00007791522024Q3false00007791522024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2024

JACK HENRY & ASSOCIATES, INC.

(Exact name of Registrant as specified in its Charter) | | | | | | | | |

| Delaware | 0-14112 | 43-1128385 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

663 Highway 60, P.O. Box 807, Monett, MO 65708

(Address of Principal Executive Offices) (Zip Code)

417-235-6652

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a.-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | JKHY | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02

Results of Operations and Financial Condition.

On May 7, 2024, Jack Henry & Associates, Inc. issued a press release announcing fiscal 2024 third quarter results, the text of which is attached hereto as Exhibit 99.1.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | JACK HENRY & ASSOCIATES, INC. |

| | | (Registrant) |

| | | |

| Date: | May 7, 2024 | | /s/ Mimi L. Carsley |

| | | Mimi L. Carsley |

| | | Chief Financial Officer and Treasurer |

| | | | | |

| |

| Press Release |

|

Mimi L. Carsley | Chief Financial Officer | mcarsley@jackhenry.com |

FOR IMMEDIATE RELEASE

Jack Henry & Associates, Inc. Reports Third Quarter Fiscal 2024 Results

Third quarter summary:

• GAAP revenue increased 5.9% and GAAP operating income increased 3.4% for the fiscal three months ended March 31, 2024, compared to the prior fiscal year quarter.

• Non-GAAP adjusted revenue increased 7.0% and non-GAAP adjusted operating income increased 8.6% for the fiscal three months ended March 31, 2024, compared to the prior fiscal year quarter.1

▪ GAAP EPS was $1.19 per diluted share for the fiscal three months ended March 31, 2024, compared to $1.12 in the prior fiscal year quarter.

Fiscal year-to-date summary:

• GAAP revenue increased 7.3% and GAAP operating income increased 2.0% for the fiscal nine months ended March 31, 2024, compared to the prior fiscal year period.

• Non-GAAP adjusted revenue increased 7.7% and non-GAAP adjusted operating income increased 12.0% for the fiscal nine months ended March 31, 2024, compared to the prior fiscal year period.1

▪ GAAP EPS was $3.85 per diluted share for the fiscal nine months ended March 31, 2024, compared to $3.68 in the prior fiscal year period.

▪ Cash and cash equivalents were $27 million at March 31, 2024, and 2023.

▪ Debt related to credit facilities was $250 million at March 31, 2024, and $375 million at March 31, 2023.

Full year fiscal 2024 guidance:2

| | | | | | | | | | | | | | | | | |

| Current | | Previous |

| GAAP | Low | High | | Low | High |

| Revenue updated | $2,215 | $2,228 | | $2,215 | $2,228 |

Operating margin | 21.9% | 22.0% | | 21.8% | 21.9% |

| EPS updated | $5.15 | $5.19 | | $5.09 | $5.13 |

| | | | | |

Non-GAAP3 | | | | | |

Adjusted revenue updated | $2,197 | $2,210 | | $2,197 | $2,210 |

Adjusted operating margin updated | 22.4% | 22.4% | | 22.3% | 22.3% |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Third Qtr Revenue | | Third Qtr Operating Income | | F'2024 YTD Net Income |

| | | | |

| GAAP | Non-GAAP1 | | GAAP | Non-GAAP1 | | GAAP | Non-GAAP1 |

| increased | increased | | increased | increased | | increased | increased |

| 5.9% | 7.0% | | 3.4% | 8.6% | | 4.4% | 15.4% |

| |

| | | | | | | | |

F'2024 YTD Revenue | | F'2024 YTD Operating Income | | F'2024 YTD EBITDA |

| | | | |

| GAAP | Non-GAAP1 | | GAAP | Non-GAAP1 | | Non-GAAP4 |

| increased | increased | | increased | increased | | increased |

| 7.3% | 7.7% | | 2.0% | 12.0% | | 9.4% |

| |

| | | | | | | | |

Monett, MO, May 7, 2024 - Jack Henry & Associates, Inc. (Nasdaq: JKHY), a leading financial technology provider, today announced results for the fiscal third quarter ended March 31, 2024.

1 See tables below on page 4 reconciling non-GAAP financial measures to GAAP.

2 The full year guidance assumes no acquisitions are made during fiscal year 2024.

3 See tables below on page 8 reconciling fiscal year 2024 GAAP to non-GAAP guidance.

4 See table below on page 14 reconciling net income to non-GAAP EBITDA.

| | | | | | | | | | | | | | | | | |

According to David Foss, Board Chair and CEO, “We are very pleased to report another quarter of strong revenue growth and overall financial performance. Our sales teams produced a record third quarter for sales bookings, and our sales pipeline remains near its all-time high. We continue to execute on our strategy to provide modern technology to help community and regional financial institutions strengthen connections with the people and businesses they serve. As a well-rounded financial technology company, we are well positioned to serve clients of all sizes through a comprehensive suite of innovative solutions and our cloud-native technology modernization strategy.” |

|

|

|

|

|

|

Operating Results

Revenue, operating expenses, operating income, and net income for the three and nine months ended March 31, 2024, compared to the three and nine months ended March 31, 2023, were as follows (all dollar amounts in this section are in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | |

| (Unaudited, In Thousands) | Three Months Ended

March 31, | | % Change | | Nine Months Ended

March 31, | | % Change |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Revenue | | | | | | | | | | | |

| Services and Support | $ | 305,017 | | | $ | 291,922 | | | 4.5 | % | | $ | 959,214 | | | $ | 902,771 | | | 6.3 | % |

| Percentage of Total Revenue | 56.6 | % | | 57.4 | % | | | | 57.9 | % | | 58.5 | % | | |

| Processing | 233,545 | | | 216,630 | | | 7.8 | % | | 696,417 | | | 640,298 | | | 8.8 | % |

| Percentage of Total Revenue | 43.4 | % | | 42.6 | % | | | | 42.1 | % | | 41.5 | % | | |

| REVENUE | $ | 538,562 | | | $ | 508,552 | | | 5.9 | % | | $ | 1,655,631 | | | $ | 1,543,069 | | | 7.3 | % |

•Services and support revenue increased for the three months ended March 31, 2024, primarily driven by growth in data processing and hosting revenue of 10.6%. Processing revenue increased for the three months ended March 31, 2024, primarily driven by growth in Jack Henry digital revenue (including Banno) of 26.1%. Other drivers were increases in card, payment processing and other processing revenues.

•Services and support revenue increased for the nine months ended March 31, 2024, primarily driven by growth in public cloud revenue of 10.0%. Other drivers were increases in on-premise support and product delivery and services revenues. Processing revenue increased for the nine months ended March 31, 2024, primarily driven by growth in transaction and digital revenue of 19.1%. Other drivers were increases in card and remittance revenues.

•For the three months ended March 31, 2024, core segment revenue increased 7.4%, payments segment revenue increased 5.3%, complementary segment revenue increased 5.1%, and corporate and other segment revenue increased 5.8%. Non-GAAP adjusted core segment revenue increased 8.2%, non-GAAP adjusted payments segment revenue increased 5.7%, non-GAAP adjusted complementary segment revenue increased 7.7%, and non-GAAP adjusted corporate and other segment revenue increased 5.8% (see revenue lines of segment break-out tables on pages 5 and 6 below).

•For the nine months ended March 31, 2024, core segment revenue increased 7.6%, payments segment revenue increased 6.2%, complementary segment revenue increased 7.1%, and corporate and other segment revenue increased 17.1%. Non-GAAP adjusted core segment revenue increased 8.0%, non-GAAP adjusted payments segment revenue increased 6.1%, non-GAAP adjusted complementary segment revenue increased 8.3%, and non-GAAP adjusted corporate and other segment revenue increased 17.1% (see revenue lines of segment break-out tables on pages 6 and 7 below).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating Expenses and Operating Income | | | | | | | | | |

| (Unaudited, In Thousands) | Three Months Ended

March 31, | | % Change | | Nine Months Ended

March 31, | | % Change | |

| 2024 | | 2023 | | | | 2024 | | 2023 | | | |

| Cost of Revenue | $ | 328,224 | | | $ | 307,345 | | | 6.8 | % | | $ | 972,205 | | | $ | 910,195 | | | 6.8 | % | |

Percentage of Total Revenue5 | 60.9 | % | | 60.4 | % | | | | 58.7 | % | | 59.0 | % | | | |

| Research and Development | 35,993 | | | 34,625 | | | 4.0 | % | | 108,363 | | | 104,179 | | | 4.0 | % | |

Percentage of Total Revenue5 | 6.7 | % | | 6.8 | % | | | | 6.5 | % | | 6.8 | % | | | |

| Selling, General, and Administrative | 62,246 | | | 58,192 | | | 7.0 | % | | 211,298 | | | 172,205 | | | 22.7 | % | |

Percentage of Total Revenue5 | 11.6 | % | | 11.4 | % | | | | 12.8 | % | | 11.2 | % | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| OPERATING EXPENSES | 426,463 | | | 400,162 | | | 6.6 | % | | 1,291,866 | | | 1,186,579 | | | 8.9 | % | |

| | | | | | | | | | | | |

| OPERATING INCOME | $ | 112,099 | | | $ | 108,390 | | | 3.4 | % | | $ | 363,765 | | | $ | 356,490 | | | 2.0 | % | |

Operating Margin5 | 20.8 | % | | 21.3 | % | | | | 22.0 | % | | 23.1 | % | | | |

•Cost of revenue increased for the three and nine months ended March 31, 2024, primarily due to higher direct costs generally consistent with increases in the related revenue, increased personnel costs due to an increase in employee headcount in the trailing twelve months, and higher internal licenses and fees.

•Research and development expense increased for the three months ended March 31, 2024, primarily due to cloud consumption costs, net of capitalization. Research and development expense increased for the nine months ended March 31, 2024, primarily due to higher personnel costs (net of capitalized personnel costs) related to the Payrailz, LLC ("Payrailz") acquisition6 and Jack Henry Platform.

•Selling, general, and administrative expense increased for the three months ended March 31, 2024, primarily due to higher personnel costs from increased commissions and medical benefits expenses. Selling, general, and administrative expense increased for the nine months ended March 31, 2024, primarily due to higher personnel costs from the voluntary employee departure incentive payment (VEDIP) program7 and a decrease in the gain on sale of assets, net, period over period.

Net Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Unaudited, In Thousands,

Except Per Share Data) | Three Months Ended

March 31, | | % Change | | Nine Months Ended

March 31, | | % Change |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Income Before Income Taxes | $ | 114,165 | | | $ | 106,115 | | | 7.6 | % | | $ | 367,635 | | | $ | 350,624 | | | 4.9 | % |

| Provision for Income Taxes | 27,066 | | | 24,566 | | | 10.2 | % | | 86,892 | | | 81,751 | | | 6.3 | % |

| NET INCOME | $ | 87,099 | | | $ | 81,549 | | | 6.8 | % | | $ | 280,743 | | | $ | 268,873 | | | 4.4 | % |

| Diluted earnings per share | $ | 1.19 | | | $ | 1.12 | | | 6.9 | % | | $ | 3.85 | | | $ | 3.68 | | | 4.6 | % |

•Effective tax rates for the three months ended March 31, 2024, and 2023 were 23.7% and 23.2%, respectively. Effective tax rates for the nine months ended March 31, 2024, and 2023 were 23.6% and 23.3%, respectively.

| | | | | | | | | | | | | | | | | |

According to Mimi Carsley, CFO and Treasurer, “For the third quarter of the fiscal year, our private cloud and processing services continued to drive strong revenue growth. We had strong, organic revenue growth of over 7% on a non-GAAP basis and non-GAAP operating income grew over 8%. These results reflect the Jack Henry team’s disciplined approach to cost control.” |

|

|

|

|

|

|

| | | | | |

5 Operating margin is calculated by dividing operating income by revenue. Operating margin plus operating expense components as a percentage of total revenue may not equal 100% due to rounding.

6 On August 31, 2022, the Company acquired all the equity interest in Payrailz.

7 The VEDIP program was a Company voluntary separation program offered to certain eligible employees beginning in July 2023.

Impact of Non-GAAP Adjustments

The tables below show our revenue, operating income, and net income (in thousands) for the three and nine months ended March 31, 2024, compared to the three and nine months ended March 31, 2023, excluding the impacts of deconversions, acquisitions, the VEDIP program expense,** and the gain on sale of assets, net.

On August 31, 2022, the Company acquired all the equity interest in Payrailz (the "acquisition"). Payrailz related revenue, operating expenses, operating income, and net income excluded in the tables below in the column for the nine months ended March 31, 2024, include Payrailz activity for the first two months of the fiscal year only.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, In Thousands) | Three Months Ended March 31, | | % Change | | Nine Months Ended March 31, | | % Change |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| | | | | | | | | | | |

GAAP Revenue* | $ | 538,562 | | | $ | 508,552 | | | 5.9 | % | | $ | 1,655,631 | | | $ | 1,543,069 | | | 7.3 | % |

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | |

| Deconversion revenue | (843) | | | (6,143) | | | | | (9,861) | | | (17,042) | | | |

| Revenue from acquisition | — | | | — | | | | | (1,945) | | | — | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

NON-GAAP ADJUSTED REVENUE* | $ | 537,719 | | | $ | 502,409 | | | 7.0 | % | | $ | 1,643,825 | | | $ | 1,526,027 | | | 7.7 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| GAAP Operating Income | $ | 112,099 | | | $ | 108,390 | | | 3.4 | % | | $ | 363,765 | | | $ | 356,490 | | | 2.0 | % |

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | |

| Operating income from deconversions | 6 | | | (5,130) | | | | | (7,552) | | | (14,459) | | | |

| Operating loss from acquisition | — | | | — | | | | | 2,237 | | | — | | | |

| | | | | | | | | | | |

VEDIP program expense** | — | | | — | | | | | 16,443 | | | — | | | |

| Gain on sale of assets, net | — | | | — | | | | | — | | | (7,384) | | | |

| | | | | | | | | | | |

| NON-GAAP ADJUSTED OPERATING INCOME | $ | 112,105 | | | $ | 103,260 | | | 8.6 | % | | $ | 374,893 | | | $ | 334,647 | | | 12.0 | % |

Non-GAAP Adjusted Operating Margin*** | 20.8 | % | | 20.6 | % | | | | 22.8 | % | | 21.9 | % | | |

| | | | | | | | | | | |

| GAAP Net Income | $ | 87,099 | | | $ | 81,549 | | | 6.8 | % | | $ | 280,743 | | | $ | 268,873 | | | 4.4 | % |

| | | | | | | | | | | |

*GAAP revenue is comprised of services and support and processing revenues (see page 2). Reducing services and support revenue by deconversion revenue for the three months ended March 31, 2024, and 2023, which was $843 for the current fiscal year quarter and $6,143 for the prior fiscal year quarter, results in non-GAAP adjusted services and support revenue growth of 6.4% quarter over quarter. There were no non-GAAP adjustments to processing revenue for the three months ended March 31, 2024, and 2023.

Reducing services and support revenue by deconversion revenue for the nine months ended March 31, 2024, and 2023, which was $9,861 for the current fiscal year-to-date period and $17,042 for the prior fiscal year-to-date period, and by $2 of revenue from acquisition in the current fiscal year-to-date period, results in non-GAAP adjusted services and support revenue growth of 7.2% period over period. Reducing processing revenue by revenue from acquisition for the nine months ended March 31, 2024, which was $1,943, results in non-GAAP adjusted processing revenue growth of 8.5% year-to-date period over year-to-date period.

**The VEDIP program expense for the nine months ended March 31, 2024, was related to a Company voluntary separation program offered to certain eligible employees beginning in July 2023.

***Non-GAAP adjusted operating margin is calculated by dividing non-GAAP adjusted operating income by non-GAAP adjusted revenue.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, In Thousands) | Three Months Ended March 31, | | % Change | | Nine Months Ended March 31, | | % Change |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| | | | | | | | | | | |

| GAAP Net Income | $ | 87,099 | | | $ | 81,549 | | | 6.8 | % | | $ | 280,743 | | | $ | 268,873 | | | 4.4 | % |

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | |

| Net income from deconversions | 6 | | | (5,130) | | | | | (7,552) | | | (14,459) | | | |

VEDIP program expense* | — | | | — | | | | | 16,443 | | | — | | | |

| Net loss from acquisition | — | | | — | | | | | 4,656 | | | — | | | |

| Gain on sale of assets, net | — | | | — | | | | | — | | | (7,384) | | | |

Tax impact of adjustments** | (1) | | | 1,231 | | | | | (3,250) | | | 5,243 | | | |

| | | | | | | | | | | |

| NON-GAAP ADJUSTED NET INCOME | $ | 87,104 | | | $ | 77,650 | | | 12.2 | % | | $ | 291,040 | | | $ | 252,273 | | | 15.4 | % |

*The VEDIP program expense for the nine months ended March 31, 2024, was related to a Company voluntary separation program offered to certain eligible employees beginning in July 2023.

**The tax impact of adjustments is calculated using a tax rate of 24% for the three and nine month periods of fiscal 2024 and for the three and nine month periods of fiscal 2023. Our tax rate for non-GAAP adjustment items takes a broad look at our recurring tax adjustments and applies them to non-GAAP revenue that does not have its own specific tax impacts.

The tables below show the segment break-out of revenue and cost of revenue for each period presented, as adjusted for the items above, and include a reconciliation to non-GAAP adjusted operating income presented above.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| (Unaudited, In Thousands) | Core | | Payments | | Complementary | | Corporate and Other | | Total |

| GAAP REVENUE | $ | 166,655 | | | $ | 201,919 | | | $ | 149,231 | | | $ | 20,757 | | | $ | 538,562 | |

| Non-GAAP adjustments* | (1,291) | | | (910) | | | 1,366 | | | (8) | | | (843) | |

| NON-GAAP ADJUSTED REVENUE | 165,364 | | | 201,009 | | | 150,597 | | | 20,749 | | | 537,719 | |

| | | | | | | | | |

| GAAP COST OF REVENUE | 72,153 | | | 109,848 | | | 65,414 | | | 80,809 | | | 328,224 | |

| Non-GAAP adjustments* | (225) | | | (95) | | | (348) | | | (3) | | | (671) | |

| NON-GAAP ADJUSTED COST OF REVENUE | 71,928 | | | 109,753 | | | 65,066 | | | 80,806 | | | 327,553 | |

| | | | | | | | | |

| GAAP SEGMENT INCOME | $ | 94,502 | | | $ | 92,071 | | | $ | 83,817 | | | $ | (60,052) | | | |

| Segment Income Margin** | 56.7 | % | | 45.6 | % | | 56.2 | % | | (289.3) | % | | |

| | | | | | | | | |

| NON-GAAP ADJUSTED SEGMENT INCOME | $ | 93,436 | | | $ | 91,256 | | | $ | 85,531 | | | $ | (60,057) | | | |

Non-GAAP Adjusted Segment Income Margin** | 56.5 | % | | 45.4 | % | | 56.8 | % | | (289.4) | % | | |

| | | | | | | | | |

| Research and Development | | | | | | | | | 35,993 | |

| Selling, General, and Administrative | | | | | | | | | 62,246 | |

| | | | | | | | | |

| Non-GAAP adjustments unassigned to a segment*** | | | | | | | | (178) | |

| NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | | | | | | | | 425,614 | |

| | | | | | | | | |

| NON-GAAP ADJUSTED OPERATING INCOME | | | | | | | | $ | 112,105 | |

*Revenue non-GAAP adjustments for all segments were deconversion revenue. Cost of revenue non-GAAP adjustments for all segments were deconversion costs.**Segment income margin is calculated by dividing segment income by revenue. Non-GAAP adjusted segment income margin is calculated by dividing non-GAAP adjusted segment income by non-GAAP adjusted revenue.

***Non-GAAP adjustments unassigned to a segment were selling, general, and administrative deconversion costs.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| (Unaudited, In Thousands) | Core | | Payments | | Complementary | | Corporate and Other | | Total |

| GAAP REVENUE | $ | 155,106 | | | $ | 191,833 | | | $ | 141,987 | | | $ | 19,626 | | | $ | 508,552 | |

| Non-GAAP adjustments* | (2,315) | | | (1,643) | | | (2,170) | | | (15) | | | (6,143) | |

| | | | | | | | | |

| NON-GAAP ADJUSTED REVENUE | 152,791 | | | 190,190 | | | 139,817 | | | 19,611 | | | 502,409 | |

| | | | | | | | | |

| GAAP COST OF REVENUE | 69,994 | | | 106,216 | | | 61,037 | | | 70,098 | | | 307,345 | |

| Non-GAAP adjustments* | (238) | | | (62) | | | (166) | | | (4) | | | (470) | |

| NON-GAAP ADJUSTED COST OF REVENUE | 69,756 | | | 106,154 | | | 60,871 | | | 70,094 | | | 306,875 | |

| | | | | | | | | |

| GAAP SEGMENT INCOME | $ | 85,112 | | | $ | 85,617 | | | $ | 80,950 | | | $ | (50,472) | | | |

| Segment Income Margin | 54.9 | % | | 44.6 | % | | 57.0 | % | | (257.2) | % | | |

| | | | | | | | | |

| NON-GAAP ADJUSTED SEGMENT INCOME | $ | 83,035 | | | $ | 84,036 | | | $ | 78,946 | | | $ | (50,483) | | | |

| Non-GAAP Adjusted Segment Income Margin | 54.3 | % | | 44.2 | % | | 56.5 | % | | (257.4) | % | | |

| | | | | | | | | |

| Research and Development | | | | | | | | | 34,625 | |

| Selling, General, and Administrative | | | | | | | | | 58,192 | |

| | | | | | | | | |

| Non-GAAP adjustments unassigned to a segment** | | | | | | | | (543) | |

| NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | | | | | | | | 399,149 | |

| | | | | | | | | |

| NON-GAAP ADJUSTED OPERATING INCOME | | | | | | | | $ | 103,260 | |

*Revenue non-GAAP adjustments for all segments were deconversion revenues. Cost of revenue non-GAAP adjustments for all segments were deconversion costs.**Non-GAAP adjustments unassigned to a segment were selling, general, and administrative deconversion costs.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Nine Months Ended March 31, 2024 |

| (Unaudited, In Thousands) | Core | | Payments | | Complementary | | Corporate and Other | | Total |

| GAAP REVENUE | $ | 518,696 | | | $ | 605,115 | | | $ | 463,064 | | | $ | 68,756 | | | $ | 1,655,631 | |

| Non-GAAP adjustments* | (4,885) | | | (5,415) | | | (1,440) | | | (66) | | | (11,806) | |

| | | | | | | | | |

| NON-GAAP ADJUSTED REVENUE | 513,811 | | | 599,700 | | | 461,624 | | | 68,690 | | | 1,643,825 | |

| | | | | | | | | |

| GAAP COST OF REVENUE | 217,449 | | | 330,297 | | | 191,712 | | | 232,747 | | | 972,205 | |

| Non-GAAP adjustments* | (650) | | | (3,507) | | | (715) | | | (24) | | | (4,896) | |

| NON-GAAP ADJUSTED COST OF REVENUE | 216,799 | | | 326,790 | | | 190,997 | | | 232,723 | | | 967,309 | |

| | | | | | | | | |

| GAAP SEGMENT INCOME | $ | 301,247 | | | $ | 274,818 | | | $ | 271,352 | | | $ | (163,991) | | | |

| Segment Income Margin | 58.1 | % | | 45.4 | % | | 58.6 | % | | (238.5) | % | | |

| | | | | | | | | |

| NON-GAAP ADJUSTED SEGMENT INCOME | $ | 297,012 | | | $ | 272,910 | | | $ | 270,627 | | | $ | (164,033) | | | |

| Non-GAAP Adjusted Segment Income Margin | 57.8 | % | | 45.5 | % | | 58.6 | % | | (238.8) | % | | |

| | | | | | | | | |

| Research and Development | | | | | | | | | 108,363 | |

| Selling, General, and Administrative | | | | | | | | | 211,298 | |

| | | | | | | | | |

| Non-GAAP adjustments unassigned to a segment** | | | | | | | | (18,038) | |

| NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | | | | | | | | 1,268,932 | |

| | | | | | | | | |

| NON-GAAP ADJUSTED OPERATING INCOME | | | | | | | | $ | 374,893 | |

*Revenue non-GAAP adjustments for the Core, Complementary, and Corporate and Other segments were deconversion revenue. Revenue non-GAAP adjustments for the Payments segment were deconversion revenue of $(3,470) and acquisition revenue of $(1,945). Cost of revenue non-GAAP adjustments for the Core and Complementary segments were deconversion costs. Cost of revenue non-GAAP adjustments for the Payments and Corporate and Other segments were deconversion costs of $(193) and $(4), respectively, and acquisition costs of $(3,314) and $(20), respectively.

**Non-GAAP adjustments unassigned to a segment were selling, general, and administrative VEDIP expenses, deconversion costs, and acquisition costs of $(16,443), $(747), and $(6), respectively, and research and development acquisition costs of $(842).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Nine Months Ended March 31, 2023 |

| (Unaudited, In Thousands) | Core | | Payments | | Complementary | | Corporate and Other | | Total |

| GAAP REVENUE | $ | 481,961 | | | $ | 569,843 | | | $ | 432,526 | | | $ | 58,739 | | | $ | 1,543,069 | |

| Non-GAAP adjustments* | (6,248) | | | (4,413) | | | (6,319) | | | (62) | | | (17,042) | |

| | | | | | | | | |

| NON-GAAP ADJUSTED REVENUE | 475,713 | | | 565,430 | | | 426,207 | | | 58,677 | | | 1,526,027 | |

| | | | | | | | | |

| GAAP COST OF REVENUE | 207,265 | | | 314,181 | | | 178,085 | | | 210,664 | | | 910,195 | |

| Non-GAAP adjustments* | (656) | | | (221) | | | (538) | | | (20) | | | (1,435) | |

| NON-GAAP ADJUSTED COST OF REVENUE | 206,609 | | | 313,960 | | | 177,547 | | | 210,644 | | | 908,760 | |

| | | | | | | | | |

| GAAP SEGMENT INCOME | $ | 274,696 | | | $ | 255,662 | | | $ | 254,441 | | | $ | (151,925) | | | |

| Segment Income Margin | 57.0 | % | | 44.9 | % | | 58.8 | % | | (258.6) | % | | |

| | | | | | | | | |

| NON-GAAP ADJUSTED SEGMENT INCOME | $ | 269,104 | | | $ | 251,470 | | | $ | 248,660 | | | $ | (151,967) | | | |

| Non-GAAP Adjusted Segment Income Margin | 56.6 | % | | 44.5 | % | | 58.3 | % | | (259.0) | % | | |

| | | | | | | | | |

| Research and Development | | | | | | | | | 104,179 | |

| Selling, General, and Administrative | | | | | | | | | 172,205 | |

| | | | | | | | | |

| Non-GAAP adjustments unassigned to a segment** | | | | | | | | 6,236 | |

| NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | | | | | | | | 1,191,380 | |

| | | | | | | | | |

| NON-GAAP ADJUSTED OPERATING INCOME | | | | | | | | $ | 334,647 | |

*Revenue non-GAAP adjustments for all segments were deconversion revenue. Cost of revenue non-GAAP adjustments for all segments were deconversion costs.

**Non-GAAP adjustments unassigned to a segment were the selling, general, and administrative gain on sale of assets, net, and deconversion costs of $7,384 and $(1,148), respectively.

The table below shows our GAAP to non-GAAP guidance for the fiscal year ending June 30, 2024. Non-GAAP guidance excludes the impacts of deconversion revenue and related operating expenses, acquisition revenue and costs related to the August 31, 2022, Payrailz acquisition,* costs related to the July 2023 VEDIP program, and assumes no acquisitions or dispositions are made during fiscal year 2024.

| | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP to Non-GAAP GUIDANCE (In Millions, except per share data) | | | | | | Annual FY24** | | |

| | | | | | | | Low | | High | | |

| GAAP REVENUE | | | | | | | $ | 2,215 | | | $ | 2,228 | | | |

| Growth | | | | | | | 6.6 | % | | 7.2 | % | | |

| Deconversions*** | | | | | | | 16 | | | 16 | | | |

| | | | | | | | | | | | |

| Acquisition | | | | | | | 2 | | | 2 | | | |

| NON-GAAP ADJUSTED REVENUE** | | | | | | | $ | 2,197 | | | $ | 2,210 | | | |

| Non-GAAP Adjusted Growth | | | | | | | 7.4 | % | | 8.0 | % | | |

| | | | | | | | | | | | |

| GAAP OPERATING EXPENSES | | | | | | | $ | 1,729 | | | $ | 1,738 | | | |

| Growth | | | | | | | 8.3 | % | | 8.8 | % | | |

| Deconversion costs*** | | | | | | | 3 | | | 3 | | | |

| Acquisition costs | | | | | | | 4 | | | 4 | | | |

| VEDIP Program**** | | | | | | | 16 | | | 16 | | | |

| NON-GAAP ADJUSTED OPERATING EXPENSES** | | | | | | | $ | 1,705 | | | $ | 1,715 | | | |

| Non-GAAP Adjusted Growth | | | | | | | 6.8 | % | | 7.3 | % | | |

| | | | | | | | | | | | |

| GAAP OPERATING INCOME | | | | | | | $ | 486 | | | $ | 490 | | | |

| Growth | | | | | | | 1.1 | % | | 1.9 | % | | |

| | | | | | | | | | | | |

| GAAP OPERATING MARGIN | | | | | | | 21.9 | % | | 22.0 | % | | |

| | | | | | | | | | | | |

| NON-GAAP ADJUSTED OPERATING INCOME** | | | | | | | $ | 492 | | | $ | 496 | | | |

| Non-GAAP Adjusted Growth | | | | | | | 9.6 | % | | 10.5 | % | | |

| | | | | | | | | | | | |

| NON-GAAP ADJUSTED OPERATING MARGIN | | | | | | | 22.4 | % | | 22.4 | % | | |

| | | | | | | | | | | | |

| GAAP EPS | | | | | | | $ | 5.15 | | | $ | 5.19 | | | |

| Growth | | | | | | | 2.6 | % | | 3.5 | % | | |

*Excluded acquisition revenue and costs are for the first two months of the fiscal year only (see "Impact of Non-GAAP Adjustments") on page 4.

**GAAP to Non-GAAP revenue, operating expenses, and operating income may not foot due to rounding.

***Deconversion revenue and related operating expenses are based on actual results for the nine months ended March 31, 2024 and estimates for the remainder of fiscal year 2024 based on the lowest actual recent historical results. See the Company’s Form 8-K filed with the Securities and Exchange Commission on April 29, 2024.

****This cost relates to the group of employees who participated in a Company VEDIP program offered in July 2023 to certain employees of a specified minimum age who had reached a specified minimum number of years of service with the Company.

Balance Sheet and Cash Flow Review

•Cash and cash equivalents were $27 million at March 31, 2024, and 2023.

•Trade receivables were $263 million at March 31, 2024, compared to $238 million at March 31, 2023.

•The Company had $250 million of borrowings at March 31, 2024 compared to $375 million of borrowings at March 31, 2023.

•Deferred revenue decreased to $214 million at March 31, 2024, compared to $226 million a year ago.

•Stockholders' equity increased to $1,780 million at March 31, 2024, compared to $1,538 million a year ago.

*See table below for Net Cash Provided by Operating Activities and on page 14 for Return on Average Shareholders’ Equity. Tables reconciling the non-GAAP measures Free Cash Flow and Return on Invested Capital (ROIC) to GAAP measures are also on page 14. See the Use of Non-GAAP Financial Information section below for the definitions of Free Cash Flow and ROIC.

The following table summarizes net cash from operating activities:

| | | | | | | | | | | |

| (Unaudited, In Thousands) | Nine Months Ended March 31, |

| 2024 | | 2023 |

| Net income | $ | 280,743 | | | $ | 268,873 | |

| Depreciation | 34,943 | | | 36,740 | |

| Amortization | 114,270 | | | 105,609 | |

| Change in deferred income taxes | (15,325) | | | (36,370) | |

| Other non-cash expenses | 22,677 | | | 14,225 | |

| Change in receivables | 97,835 | | | 110,686 | |

| Change in deferred revenue | (185,784) | | | (184,130) | |

| Change in other assets and liabilities | (13,117) | | | (108,602) | |

| NET CASH FROM OPERATING ACTIVITIES | $ | 336,242 | | | $ | 207,031 | |

The following table summarizes net cash from investing activities:

| | | | | | | | | | | |

| (Unaudited, In Thousands) | Nine Months Ended March 31, |

| 2024 | | 2023 |

| Payment for acquisitions, net of cash acquired* | $ | — | | | $ | (229,628) | |

| Capital expenditures | (34,347) | | | (27,237) | |

| | | |

| Proceeds from dispositions | 900 | | | 27,885 | |

| | | |

| Purchased software | (4,561) | | | (1,471) | |

| Computer software developed | (125,351) | | | (124,110) | |

| Purchase of investments | (1,146) | | | (1,000) | |

| | | |

| NET CASH FROM INVESTING ACTIVITIES | $ | (164,505) | | | $ | (355,561) | |

*During first quarter fiscal 2023, the Company completed its acquisition of Payrailz.

The following table summarizes net cash from financing activities:

| | | | | | | | | | | |

| (Unaudited, In Thousands) | Nine Months Ended March 31, |

| 2024 | | 2023 |

| Borrowings on credit facilities* | $ | 335,000 | | | $ | 550,000 | |

| Repayments on credit facilities and financing leases | (360,000) | | | (290,059) | |

| | | |

| Purchase of treasury stock | (20,000) | | | (25,000) | |

| Dividends paid | (115,792) | | | (109,346) | |

| Net cash from issuance of stock and tax related to stock-based compensation | 4,066 | | | 700 | |

| NET CASH FROM FINANCING ACTIVITIES | $ | (156,726) | | | $ | 126,295 | |

*The Company's acquisition of Payrailz during first quarter fiscal 2023 was primarily funded by new borrowings under the Company's credit facilities.

Use of Non-GAAP Financial Information

Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting in the United States. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, we have provided certain non-GAAP financial measures, including adjusted revenue, adjusted operating income, adjusted segment income, adjusted cost of revenue, adjusted operating expenses, adjusted operating margin, adjusted segment income margin, non-GAAP earnings before interest, taxes, depreciation, and amortization (non-GAAP EBITDA), free cash flow, return on invested capital (ROIC), and non-GAAP adjusted net income.

We believe non-GAAP financial measures help investors better understand the underlying fundamentals and true operations of our business. Adjusted revenue, adjusted operating income, adjusted operating margin, adjusted segment income, adjusted segment income margin, adjusted cost of revenue, adjusted operating expenses, and adjusted net income eliminate one-time deconversion revenue and associated costs, the effects of acquisitions and divestitures, the VEDIP program expense, and the gain on sale of assets, net, all of which management believes are not indicative of the Company's operating performance. Such adjustments give investors further insight into our performance. Non-GAAP EBITDA is defined as net income attributable to the Company before the effect of interest expense, taxes, depreciation, and amortization, adjusted for net income before the effect of interest expense, taxes, depreciation, and amortization attributable to eliminated one-time deconversions, acquisitions and divestitures, the VEDIP program expense, and the gain on sale of assets, net. Free cash flow is defined as net cash from operating activities, less capitalized expenditures, internal use software, and capitalized software, plus proceeds from the sale of assets. ROIC is defined as net income divided by average invested capital, which is the average of beginning and ending long-term debt and stockholders’ equity for a given period. Management believes that non-GAAP EBITDA is an important measure of the Company’s overall operating performance and excludes certain costs and other transactions that management deems one time or non-operational in nature; free cash flow is useful to measure the funds generated in a given period that are available for debt service requirements and strategic capital decisions; and ROIC is a measure of the Company’s allocation efficiency and effectiveness of its invested capital. For these reasons, management also uses these non-GAAP financial measures in its assessment and management of the Company's performance.

Non-GAAP financial measures used by the Company may not be comparable to similarly titled non-GAAP measures used by other companies. Non-GAAP financial measures have no standardized meaning prescribed by GAAP and therefore, are unlikely to be comparable with calculations of similar measures for other companies.

Any non-GAAP financial measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP measures. Reconciliations of the non-GAAP financial measures to related GAAP measures are included.

| | | | | | | | | | | | | | |

About Jack Henry & Associates, Inc.® | | | | Quarterly Conference Call |

Jack HenryTM (Nasdaq: JKHY) is a well-rounded financial technology company that strengthens connections between financial institutions and the people and businesses they serve. We are an S&P 500 company that prioritizes openness, collaboration, and user centricity — offering banks and credit unions a vibrant ecosystem of internally developed modern capabilities as well as the ability to integrate with leading fintechs. For more than 47 years, Jack Henry has provided technology solutions to enable clients to innovate faster, strategically differentiate, and successfully compete while serving the evolving needs of their accountholders. We empower approximately 7,500 clients with people-inspired innovation, personal service, and insight-driven solutions that help reduce the barriers to financial health. Additional information is available at www.jackhenry.com. | | | The Company will hold a conference call on May 8, 2024, at 7:45 a.m. Central Time, and investors are invited to listen at www.jackhenry.com. A webcast replay will be available approximately one hour after the event at ir.jackhenry.com/corporate-events-and-presentations and will remain available for one year. |

| |

| |

| |

| | | |

| | |

| | |

| | |

| | | |

Statements made in this news release that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because forward-looking statements relate to the future, they are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to, those discussed in the Company's Securities and Exchange Commission filings, including the Company's most recent reports on Form 10-K and Form 10-Q, particularly under the heading Risk Factors. Any forward-looking statement made in this news release speaks only as of the date of the news release, and the Company expressly disclaims any obligation to publicly update or revise any forward-looking statement, whether because of new information, future events or otherwise. | | | | MEDIA CONTACT |

| | Mark Folk |

| | Corporate Communications |

| | Jack Henry & Associates, Inc. |

| | 704-890-5323 |

| | MFolk@jackhenry.com |

| | |

| | ANALYST CONTACT |

| | Vance Sherard, CFA |

| | Investor Relations |

| | Jack Henry & Associates, Inc. |

| | 417-235-6652 |

| | VSherard@jackhenry.com |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Income (Unaudited) |

| (In Thousands, except per share data) | Three Months Ended March 31, | | % Change | | Nine Months Ended March 31, | | % Change |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| | | | | | | | | | | |

| REVENUE | $ | 538,562 | | | $ | 508,552 | | | 5.9 | % | | $ | 1,655,631 | | | $ | 1,543,069 | | | 7.3 | % |

| | | | | | | | | | | |

| Cost of Revenue | 328,224 | | | 307,345 | | | 6.8 | % | | 972,205 | | | 910,195 | | | 6.8 | % |

| Research and Development | 35,993 | | | 34,625 | | | 4.0 | % | | 108,363 | | | 104,179 | | | 4.0 | % |

| Selling, General, and Administrative | 62,246 | | | 58,192 | | | 7.0 | % | | 211,298 | | | 172,205 | | | 22.7 | % |

| | | | | | | | | | | |

| EXPENSES | 426,463 | | | 400,162 | | | 6.6 | % | | 1,291,866 | | | 1,186,579 | | | 8.9 | % |

| | | | | | | | | | | |

| OPERATING INCOME | 112,099 | | | 108,390 | | | 3.4 | % | | 363,765 | | | 356,490 | | | 2.0 | % |

| | | | | | | | | | | |

| Interest income | 6,499 | | | 2,391 | | | 171.8 | % | | 16,365 | | | 3,783 | | | 332.6 | % |

| Interest expense | (4,433) | | | (4,666) | | | (5.0) | % | | (12,495) | | | (9,649) | | | 29.5 | % |

| Interest Income (Expense), net | 2,066 | | | (2,275) | | | (190.8) | % | | 3,870 | | | (5,866) | | | (166.0) | % |

| | | | | | | | | | | |

| INCOME BEFORE INCOME TAXES | 114,165 | | | 106,115 | | | 7.6 | % | | 367,635 | | | 350,624 | | | 4.9 | % |

| | | | | | | | | | | |

| Provision for Income Taxes | 27,066 | | | 24,566 | | | 10.2 | % | | 86,892 | | | 81,751 | | | 6.3 | % |

| | | | | | | | | | | |

| NET INCOME | $ | 87,099 | | | $ | 81,549 | | | 6.8 | % | | $ | 280,743 | | | $ | 268,873 | | | 4.4 | % |

| | | | | | | | | | | |

| Diluted net income per share | $ | 1.19 | | | $ | 1.12 | | | | | $ | 3.85 | | | $ | 3.68 | | | |

| Diluted weighted average shares outstanding | 73,031 | | | 73,074 | | | | | 73,010 | | | 73,119 | | | |

| | | | | | | | | | | |

| Consolidated Balance Sheet Highlights (Unaudited) |

| (In Thousands) | | | | | | | March 31, | | % Change |

| | | | | | | 2024 | | 2023 | | |

| Cash and cash equivalents | | | | | | | $ | 27,254 | | | $ | 26,552 | | | 2.6 | % |

| Receivables | | | | | | | 263,416 | | | 238,364 | | | 10.5 | % |

| Total assets | | | | | | | 2,770,498 | | | 2,607,597 | | | 6.2 | % |

| | | | | | | | | | | |

| Accounts payable and accrued expenses | | | | | | $ | 227,715 | | | $ | 163,794 | | | 39.0 | % |

| Current and long-term debt | | | | | | | 250,000 | | | 375,001 | | | (33.3) | % |

| Deferred revenue | | | | | | | 213,945 | | | 226,146 | | | (5.4) | % |

| Stockholders' equity | | | | | | | 1,779,931 | | | 1,538,309 | | | 15.7 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Calculation of Non-GAAP Earnings Before Income Taxes, Depreciation and Amortization (Non-GAAP EBITDA) |

| Three Months Ended March 31, | | % Change | | Nine Months Ended March 31, | | % Change |

| (in thousands) | 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Net income | $ | 87,099 | | | $ | 81,549 | | | | | $ | 280,743 | | | $ | 268,873 | | | |

| Net interest | (2,066) | | | 2,275 | | | | | (3,870) | | | 5,865 | | | |

| Taxes | 27,066 | | | 24,565 | | | | | 86,893 | | | 81,751 | | | |

| Depreciation and amortization | 50,083 | | | 48,637 | | | | | 149,214 | | | 142,349 | | | |

| Less: Net income before interest expense, taxes, depreciation and amortization attributable to eliminated one-time adjustments* | 6 | | | (5,130) | | | | | 9,006 | | | (21,843) | | | |

| NON-GAAP EBITDA | $ | 162,188 | | | $ | 151,896 | | | 6.8 | % | | $ | 521,986 | | | $ | 476,995 | | | 9.4 | % |

*The fiscal third quarter adjustments for net income before interest expense, taxes, depreciation and amortization were for deconversions. The fiscal year-to-date period adjustments were for deconversions, the VEDIP program expense, and the acquisition, and were $(7,551), $16,443, and $114, respectively. The prior fiscal third quarter adjustments for net income before interest expense, taxes, depreciation and amortization were for deconversions. The prior fiscal year-to-date period adjustments were for deconversions and a gain on sale of assets, net, and were $(14,459) and $(7,384), respectively. |

| | | | | | | | | | | |

| Calculation of Free Cash Flow (Non-GAAP) | | | | | | Nine Months Ended March 31, | | |

| (in thousands) | | | | | | | 2024 | | 2023 | | |

| Net cash from operating activities | | | | | | $ | 336,242 | | | $ | 207,031 | | | |

| Capitalized expenditures | | | | | | | (34,347) | | | (27,237) | | | |

| Internal use software | | | | | | | (4,561) | | | (1,471) | | | |

| | | | | | | | | | | |

| Proceeds from sale of assets | | | | | | | 900 | | | 27,885 | | | |

| Capitalized software | | | | | | | (125,351) | | | (124,110) | | | |

| FREE CASH FLOW | | | | | | | $ | 172,883 | | | $ | 82,098 | | | |

| | | | | | | | | | | |

| Calculation of the Return on Average Shareholders’ Equity | | | | March 31, | | |

| (in thousands) | | | | | | | 2024 | | 2023 | | |

| Net income (trailing four quarters) | | | | | | $ | 378,516 | | | $ | 349,299 | | | |

| Average stockholder's equity (period beginning and ending balances) | | | | 1,659,120 | | | 1,433,459 | | | |

| RETURN ON AVERAGE SHAREHOLDERS’ EQUITY | | | | | | 22.8% | | 24.4% | | |

| | | | | | | | | | | |

| Calculation of Return on Invested Capital (ROIC) (Non-GAAP) | | | March 31, | | |

| (in thousands) | | | | | | | 2024 | | 2023 | | |

| Net income (trailing four quarters) | | | | | | $ | 378,516 | | | $ | 349,299 | | | |

| | | | | | | | | | | |

| Average stockholder's equity (period beginning and ending balances) | | | | 1,659,120 | | | 1,433,459 | | | |

| Average current maturities of long-term debt (period beginning and ending balances) | | 1 | | | 51 | | | |

| Average long-term debt (period beginning and ending balances) | | 312,500 | | | 300,001 | | | |

| Average invested capital | | | | | | | $ | 1,971,621 | | | $ | 1,733,511 | | | |

| | | | | | | | | | | |

| ROIC | | | | | | | 19.2% | | 20.1% | | |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

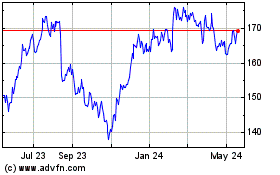

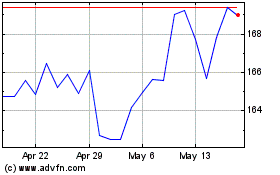

Jack Henry and Associates (NASDAQ:JKHY)

Historical Stock Chart

From Apr 2024 to May 2024

Jack Henry and Associates (NASDAQ:JKHY)

Historical Stock Chart

From May 2023 to May 2024