Form 8-K/A - Current report: [Amend]

March 06 2025 - 3:10PM

Edgar (US Regulatory)

0001496323true00014963232025-01-072025-01-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No.1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 7, 2025 |

IGM Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39045 |

77-0349194 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

325 E. Middlefield Road |

|

Mountain View, California |

|

94043 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 965-7873 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

IGMS |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On January 10, 2025, IGM Biosciences, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Form 8-K”) disclosing a strategic update to halt further development of imvotamab, an IGM-based CD20 X CD3 bispecific antibody T cell engager, and IGM-2644, an IGM-based CD38 X CD3 bispecific antibody T cell engager, for autoimmune diseases, including an approximately 73% reduction in force to preserve cash (the "2025 Restructuring").

At the time of the filing of the Original Form 8-K, the Company was unable in good faith to make a determination of an estimate or range of estimates required by paragraphs (b), (c) and (d) of Item 2.05 of Form 8-K with respect to the 2025 Restructuring. This Amendment No. 1 to the Original Form 8-K (the “Amendment”) is being filed by the Company to provide such information. Except as set forth herein, the remainder of the Original Form 8-K is unchanged.

Item 2.05 Costs Associated with Exit or Disposal Activities.

As a result of the 2025 Restructuring, the Company estimates it will incur total restructuring charges between $0.7 million and $2.0 million, consisting of cash expenditures between $4.1 million and $5.4 million for severance and one-time termination costs offset by non-cash compensation and stock-based compensation expense credit of $3.4 million. The Company expects to recognize substantially all restructuring charges in the first quarter of 2025.

The estimates of costs and expenses that the Company currently expects to incur in connection with the 2025 Restructuring are subject to a number of assumptions, and actual results may differ materially. The Company may also incur additional costs due to events that may occur as a result of, or that are associated with, the 2025 Restructuring.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. Such forward-looking statements are not based on historical fact and include, but are not limited to, the expected charges and costs of the 2025 Restructuring, and the recognition of such restructuring charges. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially, including but not limited to: the Company’s ability to discover and develop product candidates; the Company's activities to evaluate and pursue potential strategic alternatives; the Company's ability to achieve the expected financial and operational benefits of its recent cash preservation activities; risks related to the use of engineered IgM antibodies, which is a novel and unproven therapeutic approach; the Company’s ability to demonstrate the safety and efficacy of any future product candidates; developments relating to the Company's competitors and its industry, including competing product candidates and therapies; the Company's ability to successfully manufacture and supply any future product candidates for clinical trials; the potential impact of continuing or worsening supply chain constraints; the Company’s ability to successfully and timely advance any future product candidates through clinical trials; the Company’s ability to enroll patients in any future clinical trials; the potential for the results of any future clinical trials to differ from preclinical, preliminary, initial or expected results; the risk of significant adverse events, toxicities or other undesirable side effects; the risk of the occurrence of any event, change or other circumstance that could give rise to the termination of collaborations with third parties; the risk that all necessary regulatory approvals cannot be obtained; the potential market for any future product candidates, and the progress and success of alternative therapeutics currently available or in development; the Company’s ability to obtain additional capital to finance its operations; uncertainties related to the projections of the size of patient populations suffering from the diseases the Company is targeting; the Company’s ability to obtain, maintain and protect its intellectual property rights; any potential delays or disruptions resulting from catastrophic events, including epidemics or other outbreaks of infectious disease; general economic and market conditions, including inflation; and other risks and uncertainties, including those more fully described in the Company’s filings with the Securities and Exchange Commission (SEC), including in the Company’s Annual Report on Form 10-K filed with the SEC on March 6, 2025 and any future reports the Company files with the SEC. Any forward-looking statements contained in this Current Report on Form 8-K speak only as of the date hereof, and the Company specifically disclaims any obligation to update any forward-looking statement, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

IGM BIOSCIENCES, INC. |

|

|

|

|

Date: |

March 6, 2025 |

By: |

/s/ Misbah Tahir |

|

|

|

Misbah Tahir

Chief Financial Officer |

v3.25.0.1

Document and Entity Information

|

Jan. 07, 2025 |

| Cover [Abstract] |

|

| Entity Registrant Name |

IGM Biosciences, Inc.

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

On January 10, 2025, IGM Biosciences, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Form 8-K”) disclosing a strategic update to halt further development of imvotamab, an IGM-based CD20 X CD3 bispecific antibody T cell engager, and IGM-2644, an IGM-based CD38 X CD3 bispecific antibody T cell engager, for autoimmune diseases, including an approximately 73% reduction in force to preserve cash (the "2025 Restructuring").At the time of the filing of the Original Form 8-K, the Company was unable in good faith to make a determination of an estimate or range of estimates required by paragraphs (b), (c) and (d) of Item 2.05 of Form 8-K with respect to the 2025 Restructuring. This Amendment No. 1 to the Original Form 8-K (the “Amendment”) is being filed by the Company to provide such information. Except as set forth herein, the remainder of the Original Form 8-K is unchanged.

|

| Entity Central Index Key |

0001496323

|

| Document Period End Date |

Jan. 07, 2025

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39045

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

77-0349194

|

| Entity Address, Address Line One |

325 E. Middlefield Road

|

| Entity Address, City or Town |

Mountain View

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94043

|

| City Area Code |

(650)

|

| Local Phone Number |

965-7873

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

IGMS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

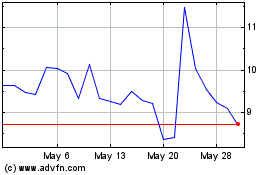

IGM Biosciences (NASDAQ:IGMS)

Historical Stock Chart

From Feb 2025 to Mar 2025

IGM Biosciences (NASDAQ:IGMS)

Historical Stock Chart

From Mar 2024 to Mar 2025