

including a discussion of factors that could materially affect the Company’s financial results are contained in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023, under the heading “Risk Factors,” as well as the Company’s

subsequent filings with the Securities and Exchange Commission. All forward-looking statements included in this press release are made

only as of the date of this press release, and we do not undertake any obligation to publicly update or correct any forward-looking statements

to reflect events or circumstances that subsequently occur or of which we hereafter become aware.

For more information:

Entero Therapeutics, Inc.

777 Yamato Road, Suite 502

Boca Raton, FL 33431

Phone: (561) 589-7020

info@enterothera.com

Media contact:

Russo Partners

David Schull

(347) 956-7697

v3.24.2.u1

Cover

|

Sep. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 09, 2024

|

| Entity File Number |

001-37853

|

| Entity Registrant Name |

Entero Therapeutics, Inc.

|

| Entity Central Index Key |

0001604191

|

| Entity Tax Identification Number |

46-4993860

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

777 Yamato Road

|

| Entity Address, Address Line Two |

Suite 502

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33431

|

| City Area Code |

561

|

| Local Phone Number |

589-7020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ENTO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

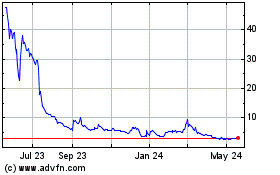

First Wave BioPharma (NASDAQ:FWBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

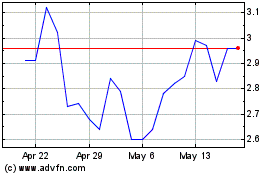

First Wave BioPharma (NASDAQ:FWBI)

Historical Stock Chart

From Jan 2024 to Jan 2025