ZimCal Asset Management, LLC Comments on Medallion Financial Corp.’s First Quarter Results

May 02 2024 - 7:00AM

Business Wire

ZimCal Asset Management, LLC, and its affiliates BIMIZCI Fund

LLC, Warnke Investments LLC and Stephen Hodges (collectively

“ZimCal”) is one of the largest investors in Medallion Financial

Corp. (the “Company” or “MFIN”), has over $15.55 million in debt

and equity investment exposure and has been invested in MFIN for

over 3 years. ZimCal is currently in a proxy contest to replace two

Directors on MFIN’s Board of Directors (the “Board”) with two more

highly qualified individuals. ZimCal is urgently trying to

strengthen the Company by adding current consumer lending and risk

management experience to its Board, precisely two areas where we

believe the current Board is lacking. ZimCal’s Board nominees will

hold management accountable and work tirelessly to improve the

Company so that it can reach its tremendous potential, thrive in

the long-term and reward shareholders.

MFIN’s earnings this morning show that the need for change is

critical. MFIN characterized 1Q24 as a “strong start,” ZimCal

strongly disagrees. The quarter was not terrible, but the earnings

release made it clear that MFIN is managing to the quarter and to

expectations, rather than proactively managing for the long-term.

Earnings were boosted $0.14 or 48% by taxi medallion recoveries and

“gains on equity investments.” Earnings were also boosted by credit

loss provisions that were significantly below 1Q23 and 4Q23

provisions despite a weaker asset quality profile. On almost all

the critical metrics, performance declined. See Table 1 and 2

below. However, our view on the next 1, 2 or 5 years is

overwhelmingly positive if MFIN can get the right governance and

leadership team in place to position the Company for long-term

success.

Click HERE for the complete presentation with graphs.

Despite the years that have passed since the taxi medallion

implosion destroyed 85% of MFIN’s market capitalization in less

than 3 years, MFIN’s President is still in place and we are

concerned that things have not changed much. The tone of the

statements the Company made about 1Q24 are eerily similar to the

statements made about 1Q16, the year the Company charged off $30.6

million in taxi medallion loans and non-performing taxi medallion

loans reached $122 million or 21% of the portfolio. Statements

after 1Q16 earnings included:

“We are extremely pleased with the 2016 first

quarter. While taxi medallion lending continues to have virtually

zero losses…”

“All the important indicators of our business

continue to demonstrate the quality of Medallion’s operations… very

solid credit performance by the portfolios…”

This is what keeps ZimCal awake at night. We obsess over the

downside risk of a ~25% subprime consumer loan portfolio heading

into economic and rate uncertainty, a concern that we repeatedly

shared with MFIN before launching our proxy contest. A NIM of 8% or

9% is meaningless if charge-offs on a $2 billion+ portfolio reach

and remain at 5% – 6% over a sustained period. Quarter to quarter

fluctuations driven by irregular equity gains or non-recurring taxi

medallion recoveries will not mask the pain caused by mass consumer

delinquencies. While we hope that consumers do not default to this

extent and we certainly do NOT expect a repeat of the taxi

medallion implosion, we urge MFIN to demonstrate that it has

thought through this scenario and is tracking and disclosing key

data. Tracking the data and demonstrating concrete actions to

mitigate risk is what ZimCal has pushed for. We have privately

given MFIN’s Board and management suggested metrics to track

including 1. stratification of loan performance by quarterly

vintage, collateral type, prime/non-prime; 2. Disclosures of

loan-to-value or loan-to-cost; 3. Loss-given-default trends; 4.

Prepayment and WAL by prime/non-prime; and 5. Recreation vehicle

wholesale and retail price trends. We have no confidence these

metrics are being tracked by the Board or that MFIN has the

technological capability to generate these reports accurately and

frequently.

Glossing over critical downward trends in key metrics like ROA,

Net Interest Margin, and charge-offs while waxing hopefully about

the future is not a viable management strategy. Table 1 and 2 show

clear and concerning trends. The status quo is unacceptable and

change at MFIN is critical.

Click HERE for the complete presentation with graphs.

Table 1

4Q19

1Q22

2Q22

3Q22

4Q22

1Q23

2Q23

3Q23

4Q23

1Q24

Charge-offs (net Ex. Taxi Medallion)

2.84%

0.96%

0.48%

2.04%

1.80%

2.29%

1.70%

2.21%

3.22%

3.20%

Recreation Charge-offs (net)

3.80%

0.64%

0.56%

1.47%

2.12%

3.29%

1.86%

2.70%

4.30%

4.40%

Home Improvement Charge-offs (net)

0.83%

0.44%

0.42%

0.77%

1.04%

0.79%

1.12%

1.62%

1.71%

2.10%

Table 1: Recreation and Home Improvement charge-offs are at

cyclical highs, have exceeded 4Q19 and are trending worse.

Table 2

1Q22

2Q22

3Q22

4Q22

1Q23

2Q23

3Q23

4Q23

1Q24

ROAA (AT)

2.05%

2.61%

1.42%

2.34%

2.66%

2.33%

1.77%

2.23%

1.80%

ROAA (AT) (Ex. Taxi Medallion)

1.74%

1.89%

1.20%

2.03%

1.58%

1.54%

1.45%

0.89%

1.39%

Net Interest Margin

9.20%

9.07%

8.91%

9.00%

8.71%

8.77%

8.64%

8.66%

8.39%

Net Interest Income

35,928

38,881

42,040

43,587

43,603

46,691

48,784

49,018

47,900

Table 2: NIM has continued to decline and net interest income is

also below the last 2 quarters. While ROAA (Ex. Medallion)

increased from its 4Q23 low, the trend is still down, and core

earnings trends do not look strong. ZimCal computed 1Q24 ROAA

(AT) of 1.54% but will defer to MFIN’s 1.80%.

Visit www.restoretheshine.com to view our nominees and for

important details and to sign up for updates.

Read our letter to MFIN shareholders under “Materials” at

www.restoretheshine.com

ZimCal will issue ongoing press releases with updates and

details on its plan to “Restore the Shine” to Medallion Financial

Corp.

About ZimCal Asset Management, LLC

ZimCal Asset Management is an alternative investment firm

focused primarily on niche, illiquid and complex credit investment

opportunities.

ZimCal Asset Management partners with both healthy and

distressed borrowers or issuers and provides customized solutions

that meet their unique needs and circumstances. Over the last 15

years, the founder of ZimCal Asset Management has developed a

specialization investing in FDIC-insured institutions and has

partnered with over 120 bank lenders through investments on both

sides of the balance sheet.

ZimCal usually works in collaboration with bank leadership teams

if required, but on very rare occasions, must insert itself more

forcefully if it believes that leadership is underwhelming and

threatens to undermine stakeholder investments. ZimCal prides

itself on performing extensive, rigorous financial analysis and

research to fully understand the risks of any investment.

Solicitation Information

Stockholders are urged to read ZimCal’s definitive proxy

statement and WHITE proxy card because they contain important

information about the ZimCal nominees and related matters.

Shareholders may obtain a free copy of the definitive proxy

statement and WHITE proxy card and other documents filed by ZimCal

on the web site of the Securities and Exchange Commission (SEC) at

www.sec.gov. Shareholders may also direct a request to ZimCal’s

proxy solicitor, Saratoga, 520 8th Avenue, 14th Floor, New York, NY

10018 (shareholders can e-mail at info@saratogaproxy.com or call

toll-free at (888) 368-0379).

Participants in

Solicitation

The identity of the participants in the solicitation and a

description of their direct or indirect interests, by security

holdings or otherwise is contained in ZimCal’s definitive proxy

statement filed with the SEC on April 26, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502285879/en/

nicole@nh-consult.com

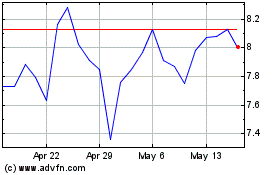

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Apr 2024 to May 2024

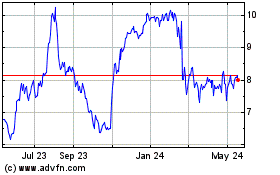

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From May 2023 to May 2024